FORWARD Token Vesting Calculator

Calculate your potential token unlocks based on Forward Protocol's vesting schedules.

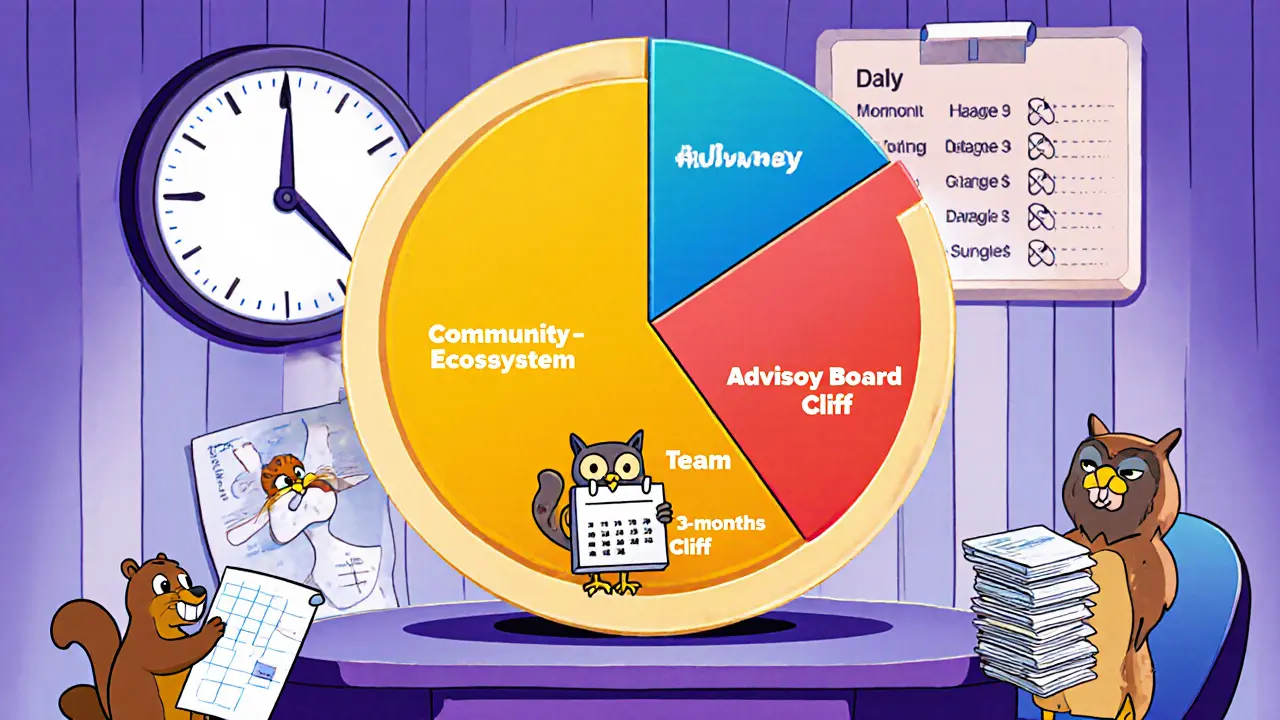

The Community Ecosystem holds 57.5% of the token supply (2.875 billion tokens). Most allocations follow either a 6-month or 9-month vesting schedule.

Input Parameters

Vesting Schedules

6-Month Schedule

25% unlock at TGE

3-month cliff before first release

3-month linear release after cliff

9-Month Schedule

8% unlock at TGE

3-month cliff before first release

6-month linear release after cliff

Unlocks Summary

Enter token amount and vesting period to see unlock details.

Quick Summary

- FORWARD’s Community Ecosystem holds 57.5% of the 5billion token supply (≈2.875billion tokens).

- The Gate.io Startup Free Offering handed out 6million tokens - about 0.12% of total supply - at no cost.

- Standard vesting: 25% unlock at TGE, 3‑month cliff, then linear daily releases over 3months (6‑month total). Some categories use a 9‑month schedule.

- Next unlock (June102025) releases 1.78million tokens, valued under $1,000, keeping market impact minimal.

- Key risks include price volatility, exchange dependency and liquidity constraints.

What is Forward Protocol?

Forward Protocol is a multi‑layer blockchain ecosystem that blends NFTs, DeFi, gamification, AI and social tokens to decentralize education. Its native currency, the FORWARD token, powers rewards for learners, content creators and community participants.

The project launched its Token Generation Event (TGE) on 7February2024 at 10:10UTC+3, kicking off a structured token release across several stakeholder groups.

Community Airdrop Mechanics

The community airdrop is the flagship distribution method aimed at broadening token ownership. Gate.io, via its Startup Free Offering, allocated 6000000 FORWARD tokens to verified users who completed simple engagement steps - such as joining the Telegram group, following on Twitter and completing a short KYC questionnaire.

This airdrop represents roughly 0.12% of the total 5billion supply, keeping the immediate market pressure low while giving early adopters a taste of the ecosystem.

