SAVVA Token Risk Assessment Calculator

Token Metrics

Risk Factors

Assessment Summary

Based on the metrics provided, SAVVA presents a high-risk investment opportunity. Key indicators include:

- Zero circulating supply indicates potential for future dumping

- Extremely low trading volume (<$10K) signals poor liquidity

- No major partnerships or community engagement

- No published security audits for smart contracts

Recommendation

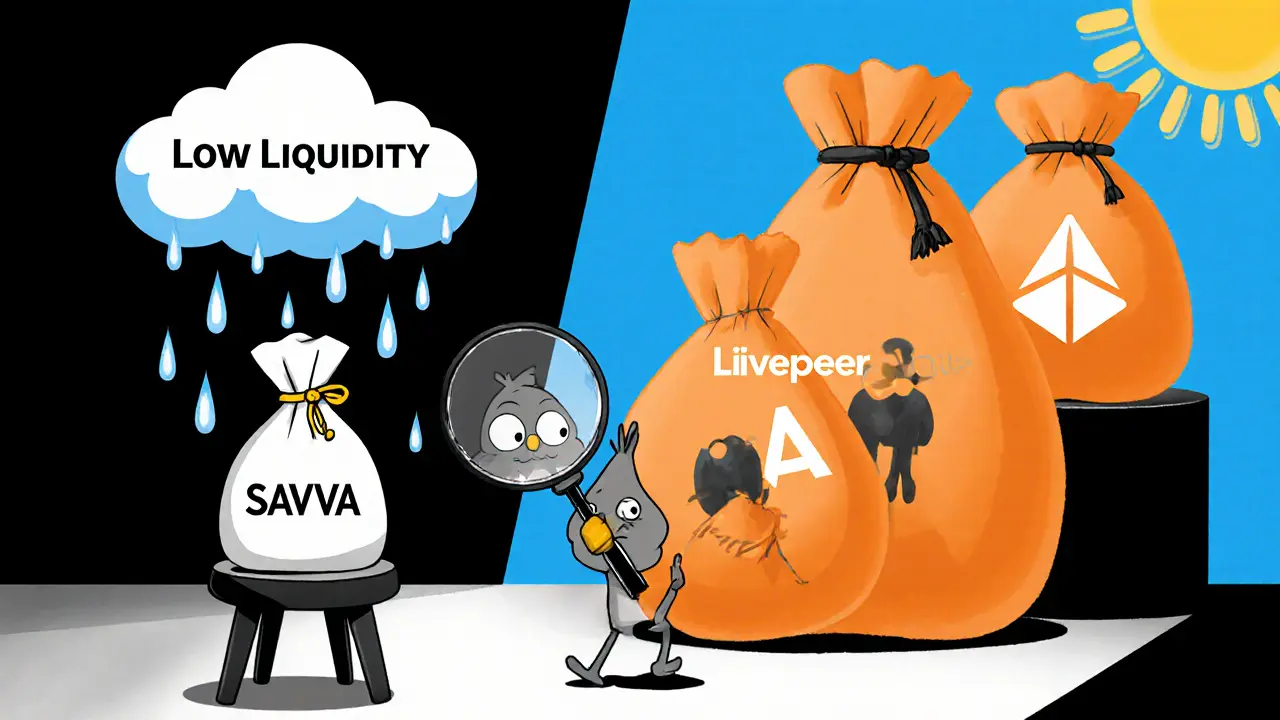

SAVVA is considered a speculative asset with limited real-world utility. Compared to established platforms like Theta, Livepeer, and Audius, it lacks:

- Significant market capitalization

- Active developer and user communities

- Proven technology or business model

- Transparency in token distribution

Only consider investing if you're comfortable with high uncertainty and potential loss of capital.

Quick Takeaways

- SAVVA is a utility token for a content‑creation platform that supports custom portals, NFT minting and creator rewards.

- Total supply is 194,167,839.21060136tokens, but circulation on major exchanges is effectively zero.

- Prices hover around $0.004USD with daily volumes under $10,000, indicating very low liquidity.

- Key features include ERC‑721‑compliant NFTs, a caching backend for fast UI, and optional content‑censoring tools.

