When you hear about blockchain, you probably think of Bitcoin or Ethereum - public, open, and running on thousands of computers around the world. But not all blockchains are like that. In fact, some of the most powerful blockchain systems today are hidden behind firewalls, used by banks, supply chains, and governments - and they work completely differently. The real question isn’t whether blockchain is useful. It’s whether you need a public blockchain or a private one. And the answer changes everything.

Who Can Join? Access Control Is Everything

Public blockchains are like open parks. Anyone can walk in, take a photo, or leave a note. You don’t need permission. You just download a wallet, send a transaction, and it gets added to the chain. Ethereum, for example, had over 7,000 active nodes in early 2024. That means thousands of computers are independently verifying every transaction - no single company or person controls it.

Private blockchains? They’re locked down. Only people the network owner approves can join. Think of it like a corporate intranet. You need an invite, a login, and maybe even a signed contract. Networks like Hyperledger Fabric or R3 Corda only let in trusted partners - a bank, its clearinghouse, and a few logistics firms. No outsiders. No random users. Just the people who need to be there.

Who Decides What Happens? Governance Is Not the Same

On a public blockchain, change is messy. Want to upgrade the software? You need buy-in from miners, validators, developers, and users. Sometimes, it takes months. Or years. Ethereum’s move from Proof of Work to Proof of Stake took over five years of debate, testing, and community votes. No one person could force it through.

Private blockchains? One company or a small group of partners makes the call. If the CEO of a shipping company wants to change how contracts are recorded, they can do it - fast. No public vote. No fork. Just a software update pushed out to the 12 approved nodes in their network. That’s efficiency. But it also means power is concentrated. And if that one company gets hacked? The whole chain could be at risk.

How Fast Is It? Speed and Scalability

Public blockchains are slow. Bitcoin takes about 10 minutes to confirm a transaction. Ethereum is faster - around 12 to 15 seconds - but when everyone’s using it, fees spike. In 2021, during the NFT boom, Ethereum gas fees hit over $500 per transaction. Why? Thousands of people are competing for space in each block. It’s like rush hour on a single-lane road.

Private blockchains don’t have that problem. With only 5 to 20 nodes validating transactions, they can process hundreds or even thousands of transactions per second. Some enterprise chains do over 10,000 TPS. That’s Visa-level speed. And because there’s no competition for block space, transaction fees are near zero. For a company moving millions of records a day - like tracking medicine shipments or settling interbank loans - that’s not a luxury. It’s a requirement.

Is It Secure? It Depends on What You Mean

Public blockchains are nearly impossible to hack - not because they’re perfect, but because they’re too big. To alter a Bitcoin transaction, you’d need to control over 51% of all mining power on the planet. That costs billions. No one’s done it. And even if you tried, the network would reject your changes. That’s immutability in action.

Private blockchains? They’re more like a vault with one key. If the administrator’s system gets breached - or if one of the 5 approved nodes gets compromised - the whole chain can be manipulated. Transactions can be reversed. Data can be edited. Some private chains even let admins delete records. That’s not a bug. It’s a feature. But it means you’re trusting a small group, not a global network. For some, that’s fine. For others, it’s a dealbreaker.

Privacy vs. Transparency - Which One Do You Need?

