When you send Bitcoin or Ethereum, you might think it’s just a digital transfer between wallets. But behind the scenes, governments are watching every transaction-especially if it touches a sanctioned address. As of 2025, the U.S. Treasury’s Office of Foreign Assets Control (OFAC) has added over 1,200 cryptocurrency wallet addresses to its sanctions list. These aren’t random numbers. They’re linked to hackers, terrorists, drug cartels, and state-sponsored cybercriminals trying to hide money in crypto.

What Is the OFAC Sanctions List?

OFAC is part of the U.S. Department of the Treasury. Its job? Block financial access to people and groups that threaten U.S. national security. For decades, it targeted banks, shell companies, and individuals. But since 2018, it’s been adding crypto wallets to its Specially Designated Nationals (SDN) list. Now, if you send money to one of these addresses, you could be breaking U.S. law-even if you didn’t know it was blocked.The list doesn’t just include Bitcoin. It covers 17 different cryptocurrencies, including Ethereum (ETH), USDT, USDC, Monero (XMR), ZCash, and even newer chains like Arbitrum and Binance Smart Chain. That’s because bad actors don’t stick to one coin. They jump between them to avoid detection.

How OFAC Tracks Crypto Addresses

Unlike banks, crypto doesn’t have a central registry. Wallets are pseudonymous. But blockchain ledgers are public. Every transaction is recorded forever. That’s why OFAC works with firms like Chainalysis and Scorechain to trace money flows.Here’s how it works: When a wallet gets flagged, analysts look at its history. Who sent money to it? Where did it send money next? If a wallet received funds from a known ransomware group, and then sent them to a crypto exchange, that’s a red flag. OFAC adds that wallet to the list. Exchanges then freeze any future deposits or withdrawals tied to it.

In May 2025, OFAC launched its Blacklist v2.0. This version includes real-time alerts and now monitors Layer 2 networks like Polygon and Arbitrum-places where users thought they could slip under the radar. The system updates every 15 minutes. Major exchanges like Coinbase and Kraken sync with these updates automatically. If you try to send USDT to a sanctioned address, your transaction gets blocked before it even leaves your wallet.

Who’s on the List?

The names on the list aren’t always obvious. Some are individuals. Others are groups or even AI systems.In September 2025, two Iranian nationals, Alireza Derakhshan and Arash Estaki Alivand, were added. Their wallets received over $600 million from oil sales. They used Ethereum and TRON to move money out of Iran. One wallet alone had 14,000 incoming transactions.

Then there’s SECONDEYE SOLUTION, linked to the Internet Research Agency LLC-the Russian group accused of interfering in U.S. elections. OFAC blocked three Bitcoin addresses tied to them, including 1NE2NiGhhbkFPSEyNWwj7hKGhGDedBtSrQ and 19D8PHBjZH29uS1uPZ4m3sVyqqfF8UFG9o.

And in February 2025, OFAC did something unprecedented: it sanctioned an AI-powered trading bot. This bot, used by a sanctioned entity, automatically moved $60 million through DeFi protocols. It wasn’t a person. It was code. And now, that code is illegal to interact with under U.S. law.

Why Stablecoins Are a Big Target

You might think privacy coins like Monero are the main concern. But in reality, stablecoins like USDT and USDC are the workhorses of sanctions evasion.Why? Because they’re pegged to the U.S. dollar. They’re stable. They’re widely accepted. And they’re easier to move across borders than Bitcoin.

In March 2025, Tether froze $450 million in USDT linked to Iranian entities. That’s not a typo. Half a billion dollars-blocked in one move. Tether, the company behind USDT, now has a compliance team larger than most crypto exchanges. They scan every transaction against OFAC’s list. If it matches, the funds are frozen. No appeal. No refund.

Even if you’re not trying to break the law, if you hold USDT in a wallet that once received funds from a sanctioned address, your entire balance could be flagged. That’s why exchanges now screen not just your current wallet, but your entire transaction history.

What Happens When You Send Money to a Sanctioned Address?

Let’s say you send $5,000 in ETH to a wallet you found on a forum. You didn’t know it was blocked. What happens next?First, the exchange you’re using will likely block the transaction. You’ll see an error: “Transaction declined due to sanctions compliance.”