To claim the tokens, participants logged into Gate.io, navigated to the “Forward Protocol” page under the “Free Offering” tab, and clicked “Claim”. Tokens were then transferred directly to the user’s linked wallet, typically a Binance Smart Chain (BSC) or Ethereum address.

Token Allocation Overview

| Category | Percentage | Tokens | Unlock Status (Oct2025) |

|---|---|---|---|

| Community Ecosystem | 57.5% | 2.875billion | Locked - staged releases |

| Team | 14% | 700million | 2.38% unlocked, 11.6% locked |

| Advisory Board | 6% | 300million | 5.05% unlocked, 0.95% locked |

| Geographic Expansion | 5.71% | 285.5million | Fully unlocked |

| Pre‑Seed Investors | 4% | 200million | Fully unlocked |

| Seed Round | 3.75% | 187.5million | Fully unlocked |

| Exchange & Liquidity Fund | 3.60% | 180million | Fully unlocked |

| Private Sale | 3% | 150million | Fully unlocked |

| Public Sale | 1.17% | 58.5million | Fully unlocked |

| KOL | 1% | 50million | Fully unlocked |

| Early Community Adopters | 0.32% | 16million | Fully unlocked |

The heavy tilt toward community allocation signals that Forward Protocol intends to democratize token ownership and fuel network effects through reward‑based participation.

Vesting Schedules Explained

Vesting protects the market from sudden token dumps. Most categories follow a “25% TGE unlock, 3‑month cliff, then daily linear unlocking over the next three months” pattern, equating to a total six‑month vesting period.

Some allocations - notably the Team and Advisory Board - adopt a slightly longer rhythm: 8% unlock at TGE, 3‑month cliff, then linear daily releases over six months, stretching the full vesting to nine months. This extended schedule aligns stakeholder incentives with the project’s multi‑year roadmap.

The current unlock calendar shows modest releases. For example, the June102025 event unlocked 1.78million tokens (≈0.04% of supply), keeping price pressure low while providing liquidity for community initiatives.

Gate.io’s Role in the Airdrop

Gate.io is a global cryptocurrency exchange that runs a “Startup Free Offering” program for emerging projects. In February2025, Gate.io partnered with Forward Protocol to distribute the 6million‑token airdrop.

The distribution required users to complete three simple actions: (1) register on Gate.io, (2) link a wallet, and (3) verify identity through a basic KYC flow. After meeting these criteria, the tokens were airdropped automatically to the user’s exchange wallet.

This approach gave Forward Protocol instant exposure to Gate.io’s ~10million user base, while Gate.io benefitted from increased activity and onboarding of a niche education‑focused audience.

Market Performance and Price Volatility

Since the TGE, FORWARD has swung between $0.0002582 and $0.000553 per token, with a market cap ranging from roughly $30k to $1.3million. A notable 58% single‑day drop on 23July2025 highlighted the token’s sensitivity to broader crypto sentiment and exchange‑specific news.

Current sentiment, according to AI‑driven analyses on CoinMarketCap, leans bearish due to limited liquidity and reliance on a handful of exchanges for volume. Nonetheless, the ongoing vesting schedule and community‑centric tokenomics provide a structural buffer against extreme price spikes.

How to Track Upcoming Unlocks and Airdrop Status

- Visit reputable tracking sites such as CoinMarketCap, CryptoRank or ICODrops.

- Search for “Forward Protocol” or the token symbol “FORWARD”.

- Open the “Tokenomics” or “Vesting Schedule” tab to view the detailed calendar.

- Set up price alerts on your preferred exchange (e.g., Gate.io, Binance) to be notified before a major unlock.

- Join Forward Protocol’s official Discord and Telegram channels for real‑time announcements.

These steps help community members stay ahead of supply changes and avoid unexpected price slippage.

Risks and Things to Watch

- Liquidity constraints: FORWARD trades on a limited number of pairs, making large moves potentially costly.

- Exchange dependency: Gate.io holds a significant share of early distribution; any exchange‑related issues could affect token availability.

- Vesting cliffs: Large unlocks, even if small percentage‑wise, may cause short‑term volatility.

- Regulatory environment: As an education‑focused utility token, changes in local crypto regulations could impact adoption.

Balancing these factors with the project’s long‑term vision is essential for anyone considering participation.

Frequently Asked Questions

Did I need to pay anything to receive the FORWARD airdrop?

No. The Gate.io Startup Free Offering distributed the tokens at zero cost. The only requirements were account registration, wallet linking and basic KYC verification.

How many FORWARD tokens are locked for the community?

The Community Ecosystem holds 2.875billion tokens (57.5% of the total supply). Most of these are scheduled for phased releases over the next few years.

When is the next token unlock expected?

The latest calendar shows an unlock on 10June2025 for 1.78million tokens. Future dates follow the same 6‑month or 9‑month vesting rhythm, depending on the allocation.

