DeFiChain Airdrop Calculator

Cake DeFi Airdrop Calculator

Calculate your potential DFI rewards from the Cake DeFi airdrop program based on your referrals. This tool helps you understand what you can earn by participating in the official DFI airdrop.

Referral Reward: $10 DFI per referral

How This Works

The Cake DeFi airdrop gives you $30 in DFI for depositing $50 worth of crypto and locking it for 28 days. For each referral who does the same, you get an additional $10 DFI. All DFI tokens earn 34.5% APY for 180 days.

Back in 2020, DeFiChain gave away 500 DFI tokens for every 1 Bitcoin held in private wallets. That’s not a typo. If you owned 10 BTC, you got 5,000 DFI. If you held 100 BTC, you got 50,000 DFI. That airdrop was one of the biggest in crypto history-and it’s long closed. But if you’re wondering whether you can still get free DFI tokens today, the answer is yes. There are active ways to claim DFI right now, and they’re not just social media gimmicks. They require real engagement, real money, and real commitment. Here’s exactly how it works in 2025.

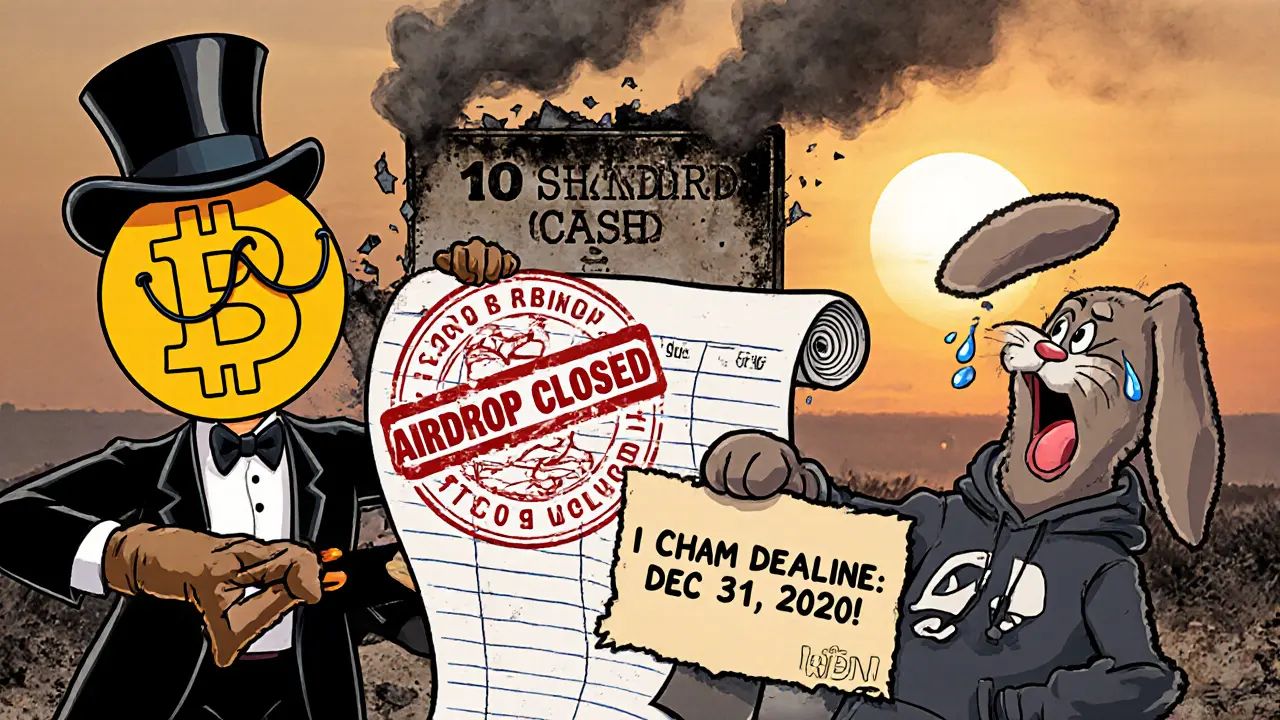

The 2020 Bitcoin Airdrop: What Happened and Why It’s Over

The original DeFiChain airdrop was tied to Bitcoin’s blockchain. On September 9, 2020, at block #647,500, DeFiChain scanned the Bitcoin chain for wallets holding BTC. If you owned any amount of Bitcoin-yes, even 0.01 BTC-and you held it in a wallet that allowed message signing (like Electrum, Bitcoin Core, or Ledger), you qualified. No minimum. No registration. Just proof of ownership. To claim, you had to sign a message with your private key, proving you controlled the wallet. Then you submitted that signature through DeFiChain’s claim portal. The deadline? December 31, 2020. If you missed it, you missed out. There’s no second chance. No extension. No recovery. That airdrop was a one-time snapshot. It wasn’t designed to be recurring. It was a way to bootstrap the DeFiChain network by tapping into Bitcoin’s existing user base. That’s why DeFiChain isn’t running that same airdrop again. It already got its early adopters. Now, it’s focused on building a real DeFi ecosystem.How to Get Free DFI Tokens Today: The Cake DeFi Airdrop

The only active, reliable way to get free DFI tokens right now is through Cake DeFi. This isn’t a gimmick. It’s a partnership. And it’s still running as of October 2025. Here’s how it works:- Create a free account on Cake DeFi (no deposit needed yet).

