Whale Alerts: What They Are, Why They Matter, and How to Use Them in Crypto

When a single wallet moves whale alerts, real-time notifications of large cryptocurrency transactions that signal activity from major holders. Also known as crypto whale tracking, these alerts show when someone with millions in holdings buys or sells — and that’s not just noise. It’s market-moving data. These aren’t random transfers. They’re the digital equivalent of a hedge fund dumping $50 million in Bitcoin overnight. And if you’re not watching, you’re trading blind.

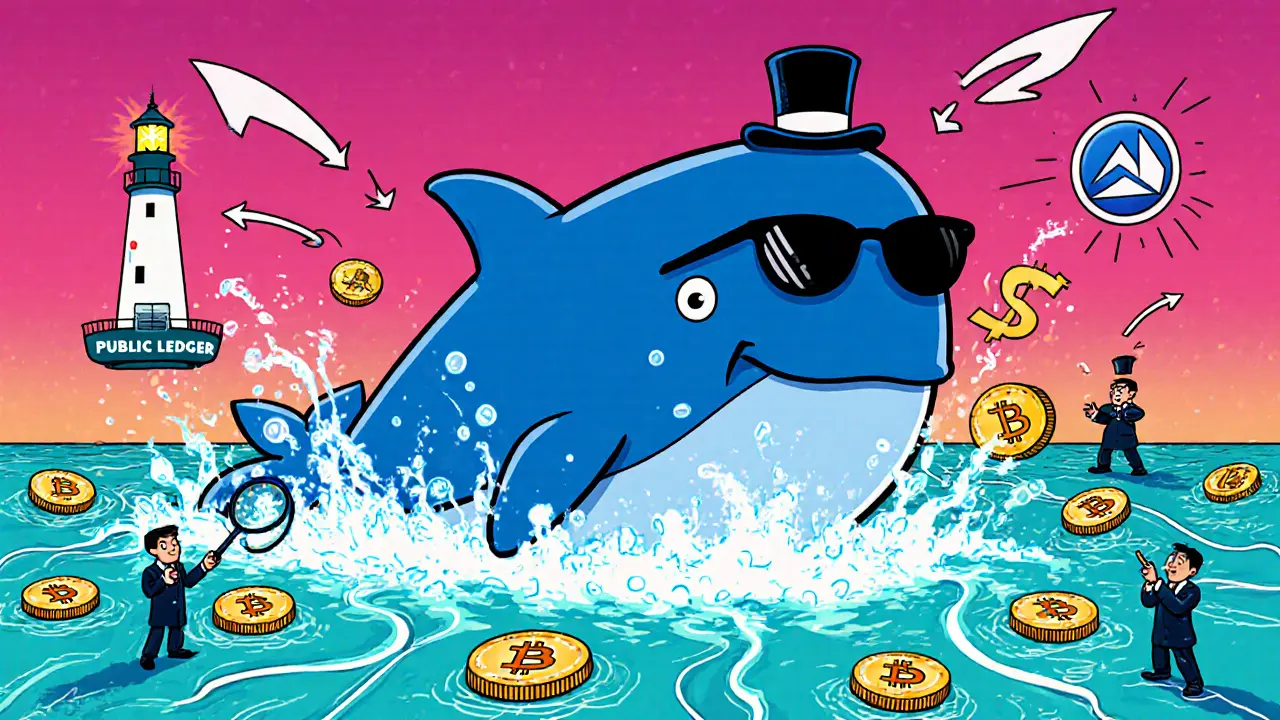

Whale alerts rely on blockchain monitoring, the practice of tracking on-chain activity across public ledgers like Bitcoin and Ethereum. Tools scan wallets tied to known big players — exchanges, early investors, institutional accounts — and flag any transfer over a set threshold, like $100K or $1M. That data gets pushed to apps, Telegram groups, and dashboards. But here’s the catch: not all whale moves are equal. A $2M ETH sell from Binance’s cold wallet? That’s a signal. A $500K transfer between two unknown wallets? Probably just internal bookkeeping. You need context.

That’s where crypto whales, individuals or entities holding massive amounts of cryptocurrency that can influence market prices through their trades. come in. These aren’t mythical creatures. They’re real people — founders, funds, early adopters — who bought Bitcoin at $10 or Ethereum at $300. When they move, markets react. Why? Because they control supply. If a whale dumps 10,000 BTC, it floods the market. If they buy, it creates FOMO. And yes, some use whale alerts to front-run trades — buying just before a big purchase hits the chain. That’s why price spikes after a whale alert often fade fast.

Whale alerts don’t predict the future. They show what’s already happening. And in crypto, what’s happening right now matters more than what some analyst thinks will happen next week. You’ll see posts here about fake airdrops like TOKAU ETERNAL BOND or CHIHUA that pretend to be legitimate — but real whale activity doesn’t lie. If no one’s moving millions in a token, it’s not a project. It’s a ghost. Meanwhile, platforms like Curve Finance or DeFi Warrior get attention because whales actually use them — and their transactions show up in alerts.

Most people chase memes. Smart traders watch the whales. You don’t need to follow every alert. Just learn to spot the ones that matter: large, repeated, and coming from known addresses. That’s how you separate noise from signal. Below, you’ll find real breakdowns of tokens that moved — and ones that didn’t. Some crashed after whale exits. Others never had whales to begin with. You’ll see why some airdrops vanished overnight, why exchanges like Naijacrypto disappeared, and how the real players in crypto aren’t shouting on Twitter. They’re quietly moving millions on-chain. And if you know how to read the alerts, you’ll see them coming before the rest of the crowd.