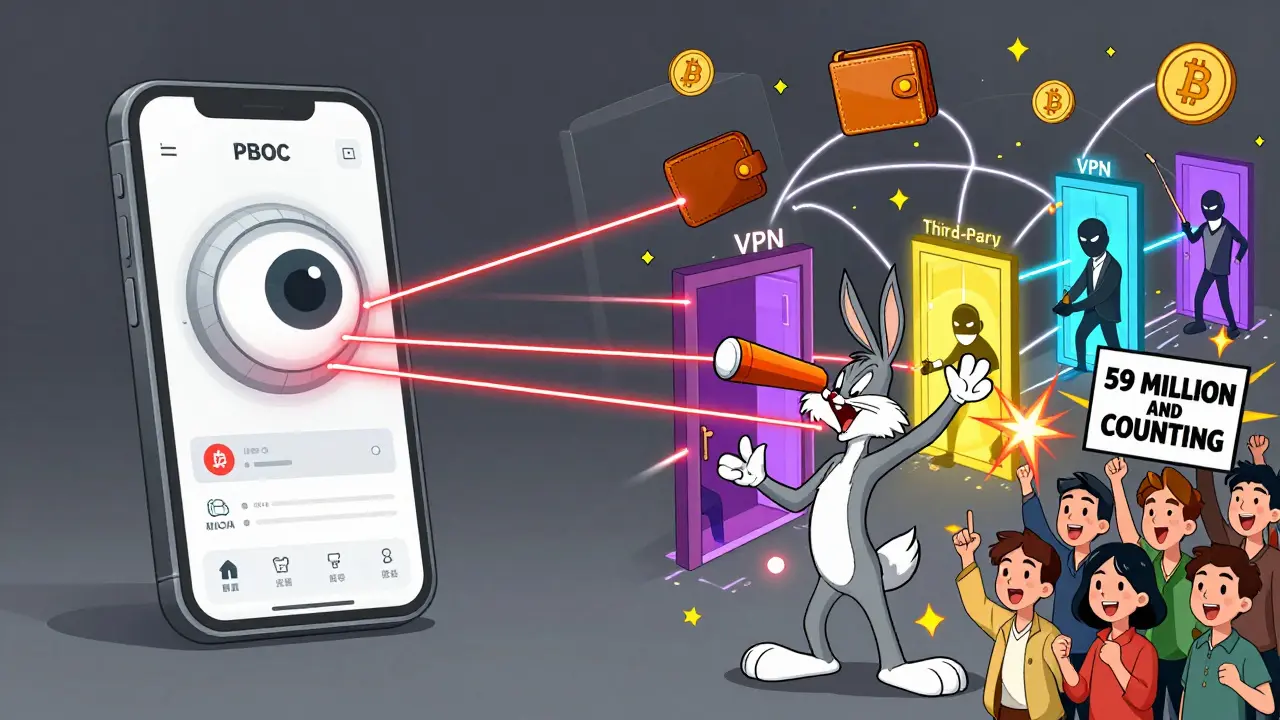

China banned cryptocurrency in 2021. No trading. No mining. No exchanges. The government said it was illegal. Yet, as of 2025, 59 million Chinese citizens are still actively using crypto. That’s more than the entire population of Australia. And it’s the second-largest crypto user base in the world - after India.

How Is This Even Possible?

The Chinese government doesn’t just discourage crypto. It shuts down servers, freezes bank accounts, and prosecutes people who run exchanges. In 2025 alone, authorities froze over 1,200 bank accounts linked to crypto activity and fined $32.6 million. But bans don’t erase demand. They just push it underground. Most Chinese crypto users don’t use local platforms. They go offshore. Binance, Bybit, and OKX still serve millions of Chinese customers - even though they officially left the mainland in 2021. How? Through VPNs. About 78% of Chinese crypto traders use virtual private networks to bypass internet filters. It’s not illegal to use a VPN for personal use, so it’s become the default tool for accessing global crypto markets.Peer-to-Peer Trading Is the Real Engine

Only 22% of crypto trades in China happen on offshore exchanges. The rest? Peer-to-peer (P2P). This is where the real action is. People use WeChat and QQ - China’s main messaging apps - to find buyers and sellers. They don’t send money directly. Instead, they use escrow services built into these groups. One person sends CNY to the seller’s bank account. The seller then releases crypto from their wallet. A third party holds the crypto until payment clears. This system works because it’s decentralized. No platform stores the funds. No exchange handles the transaction. It’s just two people trusting a middleman. According to a June 2025 analysis by Lightspark, 63% of all crypto transactions in China happen this way. And 45% of those P2P trades use WeChat groups specifically. It’s informal, fast, and hard for regulators to track.Stablecoins Are the Secret Weapon

Bitcoin? Too volatile. Ethereum? Too slow. The most popular crypto in China right now? USDT - Tether. Stablecoins pegged to the U.S. dollar. Why? Because they’re used for real life. People send money to family overseas. Students pay for tuition in Australia or the UK. Freelancers get paid for work done for foreign clients. Traditional banks charge 5-10% in fees and take 3-5 days. With USDT, you send money in 15 minutes for less than 1% in fees. Chainalysis data shows stablecoin usage in China jumped from 21.7% of all crypto transactions in 2024 to 38.7% in Q2 2025. That’s not speculation. That’s utility. People aren’t buying USDT to get rich. They’re buying it to avoid being robbed by banks.

