VaporDex vs. Zero-Fee Exchanges Comparison Tool

This tool compares VaporDex with other popular zero-fee exchanges to help you evaluate their pros and cons based on key criteria.

VaporDex

- Trading Fees 0% taker / 0% maker

- Regulation None

- Supported Assets ~10 major coins

- Monthly Visits 6,030

- Key Strength: Zero fees, simple UI

MEXC

- Trading Fees 0% maker (spot)

- Regulation Partial (some jurisdictions)

- Supported Assets 2,500+

- Monthly Visits 2M+

- Key Strength: Large asset pool, decent liquidity

Lykke

- Trading Fees 0% taker / 0% maker

- Regulation EU-licensed

- Supported Assets ~200

- Monthly Visits 150k

- Key Strength: Regulated, transparent spreads

Phemex

- Trading Fees 0% for premium members

- Regulation Some licenses (offshore)

- Supported Assets ~400

- Monthly Visits 900k

- Key Strength: Advanced trading tools, low spreads

Comparison Summary

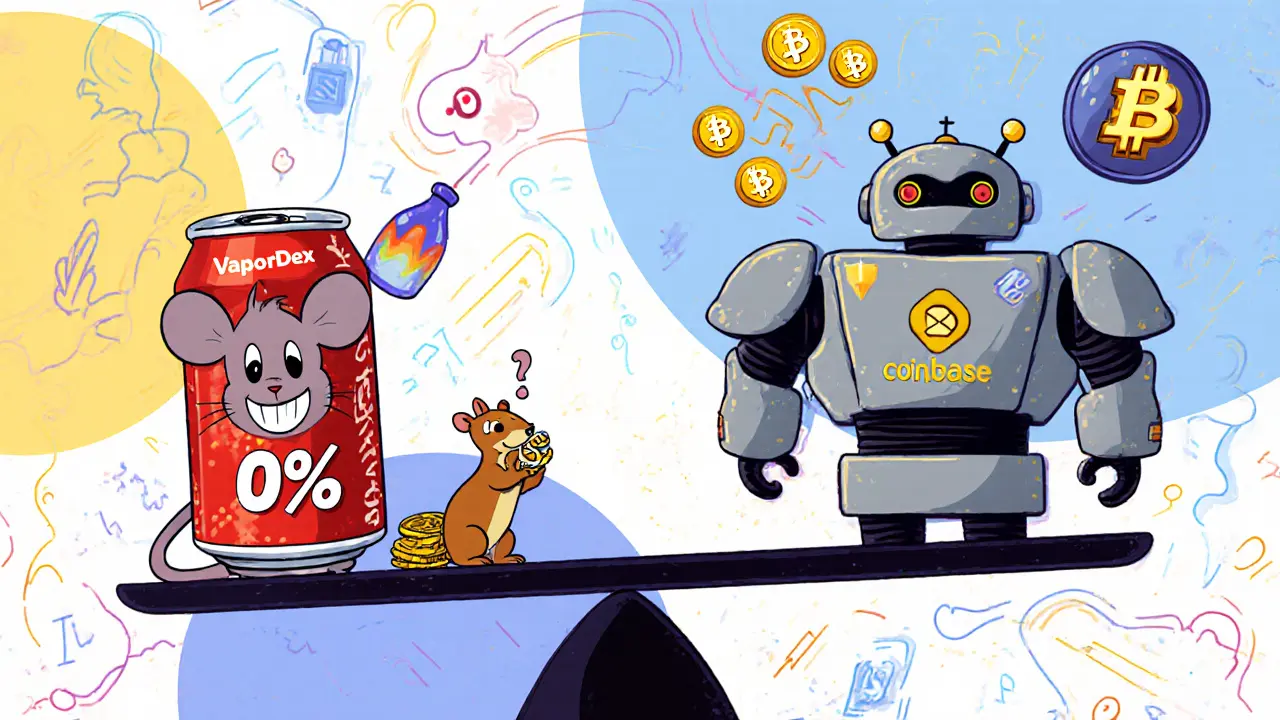

VaporDex stands out for its zero-fee model but lacks regulatory oversight and has limited assets compared to MEXC and Lykke. MEXC offers extensive asset variety, while Lykke provides regulated safety features. Phemex provides advanced tools but requires premium membership for zero fees.

Recommendation: For casual traders seeking low-cost spot trading, VaporDex may be acceptable, but for serious traders, regulated exchanges like Lykke or large platforms like MEXC offer better security, liquidity, and transparency.

