Imagine losing your phone, and with it, your entire cryptocurrency stash-gone forever. No password reset. No customer service line. Just silence. That’s the reality for millions using traditional crypto wallets. But there’s a better way. Account abstraction is changing how we interact with blockchain wallets, turning them from fragile keys into smart, recoverable, and user-friendly tools that finally feel like Web2 apps-with Web3 security.

Why Traditional Wallets Fail Real People

Most crypto users still rely on externally owned accounts (EOAs), like MetaMask. These wallets are simple: one private key, one seed phrase. If you lose it? Your funds are gone. No second chance. Ledger Academy estimates that between 2017 and 2022, over $3.8 billion in crypto was permanently lost because users couldn’t recover their keys. That’s not a bug-it’s the design. This isn’t just about forgetting a phrase. It’s about phishing, hacked devices, or even family members deleting files after someone passes away. There’s no safety net. And that’s why mainstream adoption stalled. People don’t trust systems that can’t be fixed when things go wrong.What Account Abstraction Actually Does

Account abstraction flips the script. Instead of a wallet being just a key, it becomes a smart contract-like a mini-program that controls your funds. Think of it like upgrading from a basic lock to a smart door with multiple access rules: fingerprint, backup code, time limits, and even someone else’s approval. The most widely adopted version is ERC-4337, introduced in 2021. It doesn’t require changes to Ethereum’s core. Instead, it adds a new layer on top. Your wallet is still yours, but now it can do things a regular key never could:- Let apps pay your gas fees (so you don’t need ETH to start)

- Require two people to approve big transactions

- Use your phone’s fingerprint or face ID instead of typing a 24-word phrase

- Recover your wallet using trusted friends or family, not a seed phrase

Recovery That Actually Works

The biggest win? Social recovery. In traditional wallets, if you lose your key, you’re done. In AA wallets like Argent, you pick 3 trusted contacts-your sibling, your partner, your crypto-savvy friend. If you get locked out, you just ask two of them to confirm your identity. No seed phrase needed. Argent reported a 98.7% success rate across 247,000 recovery attempts between January 2022 and August 2023. One Reddit user, u/CryptoNewbie2023, lost his phone and got his wallet back in under two hours using his brother and sister as guardians. That’s not tech jargon-that’s real life. Compare that to MetaMask, where 12% of users never recover lost access. AA makes recovery not just possible, but normal.

Gas Fees? Paid by Apps, Not You

One of the biggest barriers to using crypto? Having to buy ETH just to send ETH. If you’re new, you need to buy ETH on an exchange, transfer it to your wallet, then use it to pay for transactions. It’s a loop that turns off beginners. Account abstraction breaks that. With gas sponsorship, dApps can pay your fees. Think of it like a free trial-you don’t need to pay upfront. Gelato Network alone processes over 1.2 million sponsored transactions every month. Gaming apps use it to let you play without ever touching ETH. You sign once, and the app covers the rest. Even better? You can pay gas in other tokens. Biconomy lets users pay fees in USDC, DAI, or even tokenized stocks-no ETH required. That’s huge for people who don’t want to hold volatile assets just to interact with the blockchain.Security That Doesn’t Rely on One Key