The Digital Yuan Doesn’t Replace Crypto - It Highlights Why People Want It

The Chinese government isn’t blind to digital money. It launched the e-CNY, or digital yuan, in 2020. By the end of 2024, over 260 million personal wallets and 15.5 million business wallets were active. In the first half of 2025, the digital yuan processed $248 billion in transactions. But here’s the catch: the e-CNY is fully traceable. The government knows who you paid. What you bought. When. Where. It’s not money. It’s a spending log. That’s why crypto thrives. People don’t want surveillance. They want privacy. They want control. The digital yuan is a tool for the state. Crypto is a tool for the individual.Young, Tech-Savvy, and Fed Up

Who’s using crypto in China? Not retirees. Not government workers. Not farmers. It’s young people. Specifically, those aged 25 to 34. They make up 37.5% of crypto users - higher than the global average. They’re the first generation raised with smartphones, the internet, and global access. They see capital controls as outdated. They know how to use a VPN. They’ve watched their parents lose money to inflation and bank fees. Gender skew is extreme: 89.2% of users are male. That’s even higher than the global average of 86.9%. But the real story isn’t gender. It’s access. These users aren’t waiting for permission. They’re building their own systems.

Scams, Freezes, and Still Going

It’s not easy. In April 2025, a Reddit survey of 127,000 members of r/CryptoChina found that 68% had their bank accounts frozen because of crypto activity. The average loss per freeze? $3,250. And scams? They’re everywhere. In Q1 2025, Chinese authorities reported $165 million lost to crypto fraud. Fake exchanges. Fake P2P deals. “Guaranteed 20% daily returns” schemes. Many target older users who don’t understand blockchain. Yet 82% of users said they kept trading. And 45% increased their investment in 2025 compared to 2024. Why? Because the alternative - trusting the system - feels riskier.The Government’s Contradiction

Here’s the biggest irony: while the state crushes private crypto, it’s quietly building blockchain infrastructure for its own use. In June 2025, the Shanghai Free Trade Zone launched a blockchain pilot with 14 major banks to handle cross-border trade finance. The goal? Faster settlements, lower costs, better tracking. The same tech used to enable crypto is being used to tighten control. Meanwhile, the Shanghai State-owned Assets Supervision and Administration Commission quietly noted in July 2025 that “the rapid evolution of digital assets necessitates more nuanced regulatory approaches.” That’s bureaucratic code for: “We might have to change our minds.” Analysts at Bernstein estimate a 65% chance China will soften its stance by 2027 - not by legalizing crypto, but by creating a licensed, monitored version. Think India’s 30% tax on crypto gains. Not freedom. But tolerance.What’s Next?

China’s crypto ban isn’t working. It’s not because people are fearless. It’s because the need is too strong. People need to move money. They need to protect savings. They need privacy. The state can shut down exchanges. It can block websites. But it can’t block human behavior. The underground market is growing smarter. Apps like CryptoBridge and Silk Road Wallet are bypassing censorship using encrypted channels and domain fronting. Over 8.7 million downloads happened in just six months in 2025 - all from third-party Android stores, not Google Play. The e-CNY will dominate official payments. But crypto will keep growing in the shadows - not as rebellion, but as reality. For now, China has two digital currencies: one controlled by the state. One controlled by the people. And the people are winning - quietly, carefully, and without permission.Is it illegal to own crypto in China?

Technically, yes. The government bans all cryptocurrency business activities and considers them illegal financial operations. But private ownership isn’t explicitly outlawed - it exists in a legal gray zone. You won’t be arrested for holding Bitcoin in a personal wallet, but if you trade it, use it to pay for goods, or send it abroad, you risk having your bank account frozen or facing fines. There’s no legal protection if something goes wrong.

How do Chinese people buy crypto if exchanges are banned?

Most use offshore exchanges like Binance, Bybit, or OKX via VPNs. But the majority - over 60% - trade peer-to-peer through WeChat and QQ groups. Buyers and sellers agree on a price, one sends yuan to the other’s bank account, and the crypto is released through an escrow service. No exchange handles the money. No platform is involved. It’s decentralized and hard for regulators to stop.

Why do so many Chinese use USDT instead of Bitcoin?

USDT is used mostly for practical reasons, not speculation. It’s stable - pegged to the U.S. dollar - so it doesn’t swing wildly in value. People use it to send money overseas to family, pay for education abroad, or get paid by foreign clients. It’s faster and cheaper than banks. Sending $5,000 via USDT can cost under $50 and take 15 minutes. Traditional bank transfers cost hundreds and take days.

