Bid-Ask Spread Calculator

When you buy Bitcoin or sell Ethereum, you might think you’re getting the price you see on the screen. But that price isn’t the whole story. Hidden behind it is something that eats into your profits before you even make a move - the bid-ask spread. It’s not flashy. It doesn’t make headlines. But if you’re trading crypto, you’re paying it every single time. And if you don’t understand it, you’re leaving money on the table.

What Exactly Is the Bid-Ask Spread?

The bid-ask spread is the gap between two prices: the highest price someone is willing to pay for a crypto coin (the bid), and the lowest price someone is willing to sell it for (the ask). If Bitcoin’s bid is $62,300 and the ask is $62,350, the spread is $50. That $50 isn’t a fee you pay to the exchange. It’s the cost of getting in or out of the trade right now. Think of it like buying a used car. The seller says, "I won’t take less than $20,000." You say, "I’ll give you $19,800." The spread is $200. If you agree to $20,000, you paid the spread. If you pay $20,000 and immediately try to sell it back, you’ll only get $19,800. You just lost $200 - no broker, no commission, just the market itself. In crypto, this happens instantly. You hit "Buy" at $62,350. The moment you own it, the best price someone else will pay you is $62,300. You’re down $50 before the blockchain even confirms your transaction.How Is the Spread Calculated?

The spread isn’t just a dollar amount - it’s a percentage. And that percentage matters more than the number itself. Here’s the formula traders use:Bid-Ask Spread Percentage = (Ask Price − Bid Price) / Ask Price × 100%

Using the Bitcoin example:

- Ask price: $62,350

- Bid price: $62,300

- Spread = ($62,350 − $62,300) / $62,350 × 100% = 0.08%

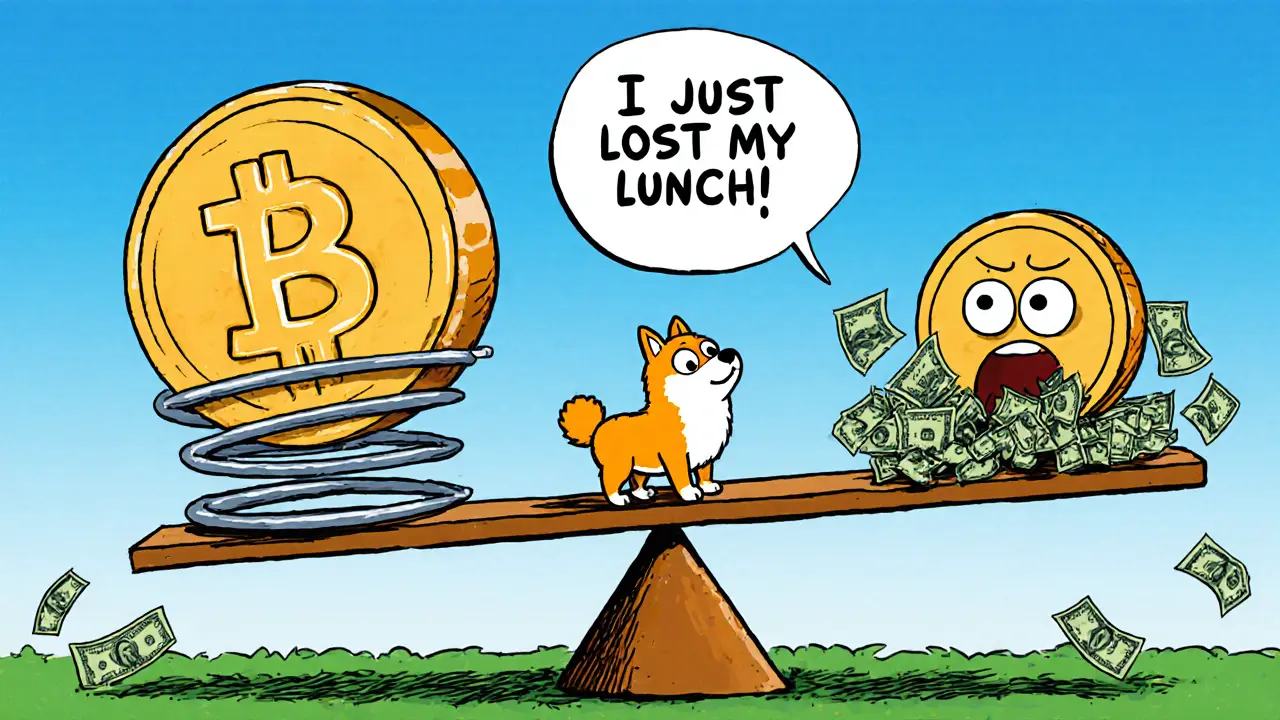

That’s tiny. But for a less popular coin like Shiba Inu, the spread might be $0.000010 bid and $0.000015 ask. Same $0.000005 difference - but now it’s 33% of the ask price. That’s not a trade. That’s a tax.

