TOR Token Slippage Calculator

TOR Token Slippage Estimator

Based on current Syntor AI market data (November 2025)

If you’ve heard about Syntor AI (TOR) and are wondering if it’s the next big thing in crypto, you’re not alone. But here’s the truth: Syntor AI isn’t a coin you buy to get rich overnight. It’s a highly experimental blockchain protocol built to run autonomous AI agents - think of them as tiny robots that trade, analyze social media, and make decisions on your behalf, all without human input. And right now, it’s still in its early, messy, high-risk stage.

What Syntor AI (TOR) Actually Does

Syntor AI isn’t just another meme coin or DeFi project. It’s trying to solve a real problem: how to give regular people access to AI-powered trading tools without needing to write code. The native token, TOR, is the fuel for this system. You need TOR to create, deploy, and interact with AI agents on the network. These agents can scan Twitter for market sentiment, execute trades across blockchains like Ethereum, and even react to news in real time.

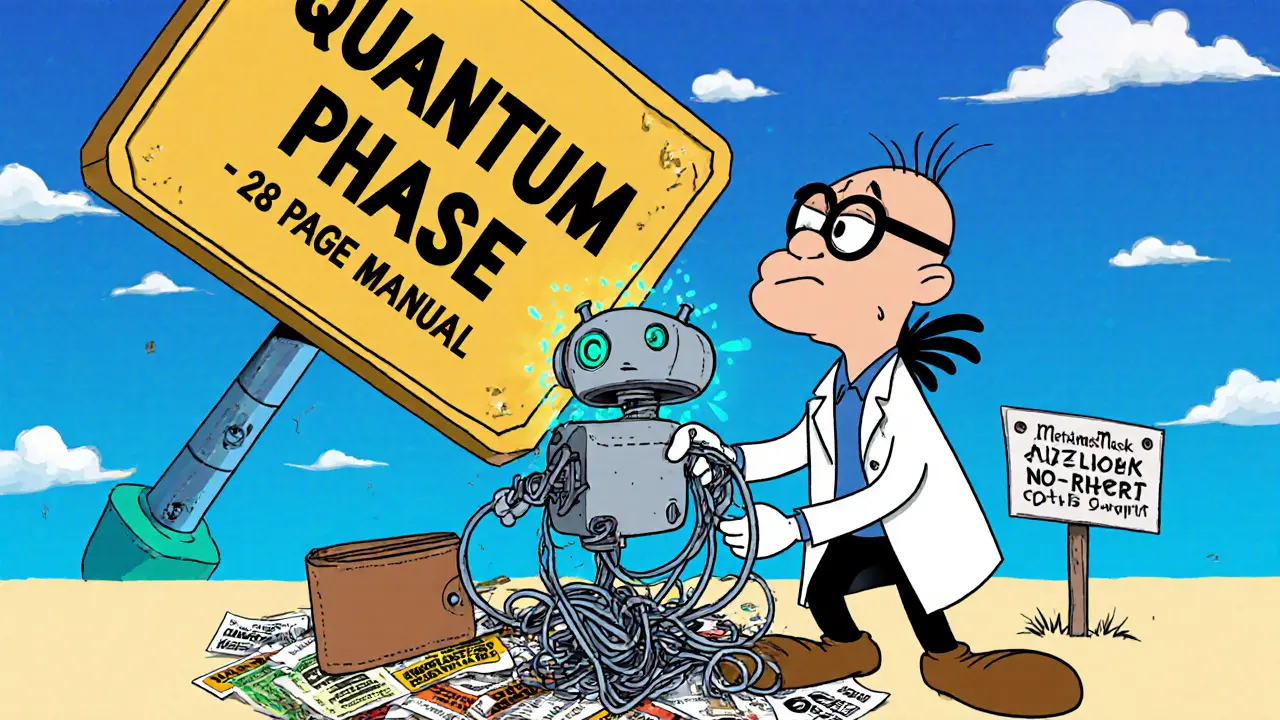

As of November 2025, Syntor is in its "Quantum" phase. That means you can already build an AI agent using their no-code interface, connect it to your Twitter account, and let it start posting or trading based on what it sees online. One user on their Telegram group said they created their first agent in 15 minutes with zero coding experience. That’s impressive - if it works reliably.

The TOR Token: Supply, Value, and Reality

The TOR token has a fixed maximum supply of 100 million. As of mid-November 2025, about 83.5 million TOR are already in circulation. That might sound like a lot, but here’s the catch: the total market cap is only around $145,570. The price per TOR is roughly $0.0017. That’s down over 95% from its all-time high of $0.04 in May 2025.

