Lifinity DEX Risk & Token Analysis Tool

Current LFNTY Price

$1.48

As of October 2025

24h Trading Volume

$2.8K

Low liquidity indicator

Risk Assessment

Factors contributing to risk:

- Low trading volume ($2.8K)

- No formal security audits

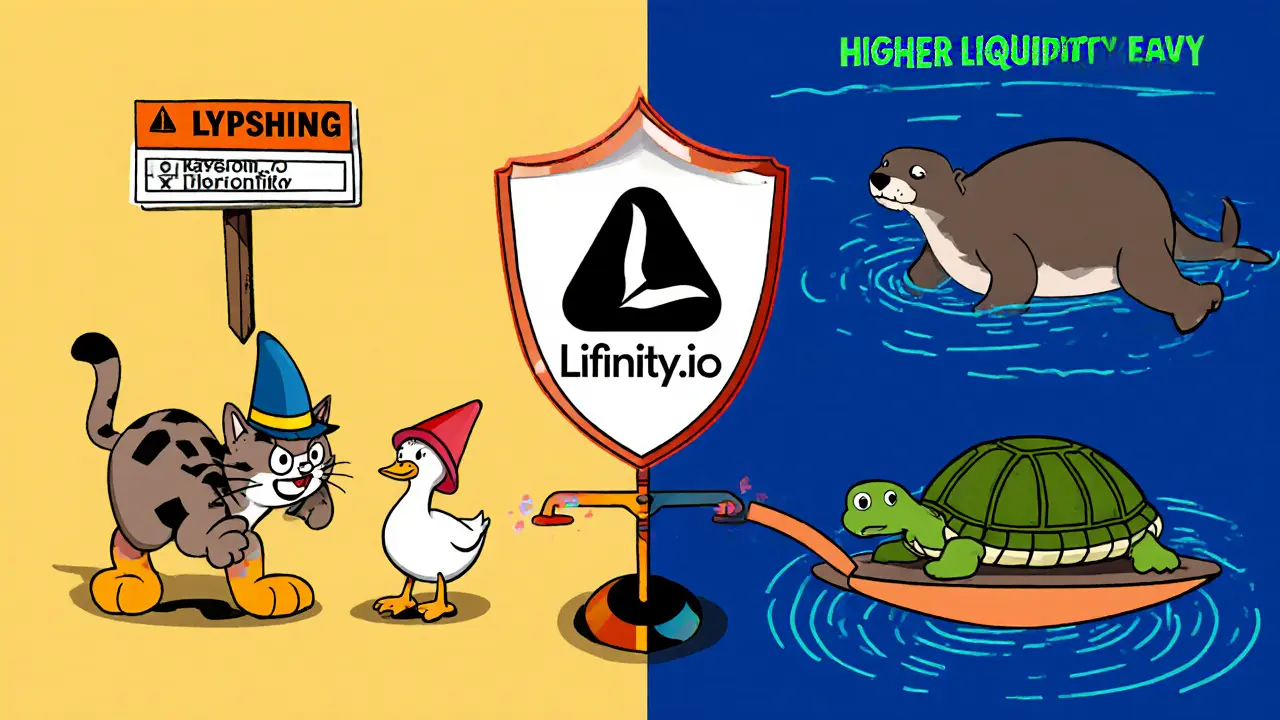

- Phishing scam reports

- Thin liquidity pools

Positive aspects:

- Unique oracle-driven AMM model

- Reduced impermanent loss potential

- Native token LFNTY offers utility

Token Potential Forecast

Based on current market indicators:

Bullish Scenario: LFNTY could reach $3.12 by end of 2025 (111% upside)

Long-Term Projection: Conservative estimates suggest $28 by 2034

Note: These projections are highly speculative due to low trading volume and lack of formal audits.