That’s why comparing spreads in dollars is useless. You need the percentage. A $1 spread on a $100 coin is 1%. A $1 spread on a $10 coin is 10%. One is manageable. The other will kill your returns.

Why Do Spreads Vary So Much Between Coins?

Liquidity is everything. The more people trading a coin, the tighter the spread. Bitcoin and Ethereum, with billions in daily volume, often have spreads under 0.1%. You can buy and sell quickly without moving the price. Now look at a new meme coin with $500,000 in daily volume. There might be only five buyers at $0.000020 and ten sellers at $0.000030. That’s a 50% spread. If you buy at $0.000030 and try to flip it, you’ll likely get $0.000020. You’ve lost a third of your money before you even check your wallet. This isn’t speculation. Data from CoinGecko and Binance shows that the top 10 cryptocurrencies by market cap have average spreads below 0.2%. The bottom 500? Many exceed 5%, and some hit 20% or more during quiet hours.How Spreads Impact Your Trading Strategy

If you’re a day trader or scalper, the spread is your biggest enemy. You might make five trades a day. Each one costs you 0.1%. That’s 0.5% in pure loss before the market moves. If you’re aiming for 1% gains, you’re already halfway to break-even. Long-term holders? You might think it doesn’t matter. But even you pay the spread when you rebalance, take profits, or move funds between wallets and exchanges. Over time, those tiny costs add up. Here’s the brutal truth: if you’re not accounting for the spread, you’re overestimating your returns. A 10% profit on paper might be a 9% net gain after the spread. That’s a 10% drop in your real profit.

Market Orders vs. Limit Orders: Which One Saves You Money?

Market orders guarantee execution - but not price. If you place a market buy order, you’ll pay the lowest ask. If the spread is wide, you might get filled at a price much higher than the last traded price you saw. Limit orders let you set your own price. You can place a buy order at $62,320 - right in the middle of the $62,300 bid and $62,350 ask. You might wait minutes, hours, or even days for someone to sell to you. But if it fills, you saved $30 per Bitcoin. That’s $30 you didn’t lose to the spread. The trade-off? Speed vs. cost. Market orders = instant, expensive. Limit orders = slow, cheaper. Smart traders use limit orders for everything except emergencies. And even then, they set limits slightly above the bid to avoid overpaying.Why Exchanges Have Different Spreads

Not all exchanges are created equal. Binance, Coinbase, and Kraken have deep order books and professional market makers. Their spreads on Bitcoin are often under 0.05%. A smaller exchange? Maybe it has 1/10th the volume. Fewer buyers. Fewer sellers. The spread balloons. You might see a $62,300 bid and $62,500 ask - a 0.32% spread. That’s six times worse than the big players. And don’t assume the exchange with the lowest price is the best. A coin might be $1 cheaper on a small exchange - but if the spread is 5%, you’ll lose $0.05 just to sell it. You’re better off paying $1 more on Binance and paying 0.05% in spread.Slippage: The Spread’s Sneaky Cousin

Slippage isn’t the same as the spread, but it often rides alongside it. Slippage happens when your order doesn’t fill at the price you expected because the market moved while your order was processing. Say you place a $10,000 market buy order for a low-liquidity altcoin. The order book shows $10,000 worth at $0.00010. But by the time your order executes, the last 50% of your buy has pushed the price up to $0.00012. You paid an average of $0.00011 - 10% more than you planned. That’s slippage. And it’s worse when the spread is already wide. The bigger the spread, the more the market shifts when you trade. High volatility? Slippage spikes. Low volume? Slippage spikes. Combine both? You might lose 15% before your trade even finishes.

How to Trade Smarter With Spreads in Mind

Here’s what works in real trading:- Always check the spread before trading. Don’t just look at the last price. Look at the order book. Is the bid 0.05% below the ask? Or 2%?

- Use limit orders by default. Only use market orders if you’re in a panic or moving funds urgently.

- Compare exchanges. Trade Bitcoin on Binance, not on a new platform with a 0.5% spread.

- Avoid low-volume coins. If you can’t find a spread under 1%, walk away. The risk isn’t worth it.

- Trade during peak hours. Spreads tighten when volume is high - usually UTC 12:00-16:00 and 20:00-24:00.

- Track your net returns. Subtract the spread from every profit. If your strategy only makes 1.5% per trade and your spread is 0.3%, you’re barely breaking even.

Is the Spread Getting Better?