- Compared with established content‑creation tokens (Theta, Livepeer, Audius), SAVVA carries high risk due to limited adoption and scarce market data.

When you see the name SAVVA is a native utility token that powers a content‑creation and distribution platform, the first question is usually: what does it actually do? Below you’ll find a straightforward breakdown of the token’s purpose, the platform’s tech, current market stats, and the risks you should weigh before considering any involvement.

What SAVVA Is and Who It Serves

SAVVA positions itself as an all‑in‑one hub for bloggers, vloggers, musicians, and any digital creator who wants to showcase work, sell NFTs, and earn token rewards without juggling multiple services. The platform promises an “intuitive interface” that lets users spin up a personalized content portal in minutes, then attach monetisation hooks that automatically distribute SAVVA tokens to creators and engaged audience members.

In practice, the token functions as three things:

- Medium of exchange - creators can charge for premium content, and fans can tip using SAVVA.

- Reward engine - the platform’s algorithm awards tokens for high‑quality posts, shares, and community interaction.

- Governance token - holders can vote on platform upgrades, moderation policies, and fee structures.

Tokenomics: Supply, Circulation, and Price

The total supply is locked at 194,167,839.21060136tokens. Oddly, Coinbase reports zero tokens in circulation, implying that distribution has not yet begun or that the team is holding the supply for future airdrops and ecosystem incentives.

Price data across exchanges is inconsistent, a hallmark of low‑volume assets:

- CoinMarketCap: $0.004043USD

- BTCC: $0.004045USD

- Crypto.com (two listings): $0.003593USD and $0.003921USD

- DigitalCoinPrice: $0.00405USD

These variations stem from fragmented order books and thin trading depth. 24‑hour volume numbers range from about $2,000 to $8,500, confirming that only a handful of trades happen each day.

Platform Features and Underlying Technology

The SAVVA ecosystem builds on several technical blocks. Below is a quick snapshot of the most distinctive components:

| Feature | Purpose | Tech Detail |

|---|---|---|

| Custom Content Portals | Fast, drag‑and‑drop site creation | Web‑based UI with caching backend for sub‑second page loads |

| NFT Minting | Monetise digital collectibles | Full ERC‑721 compliance, on‑chain metadata storage |

| Reward Distribution | Automated token payouts for engagement | Smart‑contract‑driven algorithm, adjustable reward rates |

| Content Censoring | Moderate community‑specific channels | Backend owners set moderation rules, optional on‑chain flagging |

| Performance Layer | Reduce latency for high‑traffic portals | Server‑side caching, CDN integration |

The NFT module uses the ERC‑721 standard, which means each token is truly unique and can be verified on any Ethereum‑compatible explorer. The caching layer is a less‑talked‑about but important part: by storing static assets closer to the user, the platform claims “lightning‑fast navigation” even for media‑heavy pages.

Market Landscape: How SAVVA Stacks Up

Content‑creation tokens have been around for a few years, with heavyweights like Theta (THETA), Livepeer (LPT) and Audius (AUDIO) dominating the conversation. To see where SAVVA sits, compare a few key metrics:

| Token | Market Cap | 24‑hr Volume | Primary Use‑Case |

|---|---|---|---|

| SAVVA | ≈$0(near‑zero) | $2,000 - $9,000 | Creator portals + NFT rewards |

| Theta (THETA) | $500M+ | $150M+ | Decentralised video streaming |

| Livepeer (LPT) | $120M+ | $30M+ | Decentralised video transcoding |

| Audius (AUDIO) | $80M+ | $12M+ | Music streaming & royalties |

When you line up the numbers, SAVVA’s micro‑cap status is stark. The bigger players have robust ecosystems, partnerships with mainstream media, and active developer communities. SAVVA’s limited visibility - no major press releases, few community posts, and a missing roadmap - makes it a speculative gamble.

Risks and Red Flags to Watch

Before you consider buying or using SAVVA, keep these warning signs in mind:

- Liquidity crunch - Tiny trading volumes mean you could face slippage or be unable to sell when you want.

- Unclear token distribution - Zero circulating supply on Coinbase suggests the team may hold most tokens, potentially leading to future dumps.