Comparison with Top Solana DEXs

| Feature | Lifinity | Raydium | Orca |

|---|---|---|---|

| Blockchain | Solana | Solana | Solana |

| Oracle-Based Pricing | Yes | No | No |

| 24h Volume (USD) | $2.8K | $150M | $45M |

| Liquidity Incentives | LFNTY rewards | RAY rewards | ORCA rewards |

| Security Audits | None listed | Multiple | Serum team |

Lifinity is a decentralized exchange (DEX) built on the Solana blockchain. It operates as an automated market maker (AMM) that uses oracle‑based pricing to cut down slippage and lower impermanent loss for liquidity providers. In this Lifinity crypto exchange review, we break down how the platform works, its token LFNTY, security concerns, and how it stacks up against rivals like Raydium and Orca.

Key Takeaways

- Lifinity is the first proactive market maker on Solana, aiming to reduce impermanent loss.

- The native token LFNTY trades around $1.48 (Oct2025) and shows oversold signals.

- Trading volume is low (≈2.8KUSD/24h) and the DEX ranks beyond the top5,000 cryptocurrencies.

- Scam sites mimicking lifinity.io have been reported; always verify the URL.

- Compared to Raydium and Orca, Lifinity lags on liquidity and user adoption but offers a unique oracle‑driven AMM model.

How Lifinity Works: Oracle‑Driven AMM Basics

Traditional AMMs rely on a constant‑product formula (x×y=k) that can cause significant price drift when large trades hit shallow pools. Lifinity adds an oracle layer that pulls real‑time price data from multiple sources. The oracle feeds a modified pricing curve, which helps keep pool prices aligned with the broader market and reduces slippage.

Liquidity providers (LPs) deposit paired assets into pools and earn a share of the swap fees. Because the oracle mitigates drastic price swings, LPs face less impermanent loss-a common pain point on AMMs like Uniswap. The protocol also offers a “proactive market maker” mode that automatically adjusts pool parameters based on volatility signals.

Tokenomics: LFNTY Details and Market Snapshot

The platform’s native token, LFNTY, serves three core purposes: governance, fee discounts for traders, and incentive rewards for LPs. As of 7Oct2025 the token price sits at $1.48, below its 50‑day simple moving average of $1.69 but above the 200‑day SMA of $1.18. The 14‑day Relative Strength Index (RSI) is 33.83, indicating oversold conditions, while the Fear & Greed Index reads 43.61, pointing to a cautious market mood.

Supply figures are not publicly audited, but circulating supply estimates place LFNTY in the low‑hundreds of millions. Analysts are split: bullish forecasts target $3.12 by year‑end (a 111% upside), whereas long‑term models stretch to $28 by 2034-these numbers are highly speculative given the token’s thin trading volume of roughly 2.84KUSD daily.

Security Risks & Scam Alerts

Because Lifinity is a DeFi protocol, users retain full custody of their assets, which means there’s no recourse if funds are sent to a malicious address. The biggest red flag in recent months has been phishing sites that mimic the legitimate domain lifinity.io by dropping a single character (e.g., lfinity.io). These fake sites copy the UI, prompt users to connect their Solana wallets, and then use automated scripts to drain balances.

Security analysts at PCRisk classify these attacks as social‑engineering scams spread via counterfeit social media accounts and ads. The recommendation is simple: always double‑check the URL, use a hardware wallet when possible, and avoid approving contracts from unknown sources.

Competitive Landscape: How Lifinity Stacks Up

| Feature | Lifinity | Raydium | Orca | Uniswap (Ethereum) |

|---|---|---|---|---|

| Launch Year | 2022 | 2020 | 2021 | 2018 |

| Blockchain | Solana | Solana | Solana | Ethereum |

| Oracle‑Based Pricing | Yes | No | No | No |

| 24‑h Volume (USD) | ≈2.8K | ≈150M | ≈45M | ≈1B |

| Liquidity Incentives | LFNTY rewards | RAY rewards | ORCA rewards | UNI rewards |

| Security Audits | Community‑reported; no formal audit listed | Multiple third‑party audits | Audit by Serum team | Extensive audits |

From the table it’s clear that Lifinity’s niche is its oracle‑driven AMM model, but it lags far behind on volume and audit coverage. For traders seeking deep liquidity, Raydium or Orca are safer bets. For LPs willing to experiment with reduced impermanent loss, Lifinity offers a unique proposition.

