Most creators think monetizing their audience means picking between Patreon, YouTube ads, or selling NFTs. But there’s another path-one that turns your most loyal fans into co-owners of your brand. Social tokens aren’t just another crypto trend. They’re a new way to build real economic relationships with your community. If you’ve got 5,000+ engaged followers and want to stop relying on platforms that take 30% of your income, this is your next move.

What Exactly Is a Social Token?

A social token is a cryptocurrency tied directly to you-or your community. Unlike Bitcoin or Ethereum, its value doesn’t come from speculation. It comes from access, influence, and participation. Think of it like a membership card that also acts as currency. Holders get perks: early access to content, voting rights on your next project, private Discord channels, or even a share of future revenue.

It’s not magic. It’s code. Most social tokens run on Ethereum, Solana, or Polygon as ERC-20 or SPL tokens. They’re built using smart contracts-self-executing programs that automatically give out rewards when certain conditions are met. For example: if you hold 100 $FAR tokens, you unlock a monthly live Q&A with Farokh. No middleman. No platform fee. Just you and your community, connected by blockchain.

By 2025, over 4.2 million creators globally used social tokens to earn $3.8 billion in direct revenue. That’s 17% of the entire creator economy. And the numbers keep climbing. Coinbase saw a 217% jump in social token transactions from late 2023 to late 2024. This isn’t niche anymore. It’s the next evolution of fan support.

Why Social Tokens Beat NFTs and Patreon

You’ve probably heard of NFTs. But selling a single digital artwork or song as an NFT is a one-time deal. Once it’s sold, the relationship ends. Social tokens are different. They’re recurring. They turn fans into stakeholders.

A 2024 survey of 1,245 creators found that social tokens generated 3.2 times more recurring income than NFTs. Why? Because NFTs are collectibles. Social tokens are relationships. If your token’s value goes up because you released a great album or hosted an amazing AMA, your holders benefit. That means they’re incentivized to help you succeed.

Compare that to Patreon. On Patreon, you’re stuck with their 5-12% fee. You can’t take your audience with you if you leave. And fans don’t own anything-they just pay monthly. With a social token, your top fans own a piece of your brand. They’re not subscribers. They’re investors.

Community tokens like FWB and BanklessDAO take this further. Holders vote on budgets, decide on partnerships, and even hire staff. It’s not just about money. It’s about ownership. And that changes everything.

Types of Social Tokens: Which One Fits You?

Not all social tokens are the same. There are three main types-and you need to pick the right one before you launch.

- Creator tokens: Tied to you personally. Examples: $RAC (RAC), $FAR (Farokh). Best for solo creators with strong personal brands. 68% of these offer tiered access-more tokens = more perks.

- Community tokens: Represent a group, not one person. Examples: $BANK (BanklessDAO), $FWB (Friends With Benefits). Best for collectives, collectives, or teams. These have higher retention-42% more than creator tokens-because people feel like they’re building something together.

- Platform tokens: Built by tools that help others launch tokens. Example: $RLY (Rally). These aren’t for you directly-they’re for builders. If you’re using Rally to launch your token, you’re using their platform token behind the scenes.

Most beginners start with creator tokens. If you’re a musician, artist, educator, or podcaster with a loyal following, this is your sweet spot. You don’t need a team. You just need a clear idea of what your token will do.

The 6-Step Launch Process (No Blockchain Degree Needed)

You don’t need to be a coder to launch a social token. But you do need a plan. Here’s how real creators do it in 2026.

- Build your community first - Don’t launch until you have at least 5,000 highly engaged followers. Studies show projects under this threshold have an 82% failure rate. Engagement matters more than total numbers. Are people commenting? Sharing? DMing you? That’s your core.