Can I trade FORWARD on any exchange?

Currently, FORWARD is listed on Gate.io, Bitget and a few smaller DEXs. Liquidity remains modest, so trade size should be kept reasonable.

What is the long‑term purpose of the FORWARD token?

FORWARD powers reward mechanisms for educational content, incentivizes learners, and enables governance of protocol upgrades within the Forward ecosystem.

Whether you’re a curious newcomer or a seasoned crypto enthusiast, understanding the allocation, vesting, and claim process gives you a solid footing before jumping into Forward Protocol’s community airdrop.

honestly the whole airdrop hype is just another market gimmick 😒 tokenomics look like a copy‑paste from every other DeFi project

Alright, let’s break this down step by step. The FORWARD token community airdrop allocates a massive 57.5% of the total supply, which immediately raises the question of token dilution. However, the vesting schedules-6‑month with 25% at TGE and 9‑month with 8% at TGE-are designed to mitigate sudden sell pressure. The 3‑month cliff is a standard safeguard, ensuring that early participants cannot dump tokens immediately. After the cliff, the linear release over the remaining months provides a predictable unlock curve, which is favorable for price stability. 😎

Now, let’s talk numbers. If you’re allocated 10,000 tokens under the 6‑month schedule, you’ll receive 2,500 tokens at TGE, then after the cliff you’ll get roughly 2,083 tokens each month for the next three months. For the 9‑month schedule, a 10,000‑token allocation yields 800 tokens at TGE, followed by about 1,533 tokens per month after the cliff.

From a strategic standpoint, the staggered vesting aligns incentives with long‑term network health. Early liquidity is limited, but the gradual release encourages holders to stay engaged. This approach also protects against pump‑and‑dump cycles that have plagued other token launches.

One critical aspect to watch is the overall market sentiment during the vesting period. If the broader crypto market turns bearish, even a well‑structured vesting schedule might not prevent price depreciation. Conversely, in a bullish environment, the scheduled unlocks could fuel upward momentum as new tokens enter circulation.

In summary, the FORWARD token airdrop offers a sizable stake to the community, but the true value will hinge on execution, market conditions, and participant discipline. Keep an eye on the lock‑up timers and consider the macro‑economic backdrop before making any decisions. 🚀

Looks like they really tried to keep it simple with the cliff and linear release. I think it’s a decent approach for newcomers who want to avoid a sudden dump. The 3‑month wait gives people a chance to understand the ecosystem before they start moving tokens around.

Yo, did you see the extra emoji in the UI? 😂 Also, the schedule is basically the same as every other project’s hype wheel. No surprise there, just hoping they don’t burn the community later.

Esteemed community members, allow me to extend my heartfelt appreciation for the meticulous design of the vesting framework. The inclusion of both 6‑month and 9‑month schedules showcases a dramatic yet thoughtful balance between immediate liquidity and long‑term commitment. I am confident that such a structured approach will inspire confidence and foster lasting engagement. Let us all rally behind this initiative with vigor!

Namaste friends! The colorful layout of the airdrop calculator really makes it easy to grasp. It’s wonderful to see such a culturally inclusive design that welcomes participants from every corner of the globe. Let’s celebrate this together and spread the word! 🌏

The cliff protects early investors.

The vesting calculator is straightforward, showing exact unlock amounts after the cliff. This helps users plan their holdings without overcomplicating things. Simple UI, clear info – that’s what we need.

Honestly, I think the whole thing is a front for the deep‑state crypto agenda. They’ve hidden the real terms in the fine print and you’ll never notice how the tokens are siphoned into unknown wallets. Stay vigilant, the matrix is watching.

Whoa, the drama of this airdrop is real! 🎭 I love how they’ve built suspense with the cliff-makes the rollout feel like a TV series. Still, the math checks out and the schedule isn’t too wild. Good job, team!

Another token airdrop, another empty promise...; the jargon is thick, the real value is thin; will they actually deliver or just create hype?

I’m curious about how the community will react once the first unlock hits. It could be a great catalyst for engagement if the price holds. Let’s keep an eye on the market sentiment.

yeah idk if this is really gonna work but looks ok

Philosophically speaking, the vesting model mirrors the concept of delayed gratification-rewarding patience over impulsivity. Yet, practical considerations like market volatility remain pivotal. Balancing idealism with realism is key.

The tokenomics are solid, especially for those who understand the underlying tech. A well‑structured vesting schedule can be a catalyst for sustainable growth within the ecosystem. Keep the momentum!

🇺🇸 This airdrop is a great move for American crypto enthusiasts! Let’s support it and show the world how strong our community can be! 🚀💪

Hey folks! If you’re looking for a friendly guide, the calculator makes it super easy to see when your tokens unlock. Let’s help each other navigate the schedule and keep the community thriving!

Simple and clear – the vesting periods give everyone a fair chance. No need for fancy terms, just watch the calendar and plan ahead.