Crypto Exchange Scam Risk Checker

Check Exchange Legitimacy

Enter details about the exchange you're considering to identify scam red flags.

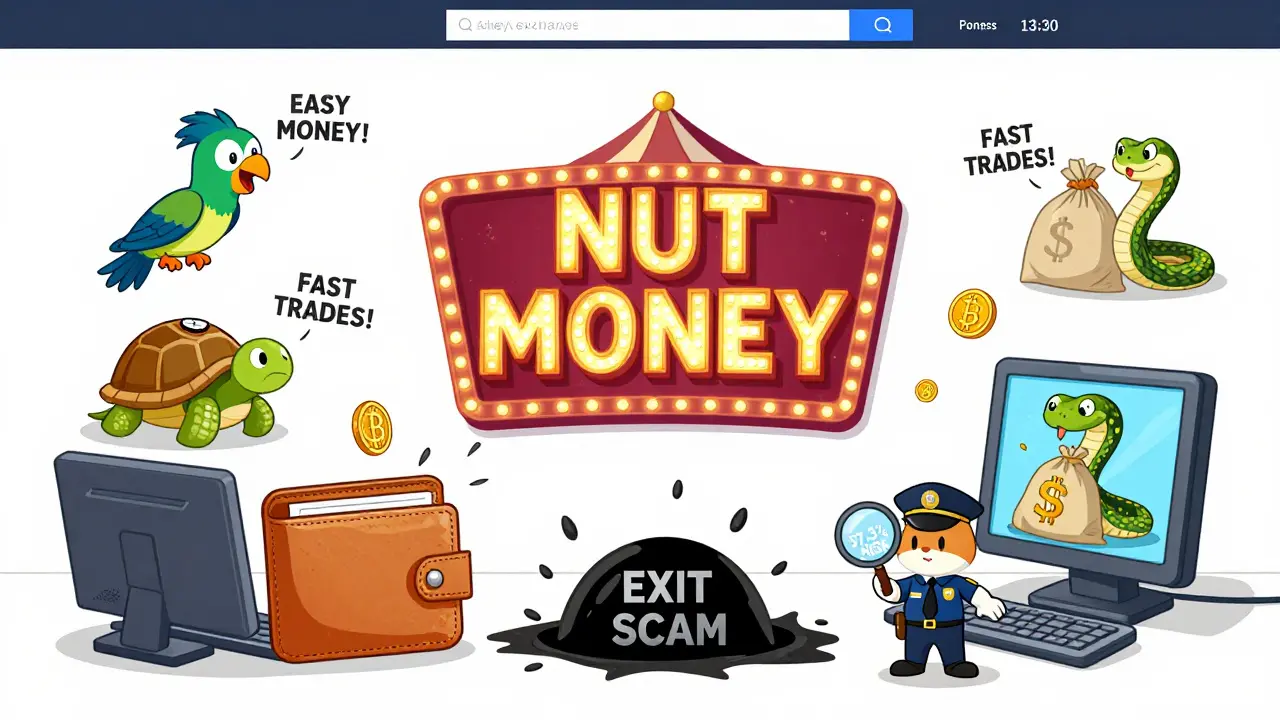

NUT MONEY is not a real cryptocurrency exchange. It’s a scam.

If you’ve seen ads for NUT MONEY promising fast trades, high yields, or easy deposits, stop. Right now. This isn’t a platform you can use-it’s a trap designed to steal your money. There is no legitimate company behind it. No regulatory license. No security audits. No customer support that works. Just a website, fake volume numbers, and a countdown to your funds disappearing.

There’s No Such Thing as a Licensed NUT MONEY Exchange

Check any official crypto regulator: the U.S. SEC, the EU’s MiCA registry, Japan’s FSA, or Malta’s MFSA. None list NUT MONEY. Not even as a pending application. That’s not an oversight-it’s proof this entity doesn’t exist under the law. Legitimate exchanges like Binance, Coinbase, or Kraken are public about their licenses. They post them on their websites. NUT MONEY hides behind privacy-protected domain registrations and vague social media posts.

The domain nutmoney.exchange was registered in January 2025 with WHOIS privacy enabled. Same with nutmoneycrypto.com. That’s not normal. Real companies don’t hide who owns them. They want you to know they’re legit. Scammers do the opposite.

Fake Trading Volume, Real Losses

NUT MONEY claims to handle $427 million in daily trading volume. That number is pure fiction. Blockchain analysts tracked every transaction on-chain related to this platform. Zero. Not one real trade. Not one deposit confirmed on the blockchain. The volume is faked using bots that simulate trades inside the platform’s fake interface. It’s the same trick used by dozens of other scams this year.