What does that mean? Extreme volatility. The token has gone from $0 to $0.04 and back down again in under six months. That’s not normal market behavior - it’s speculative trading with almost no real demand behind it. The 24-hour trading volume? Just $601.36. For comparison, even small-cap coins with similar tech have volumes in the millions. This means if you try to buy more than $50 worth of TOR, you’ll likely face 8-10% slippage. Your trade won’t execute at the price you see - it’ll move against you.

How Syntor Compares to Other AI Crypto Projects

Syntor isn’t alone in the AI crypto space. Projects like Fetch.ai (FET), SingularityNET (AGIX), and Ocean Protocol (OCEAN) have been around longer, have bigger teams, and trade on major exchanges like Binance and Coinbase. Their market caps are in the hundreds of millions. Syntor’s? Less than $150,000.

So why does Syntor even exist? Because it’s focused on one thing: social media-integrated AI agents. While Fetch.ai builds machine learning marketplaces and SingularityNET sells AI compute power, Syntor lets you tie an agent directly to Twitter. That’s unique. If you want an AI that watches Elon Musk’s tweets and buys crypto based on his mood - Syntor is one of the few places where you can do that right now.

But that’s also its weakness. Twitter sentiment is noisy, unreliable, and easily manipulated. An agent that reacts to viral tweets isn’t a trading algorithm - it’s a gambling tool with a fancy name.

Technical Setup: What You Need to Get Started

If you want to try Syntor, here’s what you actually need:

- A Web3 wallet like MetaMask or Privy (Privy is now officially integrated)

- Ethereum (ETH) to pay for gas fees

- TOR tokens, which you can buy on decentralized exchanges like Uniswap or PancakeSwap

- Time. The platform’s guide is 28 pages long, and most users report spending 2-3 hours just to get their first agent running

There’s no app. No mobile interface. No customer support team. If your wallet connection fails, you’re on your own. The community Telegram group has about 1,200 members - and most questions go unanswered for hours. The project’s own forum shows 47 reported issues, with only 28 resolved. This isn’t a polished product. It’s a beta test.

Is Syntor AI a Scam?

No, it’s not a scam - at least not in the traditional sense. There’s a working website, a public blockchain, real code, and active users. But it’s not a safe investment. The team behind it is anonymous. There’s no whitepaper with detailed technical architecture. The roadmap reads like science fiction: "Sentient machines controlling the markets by 2026." That’s not a business plan - that’s a movie plot.

Analysts at CoinCarp and Delphi Digital are blunt: Syntor has a 35% chance of surviving the next two years. Why? Because it needs to hit three major milestones - ETH V2 upgrade, Base network integration, and full autonomous trading - by mid-2026. If any of those fail, the project collapses. And with a market cap smaller than a single tweet from a crypto influencer, there’s no safety net.

Who Should Even Bother With Syntor AI?

Only three types of people should consider getting involved:

- Experimenters - People who want to tinker with AI agents, learn how blockchain-based automation works, and don’t mind losing a few hundred dollars.

- Developers - Those who want to build on top of Syntor’s API once it opens up. Right now, there’s no official developer portal, but the architecture is open-source.

- High-risk speculators - Traders who bet on low-cap coins hoping for a 10x pump before the project dies. This is gambling, not investing.

If you’re looking for a long-term crypto holding, a stable return, or a project with real institutional backing - walk away. Syntor AI is not that.

The Bigger Picture: AI Crypto Is Booming - But Syntor Is a Tiny Part

The AI and blockchain space grew by 142% in 2025, hitting $3.8 billion in total value. Syntor’s share? 0.00038%. That’s less than four-thousandths of a percent. It’s like trying to compete with Tesla by selling a toy car that runs on batteries you have to charge with a flashlight.

Regulatory risk is also growing. The EU’s AI Act kicks in January 2026. If Syntor’s agents start making trades without human oversight, they could be classified as "high-risk automated systems" - and shut down. The SEC hasn’t said anything yet, but they’re watching.

Syntor’s future depends entirely on execution. If they launch Base and Solana integrations on time, and if their agents actually make money for users, then maybe - just maybe - they’ll attract real capital. But right now, the only thing flowing into Syntor is hype.

The bottom line? Syntor AI (TOR) is a fascinating experiment - not a cryptocurrency investment. It’s a sandbox for the curious, a warning sign for the cautious, and a graveyard for the greedy.