When you hear the name VaporDex is an unregulated cryptocurrency exchange that markets itself as a zero‑fee trading platform, the first thought is usually “no fees, no problem.” But ditching fees is only one piece of the puzzle. In 2025 the crypto market is packed with giants, regulators are tightening their grip, and traders care almost as much about security and liquidity as they do about price. This review unpacks what VaporDex actually offers, how it stacks up against the best‑known zero‑fee players, and whether the platform is worth a try for everyday traders.

What VaporDex Claims to Be

VaporDex’s website (vapordex.io) pitches a clean, minimalist interface and a bold promise: 0.00% taker fees and 0.00% maker fees on all spot trades. The platform says it supports a “handful of major cryptocurrencies” and offers instant deposits/withdrawals via major blockchains. There’s no mention of futures, options, or margin products, so the focus appears to be spot trading only.

Fee Structure - The Zero‑Fee Model Explained

The allure of zero fees is obvious. Traditional exchanges like Coinbase or Kraken charge anywhere from 0% up to 3.99% depending on the trade type, while Crypto.com ranges between 0% and 2.99%.

VaporDex’s zero‑fee claim is possible only if the exchange earns money elsewhere - typically through withdrawal fees, wider spreads on buy‑sell orders, or premium services. Public data on these alternative revenue streams is scarce, meaning traders need to dig into the fine print or test the platform with small amounts first.

Regulatory Status - The Unregulated Reality

According to data from FxVerify, VaporDex operates with no registration in any jurisdiction. That places it in the same bucket as many small exchanges that lack the safeguards of regulated platforms. What does that mean for you?

- No segregated customer funds - if the exchange were to go offline, there’s no legal requirement to return your assets.

- Limited recourse - in a dispute you can’t turn to a financial regulator for mediation.

- Potential for higher risk of hacking or insider fraud, since compliance checks are often weaker.

By contrast, exchanges like Binance and Coinbase hold licenses in multiple countries, undergo regular audits, and often carry insurance for digital assets.

Traffic & User Engagement - What the Numbers Say

Traffic data from SimilarWeb shows VaporDex ranking 365th out of 604 crypto exchanges, with roughly 6,030 monthly visits. A 64% bounce rate indicates that most visitors leave the site almost immediately. Those who stay view an average of 8.8 pages but only for about 35 seconds, suggesting a quick “look before you leap” behavior.

In comparison, top exchanges like Binance enjoy millions of monthly visits and bounce rates under 30%, reflecting strong brand trust and deeper feature sets.

Security & Trust Factors

Because VaporDex is unregulated, it does not publish any security certifications, audit reports, or insurance policies. Users have reported zero reviews on major platforms such as Reddit or Trustpilot, which means community sentiment is essentially invisible. For a trader, the lack of transparent security information is a red flag.

Typical security measures you’d expect from a reputable exchange include two‑factor authentication (2FA), withdrawal whitelist, cold‑storage of the majority of funds, and regular penetration testing. VaporDex’s site mentions 2FA, but without independent verification it’s hard to gauge the robustness of the implementation.

Supported Assets and Technical Infrastructure

The platform’s documentation is minimal. No public API documentation, no mobile app links, and no clear list of available trading pairs. While many larger exchanges list over 400 assets (Binance) or even 2,500 (MEXC), VaporDex’s offering appears limited to the biggest names like Bitcoin, Ethereum, and a few altcoins.

Liquidity depth is also unknown - without order‑book depth data you can’t tell how much slippage you might face on larger trades.

Zero‑Fee Competitors - How They Differ

| Exchange | Trading Fees | Regulation | Supported Assets | Monthly Visits (approx.) | Key Strength |

|---|---|---|---|---|---|

| VaporDex | 0% taker / 0% maker | None | ~10 major coins | 6k | Zero fees, simple UI |

| MEXC | 0% maker (spot) | Partial (some jurisdictions) | 2,500+ | 2M+ | Large asset pool, decent liquidity |

| Lykke | 0% taker / 0% maker | EU‑licensed | ~200 | 150k | Regulated, transparent spreads |

| Phemex | 0% for premium members | Some licenses (offshore) | ~400 | 900k | Advanced trading tools, low spreads |

Pros and Cons - Quick Verdict

- Pros

- Zero trading fees, which can save money on high‑volume strategies.

- Simple, uncluttered web interface suitable for beginners who only need spot trading.

- Low monthly traffic means less competition on the platform’s order book (if liquidity is sufficient).

- Cons

- Unregulated - no legal protection for your funds.

- Scarce public information on security, liquidity, and supported assets.

- High bounce rate suggests many users leave quickly, possibly due to trust issues.

- Potential hidden costs via wide spreads or withdrawal fees.

Who Might Consider VaporDex?

If you’s a hobbyist who wants to test small‑scale trades without paying fees, VaporDex could be a low‑risk sandbox - provided you only deposit an amount you can afford to lose. Day traders looking for deep liquidity, institutional players, or anyone who values regulatory protection should steer toward larger, licensed exchanges.

