When you deposit ETH and USDC into a DeFi liquidity pool, you’re not just adding funds-you’re setting up a mathematical contract that decides how prices move, how fees are earned, and how much money you might lose without even trading. The key to all of this? Liquidity pool token ratios.

What Exactly Is a Token Ratio?

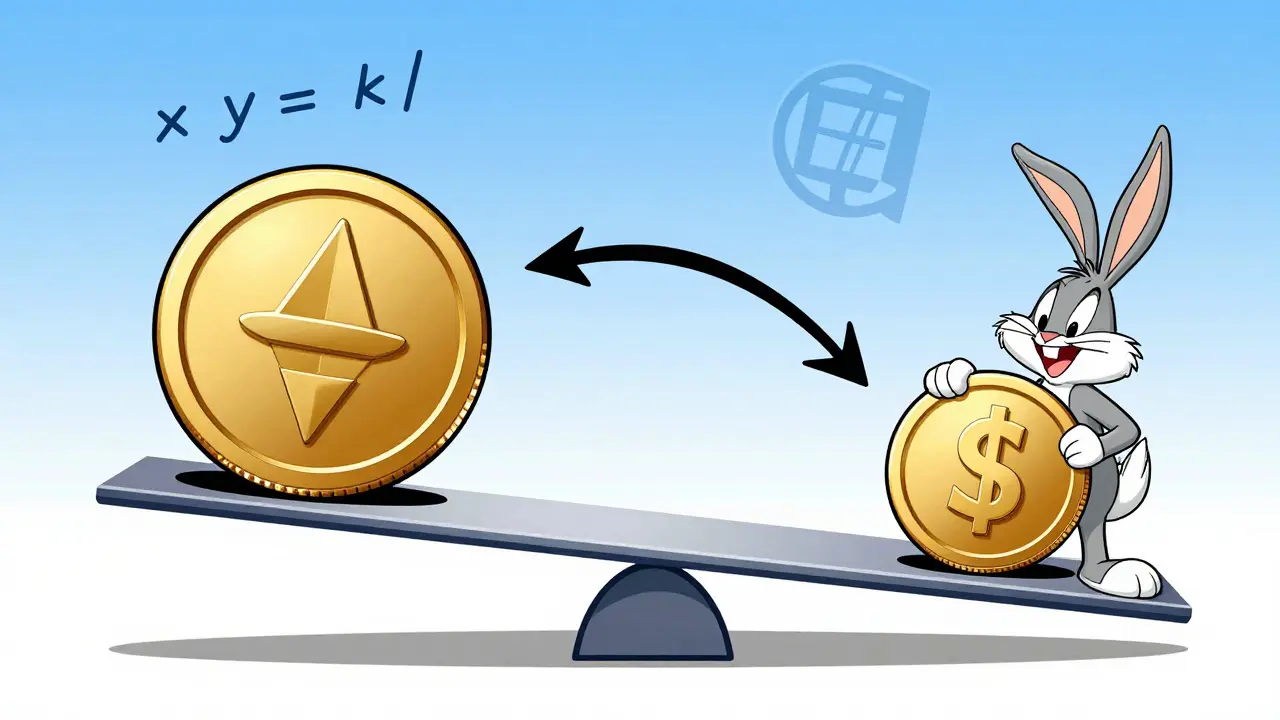

A liquidity pool token ratio is the proportion of two tokens held inside a smart contract that powers decentralized trading. Think of it like a digital seesaw: for every ETH you add, you must add a matching dollar value of USDC. In the most common setup-like Uniswap or PancakeSwap-that’s a 50/50 ratio. But it’s not always equal. Some pools use 80/20, 60/40, or even more complex formulas. These ratios aren’t arbitrary. They’re the engine behind how prices are set, how trades are filled, and how your money grows-or shrinks.Every time someone swaps tokens in the pool, the ratio shifts. If more people buy ETH, the pool loses ETH and gains USDC. That makes ETH scarcer inside the pool, so its price goes up automatically. This is called the constant product formula: x × y = k. Where x is the amount of one token, y is the amount of the other, and k is a fixed number that never changes unless someone adds or removes liquidity. The math keeps the pool balanced without needing buyers and sellers to match up manually.

Why 50/50 Isn’t Always the Best Choice

Most beginners start with 50/50 pools because they’re easy. But they’re also risky. If the price of one token swings wildly-say, ETH goes up 300% while USDC stays flat-you’ll end up with way more USDC and way less ETH in your share of the pool. When you withdraw, you get back less ETH than you put in. That’s called impermanent loss, and it’s the #1 reason people lose money in DeFi liquidity pools.That’s why advanced users avoid pairing volatile tokens with stable ones in 50/50 pools. Instead, they use weighted ratios. Balancer lets you build pools like 80% USDC and 20% ETH. If ETH spikes, you don’t get wiped out because you only had 20% exposure. You still earn trading fees, but your risk is capped. It’s like insurance for your capital.