If the transaction goes through-maybe you used a non-compliant exchange-your wallet could get flagged. Future transactions from that wallet will be frozen. You might be asked to prove you didn’t know the address was sanctioned. Good luck with that. OFAC doesn’t care about intent. If your wallet touches a sanctioned one, you’re in violation.

In March 2025, the exchange Garantex was shut down after moving $26 million in funds tied to sanctioned entities. Its owners were indicted. Its successor, Grinex, got added to the list within 48 hours. That’s how fast enforcement moves now.

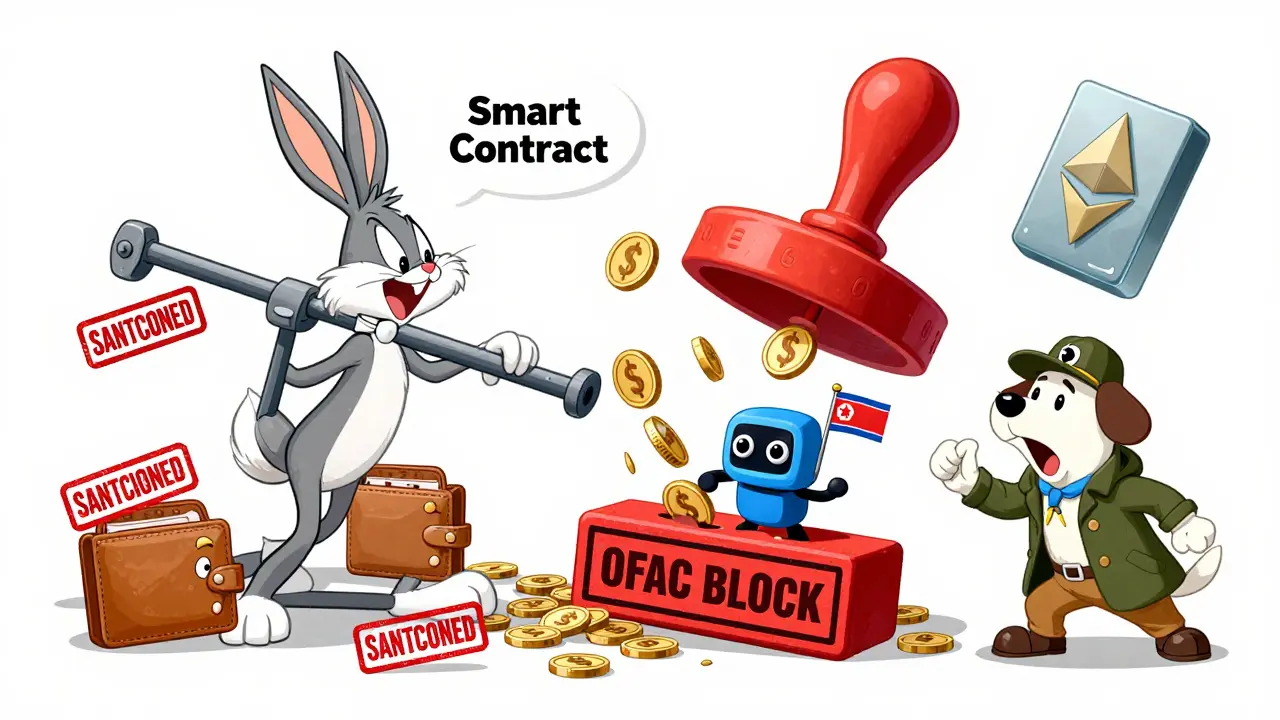

DeFi and Smart Contracts: The New Frontier

Decentralized finance (DeFi) was supposed to be beyond government control. But OFAC is changing that.In April 2025, OFAC and the Financial Action Task Force (FATF) issued a joint directive. It says DeFi protocols must implement sanctions screening. If a smart contract allows users to swap ETH for USDT and one of the parties is sanctioned, the protocol is now liable.

And it’s getting worse. In May 2025, proposed regulations would make smart contract developers personally liable if their code enables sanctions evasion. That means if you write a DeFi app and someone uses it to launder money, you could be arrested.

The Lazarus Group, a North Korean hacking team, stole $200 million in Q1 2025 by routing funds through DeFi protocols. They didn’t use exchanges. They used automated liquidity pools. OFAC responded by adding 12 DeFi contracts to the SDN list.