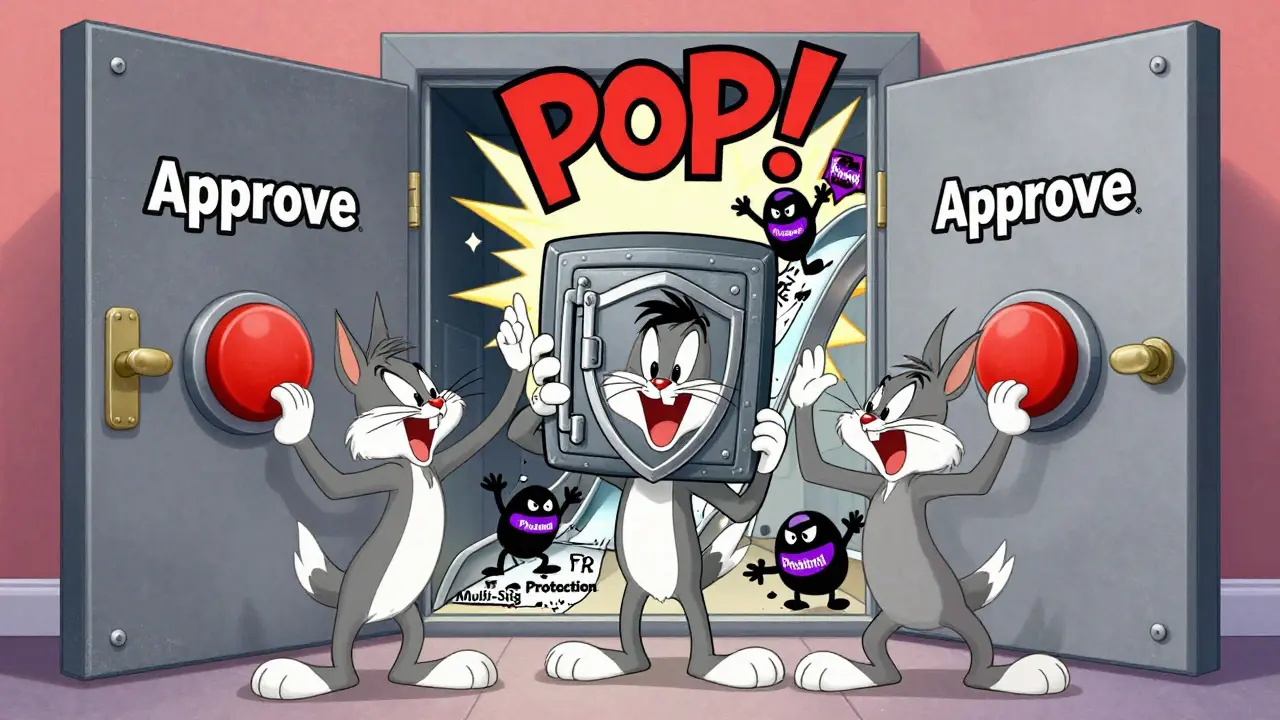

Single-key wallets are like having one lock on your front door. If someone steals that key, they own everything. AA wallets use multi-signature rules. Safe (formerly Gnosis Safe) requires at least two out of three people to approve any transaction over $500. That’s enterprise-grade protection. Cyfrin’s 2023 analysis found that multisig via AA prevents 83% of the single-point failures that led to hacks in 2022. No more hackers stealing funds because you clicked a bad link. Even if your device is compromised, the attacker still needs two other approvals. And biometrics? Ambire Wallet lets you unlock your account with your fingerprint or face ID. No typing. No memorizing. Just tap and go.But It’s Not Perfect

This isn’t magic. There are trade-offs. First, setup is slower. While MetaMask takes 5 minutes, AA wallets like Argent or Safe can take 25-45 minutes. You need to set up guardians, choose approval rules, and understand how session keys work. Reddit user u/DeFiDegen99 called it “frustrating” compared to MetaMask. Second, gas costs are higher during setup. Deploying the smart contract wallet costs more than creating a basic EOA. But after that? Transaction fees are similar. Third, not all dApps support AA yet. About 32% of DeFi protocols still don’t recognize smart wallets. That means you might need to switch back to MetaMask for some apps. And yes, more complexity means more risk. Security researcher Samczsun found a flaw in early AA wallets that could have let attackers bypass signatures. That’s why audits matter. OpenZeppelin’s September 2023 report showed 27% of AA implementations had critical vulnerabilities. The tech is powerful, but only if built right.

Okay, so I just switched to Argent last week, and honestly? It’s been a game-changer. I lost my phone last month-panic mode, right?-but I just texted my sister and my buddy, they hit approve, and boom, I was back in. No seed phrase, no stress. I didn’t even need to buy ETH first. The app paid my gas. I’m not a tech guy, but this? This feels like magic.

One must consider the ontological implications of delegating sovereignty over one’s digital assets to a programmable entity governed by social contracts. Is this not merely a reification of centralized trust, dressed in the robes of decentralization? The user, in seeking convenience, surrenders the very autonomy that crypto was meant to restore. A philosophical paradox, indeed.

Let me tell you why this matters: I’ve helped three friends recover their wallets using social recovery. One was my mom. She’s 68. She uses Face ID. She doesn’t know what a seed phrase is. And now she’s buying NFTs of her grandkids’ drawings. That’s not progress-it’s liberation. AA isn’t for crypto bros. It’s for your grandma, your roommate, your kid who just got their first paycheck. This is how Web3 becomes real.

And gas sponsorship? Yes. I paid for my friend’s first DeFi swap in USDC. He didn’t even know he needed ETH. He just clicked ‘send’ and went to lunch. That’s the future. Simple. Human. No jargon.

Yes, setup takes longer. So what? You only do it once. And if you’re setting up a wallet for someone who’s never touched crypto? You’re not just giving them a tool-you’re giving them safety. That’s worth 25 minutes.

Also, biometrics? YES. Typing 24 words on a phone screen at 2 a.m. after too many drinks? No thanks. My fingerprint doesn’t forget. My phone doesn’t get hacked if I lose it. This isn’t tech. It’s common sense.

And yes, some dApps still don’t support it. But that’s changing fast. Every week, another one adds AA compatibility. The tide’s turning. Don’t wait for it to be perfect. Jump in now. You’ll thank yourself later.

There’s something beautiful about the idea that security doesn’t have to mean isolation. We used to think safety meant locking everything behind a single key-like a vault with one combination. But humans aren’t designed to be alone with their most important things. We need community. We need backup. Account abstraction finally lets the blockchain reflect that truth. It’s not just better tech-it’s better humanity.

And the fact that apps can pay your gas? That’s the quiet revolution. It’s not about lowering barriers-it’s about removing them entirely. You don’t need to understand crypto to use it. You just need to want to.