Stablecoin pools, like those on Curve Finance, use even smarter math. They keep ratios locked near 1:1 for USDC, DAI, and USDT because those tokens are meant to be worth the same. Curve’s algorithm minimizes slippage so you can swap $1,000 of USDC for $999.80 of DAI without the price moving. That’s why Curve dominates stablecoin trading-it’s built for precision, not speculation.

Concentrated Liquidity: The New Game Changer

In 2025, the biggest shift in liquidity pools isn’t about ratios-it’s about where those ratios live. Uniswap v3 introduced concentrated liquidity market makers (CLMM). Instead of spreading your $10,000 across every possible price of ETH/USDC, you pick a range-say, $3,000 to $3,500. Your entire capital only works within that band.Why does this matter? Because if ETH trades mostly between $3,100 and $3,400, your money is working 10x harder than in a traditional pool. You earn way more fees per dollar. But if ETH breaks out past $3,500, your liquidity stops working until the price comes back. It’s a trade-off: higher returns for active management.

Most retail users still use full-range liquidity because it’s hands-off. But professional liquidity providers now treat CLMM like day trading. They monitor price action, adjust ranges daily, and even use bots to auto-rebalance. It’s not for beginners. But if you understand price trends, it can double your yield compared to old-school pools.

How LP Tokens Work (And Why They Matter)

When you deposit tokens into a pool, you don’t just get a receipt-you get LP tokens. These are digital proof that you own a slice of the pool. If you put in $5,000 of ETH and $5,000 of USDC into a pool with $100,000 total value, you get 10% of the LP tokens. That means you’re entitled to 10% of all trading fees the pool collects.LP tokens are ERC-20 or BEP-20 tokens, just like any other crypto. You can see them in your wallet as something like “ETH-USDC LP.” You can’t spend them, but you can stake them in yield farms to earn more rewards. To get your original tokens back, you must burn the LP tokens. That’s the only way the smart contract knows you’re done and should return your share of the pool.

Here’s the catch: if the ratio changes while you’re in the pool, your LP tokens still represent the same percentage-but the value of what they represent might be lower. That’s impermanent loss again. Your LP token count doesn’t drop. But the tokens inside the pool have changed.

How Token Ratios Affect Your Earnings

Your annual percentage rate (APR) isn’t just about how many fees the pool collects-it’s about how efficiently your capital is used. A pool with a 50/50 ratio and $10 million in liquidity might earn $50,000 in fees per month. But if you use a 90/10 weighted pool with only $2 million total, you might earn $30,000 in fees because the rarer token gets traded more often.High trading volume doesn’t always mean high returns. It means high volatility. If a pool has a 50/50 ratio of two tokens that move in opposite directions (like BTC and ETH), the ratio swings constantly. That means more trades, more fees, but also more impermanent loss. On the other hand, a pool with two tokens that move together-like USDC and DAI-has low trading volume, low fees, but almost no impermanent loss.

Expert analysis from Cyfrin and DeFiLlama shows that pools with correlated assets and stable ratios (like stablecoin pairs or tokenized Bitcoin and wrapped Bitcoin) deliver the most consistent returns. The ones with wild price swings-like new memecoins paired with ETH-can have 500% APRs for a week, then crash to 10% and wipe out 40% of your principal. That’s not yield farming. That’s gambling with math.

What Happens When Ratios Get Out of Balance?

Markets don’t stay still. If ETH trades at $4,000 on Coinbase but only $3,800 in a liquidity pool, arbitrage traders jump in. They buy ETH cheap from the pool and sell it high on the exchange. This brings the pool’s price back up and rebalances the ratio.That’s a good thing. It keeps prices accurate. But it’s also why you lose money. Every time arbitrageurs correct the pool, they take ETH from you and give you USDC. Your share of the pool becomes more USDC and less ETH. If ETH keeps rising, you keep losing ETH. That’s impermanent loss in action.

The bigger the price gap, the more you lose. A 20% price move can cost you 5-10% of your deposit. A 100% move? You could lose 30% or more. That’s why smart users avoid pools with uncorrelated assets. If you’re going to provide liquidity, match tokens that move together: ETH and stETH, BTC and WBTC, USDC and USDT. Don’t pair ETH with a new token that hasn’t traded for 3 months.

How to Choose the Right Ratio for You

Here’s how to pick a pool without getting wrecked:- Beginners: Stick to stablecoin pairs (USDC/DAI) or major token pairs (ETH/WETH) on Uniswap or PancakeSwap with 50/50 ratios. Low risk, low reward.

- Intermediate: Try 80/20 or 70/30 weighted pools on Balancer. Put 80% in a stablecoin, 20% in a high-potential token. You get exposure without full risk.