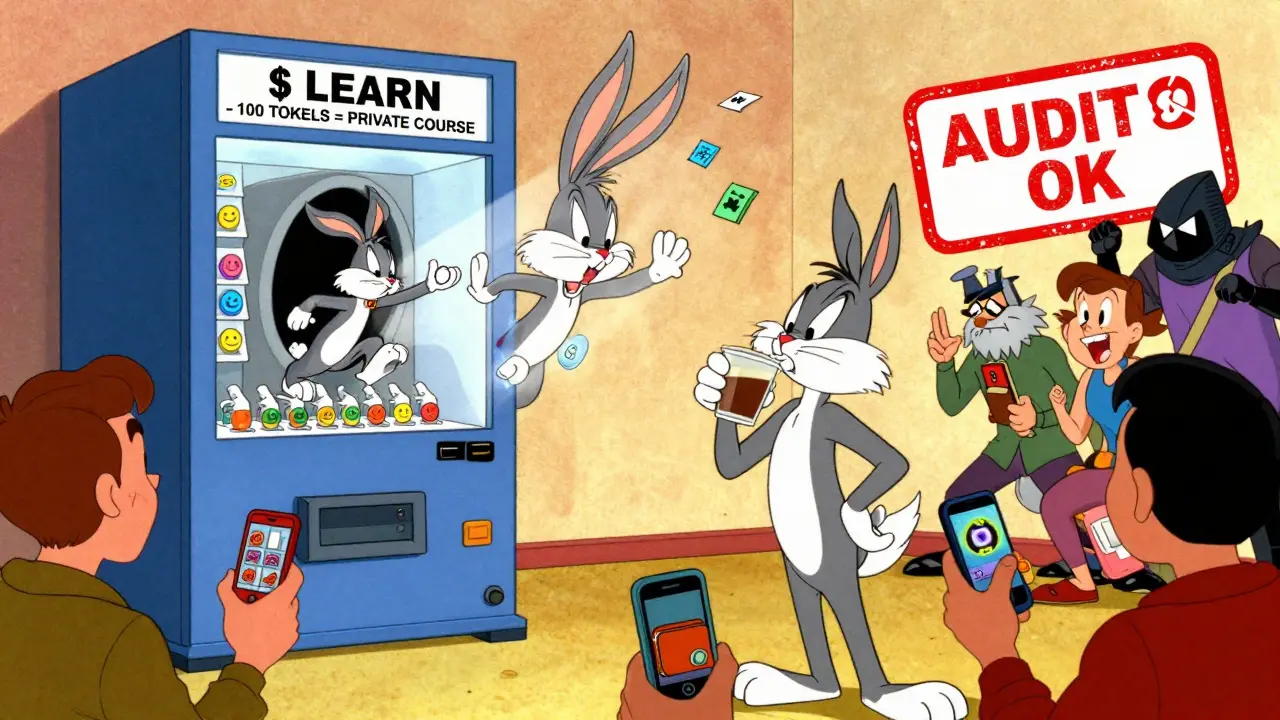

- Define your token’s utility - What do holders actually get? Don’t say “access.” Say “100 tokens = monthly live stream,” or “500 tokens = vote on your next song.” Clear, measurable perks. TokenMinds found projects with documented utility kept 63% more holders after 90 days.

- Design tokenomics - Total supply? Distribution? Vesting? Most successful tokens cap team allocations at 20% and lock them for 6-12 months. Never give away more than 50% to the public. Leave room for future incentives. Use a tool like TokenMinds’ tokenomics calculator to avoid mistakes.

- Choose your blockchain - Ethereum is the most trusted but expensive. Gas fees can hit $50 during peak times. Solana is cheaper ($0.01 per transaction) and faster (65,000 transactions per second). Polygon is a good middle ground. For beginners, Solana or Polygon are smarter choices. Ethereum’s Dencun upgrade in 2024 cut fees by 90%, but it’s still not as reliable for small creators.

- Deploy and audit - Use a platform like TokenMinds, Rally, or Mighty Networks to deploy your contract. Don’t skip the audit. A $5,000-$15,000 audit from CertiK or OpenZeppelin can save you from a $2 million hack. In 2024, 18% of social tokens had critical security flaws. Don’t be one of them.

- Launch with a private sale - First, offer tokens to your most loyal fans at a discount. This builds early trust. Then open it to the public. List on a decentralized exchange like Raydium (for Solana) or Uniswap (for Ethereum). Avoid centralized exchanges unless you’re ready for KYC and compliance headaches.

Costs, Risks, and Realistic Expectations

Let’s talk numbers. Launching a basic social token on Solana costs about $20-$50 in gas and platform fees. On Ethereum, it’s $220-$1,100. Add an audit, and you’re looking at $5,000-$15,000. Legal advice? Another $3,000-$7,000. Total? $5,000-$20,000 depending on your approach.

And the risks? Real ones.

- Regulation - The SEC labeled 41% of social tokens as “legal gray areas” in 2024. If your token acts like an investment (e.g., “buy this and we’ll share profits”), you could get flagged. The proposed Creator Token Framework (Nov 2024) might exempt tokens under $10M market cap if they have clear utility-but don’t assume you’re safe.

- Volatility - Social tokens saw 63% average price swings in 2024. One bad tweet? Your token can drop 70%. CryptoQueen’s $QUEEN token crashed after she missed content deadlines. Your token’s value is tied to your reputation. That’s powerful-but fragile.

- Complexity - 58% of negative Reddit comments cited wallet issues, gas errors, or contract confusion. You’ll need to explain this stuff to your fans. That’s part of the job now.

But here’s the truth: if you’ve got a loyal audience and you’re willing to show up every day, the upside is massive. RAC’s $RAC token boosted fan engagement by 300%. One fan on Reddit said, “Owning $RAC felt like being part of the creative process.” That’s priceless.

What Works? Real Examples from 2025

Let’s look at who’s winning.