It’s not magic. But it’s close.

Been using Safe for 8 months now. Two of my three guardians are my cousins. One lives in Canada, one in Mexico. We all have different phones, different networks. But if I vanish, they can still get me back. That’s wild. Also, I use session keys for gaming. I sign once, play for hours, no more popping in and out of my wallet. Feels like Web2, but my keys are mine. 😌

i just switched to argent and omg i think i might cry?? like i had a panic attack last year when i lost my phone and i thought i lost all my crypto and now i know i could just call my brother and be fine?? i dont even know how to explain this but i feel safer?? like, actually safer??

Let’s be real-account abstraction is just a fancy way of saying ‘trust your friends with your money.’ And let’s not pretend this isn’t a social engineering attack waiting to happen. You think your ‘trusted contacts’ won’t get hacked? Or get pressured? Or just… get bored and say yes to everything? This isn’t security. It’s a trust fall with your entire net worth.

Also, gas sponsorship? So now apps are paying your fees? Who’s really paying? The user? The investors? The VC-funded dApp? You think they’re doing this out of kindness? They’re locking you in. This isn’t freedom. It’s a subscription model with more steps.

In my country, many people don’t have access to reliable internet or smartphones. But they do have family. The idea of social recovery feels deeply familiar-like how we’ve always protected our valuables: through community, not isolation. This isn’t just innovation. It’s cultural alignment. I hope this spreads beyond Ethereum.

While the technical merits of account abstraction are undeniable, one must not overlook the regulatory implications. If a wallet is a smart contract, is it now a financial instrument? Could it be subject to KYC? Who is liable if a guardian acts maliciously? The legal framework has not caught up. This is innovation without oversight-a dangerous cocktail.

AA wallets are just phishing magnets with extra steps. 27% have critical bugs? Yeah, and you’re still using them? LOL. Also, ‘social recovery’? Your cousin gets drunk and approves a transfer? Congrats, you just lost your life savings. Don’t be a lab rat.

You people are so naive. You think this is safe? You think your ‘trusted contacts’ won’t turn on you? Or get hacked? Or just… want your ETH? You’re handing your keys to strangers and calling it ‘community.’ Pathetic. 😒

It is imperative to note that the ERC-4337 standard, while ostensibly non-invasive, introduces a layer of indirection that undermines the foundational principle of non-custodial sovereignty. One cannot claim decentralization when the execution layer is governed by relayers, paymasters, and user operations-all of which are subject to centralization pressures. This is not evolution. It is entropy disguised as progress.

I tried Safe last month. Took me 30 minutes to set up guardians, but now I sleep like a baby. My dad’s in India, my friend’s in Canada-we all use different phones. But if I disappear, they can get me back. No panic. No stress. Just… peace. I didn’t know I needed this until I had it.

Gas sponsorship? More like gas slavery. You think apps pay your fees out of the goodness of their hearts? They’re harvesting your data, locking you into their ecosystem, and selling your behavior to advertisers. This isn’t freedom-it’s a gilded cage. And you’re high-fiving them for it.

My buddy set up his AA wallet for his 70-year-old uncle. The uncle used Face ID to send $50 to his church. No seed phrase. No panic. No help desk. Just tapped his phone. That’s the moment crypto finally became useful. Not for trading. Not for speculation. For people. Real people.

Stop overthinking it. Just try it. You’ll be surprised how easy it is.

AA is the future… but I’m still scared. What if my best friend gets hacked and approves a transfer? What if my mom doesn’t understand what she’s signing? What if I die and they just… delete my wallet? I feel like I’m playing Russian roulette with my life savings. 😭

I’ve used MetaMask since 2019. I was skeptical. But after my phone died and I used Argent’s recovery with my sister and coworker? I cried. Not because I got my money back. Because I realized I didn’t have to be alone with this anymore. This isn’t tech. It’s care.

ERC-4337 enables paymasters, session keys, and account abstraction without L1 changes-but it also fragments the user experience. Wallets become siloed ecosystems. You’re not just managing a key anymore-you’re managing a protocol stack. Complexity is the new security. And that’s a dangerous trade.

My aunt in Johannesburg lost her phone. She’s not tech-savvy. But she called her daughter, who lives in Cape Town, and her neighbor who’s been helping her with crypto. Two taps later? Her wallet was back. She didn’t need to understand smart contracts. She just needed to trust her people. ❤️ This is what real inclusion looks like.

Too much hype. Still need ETH to interact with most dApps. AA doesn’t fix anything.

My mom just asked me how to send crypto to her friend. I showed her Argent. She used her face ID. Sent it. Said ‘that was easier than Venmo.’ I cried. This isn’t crypto. This is connection.

Imagine a world where your wallet doesn’t just hold your assets-but holds your story. Your recovery circle? That’s your family tree on-chain. Your session keys? Your habits, your rhythm, your life. AA doesn’t just make crypto usable-it makes it human. And honestly? That’s the most radical thing crypto has ever done.