User Experience, On‑boarding & Community

Getting started requires a Solana‑compatible wallet such as Phantom or Solflare. After connecting, users can trade any token pair that has an active pool, or add liquidity by depositing matching assets. The UI mirrors typical DEX designs: a swap box, pool details, and a “Provide Liquidity” button.

However, community chatter is thin. On Reddit’s r/solana and Discord channels, Lifinity rarely appears in top‑ranked discussions. Most mentions revolve around price speculation rather than detailed UX feedback. This lack of user‑generated content makes it hard to gauge support response times or roadmap transparency.

Future Outlook & Development Roadmap

Official roadmaps are scarce. The team hints at upcoming integrations with Solana’s upcoming Serum order‑book layer, which could boost order depth and attract more traders. Additionally, a planned audit by a reputable firm is rumored for Q42025, which would address many of the current security concerns.

Long‑term price forecasts that push LFNTY toward $28 by 2034 rely heavily on mass adoption of the oracle‑driven AMM model and broader Solana stability. Given the network’s historic outages, any future success will also depend on Solana’s ability to maintain uptime.

Bottom Line

Lifinity stands out for its technical twist on AMM pricing, offering a possible reduction in impermanent loss for LPs. Yet, low liquidity, limited community presence, and a lack of formal security audits make it a higher‑risk choice for everyday traders. If you’re comfortable navigating Solana wallets, understand the basics of AMM mechanics, and are looking for an experimental platform with a novel pricing engine, Lifinity could be worth a small allocation. Otherwise, established DEXs like Raydium or Orca remain the safer play.

Frequently Asked Questions

Is Lifinity safe to use?

Safety depends on two factors: the underlying Solana network and the protocol’s own code. Lifinity has not published a comprehensive third‑party audit, so users should treat it as experimental and only allocate funds they can afford to lose.

How does the oracle reduce impermanent loss?

The oracle feeds real‑time market prices into the AMM’s pricing curve. By aligning pool prices with external market rates, large swaps cause less divergence from the true price, which in turn reduces the temporary loss LPs would otherwise experience.

What wallets are compatible with Lifinity?

Any wallet that supports Solana’s SPL token standard works - Phantom, Solflare, Sollet, and Ledger (via Solflare) are the most common choices.

Can I earn LFNTY by providing liquidity?

Yes. Liquidity providers receive a share of swap fees and, in many pools, additional LFNTY token rewards that are distributed proportionally to their stake.

How do I avoid the fake "lfinity.io" scam site?

Always double‑check the URL: the legitimate site is lifinity.io. Bookmark the page, use a reputable DNS resolver, and never approve a connection request from an unfamiliar domain.

The oracle‑driven AMM model is an intriguing approach to mitigating impermanent loss; by anchoring pool prices to external feeds, it can keep swaps nearer to market rates. However, the thin liquidity means that price impact remains a concern for sizable trades. Users should weigh the novelty against the current lack of depth before allocating significant capital. A cautious, experimental allocation might be the prudent path.

Wow-what a bold experiment, folks! Leveraging real‑time price feeds, Lifinity promises lower slippage, but the $2.8K daily volume raises eyebrows, and the absence of formal audits is a red flag, so proceed with caution, keep your keys safe, and don’t chase hype!

Imagine a DEX that actually tames the beast of impermanent loss-Lifinity tries to do just that! Its oracle‑based pricing feels like a superhero swooping in to save LPs from the usual pain. The trade‑off is clear, though: you risk venturing into uncharted waters with low liquidity. Still, for the adventurous trader, it’s a story worth watching!

Even though the tech sounds slick, I’d bet the market will stick with Raydium and Orca for the foreseeable future; users need deep pools, not experimental curves.

yeah, the UI’s pretty clean and you can hook up Phantom in seconds, but if you’re looking for big swaps the slippage might bite you hard.