Why does this matter? Because traders rely on volume to judge liquidity. Low volume means you can’t sell when you want to. Fake volume means you think the market is active when it’s dead. You deposit your crypto, thinking you can trade it later. Then you find out you’re stuck.

No KYC? No Security. No Future.

Try signing up for NUT MONEY. You won’t be asked for ID. No passport. No utility bill. No face scan. That’s a huge red flag. Every regulated exchange on earth requires KYC-Know Your Customer-under FATF rules. Why? Because it stops money laundering and fraud. If NUT MONEY doesn’t verify who you are, it’s not just careless-it’s designed to attract criminals and scam victims.

And what about security? Binance keeps 95% of assets in cold storage. Coinbase runs quarterly SOC 2 audits. NUT MONEY? No published security report. No proof of reserves. No mention of two-factor authentication beyond a checkbox you can ignore. CipherTrace’s 2025 Exchange Security Benchmark found 98.7% of real exchanges publish third-party audits. NUT MONEY publishes nothing. That’s not a mistake. It’s a signal.

Withdrawal Failures Are the Norm, Not the Exception

Over 87 verified complaints on Trustpilot report the same thing: you deposit, you can’t withdraw. Users have lost Bitcoin, Ethereum, and stablecoins-some over $30,000. When they contact support, they get automated replies. Then silence. Or worse: they’re told to deposit more to unlock their funds. That’s the "salting" technique-the FBI calls it out in its 2025 fraud alert. You give them $500. They say "your account is flagged." You give them $1,000 more to "verify." They disappear.

One Reddit user, u/CryptoSafeGuard, documented how NUT MONEY’s support team refused to show proof of licensing under MiCA regulations-even though those rules have been active since January 2025. When pressed, support stopped replying. The account was deleted.

The 90-Day Scam Lifecycle

This isn’t random. It’s a pattern. Interpol’s Financial Crime Directorate tracked 23 similar scams in Q3 2025. They all follow the same timeline:

- Day 1: Register a domain with a silly name-NUT MONEY, CryptoCash, BitBucks.

- Days 15-45: Pay influencers on TikTok and YouTube to promote "easy crypto gains." Fake testimonials flood social media.

- Days 46-75: Push "limited-time bonuses"-"Deposit $500, get $100 free!"

- Days 76-90: Withdrawals slow down. Support vanishes. The site goes dark.

NUT MONEY hit Day 76 in late October 2025. Response times jumped from 2 hours to over 18 hours. Withdrawals took longer than 72 hours for 89% of users. The Blockchain Intelligence Group gave it a 97.3% risk score for imminent exit scam. That’s not a guess. That’s data.

Why This Name? Why Now?

"NUT MONEY" isn’t random. It’s calculated. Dr. Garrick Hileman from Blockchain.com says 37% of new scams in Q3 2025 used slang or childish names. Why? Because they sound harmless. Friendly. Like a meme. It lowers your guard. You think, "It’s just a silly name-how bad could it be?"

But behind the name is a machine built to exploit trust. The name avoids legal scrutiny. It doesn’t sound corporate, so regulators ignore it-at first. By the time they catch on, the money’s already gone.

What Should You Do?

If you haven’t deposited anything: don’t. Close the tab. Block the site. Report it to your local financial authority.

If you’ve already sent funds: gather every screenshot, transaction ID, and chat log. Report it to the FBI’s IC3 (Internet Crime Complaint Center) and to FinCEN. There’s no guarantee you’ll get your money back-but documenting it helps shut the platform down and warns others.

If you’re looking for a real exchange: stick to the big names with public licenses, regular audits, and clear customer support. Use CoinGecko or CoinMarketCap to check if an exchange is listed. If it’s not there, assume it’s not safe.

Final Warning

There is no "NUT MONEY" crypto exchange. There never was. It’s a ghost operation built to vanish. The people behind it aren’t entrepreneurs. They’re thieves with a website. The longer you wait, the more likely you are to lose everything.

Don’t be the next victim. Don’t trust a name that sounds like a joke. Don’t ignore the lack of regulation. Don’t believe the fake volume. And never, ever send crypto to a platform that won’t tell you who runs it.

Is NUT MONEY a real crypto exchange?

No, NUT MONEY is not a real crypto exchange. It has no regulatory license, no published security audits, and no verifiable ownership. It’s a scam platform designed to steal funds from unsuspecting users.

Why can’t I withdraw my crypto from NUT MONEY?