- Complete email verification and full KYC (upload ID, selfie, address proof).

- Deposit at least $50 worth of any supported crypto (BTC, ETH, USDT, etc.) into one of Cake’s staking, lending, or liquidity mining freezers.

- Lock your deposit for at least 28 days.

The CoinMarketCap Airdrop: Low Effort, Small Rewards

If you don’t want to deposit money, CoinMarketCap still runs a DFI airdrop. It’s simple:- Follow DeFiChain’s official Twitter account

- Join the DeFiChain Telegram group

- Join the DeFiChain Reddit community

- Follow DeFiChain on the CoinMarketCap platform

- Add DeFiChain to your watchlist on CoinMarketCap

Why DeFiChain’s Airdrops Are Different

Most crypto airdrops are just noise. They ask you to retweet, join a Discord, and hope for a tiny payout. DeFiChain’s current programs are different. The Cake DeFi airdrop requires you to lock up real money. That means you’re not just grabbing free tokens-you’re committing to the DeFiChain ecosystem. You’re using staking. You’re earning yield. You’re learning how DeFi works. That’s why DeFiChain ranks among the top airdrops of 2025, alongside projects like Tamadoge and Metamask. It’s not about volume. It’s about quality. Compare that to StormGain, which gives you 25 USDT just for signing up. No lock-up. No deposit. No strings. Easy, but useless. You get cash, but you don’t learn anything. DeFiChain wants users who will stay. StormGain wants clicks.Who Should Try These Airdrops?

If you’re new to crypto and don’t want to spend money: go for the CoinMarketCap airdrop. It’s free, fast, and easy. You might get $20 in DFI. That’s enough to try staking later. If you already have $50+ in crypto and want to start earning passive income: use Cake DeFi. You get $30 in DFI, plus 34.5% APY on it, and access to other DeFi tools like BTC lending and ETH staking. You’re not just getting tokens-you’re building a DeFi portfolio. If you held Bitcoin in 2020 and never claimed: too late. There’s no way back. Don’t waste time looking for loopholes. That door closed five years ago.What to Do After You Get DFI Tokens

Once you have DFI, don’t just sit on it. Here’s what to do next:- Transfer it to a DeFiChain wallet (like DeFiWallet or Trust Wallet) if you want full control.

- Stake it on DeFiChain’s native DEX to earn more DFI as rewards.

- Use it to trade on DeFiChain’s decentralized exchange (DFI Swap).

- Use it as collateral to borrow other assets.

Common Mistakes to Avoid

- Don’t send BTC to a DeFiChain address. It won’t work. The 2020 airdrop used Bitcoin wallet signatures, not direct transfers.

- Don’t use fake KYC on Cake DeFi. It gets flagged. You’ll lose your reward.

- Don’t withdraw your $50 deposit before 28 days. You’ll be disqualified.

- Don’t think DFI is a quick flip. It’s a long-term DeFi asset. The APY is the real reward.

Final Thoughts

DeFiChain’s airdrop strategy isn’t about giving away free tokens. It’s about building a real DeFi community. The 2020 airdrop brought in Bitcoin holders. The Cake DeFi airdrop brings in active users. The CoinMarketCap one brings in curious newcomers. If you want free DFI today, you have two real options: the low-effort CoinMarketCap draw or the high-reward Cake DeFi program. Neither is a scam. Both are transparent. Both are running right now. Pick the one that fits your situation. If you’ve got cash to lock up, go with Cake. If you’re just exploring, try CoinMarketCap. Either way, you’re getting into one of the most unique DeFi projects on the market-one that’s built on Bitcoin, not competing with it.Can I still claim the 2020 DeFiChain Bitcoin airdrop?

No. The claim period ended on December 31, 2020. DeFiChain scanned the Bitcoin blockchain at block #647,500 and distributed tokens based on wallet ownership at that exact moment. There is no way to claim those tokens now. Any website or service claiming to help you recover them is a scam.

Do I need to own Bitcoin to get DFI tokens now?

No. The only current way to get free DFI is through Cake DeFi or CoinMarketCap, neither of which requires Bitcoin ownership. You can deposit any supported crypto-like USDT, ETH, or LTC-into Cake DeFi to qualify for the $30 DFI reward.

Is the Cake DeFi airdrop safe?

Yes, as long as you use the official Cake DeFi website (cakedefi.com) and complete verified KYC. Cake DeFi is a well-established platform with over 2 million users. The DFI tokens you receive are real and are automatically sent to your wallet. Never share your private keys or seed phrase with anyone.

How long do I have to lock my deposit for the Cake DeFi airdrop?