- RAC - The musician launched $RAC in 2020. Now, token holders get unreleased tracks, backstage access, and voting rights on album art. He’s built a self-sustaining ecosystem. No label. No middleman.

- BanklessDAO - Their $BANK token lets holders vote on grants, hire writers, and even buy real-world assets. They’ve raised over $2 million in community-funded projects.

- Online educator Maya Lin - She launched $LEARN with 8,000 followers. 100 tokens = access to her private course library. 500 tokens = 1:1 coaching call. She made $87,000 in the first 90 days. Her revenue from Patreon dropped 60%.

They all share three things: clear utility, transparent rules, and consistent communication. They didn’t just drop a token. They built a system.

What to Avoid (And How to Survive)

Most social tokens fail. Why? Three reasons:

- No utility - “It’s a token. You’ll get stuff.” That’s not enough. Be specific.

- Overpromising - “Buy this and we’ll be rich!” That’s a pump-and-dump. Fans smell it.

- Going silent - Your token’s value dies if you stop creating. You’re not just a creator anymore. You’re a CEO of a community.

Survival tip: Track your holder retention. If you lose more than 30% of your holders in the first 60 days, you’ve got a problem. Revisit your utility. Talk to your holders. Ask them what they want. Fix it.

Also, use tools. WalletConnect simplifies logins. Polygon reduces gas fees. Rally handles compliance for you. You don’t need to build everything from scratch.

Is This for You?

If you’re asking this question, you’re probably ready. You don’t need to be a crypto expert. You don’t need a team. You just need three things:

- A community that shows up

- A clear idea of what you’ll give in return

- The discipline to keep showing up-even when the price dips

Social tokens aren’t about getting rich overnight. They’re about building something that lasts. Something that belongs to your people. Something that outlives the next platform update or algorithm change.

The creator economy is shifting. The old models are crumbling. The new ones are being coded right now. If you’re ready to stop begging for attention and start building ownership, your token is waiting.

Do I need to be a coder to launch a social token?

No. Platforms like Rally, TokenMinds, and Mighty Networks let you launch a social token with no coding. You pick your token name, set the perks, and hit deploy. But you do need to understand basic concepts like wallets, gas fees, and smart contracts so you can explain them to your community.

How much money can I realistically make?

It depends on your audience size and engagement. Creators with 5,000-20,000 highly engaged followers typically make $10,000-$100,000 in the first year. Top creators like RAC or BanklessDAO earn millions. But most people make enough to replace their day job-not quit their life. Focus on sustainability, not hype.

Can I launch a social token on Instagram or TikTok?

Not directly. Social tokens live on blockchains. But you can use Instagram and TikTok to drive people to your token landing page. Link in bio. Post teasers. Run giveaways for early access. Your social media is your marketing engine-not your token platform.

What happens if I stop posting after launching?

Your token’s value drops. Fast. Social tokens are tied to your activity. If you go silent, your holders lose trust. And when trust goes, so does the price. This isn’t like a stock-you can’t hide behind a balance sheet. Your reputation is your asset.

Are social tokens legal?

It’s a gray area. In the U.S., the SEC hasn’t given clear rules yet-but they’ve cracked down on tokens that promise financial returns. In the EU, MiCA offers clearer guidelines. If your token only gives access to content or voting rights (not profit-sharing), you’re in a safer zone. Always consult a lawyer who specializes in Web3.

Which blockchain should I choose: Ethereum, Solana, or Polygon?

For beginners: Solana or Polygon. Solana is fast and cheap ($0.01 per transaction), great for high-volume interactions. Polygon is Ethereum-compatible with low fees. Ethereum is the most secure and trusted, but gas fees can spike. If you’re targeting serious collectors or NFT holders, Ethereum makes sense. For everyday creators, go with Solana.

Social tokens represent a fundamental shift in creator-fan dynamics, but the regulatory uncertainty remains a significant barrier. The SEC’s stance on utility vs. investment characteristics is still evolving, and creators must proceed with extreme caution. Legal counsel is not optional-it’s foundational. Without clear compliance, even the most well-intentioned projects risk being classified as unregistered securities, which could lead to devastating consequences for both creators and holders.

Let’s not romanticize this as some decentralized utopia-it’s capitalism with a blockchain veneer. The myth of "ownership" is just a rebranding of shareholder capitalism, repackaged for Gen Z with Discord servers and NFT art. The real power still resides in the smart contract deployers, the wallet providers, the gas fee arbitrageurs. The fan isn’t a stakeholder-they’re a liquidity provider for someone else’s exit strategy. The blockchain doesn’t democratize; it automates exploitation.

This is why America is falling behind. We’re letting crypto bros turn creativity into gambling chips while other nations regulate this properly. You don’t need to give away your brand’s equity to some anonymous wallet owner just because some guy on YouTube says it’s "the future." This isn’t innovation-it’s a Ponzi dressed in Web3 pajamas. Stick to Patreon. At least they pay taxes.