- Scarce community presence - Minimal discussion on Reddit, Twitter, and crypto forums suggests low organic interest.

- Lack of independent audits - No publicly available security audits for the smart contracts, leaving the code’s safety unverified.

- Competitive pressure - Established platforms already capture the creator market; SAVVA needs massive adoption to compete.

These factors don’t outright disqualify SAVVA, but they do demand thorough due diligence. Treat it as a high‑risk, high‑uncertainty asset.

How to Obtain SAVVA (If You Still Want to)

Should you decide the potential upside outweighs the risks, here’s a simple step‑by‑step guide:

- Set up a compatible wallet (e.g., MetaMask) that supports ERC‑20 tokens.

- Locate a listed exchange - BTCC, Crypto.com or any of the smaller DEXs that show a SAVVA pair.

- Deposit a stablecoin (USDT/USDC) or ETH, depending on the pair offered.

- Place a market order (use a small amount first to test liquidity).

- Once the tokens appear in your wallet, add the custom token contract address to view the balance.

Because liquidity is thin, it’s wise to keep trade sizes modest and be prepared for price swings.

Future Outlook - What Might Change?

There are a handful of scenarios that could shift SAVVA’s trajectory:

- Official roadmap release - A clear development plan with milestone dates could boost investor confidence.

- Strategic partnerships - Integration with an established creator platform or NFT marketplace would provide instant user base.

- Audit and security certification - A third‑party audit report would alleviate many security concerns.

- Community activation - A strong Discord or Reddit presence, regular AMAs, and tangible creator success stories could spark network effects.

If none of these materialize, SAVVA may remain a niche token with limited use, making it more of a speculative collector’s item than a functional ecosystem token.

Frequently Asked Questions

What is the primary purpose of the SAVVA token?

SAVVA is designed to act as a utility and reward token within a creator‑focused platform, enabling payments for content, automatic token rewards for high‑engagement posts, and governance voting for platform decisions.

Why is the circulating supply shown as zero on Coinbase?

Coinbase likely reports zero because the team has not yet distributed any tokens to public wallets. The total supply exists on‑chain, but without a token‑distribution event the circulating figure remains at zero.

How does SAVVA’s NFT feature differ from other token platforms?

SAVVA supports ERC‑721 NFTs that can be minted directly from a creator’s portal, linking each collectible to that creator’s profile and reward system. This tight integration is meant to streamline monetisation, but it still relies on the same Ethereum standards as other NFT platforms.

Is SAVVA a good investment compared to Theta or Audius?

Compared to established tokens like Theta or Audius, SAVVA carries significantly higher risk due to minimal liquidity, unclear distribution, and virtually no community traction. It might appeal to speculative investors, but most analysts would rate it lower than the larger, more proven platforms.

Where can I trade SAVVA safely?

The token appears on a handful of exchanges such as BTCC and Crypto.com. Because volumes are low, consider using a reputable exchange that offers strong security measures and always transfer tokens to a personal wallet after purchase.

Hey folks, just wanted to point out that the zero circulating supply is a red flag for anyone thinking about buying in now. It means the token could see a massive price swing once the first coins hit the market. Keep an eye on any announcements from the dev team about token unlocks. Stay safe out there.

When evaluating a token like SAVVA, it is essential to consider a multitude of factors before forming an opinion. First, the total supply of roughly 194 million tokens suggests a considerable dilution risk if large holders decide to sell. Second, the complete absence of circulating supply indicates that the token is not yet actively traded, which amplifies uncertainty. Third, the current price of $0.0040 is nominal, yet such low prices can attract speculative buying and price manipulation. Fourth, a daily trading volume of only $5,000 demonstrates a severe liquidity shortage, making it difficult for investors to enter or exit positions without substantial slippage. Fifth, the risk assessment highlights high liquidity and distribution risks, both of which are concerning for long‑term holders. Sixth, the lack of a security audit leaves the smart contract open to potential vulnerabilities, a point that cannot be ignored. Seventh, community presence is listed as low, which often correlates with limited support and fewer development updates. Eighth, the token’s roadmap and use‑case remain vague, providing little confidence about future utility. Ninth, without a clear tokenomics model, it is challenging to predict how token value may evolve over time. Tenth, the platform’s transparency regarding fund allocation is minimal, raising questions about the developers’ intentions. Eleventh, any future token unlock events could create significant sell pressure, further destabilizing the price. Twelfth, the overall market sentiment towards low‑volume tokens is generally negative, especially in a bearish environment. Thirteenth, investors should perform thorough due diligence, including reviewing any available whitepaper or technical documentation. Fourteenth, diversification across more established assets can help mitigate the high risk associated with SAVVA. Finally, remember that high‑risk investments should only comprise a small portion of a balanced portfolio.

