Russian Crypto Investor Eligibility Checker

Check Your Eligibility

Verify if you meet Russia's requirements for investing in cryptocurrency products under the new regulations.

Eligibility Result

Under Russia's new regulations (2024), only "highly qualified investors" can purchase crypto-based financial products. You must meet either of these criteria:

- Over 100 million rubles ($1.1 million USD) in securities or bank deposits

- Or annual income exceeding 50 million rubles ($550,000 USD)

Note: You cannot buy Bitcoin directly. You purchase crypto-based financial products (like futures contracts) through regulated platforms.

When Russia banned cryptocurrency payments for everyday use in 2021, most thought it was the end of the road for digital assets there. But by 2025, the story had flipped completely. Now, Russian companies can legally use Bitcoin, Ethereum, and stablecoins to pay for oil, gas, and machinery across borders - all under a government-backed pilot program. This isn’t a loophole. It’s policy. And it’s changing how Russia does business with the world.

What Changed in 2024?

The big shift came with Federal Law No 221-FZ, which took effect in September 2024. It didn’t legalize crypto for buying coffee or paying rent. Instead, it created a narrow, controlled path for legal entities - companies, not individuals - to use cryptocurrencies in international trade. The goal? To bypass Western financial sanctions that froze Russian banks out of SWIFT and cut off access to dollar and euro clearing systems. The Bank of Russia now supervises every transaction. Only approved digital asset platform operators can process these payments. These platforms must track every coin’s origin, report transaction histories, and verify the identity of both sender and receiver. No anonymity. No gray zones. If you’re not on the approved list, you’re breaking the law. The list of approved assets includes Bitcoin (BTC), Ethereum (ETH), and Tether (USDT). Stablecoins tied to the ruble are also used heavily, especially by firms that want to avoid Bitcoin’s price swings. One company, the A7 Group, started using ruble-backed stablecoins to pay for machinery imports from Turkey and China. They didn’t need a Western bank. They didn’t need to wait weeks for clearance. They just sent the tokens - and got the goods.Domestic Crypto? Still Banned

Here’s the catch: you still can’t use Bitcoin to pay your utility bill in Moscow. Or buy a car from a local dealer. Or tip a freelancer in Russia. Domestic crypto payments remain illegal. The government wants zero exposure to retail crypto speculation. They fear inflation, capital flight, and unregulated gambling in digital assets. That’s why only “highly qualified investors” can buy crypto for investment. To qualify, you need either:- Over 100 million rubles ($1.1 million USD) in securities or bank deposits

- Or an annual income exceeding 50 million rubles ($550,000 USD)