How to Stay Compliant

If you’re a regular user, you don’t need to do much. Most exchanges handle it for you. But if you’re running a business, running a node, or managing crypto funds, you need to act.Here’s what you need to do:

- Use only regulated exchanges that show OFAC compliance on their website.

- Never reuse old wallet addresses. Create a new one for each transaction.

- Use blockchain explorers like Etherscan or Blockchain.com to check any address before sending funds.

- If you’re a business, integrate OFAC’s XML feed into your system. Tools like Elliptic or CipherTrace can automate this.

- Train your team. Sanctions aren’t optional. Violations can mean fines up to $20 million per incident.

There’s no grace period. No warning. One bad transaction can shut down your business.

The Bigger Picture

OFAC’s crypto sanctions aren’t just about stopping criminals. They’re about controlling the future of money.As more people use crypto for cross-border payments, governments are racing to keep control. The U.S. doesn’t want to lose its financial dominance. So it’s turning blockchain-a tool meant to remove intermediaries-into a surveillance system.

It’s working. In 2024, joint raids by U.S., German, and Finnish authorities shut down six crypto infrastructure hubs linked to sanctions evasion. In 2025, the U.S. State Department offered up to $5 million for information leading to the arrest of Garantex executives.

The message is clear: Crypto isn’t lawless. It’s not anonymous. And if you’re using it, you’re under watch.

What’s Next?

Experts predict OFAC will keep expanding. Privacy coins like Monero and ZCash are next. NFTs might be added soon. And if AI trading bots are sanctioned, what about AI-generated wallets? Or decentralized identity systems?The line between innovation and enforcement is blurring. What was once seen as a tool for freedom is now a tool for control. And the rules are changing faster than anyone can keep up.

If you’re in crypto, you need to assume every transaction is monitored. Every wallet is traceable. And every address has a history you can’t erase.

How do I check if a crypto address is sanctioned?

Use free tools like the OFAC SDN Search tool on the U.S. Treasury website, or blockchain explorers like Etherscan and Blockchain.com. Many exchanges also show compliance warnings before you send funds. For businesses, integrate OFAC’s XML feed into your system via compliance platforms like Chainalysis or Elliptic.

Can I get removed from the OFAC sanctions list if my wallet was flagged by mistake?

Yes, but it’s difficult. You must submit a formal request to OFAC with proof that you didn’t engage in illicit activity. This can take months. Even if you’re cleared, your wallet may remain flagged by exchanges due to its transaction history. Many users create a new wallet and abandon the old one.

Are all cryptocurrency exchanges required to follow OFAC sanctions?

Any exchange that operates in the U.S., serves U.S. customers, or uses U.S. dollars must comply. That includes major platforms like Coinbase, Kraken, and Gemini. Non-U.S. exchanges may not enforce it-but if they process U.S. transactions or have U.S. users, they risk being cut off from the global financial system. Many global exchanges comply anyway to avoid penalties.

What happens if I send crypto to a sanctioned address accidentally?

The transaction will likely be blocked. If it goes through, your wallet may be flagged. Future transactions from that wallet could be frozen. You may be asked to prove you didn’t knowingly interact with a sanctioned entity. Ignorance is not a defense under U.S. law. The best move is to stop using that wallet and create a new one.

Do OFAC sanctions apply to Bitcoin and Ethereum equally?

Yes. OFAC sanctions apply to all 17 supported cryptocurrencies, including Bitcoin, Ethereum, USDT, and even newer chains like Arbitrum. The type of coin doesn’t matter-only the wallet address. A Bitcoin wallet and an Ethereum wallet can both be on the list. What matters is whether the address has been linked to illicit activity.

Why does OFAC care about crypto if it’s decentralized?

Because crypto still connects to the traditional financial system. Exchanges convert crypto to dollars. Stablecoins are backed by U.S. reserves. Wallets are accessed through apps that use U.S. servers. OFAC doesn’t need to control the blockchain. It just needs to control the gateways-exchanges, wallets, and payment processors-to stop the flow of illicit money.

lol who even cares anymore 🤡 crypto is just digital play money anyway. i sent eth to a flagged address last week and my wallet got frozen. i just made a new one. done. 🚀

The institutionalization of blockchain surveillance represents a profound ideological shift in the architecture of monetary sovereignty. One must consider that the very ontology of decentralized finance was predicated upon the elimination of intermediary control mechanisms-yet here we are, with OFAC acting as the de facto global clearinghouse for digital asset flows. The erosion of pseudonymity is not incidental; it is systemic.