- Advanced: Use concentrated liquidity on Uniswap v3. Pick a narrow price range around where you think the price will stay. Monitor it weekly. Rebalance if the price moves outside your range.

- Never: Deposit into pools with tokens you don’t understand. If you can’t explain how the token works, don’t put your money in its liquidity pool.

Check the pool’s trading volume and TVL (Total Value Locked). A pool with $100M TVL and $5M daily volume is stable. One with $5M TVL and $500K volume? It’s a graveyard for LPs. Low volume means few fees. Low TVL means high slippage and easy manipulation.

What’s Next for Liquidity Pool Ratios?

Uniswap v4, launching in early 2026, will let developers build custom pool logic. Imagine a pool that automatically shifts its ratio based on market volatility. Or one that adds more liquidity when price moves go beyond a threshold. These are no longer science fiction-they’re coming.On-chain analytics tools now track ratio stability in real time. Platforms like DeFiSaver and Zapper show you if your pool’s ratio has drifted 15% from its starting point. That’s a red flag. It means you’ve lost value. You can now set alerts to warn you before you withdraw.

The future isn’t just about ratios. It’s about automation. The next generation of DeFi will let you set rules: “Keep my ETH/USDC ratio between 45/55 and 55/45. If it drifts beyond that, auto-rebalance using my staked rewards.” That’s the future. And it’s already being built.

Final Advice: Ratios Are Your Risk Meter

Liquidity pool token ratios aren’t just math. They’re your risk dashboard. A 50/50 ratio with two volatile tokens? High risk. An 80/20 ratio with one stablecoin? Low risk. Concentrated liquidity? High reward, high attention needed.Most people lose money in DeFi not because they picked the wrong token. They lost because they didn’t understand how the ratio worked. The math doesn’t lie. If your token pair is moving in opposite directions, your LP tokens are slowly turning into the wrong asset. Watch the ratio. Understand the formula. Choose your pool like you’d choose a car-not by the color, but by the engine.

What is the most common liquidity pool token ratio?

The most common ratio is 50/50, used by Uniswap, PancakeSwap, and other major AMMs. This means you deposit equal dollar values of two tokens-for example, $500 of ETH and $500 of USDC. It’s simple and widely supported, but it exposes you to higher impermanent loss if the tokens’ prices diverge.

Can I lose money even if the token price goes up?

Yes. If you provide liquidity in a 50/50 pool and one token rises sharply-say ETH goes from $3,000 to $4,500-you’ll end up with more of the stable token (like USDC) and less of the rising one. When you withdraw, you get back less ETH than you put in, even though ETH’s market price went up. This is called impermanent loss, and it’s caused by the AMM’s math rebalancing the pool.

What’s the difference between a 50/50 pool and a weighted pool?

A 50/50 pool forces equal dollar values of both tokens. A weighted pool lets you set custom ratios, like 80/20 or 75/25. Weighted pools reduce your exposure to one token’s volatility. For example, an 80/20 USDC/ETH pool means you’re only risking 20% of your capital on ETH’s price swings. This lowers impermanent loss and is better for long-term holding.

Do all DeFi platforms use the same ratio formulas?

No. Uniswap and PancakeSwap use the constant product formula (x × y = k) for 50/50 pools. Balancer uses weighted ratios with customizable weights. Curve uses a stableswap algorithm optimized for tokens with similar values, like USDC and DAI. Uniswap v3 introduced concentrated liquidity, where you define a price range. Each formula serves a different purpose: simplicity, stability, or capital efficiency.

How do I know if my liquidity pool ratio is healthy?

Check the pool’s current ratio against your deposit ratio. If ETH/USDC was 50/50 when you deposited, but now it’s 60/40, your position has drifted. Use tools like DeFiSaver or Zapper to track this. A drift over 10% means you’ve likely lost value due to impermanent loss. High trading volume and high TVL (Total Value Locked) are also signs of a healthy, stable pool.

Should I use concentrated liquidity as a beginner?

No. Concentrated liquidity (like Uniswap v3) requires you to predict price ranges and actively manage your position. If you pick the wrong range, your funds stop earning fees. Beginners should start with full-range 50/50 or weighted pools. Once you understand how prices move and how fees accumulate, then consider concentrated liquidity.

Are LP tokens the same as the underlying tokens?

No. LP tokens are proof of your share in the liquidity pool. They’re not the actual ETH or USDC you deposited. You need to burn your LP tokens to get your original assets back. LP tokens can be staked in yield farms for extra rewards, but they can’t be traded or spent like regular crypto.

What causes impermanent loss to be worse?

Impermanent loss gets worse when: 1) The two tokens have very different price movements (e.g., ETH vs. a new memecoin), 2) The price swings are large and fast, 3) The pool has low trading volume (so arbitrage doesn’t fix the ratio quickly), and 4) You hold for a long time without withdrawing. The more the ratio drifts from your original deposit, the bigger the loss.