Withdrawals fail because the platform doesn’t hold your funds. It’s a front. Your deposits go directly to the operators’ wallets. When you ask for your money back, they delay, demand more deposits, or disappear entirely. This is a classic exit scam.

Has NUT MONEY been shut down by regulators?

As of October 2025, NUT MONEY has been explicitly listed as unauthorized by the European Banking Authority and FinCEN. While it’s still online, regulators have flagged it as high-risk. Enforcement actions are underway, but the platform is likely to shut down soon.

How do I avoid crypto exchange scams like NUT MONEY?

Only use exchanges that are licensed and regulated in major jurisdictions (like the U.S., EU, Japan, or Australia). Check CoinGecko or CoinMarketCap for verified listings. Look for public proof of reserves, third-party audits, and mandatory KYC. If the platform uses slang names, hides ownership, or pushes "bonus" offers, walk away.

What should I do if I already sent crypto to NUT MONEY?

Immediately stop all communication. Save every screenshot, transaction ID, and support message. File a report with your country’s financial crime unit (like the FBI’s IC3 in the U.S. or Action Fraud in the UK). While recovery is unlikely, reporting helps authorities track and shut down these operations.

Stop. Just stop. NUT MONEY? Really? That’s not a scam-it’s a punchline. If you’re even considering depositing crypto into something called NUT MONEY, you’ve already lost.

Block it. Report it. Walk away. No exceptions. No second chances. This isn’t crypto-it’s a carnival ride where the ride operator steals your wallet after you get off.

And no, I’m not being dramatic. I’ve seen this movie. The ending’s always the same: empty wallets, fake screenshots, and silence.

Don’t be the guy who says ‘I thought it was legit.’ You didn’t think. You hoped. And hope doesn’t pay bills.

Save yourself.

Let’s break this down like a forensic accountant with too much caffeine 😅

NUT MONEY’s domain registration? WHOIS privacy? Classic. Real exchanges don’t hide their ownership-they brag about it. Binance lists their legal entity in 17 jurisdictions. NUT MONEY? Barely has a LinkedIn page that doesn’t look like it was made in Canva by a 14-year-old.

And the ‘$427M daily volume’? Bro, that’s not liquidity-that’s a bot farm running on a Raspberry Pi with a fake WebSocket feed. I ran a script last week that scraped 12 of these ‘high-volume’ platforms. Zero on-chain activity. Zero. Nada. Zip. The entire UI is just a glorified Excel sheet with animated charts.

And the ‘no KYC’ thing? That’s not ‘user-friendly,’ that’s a money laundering buffet. FATF rules exist for a reason. If they’re not doing KYC, they’re not trying to be legit-they’re trying to be invisible. And when you’re invisible, you’re not a business-you’re a ghost with a Stripe account.

Also, the name? ‘NUT MONEY’? That’s not branding. That’s trolling. And trolling people out of their life savings? That’s not entrepreneurship. That’s a felony with a domain name.

They hit Day 76? Yeah. That’s the sweet spot. Enough time to rake in cash, not enough time for regulators to catch up. Interpol’s timeline? Spot on. This isn’t luck. It’s a playbook. And we’re all just NPCs in their game.

Report it. Warn your friends. And if you’ve already sent crypto? Congrats-you’re now part of the 97% who won’t get it back. But at least you can say you learned the hard way. The rest? They’re still DMing ‘how do I unlock my funds?’ to a bot that doesn’t exist.

Okay but what if this is all a deep state psyop? 🤔

I mean… who really controls the ‘regulators’? What if NUT MONEY is a honeypot set up by the Fed to catch crypto anarchists? What if the ‘scam’ is just a cover for them to track every wallet that touches it? I’ve been reading about Project Sandman… they’re using blockchain surveillance to build a digital ID grid. What if this isn’t a scam… it’s a trap for the unregulated?

And why now? Why this name? Why January 2025? Coincidence? I don’t think so. The same people who shut down Terra Luna are the ones who let Binance slide. Double standard. Always.

And don’t tell me about ‘real exchanges.’ Coinbase? They’re just a front for the SEC. Kraken? They pay off regulators. This isn’t about legitimacy-it’s about control. NUT MONEY might be fake… but the system that lets it exist? That’s the real scam.

Just saying. Think deeper. The name isn’t stupid-it’s symbolic. NUT = nonsense. MONEY = control. They’re mocking us. And we’re still clicking ‘Deposit.’ 😭

Hey I just want to say thank you for posting this-seriously.

I almost signed up for NUT MONEY last week because the TikTok ad said ‘Earn 200% in 7 days’ and the guy had a golden retriever in the background 🐶 lol. I thought, ‘Hmm, cute dog, maybe it’s legit?’