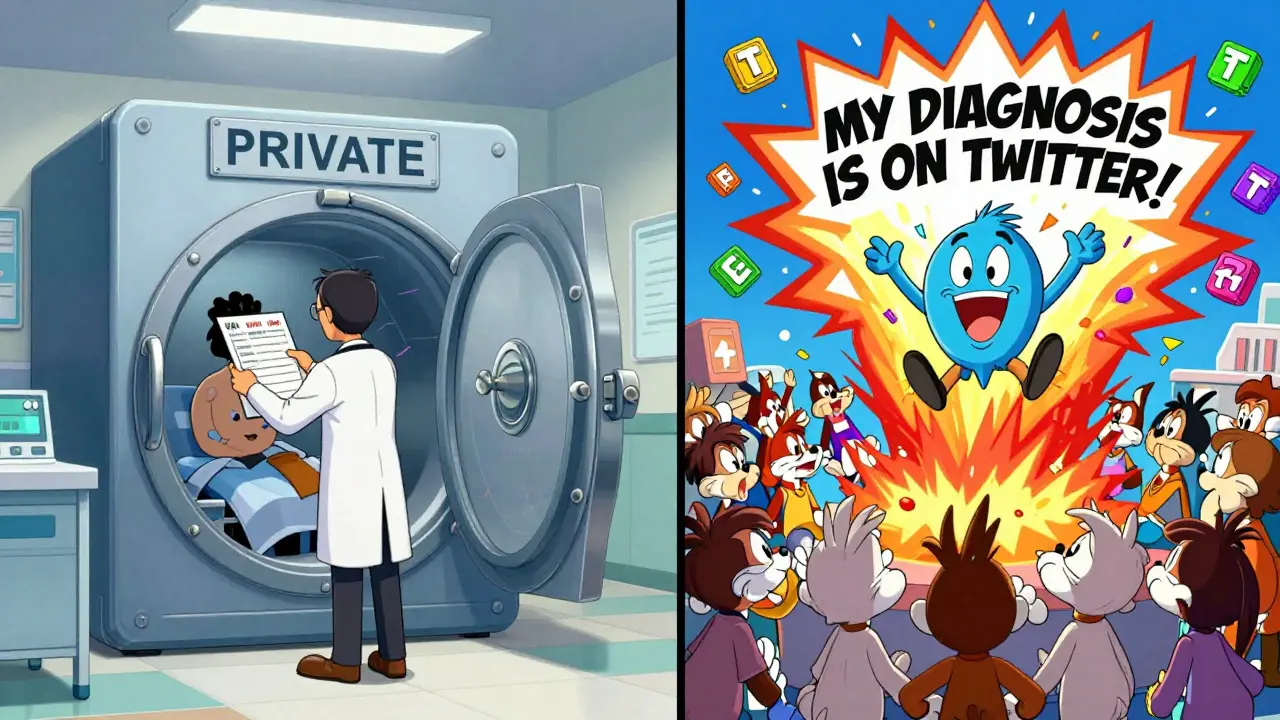

Public blockchains are transparent by design. Every transaction is visible. Anyone can check how much Bitcoin a wallet holds. That’s great for accountability. But imagine a hospital using a public chain to store patient records. Suddenly, your diagnosis is out there for anyone to see. Not cool.

Private blockchains solve that. Only authorized users see what’s happening. A pharmaceutical company can track drug batches from factory to pharmacy - but competitors, regulators, or the public? They’re locked out. This is why supply chains, healthcare systems, and government agencies prefer private chains. Privacy isn’t just nice to have - it’s mandatory.

Costs Add Up - And They’re Very Different

Public blockchains charge fees - and they’re unpredictable. Ethereum’s fees fluctuate based on demand. On busy days, you might pay $20 to send a simple token. On quiet days? $0.50. Plus, the energy use is huge. Bitcoin mining alone uses more electricity than entire countries. That’s why many governments are pushing for greener alternatives.

Private blockchains run on low-power servers inside company data centers. They use consensus methods like Proof of Authority (PoA), where trusted nodes validate transactions - no mining, no competition, no wasted energy. Costs are fixed. Predictable. Often under $0.01 per transaction. For businesses running thousands of operations daily, that’s a massive saving.

Can It Talk to Other Systems? Interoperability Matters

Public blockchains are built to connect. Bitcoin, Ethereum, Solana, Polygon - they all speak the same language. Tokens move between them. DeFi apps pull data from multiple chains. NFTs get traded across platforms. That’s composability. It’s why the crypto ecosystem exploded.

Private blockchains? They’re islands. A private chain built for a bank doesn’t talk to a private chain built for a retailer. Even if both use Hyperledger, they’re separate networks. No cross-chain swaps. No shared liquidity. That’s intentional - security over synergy. But it means you can’t easily build on top of them. No DeFi. No DAOs. No tokenized assets outside your own network.

What Are They Used For? Real-World Examples

Public blockchains power things you can’t control - but you can use. Cryptocurrency payments. Decentralized apps (dApps). NFT marketplaces. DAOs that run without CEOs. If you want to send money without a bank, or own a digital collectible without a middleman - public is your only option.