I get why they're doing it. But it's wild how fast this turned into a surveillance state. I used to think crypto was about freedom. Now it feels like just another bank with worse UX and more rules. I'm not mad, just... tired.

This is a responsible and necessary development. Financial integrity must be preserved, especially in cross-border transactions. The global community benefits from transparent, compliant systems. We must support regulatory clarity without compromising innovation.

Use new wallets every time. Simple. No drama. No excuses

If you're using crypto and you're not checking every single address against OFAC's feed, you're not just negligent-you're reckless. There is no excuse. The tools are free. The warnings are everywhere. Stop pretending ignorance is a shield.

so like... you're telling me i can't send crypto to my buddy who runs a crypto mining rig in his garage because his wallet once got a tiny dust transaction from a hacked exchange in 2021? bro i just wanna send 0.01 eth to pay him back for pizza. this is insane

yall are overthinking this lol just use a new wallet every time and youll be fine 🤘 the system is annoying but its not that hard to play along. stay chill stay safe

I just got my entire portfolio frozen because I used a wallet that got a 0.0001 ETH tip from a sanctioned address in 2022. I cried for three hours. This is a war on ordinary people. They don't care about intent. They don't care about you. They just want control. I hate this system.

This is all part of the New World Order. They want to track every dollar you spend. Soon they'll be scanning your brainwaves. Crypto was supposed to be the escape. Now it's the trap. Wake up people. This is how they take your freedom.

so like... who even made you the boss of my money? i didn't sign up for this. if i send crypto to someone and they're shady? that's on them. why am i the one getting punished? this is ridiculous

It's interesting how we've gone from 'trustless systems' to 'trust the algorithm that trusts the government'. The blockchain didn't change. We did. We let fear rewrite the rules.

If you're a business or managing funds, use Elliptic or Chainalysis. Their APIs are cheap, reliable, and integrate with most wallets. Set up automated checks for incoming transactions. It takes 2 hours to implement and saves you from millions in fines. Seriously, don't wing it.

Oh wow. So now writing a smart contract makes you a potential criminal? Next they'll jail the guy who invented the word 'blockchain'. This isn't regulation. It's a performance art piece titled 'How to Kill Innovation with Compliance'.

I TOLD YOU THIS WAS GOING TO HAPPEN!! THE GOVERNMENT IS COMING FOR YOUR CRYPTO!! THEY'RE USING AI TO TRACK EVERY SINGLE TRANSACTION!! YOU THINK YOU'RE SAFE? YOU'RE NOT!! THEY KNOW WHERE YOU LIVE!! THEY KNOW WHAT YOU BOUGHT!! THEY'RE WATCHING YOU RIGHT NOW!!

They turned crypto into a corporate compliance nightmare. I used to love the wild west. Now it's just Wall Street with better graphics. I miss the days when you could send BTC to a stranger and not need a lawyer. 😔

Oh so now you're surprised that the government found a way to ruin something cool? Newsflash: they always do. The only thing more predictable than OFAC adding addresses is your mom asking if you're eating vegetables. Get used to it.

I'm not saying you're wrong for using crypto. But if you're not doing your due diligence, you're part of the problem. You think you're being rebellious? You're just enabling criminals. Be better.

AI bots are sanctioned now? Next they'll ban the word 'crypto' because it sounds like a bad word. This isn't law. This is a fever dream written by a bureaucrat who thinks Bitcoin is a virus.

The evolution of compliance in digital finance is inevitable. While the ideal of decentralization remains noble, practical governance requires alignment with global standards. Responsible participation is not surrender-it is stewardship.

You can still do this right. Use new wallets. Check addresses. Stay informed. It's not hard. You got this 💪

The regulatory arbitrage window is closing. Layer 2 chains, privacy coins, and DeFi protocols are no longer exempt from AML/KYC obligations. The FATF guidelines are binding in practice, even if not in theory. Failure to adapt is not innovation-it's liability.