Yes - but only for the big coins. As institutional money flows into Bitcoin and Ethereum, liquidity grows. Spreads have dropped 30-50% over the last three years for top assets. Market makers now compete fiercely to offer tighter spreads. But for everything else? Not so much. Thousands of new tokens launch every year. Most die within months. Their spreads stay wide. And as long as retail traders keep chasing them, the cycle continues. The takeaway? The crypto market is two markets. One for the big players with tight spreads and deep liquidity. One for everyone else - where spreads are wide, slippage is high, and profits vanish before they’re counted.Final Thought: The Spread Is the Hidden Tax

You pay taxes on your gains. You pay fees on withdrawals. But the bid-ask spread? That’s the tax you didn’t know you were paying. It’s automatic. It’s invisible. And it’s the reason so many traders lose money - not because the market moved against them, but because they didn’t understand the cost of getting in and out. If you want to trade crypto successfully, you need to treat the spread like a cost of doing business. Measure it. Minimize it. Account for it. Otherwise, you’re just giving your money to the people who sit on the other side of the order book - the market makers who profit from your ignorance.What causes the bid-ask spread to widen in cryptocurrency markets?

The bid-ask spread widens when liquidity drops - meaning fewer buyers and sellers are active. This happens during low trading hours, after major news events, or with lesser-known cryptocurrencies. High volatility also causes traders to become cautious, pulling their orders back and creating larger gaps between bids and asks. Smaller exchanges with less volume typically have wider spreads than major platforms like Binance or Coinbase.

Is a smaller bid-ask spread always better for traders?

Yes, generally. A smaller spread means lower transaction costs and more efficient trades. For short-term traders, tight spreads are essential - even a 0.1% difference can mean the difference between profit and loss after multiple trades. For long-term holders, it matters less on a single trade, but still adds up over time when buying, selling, or moving funds between wallets and exchanges.

How can I check the bid-ask spread on a crypto exchange?

Most exchanges show the order book on their trading interface. Look for two columns: one listing buy orders (bids) and another listing sell orders (asks). The top bid is the highest price buyers are offering. The top ask is the lowest price sellers are asking. Subtract the bid from the ask to get the spread. Many platforms also display the spread percentage directly.

Do market makers profit from the bid-ask spread in crypto?

Yes. Market makers place both buy and sell orders simultaneously, earning the difference between the bid and ask prices. They profit from the spread, not from price movements. Their goal is to buy low and sell high within the spread, often holding positions for seconds or minutes. In crypto, automated algorithms handle most of this, especially on large exchanges.

Can I avoid paying the bid-ask spread entirely?

No - you can’t avoid it completely, because it’s built into how markets work. But you can minimize it. Use limit orders instead of market orders, trade only high-liquidity coins like Bitcoin and Ethereum, and use exchanges with deep order books. Waiting for a better price might mean delayed execution, but it saves you money in the long run.

What’s the difference between bid-ask spread and slippage?

The bid-ask spread is the fixed gap between the best bid and best ask prices at a given moment. Slippage is what happens when your order executes at a worse price than expected because the market moved while your order was being filled. Slippage often occurs in wide-spread markets during high volatility or large trades. Both increase your trading costs, but slippage is unpredictable, while the spread is visible upfront.

Man i just realized i been paying this spread like its just part of the game lmao. i thought the price i saw was the price i got. nope. i bought solana at 140 and instantly it was 139.80. like bro that’s 0.20 gone before my wallet even blinked. thanks for pointing this out, i feel like i just got scammed by the market itself 😅

The bid-ask spread is not merely a financial metric-it is the silent architect of retail trader despair. It is the invisible hand that plucks coins from your portfolio before you even feel the warmth of ownership. We are not trading markets; we are feeding market makers who sip espresso while our losses accumulate in their ledgers. The spread is capitalism’s velvet glove-soft, silent, and suffocating.

Let’s be clear: the spread is the first tax you pay in crypto. No receipt. No invoice. Just a silent deduction from your buying power. The fact that retail traders don’t track it is why 90% lose money. It’s not volatility. It’s not FUD. It’s the simple math of being on the wrong side of the order book. If you’re not measuring spread as a percentage, you’re flying blind.

why do people even trade low volume coins?? like… do you just like losing money?? i mean i get the meme thing but if your spread is 30% you’re not trading you’re donating. also why is everyone so obsessed with bitcoin when you could just… not trade at all??

i was trading dogecoin last week and i thought i made 50% profit but when i tried to sell i lost 40% just to the spread. i thought i was smart but i was just feeding the bots. now i only trade btc and eth. even then i use limit orders. my friend says i’m too careful but i’d rather be alive than rich and broke.

i never thought about how the spread works until i saw the order book for the first time. it’s wild how different it looks on a big exchange vs a small one. like on binance it’s almost flat but on some random exchange the bids and asks are like miles apart. i started using limit orders after that and my trades feel less like gambling now. also i check spreads before every trade. small habit big difference.

so you’re telling me the guy who made 200% on shiba last month… actually lost 15% just to the spread? and he’s still posting memes about being a crypto genius? 😂 i love how the market rewards ignorance and punishes awareness. i’m just here for the comedy.