It is utterly irresponsible for any platform to invite users to lock their assets without a proper security audit; scammers exploiting the lifinity.io typo only prove how essential vigilance is.

From a rigorous analytical standpoint, the absence of third‑party verification, coupled with the markedly low 24‑hour volume, inevitably engenders a heightened risk profile, which, in turn, obliges prospective participants to conduct exhaustive due diligence prior to any capital deployment.

Lifinity’s proposition of integrating an oracle layer into the traditional constant‑product AMM formula represents a noteworthy evolution in the design of decentralized exchanges.

By sourcing real‑time price data from multiple feeds, the protocol aims to align pool pricing with external market valuations, thereby attenuating the notorious impermanent loss that plagues liquidity providers on conventional platforms.

In practice, this mechanism can reduce the divergence between the pool price and the broader market price, which translates into more stable returns for those who stake assets in shallow pools.

Nevertheless, the effectiveness of the oracle is contingent upon the reliability and timeliness of the data sources, and any latency or manipulation could reintroduce volatility into the system.

The current liquidity metrics underscore a fundamental challenge: with only about $2.8 K rotating daily, the depth is insufficient to accommodate larger trades without incurring noticeable price impact.

This paucity of volume also means that fee revenue for liquidity providers is modest, potentially offsetting the gains from reduced impermanent loss.

Security considerations further complicate the landscape, as Lifinity has yet to publish a comprehensive third‑party audit, leaving a gap in confidence for risk‑averse participants.

Recent reports of phishing sites mimicking the official domain amplify the importance of user vigilance and underscore the broader ecosystem’s susceptibility to social engineering attacks.

From a governance perspective, the LFNTY token’s utility in fee discounts and reward distribution provides an incentive alignment mechanism, yet the token’s supply transparency remains opaque.

Analysts who focus on on‑chain metrics notice that the token’s relative strength index signals oversold conditions, which could hint at a short‑term rebound if market sentiment improves.

Long‑term projections that envision a price surge into the double‑digit range, however, hinge on widespread adoption of the oracle‑driven model and a substantial increase in user base.

Should Solana’s network stability improve and Lifinity secure a reputable audit, the platform could attract more capital, thereby enhancing liquidity and reducing the risk premium.

Conversely, persistent network outages or continued low participation might relegate Lifinity to a niche experimental corner of the DeFi space.

For traders who prioritize deep liquidity and robust security audits, established DEXs such as Raydium or Orca remain the safer choices.

For those willing to allocate a modest portion of their portfolio to explore innovative AMM designs, Lifinity offers a unique value proposition worth a measured experiment.

Ultimately, the decision rests on balancing the allure of reduced impermanent loss against the realities of limited liquidity, audit uncertainty, and the imperative to safeguard private keys.

One can't ignore the pattern of low‑volume DEXs emerging just as major players face regulatory pressure; Lifinity could be a smokescreen for funneling funds into unknown contracts, especially given the missing audit and the recent phishing clones.

I hear your balanced summary, and I’d add that monitoring the LFNTY token’s on‑chain activity could help spot any irregularities early.

Great point about the oracle, Michael! 🌟 Keeping an eye on the data sources is key.

From a community angle, it would help if the team shared more frequent updates; transparency builds trust.

Technically, the constant‑product curve x·y=k is mathematically vulnerable to large trades; the oracle adjustment modifies the invariant to something akin to a weighted price curve, which mathematically reduces slippage but introduces external dependency.

Indeed, the novelty is exciting, yet the risk factors-low volume, no audit, phishing threats-should not be glossed over!

For newcomers, I suggest starting with a small test amount on Lifinity, observing the swap fees, and then deciding whether to scale up based on personal risk tolerance.

Skip it until they get a proper audit.

Patrick’s contrarian take is noted, but the oracle’s potential could still carve a niche if liquidity incentives improve.