Key Takeaways

- VaporDex offers a genuinely 0% fee model but lacks regulatory oversight.

- Traffic and user‑engagement metrics indicate limited adoption and possible trust gaps.

- Security details are sparse; no public audits or insurance.

- Compared to other zero‑fee platforms, VaporDex provides fewer assets and lower liquidity.

- Best suited for low‑volume, fee‑sensitive experimentation rather than serious trading.

Bottom Line

Zero fees are tempting, but they’re only part of a healthy trading environment. VaporDex’s unregulated status, thin asset list, and lack of transparent security make it a niche option for cautious, low‑stakes users. For anyone looking to trade larger volumes, diversify across many tokens, or have peace of mind about fund protection, the more established exchanges-Binance, Coinbase, Kraken, or even regulated zero‑fee players like Lykke-are safer bets.

Frequently Asked Questions

Is VaporDex really free to trade?

VaporDex advertises 0% taker and maker fees on spot trades. However, you may still pay withdrawal fees or encounter wider bid‑ask spreads that act as hidden costs.

Can I trust an unregulated exchange?

Without regulation, there’s no legal requirement for fund segregation, audits, or insurance. Trust must come from transparent security practices, which VaporDex currently does not fully disclose.

How does VaporDex compare to MEXC or Lykke?

All four platforms claim zero‑fee spot trading, but MEXC and Lykke offer hundreds to thousands of assets, higher traffic, and at least partial regulatory coverage. VaporDex lags on asset variety and transparency.

What are the hidden costs I should watch for?

Typical hidden costs include withdrawal fees (especially for on‑chain withdrawals), wider spreads between buy and sell prices, and potential fees for premium services or API access.

Is VaporDex safe for large deposits?

Given the lack of regulatory oversight and limited public security information, most experts advise keeping large amounts on regulated exchanges with proven custody solutions.

Zero‑fee trading certainly tempts the bargain‑hunter, yet if you strip away the shiny headline you encounter a platform that forgoes the regulatory safety nets most traders rely on. In a market where custodial protection can be the difference between a night’s loss and a long‑term hold, the lack of oversight feels like walking a tightrope without a net. It’s a trade‑off worth weighing before you park any significant capital.

Wow!! VaporDex really screams “free trading”!! But don’t be fooled – hidden spreads and withdrawal fees can bite you hard!!! Think twice before you dump all your funds on a platform that hides its costs behind a glossy UI!!!

Imagine a world where every trade you make costs you nothing – that’s the VaporDex promise, a siren song for the everyday trader! It’s like finding a treasure chest on the blockchain, shimmering with the promise of pure profit. While the hype may be dazzling, remember that even gold can be counterfeit if the vault isn’t guarded.

Honestly, the whole zero‑fee hype feels more like a marketing stunt than a real advantage. If the exchange can’t back it up with solid liquidity and security, those “free” trades are just a cheap illusion.

i dunno if its safe but the no fees part is cool, just make sure u don’t lose all ur coins cause of hack.

It is utterly irresponsible for any platform to invite users to trade without the shield of regulation; such reckless behavior borders on exploitation. Traders deserve transparency and legal protection, not a wild west of unchecked promises. Ignoring these fundamentals undermines the entire crypto ecosystem.

Upon rigorous examination, one observes that VaporDex’s ostensibly “zero‑fee” paradigm is predicated upon the assumption of negligible spread differentials; however, empirical data suggests otherwise, revealing statistically significant deviations between bid and ask prices, thereby eroding the purported cost‑free advantage.

While the allure of a truly zero‑fee exchange is compelling, it is essential to consider the broader ecosystem: liquidity depth, asset variety, and user experience all play pivotal roles in determining an exchange’s viability. VaporDex may excel in simplicity, yet its limited token roster could hinder diversification strategies for seasoned traders. Moreover, the platform’s modest traffic figures might translate into thinner order books, potentially increasing slippage during larger transactions. Balancing these factors against the cost savings is a nuanced decision that each trader must make based on personal risk tolerance and trading objectives.

The moment you encounter a crypto exchange that proudly declares “no regulation” should you set off alarm bells; it is reminiscent of the early wild‑west days where anonymity masked nefarious schemes. One must ask: who funds the infrastructure? Who holds the private keys? Without a regulatory overseer, a single rogue entity could redirect deposits, manipulate order books, or even collude with external actors to orchestrate price manipulation. History is rife with examples of unregulated platforms becoming havens for pump‑and‑dump operations, laundering schemes, and outright theft. The lack of required audits means there is no independent verification of solvency, leaving users vulnerable to sudden collapses. Furthermore, the sparse traffic and high bounce rate suggest a community uncomfortable with the platform, possibly aware of hidden risks. In an era where governments worldwide tighten crypto legislation, operating in the shadows is increasingly perilous and likely to attract enforcement actions. Thus, the purported freedom of zero fees might be a façade for deeper systemic vulnerabilities.