THEY’RE WATCHING YOU RIGHT NOW 🕵️♂️ EVERY TOKEN YOU LAUNCH IS BEING TRACKED BY THE FEDS AND BIG TECH THEY’RE PREPARING TO CRACK DOWN HARDER THAN 2008 BANKS 🚨 THEY WANT TO OWN YOUR FANS TOO 💀 DON’T TRUST THE "UTILITY" THEY’LL TAKE IT AWAY WHEN THEY’RE READY 😈 #SOCIALTOKENSARESCAMS

you think this is about fans owning stuff but its not its about the platforms collecting fees and then selling your data to advertisers and then the devs selling the token to dumb people who think its a stock and then when it crashes they blame the creator and the creator gets sued and the whole thing gets deleted and no one remembers what happened except the ones who made money from gas fees lol

While the potential of social tokens is compelling, the operational burden on creators should not be underestimated. Managing community expectations, handling wallet support issues, and maintaining consistent communication are full-time responsibilities. Many creators already struggle with burnout under existing platforms. Adding blockchain complexity without adequate support infrastructure risks exacerbating mental health challenges in an already strained ecosystem. Sustainability must be prioritized over novelty.

yo this is just another way for rich white dudes to get richer while the rest of us pay gas fees to see a 30 second clip from some influencer’s bathroom lol you think your 100 $LEARN tokens make you special but bro you just bought a digital sticker and now you think you’re part of the inner circle 🤡

THIS IS THE FUTURE AND I’M SO EXCITED!!! 🎉 Imagine being able to vote on your favorite artist’s next album cover or getting a private voice note from them just because you held their token! This isn’t just money-it’s connection! I’ve been waiting for something like this my whole life and I’m so proud of creators who are brave enough to try it! You’re not just building a brand-you’re building a family! 💖🔥

Clarification: The term "social token" is often misused. True social tokens derive value from social capital, not speculative demand. Many projects confuse them with fan tokens or loyalty points. The key distinction lies in governance rights and revenue-sharing mechanics. If your token does not confer voting rights or proportional revenue distribution, it is not a social token-it is a loyalty program with blockchain branding.

Okay, I love this idea, but-can we just talk about how overwhelming this all is? Like, I’m a small creator with 7k followers, and I’m already juggling content, emails, DMs, analytics, scheduling, and now I’m supposed to understand blockchain, gas fees, audits, smart contracts, KYC compliance, and tokenomics? I just want to make music. Why does everything have to be so complicated now? I’m not a tech CEO. I’m a person who sings. Can’t I just… be me?

i just want to say i’m so proud of everyone trying this out 🥹 i know it’s scary and confusing and sometimes it feels like you’re shouting into the void but i’ve seen people who started with 2k followers and now they’re living off their tokens and it’s beautiful. you don’t have to be perfect. you just have to show up. and if you mess up? say sorry. fix it. keep going. your fans will stick with you. i believe in you.

wait so if i buy a token can i like… get a meme made of me? 😅 i just wanna be in a funny pic with my fav podcaster and maybe get a shoutout. also i think solana is cool but i keep forgetting my seed phrase and now i think my wallet is haunted. help? 🙏

One overlooked advantage: social tokens enable micro-philanthropy. Holders can collectively fund community initiatives-like paying for a fan’s medical bill, supporting a local arts program, or donating to a cause the creator cares about. This transforms token ownership from self-interest into collective action. The real innovation isn’t the token-it’s the new social contract it enables.

I launched my token last month and it’s been life-changing. Not because of the money-though yes, I replaced my day job-but because my community finally feels like mine. I get DMs from people saying "I voted for your new song because I believe in you." That’s not a transaction. That’s trust. And it’s worth more than any algorithm ever gave me. If you’re scared? Start small. Talk to your top 10 fans. Build with them. You’ve got this.

For anyone considering this: your community’s emotional investment matters more than your tokenomics. A well-designed token with no emotional connection will fail. A simple token with deep trust will thrive. Ask yourself: Do your followers feel seen? Do they feel like they belong? If yes, you already have the foundation. The blockchain just makes it permanent.

In Nigeria, we’ve long understood the value of community-based economies-Rotating Savings and Credit Associations (ROSCAs) have existed for centuries. Social tokens are not new; they are digitized tradition. What matters is not the technology, but the intention. If the goal is collective empowerment-not extraction-then this model can uplift creators in the Global South far more than any Silicon Valley platform ever has.

Just launched my $MUSIC token on Solana. 100 tokens = early access to demos. 500 = name in credits. 1000 = invite to private studio session. 12 hours in: 400 holders. $18k raised. No ads. No sponsors. Just my fans. I cried. This is real. This is power. You can do this too. Start today. Don’t wait for perfect. Just start.