Why This Matters for Global Trade

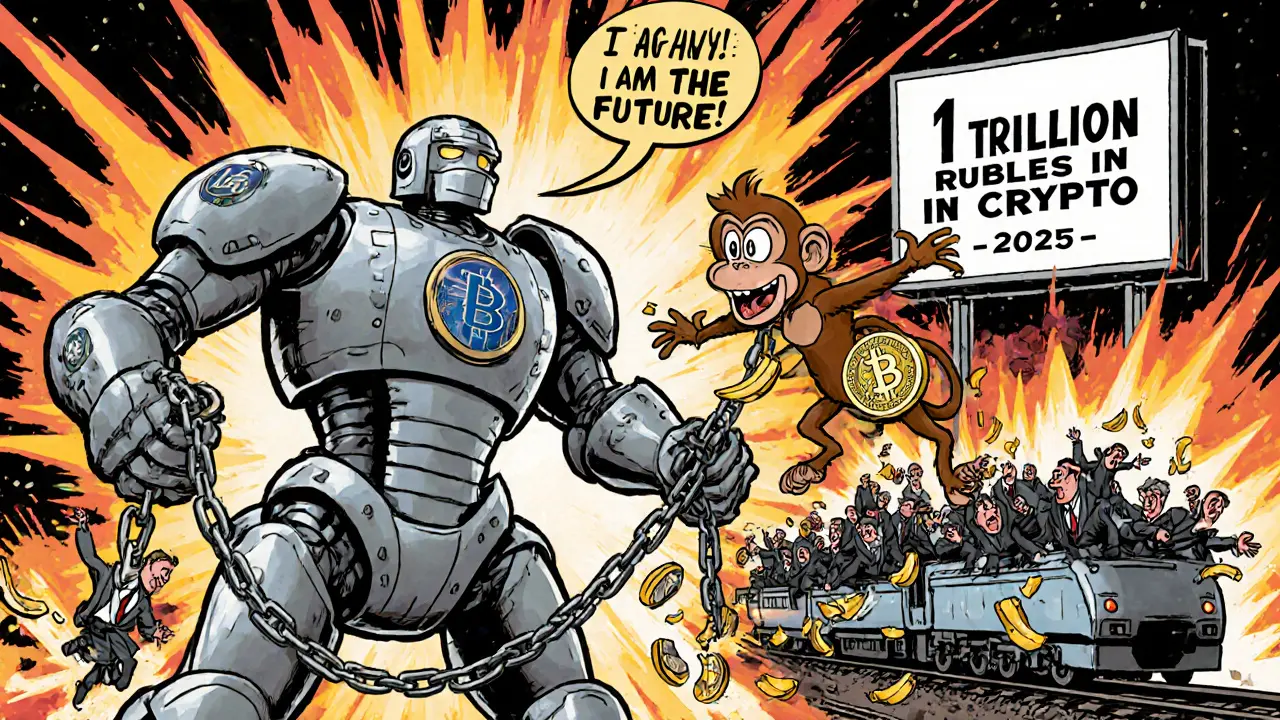

Russia’s energy sector moved fastest. By early 2025, state-owned and private energy companies were invoicing oil and gas exports to China, India, and Turkey in Bitcoin and stablecoins. No more waiting for sanctions-busted payment channels. No more relying on intermediaries in Dubai or Turkey to clear dollars. The numbers speak for themselves. In 2025, Russia’s cross-border crypto trade hit 1 trillion rubles ($11 billion USD). That’s not a drop in the ocean. It’s a new pipeline. And it’s growing. Countries like China and India, which aren’t enforcing Western sanctions, are happy to accept these payments. They get lower fees, faster settlements, and access to Russian resources without political baggage. Russia gets to keep selling its commodities - and keep its economy running.

The Digital Ruble: Russia’s Own Crypto

While Bitcoin is used for trade, the government is building its own digital currency: the Digital Ruble. Launched in August 2023, it’s already processed over 100,000 transactions through 2,500 wallets in more than 150 cities. But this isn’t Bitcoin. It’s not decentralized. It’s not anonymous. It’s a state-controlled digital version of the ruble - tracked, monitored, and programmable. Starting September 1, 2026, large Russian companies will be required to accept the Digital Ruble for payments. By 2028, even small shops and street vendors will need to support it. The goal? To replace cash and reduce reliance on foreign payment systems entirely. The Digital Ruble won’t replace Bitcoin for international trade. But it will replace traditional banking for everyday business inside Russia. Think of it as the government’s insurance policy: if the world cuts off crypto again, they’ve got their own system ready.Who’s Winning and Who’s Losing

Big corporations and energy exporters are winning. They get faster payments, lower fees, and access to new markets. Small businesses? They’re stuck. No one can legally send them crypto. No one can pay them in Bitcoin. They still need banks - and banks are still under sanctions. Ordinary Russians hold more than $25 billion in crypto, according to estimates. But they can’t buy it legally inside Russia. So they use foreign exchanges - Binance, Bybit, Kraken - often with VPNs and peer-to-peer deals. The government doesn’t stop them. But they don’t protect them either. If you get hacked or scammed on a foreign platform, you’re on your own. The Bank of Russia still calls crypto a “high-risk asset” and warns against domestic use. In March 2025, they even proposed criminal penalties for unauthorized crypto transactions. But at the same time, the Finance Ministry is quietly pushing for broader adoption. Deputy head Ivan Chebeskov has said Russia needs a “comprehensive digital asset strategy” - not just sanctions evasion.

What’s Next?

The pilot program runs for three years. By 2027, the government will decide whether to make these rules permanent. If they do, expect:- More approved cryptocurrencies

- Lower thresholds for “highly qualified investors”

- Legal crypto derivatives for institutional funds (planned for 2026)

- Stronger AML/KYC rules for all platforms

Wow-this is a masterclass in sanctions arbitrage! The state-coordinated crypto corridor is genius: Bitcoin as a sovereign payment rail, stablecoins as shock absorbers, and the Digital Ruble as the internal firewall. The fact that they’ve engineered legal opacity-allowing institutional use while crushing retail-isn’t hypocrisy, it’s hyperrealpolitik. They’re not rejecting the global financial system; they’re building a parallel stack with better latency and lower fees. The 1 trillion ruble volume? That’s not a footnote-it’s a new asset class in the making.

Man, this is actually kind of inspiring. Nigeria’s been trying to figure out how to bypass SWIFT for years, and here’s Russia doing it with clear rules, not chaos. Maybe we can learn something-structured crypto trade, not just P2P hacks. The key is regulation that works for the economy, not just panic-driven bans.

One must question the epistemological foundations of this so-called ‘policy.’ The use of decentralized assets under state supervision is a logical contradiction-a regulatory oxymoron. One cannot simultaneously endorse decentralization and enforce KYC/AML protocols that render it centralized by design. This is not innovation; it is the colonization of blockchain by statist machinery.