Private blockchains are behind the scenes. Walmart uses one to track food safety. Maersk uses one to manage global shipping paperwork. The Reserve Bank of Australia tested one for digital currency settlement. These aren’t flashy. But they’re vital. They cut delays, reduce fraud, and save millions in paperwork.

Which One Should You Choose?

Here’s the shortcut:

- Choose a public blockchain if you need: openness, censorship resistance, global access, or trustless interactions. Think: crypto, NFTs, DeFi, or public audits.

- Choose a private blockchain if you need: speed, privacy, control, low cost, and compliance. Think: banking, supply chains, healthcare, or government records.

There’s no “better” option. Only the right one for your job. A public chain won’t help a hospital keep patient data private. A private chain won’t let you send Bitcoin to someone in another country without a bank.

Most organizations today don’t pick one and stick with it. They use both. Public for customer-facing apps. Private for internal operations. The future isn’t one blockchain. It’s a mix - and knowing the difference is the first step.

Can a private blockchain be made public later?

Technically, yes - but it’s not practical. Private blockchains are built with different rules: fewer nodes, centralized control, and hidden data. To open them up, you’d need to rebuild the entire network from scratch - change the consensus, expose all data, add public access layers, and retrain users. Most companies don’t do this. Instead, they build public-facing apps on top of their private chain using bridges or APIs.

Are private blockchains really more secure?

It depends on what you mean by secure. Public blockchains are harder to hack because they’re decentralized - you’d need to control most of the network. Private blockchains are easier to attack if you get inside - but that’s rare. The real security advantage of private chains is control: you can patch vulnerabilities fast, revoke access instantly, and audit every action. Public chains can’t do that. So private chains are more secure against internal threats; public chains are more secure against external ones.

Why do some companies use both public and private blockchains?

Because they solve different problems. A bank might use a private blockchain to settle trades between itself and its partners - fast, private, and compliant. Then it uses a public blockchain to let customers buy crypto or trade tokens with others. The private chain handles internal efficiency. The public chain handles customer engagement. Together, they cover more ground than either one alone.

Can private blockchains be hacked?

Yes - and more easily than public ones. Since private chains have fewer nodes (sometimes just 5 or 10), an attacker only needs to compromise one or two to gain control. There’s no global network to override them. That’s why private chains rely on strong identity verification, encrypted communication, and strict access policies. But if those fail, the chain can be altered, reversed, or shut down.

Do private blockchains use cryptocurrency?

Not usually. Most private blockchains don’t use tokens like Bitcoin or Ethereum. Instead, they use internal digital credits or just record data without any native currency. Some do issue tokens - but only for internal use, like rewarding suppliers or tracking loyalty points. These tokens can’t be traded outside the network. They’re not meant to be money. They’re meant to be tools.

Public blockchains are great for decentralization, but let’s be real-most enterprises don’t care about being permissionless. They care about audit trails, compliance, and not getting sued. Private chains give you control without sacrificing immutability. Hyperledger Fabric isn’t sexy, but it’s the reason your supply chain didn’t collapse during the pandemic.

And yes, you can technically make a private chain public, but why? You’d be throwing away years of governance design just to chase a crypto bro’s fantasy. APIs and bridges are the real answer-layer public interfaces on top of private infrastructure. That’s how you get the best of both worlds.

lol private blockchains are just centralized databases with a blockchain sticker on it

So… you’re telling me the whole crypto world is built on a lie? That the ‘revolution’ is just a bunch of corporations using tech they can’t even explain? I’m so done. I just wanted to believe. 😭

You call that a fair comparison? Public chains have 7,000 nodes. Private chains have 5. One is a democracy. The other is a dictatorship with a whitepaper. And you’re telling me people are okay with this? That’s not innovation. That’s corporate theater. They’re not building the future-they’re just trying to avoid regulation.

And don’t get me started on ‘privacy.’ If your blockchain lets admins delete transactions, it’s not a blockchain. It’s a Word doc with a blockchain-shaped logo.

Big picture: public = trustless, private = trusted. Pick based on your threat model. If you’re a bank, you’re not worried about a 51% attack-you’re worried about an employee with bad intentions. Private chains fix that. Simple.

Why are we even talking about this? It’s obvious. Public chains are a scam. Private ones are just corporate vanity projects. Nobody needs blockchain. We need better databases. And nobody’s talking about that.