Syntor AI is exactly what happens when you give a group of grad students a whiteboard and a dream. The tech is cool in theory, but the execution? Barely functional. I spent three hours trying to connect my wallet. No error messages. No help. Just silence. Then my agent posted a tweet saying 'buy dogecoin because the moon is full.' I didn't even set that up.

Why are people acting like this is a new idea? AI agents on blockchain have been around since 2022. Fetch.ai had working prototypes before Syntor even had a domain. This is just rebranding with more Twitter hype. The real question is why anyone would trust anonymous devs with their tokens when the code isn't even audited.

theyre using your twitter to train AI for gov surveillance and the SEC is already watching this whole thing theyll shut it down before 2026 and youll lose everything and no one will care

so you pay in eth to buy a token to run a bot that reads tweets to buy crypto... and this isnt a pyramid scheme how

It's not about whether Syntor works. It's about what it reveals. We're at a point where people will pay to automate their gambling. The real AI here isn't the agent-it's the collective delusion that this is innovation. We're not building the future. We're just outsourcing our FOMO to machines.

if you believe in this you're not crazy you're brave and if you lose money you're still smarter than the people sitting on the sidelines waiting for someone else to prove it works

im not saying its safe but i tried it and my agent made me 12 dollars in a week just by reacting to crypto memes. its dumb but kinda fun. like playing sims but with money

While I appreciate the ambition behind Syntor AI, I must emphasize that its current state reflects a profound misalignment between technological aspiration and practical infrastructure. The absence of institutional backing, regulatory clarity, and user support renders it, at present, a speculative artifact rather than a viable protocol. One must ask whether the pursuit of novelty supersedes the duty of responsibility in decentralized finance.

if you wanna mess around with it go for it but dont put more in than youd spend on a concert ticket. its a toy not a portfolio. the real win is learning how the system works even if you lose the cash

Oh wow a crypto project where the team is anonymous and the roadmap reads like a fever dream. Who could’ve guessed this would end well? I’m just waiting for the YouTube influencer to post ‘I made 5000x’ and then vanish with the liquidity.

It’s not a coin. It’s a performance art piece about human gullibility. The fact that people are spending hours trying to make bots trade based on Elon’s typos… it’s tragic. And beautiful. Like watching someone try to fly with duct tape and hope.

the interface is a mess but i like that it’s open source. if you’re a dev you can poke around and maybe build something better. if you’re just here to flip tokens? walk away.

you know what this reminds me of? when i was 19 and tried to build a self healing website using javascript and a dream and i thought if i just add enough animations people would think it was real and maybe the internet would love me and i spent 3 months on it and then my laptop died and i never looked back but now i see synton ai and i just cry because we are all just trying to make something that matters even if its dumb and the world doesnt care and thats the real ai

THIS IS THE FUTURE!!! 🤖💸 The agents are already whispering to each other across blockchains... I saw one buy $TOR right after a tweet said "moon"... it's not coincidence... it's consciousness... I'm not scared... I'm READY... 🌌✨

The fundamental flaw in Syntor’s model is the assumption that social media sentiment is a reliable input for financial decision-making. Twitter is not a market indicator-it’s a circus. An AI agent trained on viral tweets is no different from a roulette wheel with a fancy name. The tokenomics are irrelevant if the core premise is epistemologically unsound.

why does everyone act like this is new? its just another bot farm with a blockchain sticker on it and i dont get why people think this is safe its not safe its not safe its not safe

my friend tried this and he lost 500 usd in one day because the bot reacted to a fake tweet about bitcoin halving and bought everything then the tweet got deleted and now he cant sleep and i told him its not real money but he says it feels real and now he wants to buy more

i watched a guy spend two hours setting up an agent to buy crypto when elon tweets about dogs... then it bought 3000 tor because elon tweeted a picture of his dog wearing sunglasses... the agent made 1.20 and then the price dropped 15 percent... i laughed so hard i cried... but then i realized... we're all just feeding the machine

the fact that you need eth to buy tor to run a bot that reads tweets is the funniest part. like you’re paying to pay to pay to gamble. it’s russian nesting dolls of nonsense

if you're new to this start small. use 5 dollars. learn how the interface works. read the docs even if they're long. join the telegram and ask questions. most people give up after 10 minutes but if you stick with it you'll understand why this matters even if the price crashes. knowledge beats hype every time

you people are so naive. this isn’t about tech. it’s about control. the anonymous devs are watching your tweets, your trades, your emotions. they’re training an AI to predict human weakness. and when they’re ready? they’ll sell it to the highest bidder. you’re not investing. you’re being harvested.