Look, the entire crypto scene is a playground for the powers that be, and SAVVA is just another pawn in their game. The fact that there is zero circulating supply is a classic bait‑and‑switch tactic they use to pump the price before the big dump. The high liquidity risk isn’t an accident; it’s engineered so that when the insiders cash out, the rest of us are left holding nothing. They haven’t even bothered to get a security audit, which tells you how sloppy they are or how much they want to hide. The distribution risk being high is a clear sign that a handful of wallets control the majority, waiting for the perfect moment to unleash chaos. You think you’re a savvy investor, but you’re just a cog in their grand design. Even the low community presence is intentional – they don’t want any whistleblowers. The whole thing reeks of a coordinated effort to siphon funds from unsuspecting newcomers. So, before you even think about putting a cent into SAVVA, remember that the odds are stacked against you from the start.

Holy crap, did you see the risk numbers? This is straight drama material! High liquidity risk and zero circulating? That’s a recipe for a total disaster, and yet some people are still eyeing it like it’s the next big thing. I mean, who even trusts a token with no audit? The whole thing feels like a circus act gone wrong. Just stay away unless you enjoy watching your money disappear in a puff of smoke.

I hear you all, this token looks shaky, but let’s keep an open mind, and maybe there’s a hidden upside, though it seems unlikely, given the data, and the community is barely there.

Hey everyone! 🌟 Even if SAVVA looks risky, maybe the team will surprise us with a solid plan. Stay hopeful! 😊

It’s good to stay hopeful, but remember to only invest what you can afford to lose. Let’s see if the project brings anything new.

From a philosophical standpoint, every investment carries inherent uncertainty. The absence of a circulating supply suggests a future event that could redefine value. Yet, we must weigh this against the ethical responsibility of supporting transparent projects.

Exactly! If the developers pull through, this could be a massive win!! However, the current indicators scream caution!!!

Sounds like a wild ride, buckle up!

Honestly, I think people are overreacting to the hype around SAVVA. It’s just another meme token that will fade away like countless others. You’re better off looking at projects with real utility.

nah man, i get u but still think its prob a lil risky but maybe some peeps will pull it off lol

It is fundamentally irresponsible to promote or even consider investing in a token that displays such glaring deficiencies. The lack of a security audit alone suggests that the developers either can’t afford proper verification or intentionally conceal vulnerabilities. High liquidity risk means that market participants will suffer severe slippage, effectively punishing ordinary investors while benefitting insiders. The distribution risk being high indicates a concentration of ownership that is antithetical to the decentralized ethos that crypto purports to uphold. Low community presence further underscores the absence of a supportive ecosystem, which is essential for sustainable growth. Without transparent communication, any future roadmap remains speculative at best. Moreover, the token’s price history shows no genuine market activity, reflecting a potential pump‑and‑dump scheme. Engaging with such an asset not only jeopardizes personal finances but also contributes to the broader erosion of trust in the cryptocurrency space. Investors must prioritize projects that demonstrate rigorous security practices, robust community engagement, and clear utility. In short, avoid SAVVA as you would a financial black hole. The ethical imperative is clear: protect yourself and the community from reckless speculation.

While the aforementioned critique raises valid concerns, it is incumbent upon us to consider the possibility that the project’s limited visibility may be a strategic choice, pending forthcoming developments. Nonetheless, the high‑risk metrics are undeniably pronounced, and any prospective participant should conduct exhaustive due diligence. In the interim, a measured approach-perhaps allocating a nominal portion of one’s portfolio-would be prudent, pending further evidence of transparency and functional utility.