Let me guess-the whole ‘private blockchain’ thing is just the deep state’s way of controlling financial data under the guise of ‘efficiency.’ You think Walmart’s chain is just for tracking lettuce? Nah. They’re building a shadow ledger. Every transaction, every supplier, every employee. Soon, they’ll know if you bought organic kale… and charge you extra for it. Welcome to the blockchain surveillance state. 🕵️♂️

And don’t even get me started on ‘Proof of Authority.’ That’s just ‘Proof of Who You Know.’ It’s not blockchain. It’s feudalism with APIs.

Meanwhile, Bitcoin’s still out there, mining away in someone’s garage while the suits think they’re smart. The real revolution isn’t in the enterprise-it’s in the unbanked.

They’ll tell you private chains are ‘secure.’ But security isn’t about who controls the keys-it’s about who can’t touch them. And right now? The whole system is one CEO’s bad laptop away from collapse.

And don’t say ‘but the data is encrypted!’ Encryption doesn’t matter if the admin can just hit delete. That’s not security. That’s a backdoor with a business card.

I’ve seen this movie before. Remember when ‘cloud computing’ was going to revolutionize everything? Then it turned into AWS monopoly. Same story. Different tech.

They say private chains are ‘scalable.’ But scalability without decentralization is just centralization with a fancy name. And history says centralized systems always fail. Always.

So yeah. Go ahead. Build your private chain. But don’t call it blockchain. Call it ‘database 2.0.’ At least then we’ll know what we’re dealing with.

OMG I’m so glad someone finally said this! 💖 Private blockchains are the REAL innovation. Public ones are just crypto bros playing with fire. I work in healthcare and we use a private chain to track meds-no one sees patient data, no one hacks it, and we save $2M a year on paperwork. 🙌 Blockchain isn’t about decentralization-it’s about trust. And trust? It’s built with permissions. Not hashtags. 💼

Public chains are slow. Private chains are efficient. End of story

Look, I get it. You think private chains are the future. But let’s not pretend this isn’t just Big Tech trying to own the infrastructure while pretending they’re being ‘innovative.’ You’re not solving problems-you’re just locking people out. And that’s not progress. That’s control.

And don’t tell me about ‘compliance.’ Compliance doesn’t require a blockchain. It requires lawyers. And audits. And oversight. Not a permissioned ledger.

Also-why do you always assume the public can’t handle transparency? Maybe the problem isn’t the tech. Maybe it’s the people running it.

This is such a clear breakdown! I’ve been trying to explain this to my team at work and this nails it. The key thing I keep saying is: it’s not about which one is ‘better’-it’s about which one fits the problem. Like using a hammer vs. a screwdriver. You wouldn’t use a hammer to put in a screw, right? Same here. Public for open systems, private for controlled ones. Simple. Thanks for this!

So true! I love how you showed both sides. 🌟 I work in logistics and we use a private chain internally, but we’re starting to let customers track shipments on a public-facing dashboard. It’s the perfect combo. Not ‘either/or’-it’s ‘both/and.’

Great post. I’ve seen both sides. Private chains work because they’re simple. Public chains work because they’re stubborn. Both have their place. Just don’t let the hype blind you.

Private blockchains are a scam. They’re just databases with a blockchain label so VCs will fund them. Real blockchain is public. Everything else is corporate theater. And anyone who says otherwise is either being paid or doesn’t understand decentralization.

The distinction between public and private blockchains is not merely technical but philosophical. Public systems embody the principle of distributed trust, whereas private systems reflect centralized authority. The choice between them must therefore be guided not by efficiency alone but by the underlying values of the organization.

USA built the internet. Now China and EU are building private chains. We’re falling behind. Time to wake up.

Public chains are for amateurs. Professionals use private. End of discussion.

I’ve worked on both. Private chains are underrated. They’re not sexy, but they solve real problems. If your use case doesn’t need global trust, don’t force it. Use the right tool.

This is exactly why I love blockchain-because it gives us choices. Not one-size-fits-all. Not ‘crypto or bust.’ We can build systems that are fast, private, and still tamper-proof. And that’s powerful. Thank you for writing this-it’s the clearest breakdown I’ve seen. 💪