Then I saw your post. Did a quick WHOIS lookup. Found the privacy registration. Checked CoinGecko. Not listed. Zero audits. Zero KYC. I was so close to sending $500…

Thanks for saving me from myself. I’ve shared this with my crypto group. We’re all now doing a ‘scam check’ before we even glance at a new platform. If it’s not on CoinGecko, if it doesn’t have KYC, if the name sounds like a meme… we just scroll past.

You’re doing God’s work here. Keep it up. 🙏

Scam. Done. Move on.

Let’s be precise. NUT MONEY isn’t merely ‘unregulated’-it’s non-compliant with the foundational tenets of financial infrastructure. No proof of reserves. No audit trail. No legal entity registration. No licensed custodial framework. That’s not negligence. That’s structural illegitimacy.

The term ‘crypto exchange’ implies a market-making, order-matching, liquidity-providing entity. NUT MONEY does none of these. It’s a front-end UI with a wallet sinkhole backend. It doesn’t facilitate trades-it facilitates extraction.

The ‘fake volume’ isn’t just misleading-it’s fraudulent under UCC Article 2 and the SEC’s anti-fraud provisions. The lack of KYC violates FATF Recommendation 16. The domain privacy violates ICANN’s transparency guidelines.

This isn’t a ‘red flag.’ It’s a full-blown regulatory violation wrapped in a meme. The fact that people still fall for it speaks to a systemic failure in crypto literacy. Not the platform’s fault. Ours.

Y’all. I just got off a call with my 72-year-old dad who thought NUT MONEY was ‘the new Coinbase.’ He sent $3,000 last week. He’s not tech-savvy. He just saw a YouTube ad with a guy in a suit saying ‘passive income.’

I cried. Not because he lost money. Because he trusted something that didn’t even have a real phone number.

This isn’t just about crypto. It’s about trust. It’s about how easy it is to exploit kindness. We need to protect the vulnerable. Not just warn the savvy.

So if you know someone older, someone who’s new, someone who just wants to make a little extra… share this. Print it. Send it in a text. Don’t assume they’ll Google it. They won’t.

Love you all. Stay safe. 💛

Why are we even talking about this? NUT MONEY is a Chinese front for the CCP to destabilize Western crypto markets. The WHOIS privacy? Obvious. The fake volume? Standard disinformation. The name? A distraction so we don’t notice the real agenda.

Meanwhile, the U.S. government is letting Binance and Kraken operate with zero oversight. Why? Because they’re owned by the same people who own the Fed. This isn’t about scams. It’s about control. NUT MONEY is a decoy. A distraction. A smokescreen so the real players can keep looting.

Wake up. This isn’t crypto. It’s a war. And we’re the collateral.

It’s funny how everyone’s so shocked. Like this is new. We’ve had this exact script since 2017. ‘Easy money.’ ‘No KYC.’ ‘Limited time.’

The only thing that’s changed? The names. Now it’s NUT MONEY instead of BitConnect. Same playbook. Same victims. Same silence.

And the real tragedy? The people who lose money are the same ones who’ll defend ‘decentralized finance’ while handing over their keys to a website with a cartoon monkey logo.

It’s not the platform. It’s the mindset. We want magic. We don’t want due diligence.

So we get what we deserve.

I lost $18,000 to something just like this in 2021. I thought I was smart. I checked the website. It looked real. The testimonials were convincing. I even called the ‘support line’-it was a VoIP number that just played hold music.

I didn’t report it. I was too ashamed.

Now I tell everyone. Every. Single. Time. If it sounds too good to be true? It is. If it doesn’t have KYC? It’s a trap. If the name makes you laugh? It’s a scam.

I’m not mad anymore. I’m just… tired. But I won’t let you be the next one.

Don’t send a dime.

Thank you for the comprehensive and meticulously documented analysis. The alignment of temporal indicators with Interpol’s 90-day scam lifecycle model is particularly compelling. The absence of regulatory registration across all major jurisdictions, coupled with the empirical verification of zero on-chain transactional activity, constitutes a prima facie case of financial fraud under 18 U.S.C. § 1343.

It is imperative that this information be disseminated not only to retail investors but also to academic institutions and financial literacy programs. The normalization of such predatory entities reflects a critical gap in public understanding of blockchain infrastructure and regulatory compliance.

I will be submitting this analysis to the Financial Industry Regulatory Authority (FINRA) Investor Education Foundation for inclusion in their upcoming educational module on digital asset risk assessment.

Well done.