Just deposited into a 80/20 USDC/ETH pool last week. Been sleeping like a baby since. No drama, no panic, just steady fees rolling in. This is how you do it.

Oh sweetie, you think 80/20 is ‘safe’? 😌 You’re just delaying the inevitable. The moment ETH hits $10K, your ‘insurance’ turns into a paper napkin. You didn’t hedge-you just got a VIP pass to watch your portfolio bleed out slowly while you sip your oat milk latte.

People still use 50/50? That’s like driving a Ferrari with the parking brake on. If you don’t understand impermanent loss, you shouldn’t be near a liquidity pool, let alone managing it.

Impermanent loss is not a bug-it’s a feature of the constant product formula. Misunderstanding it reflects a fundamental failure to grasp AMM mechanics. Your emotional attachment to ‘safety’ is statistically irrelevant.

CLMM is the future. You’re not a liquidity provider-you’re a market maker. If you’re not rebalancing on-chain with SlippageGuard + Chainlink oracles, you’re just a bagholder with a wallet.

lol you guys are so naive 😏 what if the Fed just prints $10T and USDC depegs? Then your ‘stable’ pool becomes a graveyard. They’re all rigged. I know things.

i just stare at my lp tokens now. they don't move. i don't move. we're both just... waiting. for what? i don't know anymore.

yo i tried the 80/20 thing and it felt like i was holding a balloon full of glitter-pretty but you know it’s gonna explode and ruin your couch. still, i’m hooked. the fees are wild. i’m like a kid in a candy store but the candy is math and i’m bad at math 😅

One must consider the ontological implications of token ratios as metaphors for economic equilibrium. The 50/50 paradigm reflects a Cartesian duality-binary, rigid, and ultimately unsustainable in a world of quantum volatility. One must transcend the ratio to achieve true liquidity enlightenment.

They don’t want you to know this-but all these ‘weighted pools’ are just front-end tricks. The real control is in the algorithmic arb bots owned by hedge funds. You’re not earning fees-you’re feeding data to their models. Wake up.

Did you know that Uniswap v4 is secretly being coded by the same people who made the 2008 mortgage crisis? They’re just swapping ‘subprime’ for ‘memecoins’ now. I’ve seen the documents. They’re coming for your LP tokens next.

why do people even care about ratios anymore i just throw eth and usdc in and hope for the best honestly i dont even check my wallet anymore

Interesting breakdown. I’ve been using Curve for stable swaps and haven’t had a single impermanent loss event. The math really does work when assets are pegged. Good reminder to stick to fundamentals.

Okay so let me just say-I’ve been in DeFi since 2021 and I’ve seen everything. I’ve been in pools that lost 90% of value, I’ve been in pools that doubled my money in a week, I’ve been front-run, I’ve been rug-pulled, I’ve been MEV’d, I’ve been rekt, I’ve been rewarded, I’ve been betrayed, I’ve been gaslit by my own wallet, I’ve cried over my LP tokens, I’ve prayed to the Ethereum gods, I’ve written 47-page spreadsheets on token correlation matrices, I’ve lost sleep over slippage percentages, I’ve used 12 different analytics dashboards simultaneously, I’ve set up 3 bots to auto-rebalance, I’ve tried to explain impermanent loss to my mom who thought it was a new type of yoga, and I’m here to tell you-none of it matters unless you’re emotionally detached and have a trust fund. But hey, if you’re reading this, you’re probably already too deep. Just don’t tell anyone I said that.

you got this!! 💪 seriously-start small, learn the ratios, don’t panic when the chart goes down, and remember: every expert was once a beginner. you’re doing better than you think! 🤝✨

Thank you for this comprehensive overview. The distinction between constant product and concentrated liquidity models is critical for long-term capital preservation. One must approach liquidity provision with the same rigor as one would a fiduciary duty.

bro i used to think 50/50 was the only way till i tried balancer and now i feel like a wizard 🧙♂️ just put 75% usdc 25% eth and watch your fees stack like legos. no cap. you got this.

While the technical architecture of liquidity pools is undeniably sophisticated, one must not overlook the human element-the psychological burden of watching one’s capital fluctuate in real-time, the isolation of managing positions without human feedback, and the existential weight of trusting code over community. The ratio is not merely mathematical-it is a mirror reflecting our relationship with risk, control, and uncertainty in a decentralized world.

You all are missing the forest for the trees. The real issue isn't the ratio-it's the lack of liquidity mining incentives aligned with long-term price stability. AMMs are designed for arbitrage, not wealth preservation. The only way to win is to become the arbitrageur, not the liquidity provider. If you're not front-running your own position with a bot, you're already losing. The system isn't broken. It's working exactly as intended-for the whales.