Multi-Signature Wallet: How It Keeps Your Crypto Safe and Who Uses It

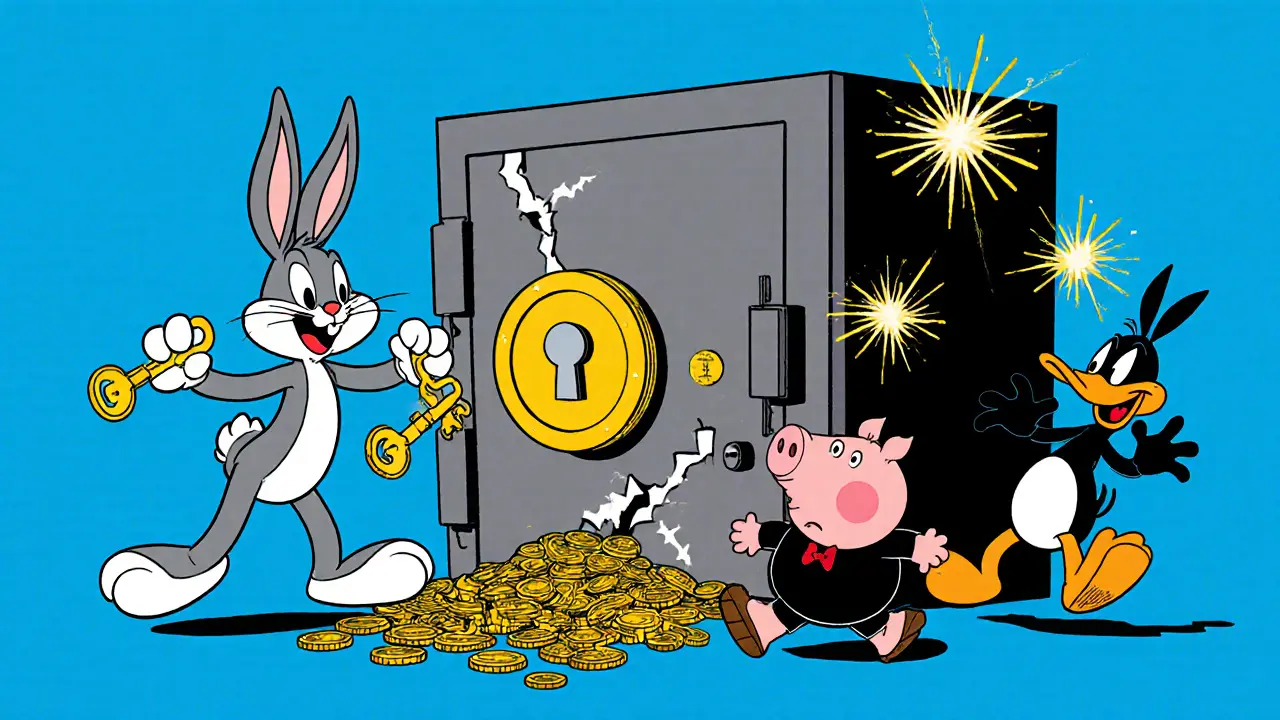

When you hold crypto, your multi-signature wallet, a type of digital wallet that requires two or more private keys to approve a transaction. Also known as M-of-N wallet, it’s not just a feature—it’s a security layer that turns a single point of failure into a team effort. Think of it like a bank vault that needs two people to open it: one person has the key, another has the combination. If one gets lost, stolen, or hacked, your funds stay locked. That’s the whole point.

This isn’t theory. Real users rely on multi-signature wallets, a system where control is split among multiple parties to prevent single-point compromise for everything from corporate treasuries to family inheritances. Exchanges like Coinbase and institutional players use them to guard billions. Even individual users who hold large amounts of Bitcoin or Ethereum turn to multi-sig because one lost phone or phishing attack doesn’t mean total loss. It’s not about being paranoid—it’s about being smart. And it’s not just about keys. hardware wallets, physical devices that store private keys offline and are often used in multi-sig setups are the most common partner to multi-sig, giving you both air-gapped security and distributed control. Then there’s MPC, Multi-Party Computation, a modern alternative that splits key fragments across devices without storing full keys anywhere. It’s not as old as multi-sig, but it’s growing fast because it avoids the complexity of managing multiple physical devices.

What you’ll find here isn’t marketing fluff. These posts show real cases: how a failed airdrop scam exploited users who trusted single-key wallets, why whale trackers rely on multi-sig addresses to spot big moves, and how regulated stablecoin issuers use multi-signature setups to meet federal compliance under laws like the GENIUS Act. You’ll see how crypto exchanges like Curve Finance and MagicSwap handle security behind the scenes, and why projects like BlockSwap Network avoid NFT airdrops by locking funds in multi-sig contracts. This isn’t about hype. It’s about what works when the stakes are real.