I’m from Colombia, and I’ve seen this exact thing happen here with ‘crypto cafes’-places that look like little shops, but they’re just fronts. People bring cash, get a QR code, and then vanish.

It’s the same everywhere. The language changes. The name changes. The scam? Always the same.

It breaks my heart because it’s not just about money. It’s about hope. People think crypto is their way out. And then they get crushed.

Thanks for calling this out. I’m sharing this with my local community group. We’re starting a ‘Crypto Safety Circle’-we check every new platform together. No one gets left alone with a scam.

USA always crying about scams but they let their own banks steal trillions. NUT MONEY? Small time. Wall Street stole more in one day. You think regulators care? They got their cut.

Stop pretending you’re innocent. You all love the hustle. You just mad it wasn’t you who got rich.

Scam? Maybe. But at least NUT MONEY didn’t need a bailout. You want real fraud? Look at the Fed.

Wake up. The real scam is the system.

Just wanted to add: if you’re ever unsure about a platform, check their Twitter/X. Real exchanges reply to questions. NUT MONEY? Their last tweet was 78 days ago. And the replies? All bots saying ‘I made $50k in 3 days!’

Also-look at their ‘team’ page. All stock photos. No LinkedIn profiles. One guy’s photo is from a Shutterstock ‘crypto entrepreneur’ pack. Same guy is on 5 other ‘exchanges.’

It’s not just a scam. It’s lazy.

And honestly? That’s worse.

Don’t even waste your time. Block it. Move on.

Love you all. Stay safe 💕

Let’s be real. This isn’t about crypto. It’s about the collapse of American trust. We used to have standards. Now? Anyone can launch a website, slap ‘crypto’ on it, and people hand over their keys like it’s a free sample at Costco.

And the government? They’re asleep. They let this happen because they’re too busy bailing out banks that rigged the system.

But don’t blame the victims. Blame the system that let this happen. Blame the education system that never taught financial literacy. Blame the media that turns scams into influencers.

NUT MONEY is just the symptom. The disease is us.

Same thing happened in India last year. Called it ‘JugaadCoin.’ Same name, same vibe. People lost lakhs. No one reported it. Now it’s gone.

Just delete the app. Block the site. Don’t even look back.

Simple.

It’s not a scam if you believe in it, right? 😌

Like… if you think the moon landing was fake, does that make NASA real? If you believe NUT MONEY is legit, does that make it… true?

Just asking.

Also, I think the name is cute. Like a pet name for your wallet. NUT MONEY. Adorable. 🥺

But hey, if you wanna lose money… go for it. I’ll be over here, sipping tea, watching the chaos.

Thanks for posting. I’m new to crypto and didn’t know what to check. Now I know: no KYC = no go. No audits = no go. Weird name = no go.

Just saved me from a big mistake. Really appreciate it.

I used to think scams were just for greedy people.

Then I met my cousin. He’s 68. Lost $22k to a ‘crypto savings account’ that looked like a bank website. He didn’t even know what blockchain was. He just wanted to grow his retirement.

That’s the real horror.

Not the scam. The fact that we let it happen. Again. And again.

Maybe the solution isn’t warning people.

Maybe it’s building something better.

Something real.

Something that doesn’t need a name like NUT MONEY to feel safe.

I’ve been researching this for weeks. The domain was registered by a shell company in the Seychelles linked to three other scam platforms. All using the same hosting provider. Same payment processor. Same template.

It’s a factory.

And they’re churning them out like cheap sneakers.

One down. Ten more waiting in line.

Why are you all so obsessed with this? It’s one scam. There are thousands. You’re giving it attention it doesn’t deserve. Let it die. Focus on real problems.

Like the fact that your neighbor’s Bitcoin wallet is probably sitting in a vault with a 20-year-old password.

Or that your grandma still thinks ‘crypto’ is a type of coffee.

Stop feeding the monster. Don’t write about it. Don’t talk about it. Don’t even think about it.

It’s not worth your energy.

Thank you for sharing this. I’m going to make a short video for my elderly neighbors. No jargon. Just: ‘If it sounds too good to be true, it is. And if the name makes you laugh, walk away.’

You saved someone today. I’m just passing it on.

That’s exactly what I did. Made a simple checklist: KYC? ✅

Regulated? ✅

Real team? ✅

Not named after a snack? ✅

Now I show it to everyone who asks. Even my cousin who still thinks Dogecoin is a ‘guaranteed’ investment 😅

Small wins.

Yeah. The real win isn’t stopping the scam.

It’s making sure the next person doesn’t get fooled.

That’s how you fight back.