It is deeply concerning that a government would weaponize financial technology to circumvent internationally agreed-upon sanctions. This is not economic ingenuity-it is an erosion of the global financial order. The Bank of Russia’s involvement legitimizes what should be treated as illicit activity. The world must respond with coordinated sanctions against the approved platforms.

So… they banned crypto for civilians, but let oligarchs use it to buy Turkish machinery? Classic. The ‘highly qualified investor’ threshold is just a fancy way of saying ‘only the 0.1% can gamble with Bitcoin.’ And let’s not pretend this isn’t just a sanctions workaround disguised as a ‘pilot program.’ The Digital Ruble? More like the Digital Surveillance Ruble. Congrats, Russia-you’ve turned blockchain into a state surveillance tool with better UX.

It’s morally indefensible to use cryptocurrency to evade sanctions designed to prevent war financing. These aren’t ‘trade tools’-they’re lifelines for a regime committing atrocities. The fact that India and China are complicit by accepting these payments makes them equally culpable. This isn’t economics-it’s ethical bankruptcy dressed in blockchain.

This is all a distraction. The real story? The Federal Law No 221-FZ was drafted by former CIA operatives working for the FSB. The entire ‘pilot’ is a psyop to lure Western crypto investors into a trap. They’re laundering intelligence through blockchain ledgers. The Digital Ruble? It’s a backdoor for quantum surveillance. Don’t be fooled-the blockchain is not neutral. It’s a weaponized grid.

Let’s cut through the noise: this is the most pragmatic response to sanctions we’ve seen in decades. Russia didn’t whine-they built. They turned a weakness into a structural advantage. The fact that they’re using stablecoins to avoid volatility? Smart. The fact that they’re tracking every coin? Even smarter. This isn’t a loophole-it’s a blueprint. Other sanctioned nations should copy this. And the West? They’re going to have to adapt-or get left behind.

This is actually kind of beautiful? 🤍 Like, imagine a world where countries aren’t stuck in old banking systems and can trade directly-even under pressure. Russia’s not perfect, but they’re trying to build something real. And hey, if it helps small businesses in Turkey or India get paid faster? That’s a win. Let’s not forget the human side of this-people just want to work and get paid. 💪

The elegance here is in the duality: international crypto for trade, state-controlled digital ruble for domestic control. It’s not contradictory-it’s layered governance. They’ve created a firewall between speculative retail risk and strategic sovereign utility. This isn’t crypto anarchism; it’s crypto statecraft. And honestly? It’s more sophisticated than anything the EU or US has cooked up in the last five years.

People think crypto is freedom. But look closer. Russia controls every coin. The blockchain is just a shiny cage. The real slaves are the ones who think they’re free because they can send tokens. The state still owns your wallet. Always has. Always will.

Of course this is a trap. The Bank of Russia is using Bitcoin as a honeypot to identify foreign intelligence operatives. Every transaction is being fingerprinted. The ‘approved platforms’? They’re all owned by Kremlin-linked shell companies. And the Digital Ruble? It’s the final step-when every ruble you hold is traceable, spendable, and cancellable by a bureaucrat in a Moscow basement. This isn’t innovation. It’s the birth of financial fascism.

Wait-so it’s illegal to pay your neighbor in Bitcoin, but perfectly legal for Gazprom to pay a Chinese firm in ETH? That’s not policy. That’s class warfare dressed in crypto. The government wants the benefits of decentralization without any of the risks… for themselves. Classic. Meanwhile, the average Russian is still stuck using cash and bribes. This isn’t a revolution-it’s a privilege upgrade for the elite.

Let’s be clear: this is not ‘innovation.’ This is financial terrorism. The use of crypto to evade sanctions is a direct assault on the rule of law. And the fact that the Bank of Russia is ‘supervising’ it? That’s like letting a thief guard the vault and calling it ‘security.’ This isn’t policy-it’s a joke wrapped in a whitepaper.

I think what’s really interesting here is how Russia managed to avoid the usual crypto chaos-no pump-and-dumps, no retail panic. They kept it institutional, locked down the liquidity, and made sure it served a clear purpose. That’s rare. Most countries either ban crypto or let it run wild. Russia? They built a cage… and made it work.

What’s unfolding here isn’t just about sanctions-it’s about the redefinition of monetary sovereignty in the 21st century. Russia is demonstrating that a state doesn’t need SWIFT, doesn’t need the dollar, doesn’t need Western clearinghouses to remain economically viable. They’re stitching together a new financial fabric using blockchain threads, state oversight, and geopolitical alliances. The Digital Ruble isn’t a competitor to Bitcoin-it’s its counterweight. One is for the people, the other is for the state. And in a world where trust in institutions is collapsing, this duality might be the future: decentralized for trade, centralized for control. The West is still debating whether to regulate crypto. Russia already did-and turned it into a survival mechanism. The question isn’t whether others will follow. The question is: will we recognize it before it’s too late?