Can the Chinese government shut down crypto completely?

No - not if people keep using it. The government can shut down exchanges, freeze accounts, and block websites. But it can’t stop two people from sending money and crypto through messaging apps. It can’t stop someone from downloading a crypto wallet from a third-party app store. As long as there’s demand for financial freedom, people will find ways around the ban. The ban has made crypto more secretive, not less popular.

What’s the difference between the digital yuan and Bitcoin?

The digital yuan is controlled entirely by the People’s Bank of China. Every transaction is tracked. The government knows who paid whom, how much, and when. Bitcoin and other cryptos are decentralized. No one owns them. No one tracks them unless you leak your wallet address. The digital yuan is a payment tool. Crypto is a financial tool - for savings, remittances, and escaping control.

Is crypto adoption growing or shrinking in China?

It’s growing. Despite crackdowns, the number of Chinese crypto users rose to 59 million in 2025 - up from 52 million in 2023. Stablecoin usage jumped 78% in one year. More young people are using crypto for real-life needs. Even with account freezes and scams, 82% of users say they’re trading more, not less. The ban hasn’t stopped adoption. It’s just made it harder - and more sophisticated.

Bro this is wild. People are literally building their own financial system because the government won't let them have one. I mean, who needs banks when you can send USDT in 15 minutes? 😅

The fact that 63% of crypto trades in China happen via P2P through WeChat is insane. It’s not just evasion-it’s innovation. People created a decentralized finance network without any tech company’s permission. That’s real resilience.

Wait wait wait… so the Chinese government is banning crypto but building blockchain for state-controlled trade finance? Classic. They want the power of the tech without the freedom. They’re not afraid of crypto-they’re afraid of people having control. This is just digital authoritarianism with a fancy name

The structural arbitrage here is fascinating-the regulatory impedance mismatch between capital controls and decentralized settlement layers is creating a latent liquidity channel that outperforms SWIFT in efficiency and cost. USDT is effectively a private monetary protocol operating beneath the state’s surveillance lattice.

Oh wow another ‘crypto freedom’ fairy tale. China’s just letting people do whatever they want? Sure. Next you’ll say the DMV is chill with people skipping lines. The government’s crushing these people daily-freezing accounts, jail time, you name it. Stop romanticizing oppression.

They’re all being watched. Every single transaction. Every VPN. Every WeChat group. The government lets this happen so they can track who’s rich, who’s rebellious, who’s got foreign ties. This isn’t freedom-it’s a honeypot. They’re collecting data on 59 million people and calling it ‘tolerance’.

Imagine being told you can’t move your own money… then just doing it anyway. That’s not rebellion. That’s basic human instinct. China’s ban didn’t kill crypto-it turned it into a silent revolution. And honestly? I respect the hell out of that.

USDT for remittances? Duh. Banks are dinosaurs. Why pay $200 to send $5K overseas when you can do it for $20 in 10 minutes? The system is broken and people fixed it themselves. No thanks to the state

the digital yuan is like a loyalty card that knows everything you buy… and crypto is the cash you keep in your sock. one’s convenient, the other’s free. i get why people pick the sock.

89% male users? Yeah that tracks. Crypto’s still a bro zone. But honestly? The real story isn’t gender-it’s that young Chinese people are smarter than their government thinks. They’re not breaking rules. They’re rewriting the game.

the whole thing is a paradox. the state wants to control money so bad they built their own digital currency… but the people want to escape control so bad they built their own underground economy. one side has the law, the other has the will. and right now? the will is winning. quietly. no fanfare. just transfers.

you think this is underground? nah. this is the future. the state is just pretending to be in charge. meanwhile, 59 million people are running a parallel economy using apps downloaded from sketchy android stores. the real power isn’t in Beijing-it’s in the hands of a 28-year-old in Chengdu who just sent USDT to his sister in London. and you can’t stop that.

so china banned crypto… then everyone just used wechat to become bankers? classic. next they’ll ban air and people will start breathing through straws.

This is not merely an act of defiance-it is a profound reclamation of economic agency by a generation that refuses to be confined by archaic paradigms. The resilience displayed through peer-to-peer mechanisms and stablecoin utility represents a paradigm shift in financial sovereignty, particularly in contexts where institutional trust has been systematically eroded.

People don’t need permission to use money. That’s the whole point.

I can’t stop thinking about how these young people are building something beautiful out of oppression. They’re not just trading crypto-they’re building trust networks, creating new rules, and proving that human ingenuity can’t be legislated away. This isn’t just finance. It’s hope in action.

It’s fascinating how the digital yuan’s transparency makes it feel like surveillance, while crypto’s anonymity feels like liberation-even if it’s not always safe. People aren’t choosing crypto because it’s perfect. They’re choosing it because the alternative feels worse.

the real win isn’t the 59 million users-it’s that the government can’t even pretend they’ve won. they’ve got all the power, but zero control. and that’s gotta sting.