I feel for anyone drawn to the idea of fee‑free trading; the temptation is real, and the promise can feel like a lifeline. Yet it’s crucial to prioritize security over savings, because a compromised account can erase any fee advantage in an instant.

VaporDex looks slick 😎, but remember that a shiny UI doesn’t replace solid security 🔐. Stay safe, friends! 👍

From a global perspective, many traders look for trustworthy places to keep their money. An exchange without regulation might not give that trust, especially when you consider different country rules. It’s better to pick a platform that follows at least some local laws.

Let me break it down: the zero‑fee model isn’t magic, it’s a revenue shift. They likely earn from wider spreads or premium features, and those hidden costs can add up faster than you think. Plus, with no oversight, the odds of a rug pull rise dramatically. Keep your eyes open and don’t put all your eggs in an unregulated basket.

Hey folks!! If you’re curious about trying VaporDex, maybe start with a tiny amount just to test the waters!! It’s always good to experiment, but remember to stay cautious and protect your assets!!

When evaluating any exchange, consider three pillars: security, liquidity, and user experience. VaporDex scores high on the fee front but lags behind on the other two. You might find it suitable for small, exploratory trades, but for larger positions, a more established platform could provide peace of mind.

Zero fees sound too good to be true.

Seriously, VaporDex is the drama queen of crypto exchanges – shouting “no fees!” while hiding a mess of hidden costs and shoddy security behind the curtain. It’s like that reality TV star who pretends to be humble but is really just hungry for attention.

i get why ppl are drawn to the free trades, but u gotta be careful, some things look good on the surface but hide problems.

In conducting a comprehensive assessment of VaporDex, it is incumbent upon the prospective user to meticulously examine a multitude of operational dimensions. First, the advertised zero‑fee structure warrants scrutiny, as the absence of explicit transaction charges typically necessitates alternative revenue mechanisms, such as amplified bid‑ask spreads or ancillary service fees. Second, the platform’s regulatory status, or lack thereof, constitutes a pivotal risk factor; without adherence to established financial oversight, users are deprived of statutory recourse in the event of insolvency or malpractice. Third, the paucity of publicly disclosed security protocols-encompassing cold‑storage ratios, penetration testing results, and third‑party audit reports-raises legitimate concerns regarding custodial integrity. Fourth, liquidity considerations are paramount; limited order‑book depth can precipitate substantial slippage, particularly for sizable order sizes, thereby eroding the nominal cost advantage. Fifth, the modest traffic metrics, evidenced by a mere six thousand monthly visits, suggest a nascent user base, which may further constrain market depth and exacerbate price volatility. Sixth, asset diversification on VaporDex is markedly constrained, offering approximately ten major cryptocurrencies, a stark contrast to competitors boasting thousands of trading pairs. Seventh, the user interface, while minimalist, may lack advanced analytical tools essential for professional trading strategies. Eighth, the platform’s withdrawal fee structure, often omitted from headline marketing, can impose unexpected out‑of‑pocket expenses. Ninth, the legal jurisdiction of operation remains opaque, compounding the difficulty of enforcing contractual obligations. Tenth, community sentiment, as inferred from the high bounce rate and scant user reviews, appears tepid, potentially reflecting broader apprehensions. Eleventh, the absence of a mobile application may limit accessibility for traders who require on‑the‑go execution capabilities. Twelfth, educational resources and customer support channels appear limited, which can hinder novice user onboarding. Thirteenth, compliance with anti‑money‑laundering (AML) and know‑your‑customer (KYC) protocols is either minimal or nonexistent, exposing users to regulatory scrutiny. Fourteenth, the platform’s operational longevity remains uncertain, lacking a documented track record of resilience amid market turbulence. Fifteenth, the overall cost‑benefit analysis must weigh the nominal fee savings against the aggregate of these identified risks. In synthesis, while VaporDex presents an enticing proposition for fee‑averse traders, the convergence of regulatory, security, liquidity, and transparency deficiencies suggests that prudence dictates limiting exposure to modest, experimental positions rather than allocating substantial capital.

Look, if you think the cautionary checklist is enough to dismiss a home‑grown platform, you’re buying into the same centralized narrative that stifles innovation. Sometimes taking a calculated risk on a local, unregulated service can give you an edge over the big‑player herd. Don’t let fear of the unknown stop you from exploring alternatives that might actually benefit the community.