You must lock your deposit for at least 28 days. If you withdraw before that, you’ll lose your DFI reward. The 28-day lock ensures you’re committed to using DeFi services, not just grabbing free tokens.

Can I get more than $30 in DFI from Cake DeFi?

Yes. For every person you refer who deposits $50 and locks it for 28 days, you get an extra $10 in DFI. There’s no limit to how many referrals you can make. So if you refer four people, you get $70 in DFI total.

What’s the APY on DFI tokens from the airdrop?

All DFI tokens received through the Cake DeFi airdrop are automatically enrolled in the Confectionery program, which pays 34.5% annual percentage yield (APY) for 180 days. After that, you can choose to re-stake or withdraw.

Is DeFiChain built on Bitcoin?

Yes. DeFiChain is a sidechain of Bitcoin. It uses Bitcoin’s security and consensus but runs its own smart contract layer for DeFi applications. That means DFI tokens are backed by Bitcoin’s network, making it one of the most secure DeFi platforms available.

Where can I store my DFI tokens?

You can store DFI in any wallet that supports the DeFiChain blockchain. Recommended options include DeFiWallet (official), Trust Wallet, and Ledger (via DeFiChain app). Never store DFI on centralized exchanges unless you plan to trade it immediately.

Bro just bought 500 DFI on Binance and called it a day. Airdrops are dead anyway.

wait wait wait - did u say $30 in DFI for locking $50? i thought it was 100$ min?? i just deposited 75$ on cake defi yesterday… hope i still get it 😅

The Cake DeFi setup is actually one of the cleanest airdrops out there. Most projects just want your email and a tweet. This one asks you to commit real capital - which means the people who join are actually going to use the platform. Smart move by DeFiChain.

I did the CoinMarketCap thing last week. Got the confirmation email today. No idea if I’ll win, but hey - free crypto is free crypto. I’m just glad I didn’t have to send any money anywhere.

If you’re new and scared of locking up cash, start with CoinMarketCap. It’s zero risk. If you’re ready to learn DeFi, go all-in on Cake. DFI’s APY is insane right now - 34.5% isn’t a gimmick, it’s a gateway drug to real yield farming.

So let me get this straight… I gotta lock up $50 to get $30 in DFI… which earns me 34% APY… so I’m basically paying $20 to earn $10 in interest? 🤔 I’ll pass. Thanks for the math lesson.

I’m so glad someone finally said it - this isn’t a ‘get rich quick’ thing. It’s a ‘get smart slow’ thing. DeFiChain is building something real. Most airdrops are just ads with tokens attached. This? This is a classroom.

I appreciate the thorough breakdown. The distinction between speculative airdrops and ecosystem-building initiatives is critical. Many newcomers conflate the two, resulting in disillusionment. DeFiChain’s approach reflects a mature understanding of user acquisition.

I did the Cake thing last month. Got my DFI, staked it, and now I’m earning more DFI just by holding it. Plus, I started lending BTC on there too. It’s wild how one small deposit opened the whole DeFi door for me. 🙌

As someone from India, I’ve seen so many ‘free crypto’ scams here - fake wallets, fake airdrops, fake Telegram groups. But Cake DeFi? It’s legit. KYC is strict, but that’s a good thing. No one’s getting scammed here. Also, the 34.5% APY? That’s better than my bank’s fixed deposit. 😅

I just joined the CoinMarketCap airdrop. Took me 3 minutes. No deposit. No stress. If I win? Bonus. If not? No loss. Perfect for people like me who are still learning. 💫

I held 12 BTC in 2020 and never claimed. I still feel a little sad about it. But honestly? I’m glad I didn’t. I’d have just sold it all for pizza. Now I’m actually learning how to use DFI. Growth, not regret.

The fact that DeFiChain is built on Bitcoin’s security layer is the real genius here. Most DeFi chains are just Ethereum clones with a new coat of paint. This? This is Bitcoin 2.0 - decentralized finance without compromising the original chain’s integrity. That’s not an airdrop. That’s a revolution.

I’ve seen too many people lose money trying to recover the 2020 airdrop. Please don’t fall for scams. The window closed. It’s over. Move on. Focus on what’s active now.

Why are we giving away tokens to foreigners? Why not focus on American crypto users? We built Bitcoin. We should be the ones getting the rewards.

It is imperative to note that the term 'free' is misleading. The Cake DeFi program necessitates the commitment of capital, thereby transforming the nature of the transaction from an airdrop to a conditional incentive structure. One must exercise due diligence before participation.

The 28-day lock-up is genius. It stops people from just grabbing tokens and dumping. I’ve seen so many projects fail because they attracted flippers, not users. DeFiChain gets it.

The CoinMarketCap airdrop is a waste of time. 36 DFI is worth $20. You could earn that in 3 hours working a gig on Fiverr. Why bother?

I must express my profound skepticism regarding the legitimacy of the Confectionery program’s stated 34.5% APY. Such yields are unprecedented in decentralized finance without commensurate risk exposure. One must question the sustainability of such returns.