Bitcoin multi-sig: How it works and why it's the gold standard for crypto security

When you control your own Bitcoin, you’re responsible for its safety. That’s where Bitcoin multi-sig, a security system that requires multiple private keys to authorize a transaction. Also known as multi-signature wallet, it’s not just a feature—it’s a fundamental shift in how you think about ownership and control. Instead of one person holding the only key, multi-sig splits that power across two or more people or devices. If one key is lost, stolen, or compromised, your funds stay safe because the others won’t sign the transaction. This isn’t theory—it’s how exchanges like Coinbase hold institutional funds, how families manage inheritance wallets, and how DAOs distribute decision-making.

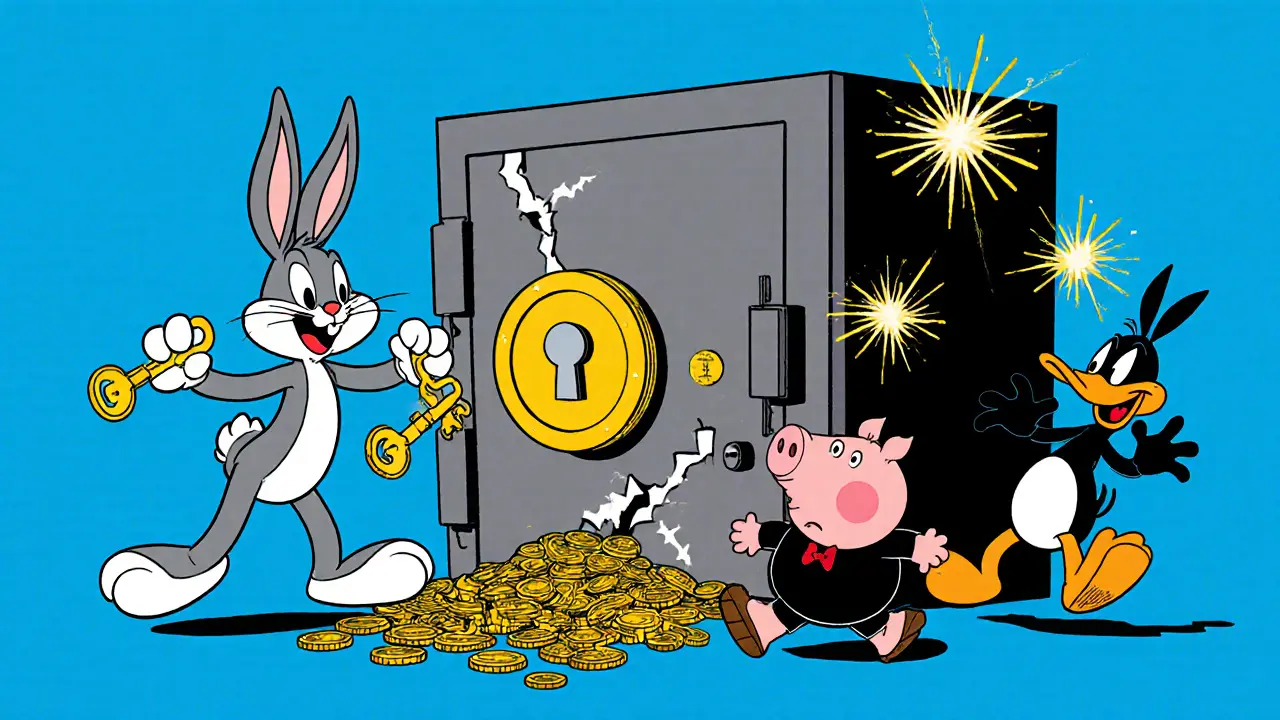

Multi-sig isn’t just about more keys—it’s about trust distribution. You can set it up as 2-of-3, meaning any two out of three keys must approve a transfer. Maybe one key lives on your phone, another on a hardware wallet in a safe, and the third with a trusted friend. Or all three could be stored in different locations. It’s like having a bank vault that needs two people to open it, not one. This setup prevents single points of failure. If your phone gets hacked, your funds aren’t gone. If you forget your password, you’re not locked out. And if someone tries to force you to send Bitcoin, they can’t—because they don’t have the other keys.

It’s no surprise that multi-sig shows up in posts about encryption key management, the practice of generating, storing, and protecting cryptographic keys to prevent loss or theft. Without proper key handling, even the best multi-sig setup fails. That’s why tools like hardware wallets and MPC (multi-party computation) are often paired with multi-sig—they add layers without adding complexity. You don’t need to be a tech expert to use it, but you do need to understand the basics: keys aren’t passwords, backups aren’t screenshots, and sharing keys isn’t sharing access.

Multi-sig also connects directly to how people protect their assets in volatile markets. When you see posts warning about scams, lost funds, or exchange hacks, the root cause is often single-key control. Multi-sig turns that weakness into strength. It’s the reason institutional investors won’t touch crypto without it. It’s why families use it to pass down Bitcoin across generations. And it’s why even beginners are starting to ask: "How do I set this up?"

Below, you’ll find real-world examples of how multi-sig is used, abused, and misunderstood. From wallet setups that saved users from theft, to airdrop scams that pretended to offer "multi-sig rewards," you’ll see what works, what doesn’t, and what to watch for. No fluff. No hype. Just what you need to know to keep your Bitcoin safe.