Hey everyone, if you're new to trading, don't panic about the spread-it’s just one more tool to learn. Start with BTC and ETH on Binance or Kraken. Use limit orders. Watch the order book for a few days before you trade. You’ll start seeing patterns. And remember: slow and steady wins the race. You don’t need to trade every hour. Just trade smart. I’ve helped dozens of beginners avoid this exact trap-you got this 💪

It is imperative that retail participants internalize the bid-ask spread as a non-negotiable cost of market participation. To disregard it is to engage in economic self-sabotage. One must treat the spread with the same rigor as one treats tax obligations or transaction fees. Only through disciplined accounting can one discern true alpha from illusionary gain. This is not speculation; it is financial literacy.

Oh wow. A 1500-word essay on how the market works. Groundbreaking. I didn’t realize that buying at the ask and selling at the bid was a ‘hidden tax.’ Maybe next you’ll explain that gravity exists. Also, your ‘smart trader’ tips are just basic finance 101. Congrats, you’ve discovered water is wet.

bro i used to be the guy who clicked market buy on every pump. then i lost $800 on a 5% coin with a 40% spread. now i wait. i watch. i set my limit and walk away. sometimes it takes hours. sometimes days. but when it fills? i feel like i outsmarted the system. not because i’m smart-because i stopped being impatient. you don’t need to trade all the time. you just need to trade right.

the spread is like the ghost in the machine-nobody sees it but everyone pays for it. in Lagos we call it ‘market juju’-the invisible force that eats your profit before you even smile. i used to think crypto was magic. now i know it’s just math with attitude. and the smartest traders? they’re the ones who don’t trade at all until the spread is clean.

Every time I see someone post a screenshot of their ‘10x’ gain on a meme coin, I want to cry. Not because they’re rich-but because they’re blind. They think they won. They don’t realize they paid the spread twice: once when they bought, once when they tried to sell. That’s not a win. That’s a funeral. The market doesn’t reward greed. It rewards patience. And the spread? It’s the toll booth on the road to enlightenment.

Yessss this is so important!! 🙌 I used to think I was doing great until I checked my actual net profit after spread. Now I only trade during peak hours and use limit orders. It’s like I unlocked a secret level in the game. Also-BTC and ETH are the only coins I touch now. The rest? Too much drama 😅

Interesting. I guess I never paid attention to the spread because I only hold long term. But now that you mention it… I did sell some ETH last month to rebalance. Wonder how much I lost to the spread then. Maybe I should track it.

Of course the spread is a tax. It’s not even a tax-it’s a ritual sacrifice. The market makers are the high priests and we’re the sheep. You think you’re trading? No. You’re lighting candles and dropping coins into the altar. The only way out? Don’t play. Or become the priest. Good luck with that.

Limit orders changed everything for me. I used to be a market order guy. Now I set my price, walk away, and come back later. Sometimes it fills. Sometimes it doesn’t. Either way, I didn’t overpay. That’s the win.

spread percentage is the only metric that matters. dollar spread means nothing. if you’re trading a $2 coin with $0.10 spread, you’re paying 5%. if you’re trading BTC with $50 spread, it’s 0.08%. compare apples to apples. most people don’t. that’s why they lose.

They’re not teaching you this because they want you to win. They want you to lose slowly so you keep trading. The spread is part of the system. The system is rigged. The exchanges profit from your ignorance. The market makers profit from your desperation. You’re not trading crypto. You’re feeding a machine designed to take your money. Wake up.

Wow. A whole article about the spread. And you think people didn’t know this? I mean… come on. It’s like writing a 10-page essay on why water is wet.

You don’t need to be a genius to beat the spread. You just need to be patient. And humble. Most people want to win fast. The market rewards those who wait. The spread doesn’t care how smart you think you are. It only cares if you’re reckless.

I started tracking spreads last month and my trades went from ‘meh’ to actually profitable. I used to think I was bad at trading. Turns out I was just paying invisible fees. Now I only trade when the spread is under 0.2%. Game changer.

man i just realized i been doing this wrong for years. i thought limit orders were for wimps. turns out they’re for people who want to keep their money. i’m switching now. thanks for the wake up call 😅

It is a matter of considerable academic and practical significance that the bid-ask spread constitutes the primary frictional cost in decentralized asset exchange. One must not conflate liquidity with popularity. The empirical data, as presented, corroborates the hypothesis that institutional participation correlates inversely with spread width. A compelling case for centralized liquidity aggregation as a superior trading paradigm.