VARA License Cost Calculator

Total Estimated Cost

No licenses selected yet

Getting a crypto license in Dubai isn’t just about filling out forms. If you’re trying to operate a virtual asset business in the UAE outside the DIFC, VARA is the only authority that matters. Since 2022, it’s become the most detailed, strict, and comprehensive crypto regulator in the Middle East-and by 2025, it’s raised the bar even higher. This isn’t a license you can get with a quick online application. It’s a multi-month process requiring serious capital, legal structure, and operational discipline. And if you ignore the new 2025 restrictions, your application won’t just be delayed-it’ll be rejected.

What VARA Actually Regulates in 2025

VARA doesn’t just cover Bitcoin exchanges. Its jurisdiction now includes everything from DeFi protocols and NFT marketplaces to tokenized real estate and stablecoins. If your business touches virtual assets in Dubai, you need VARA approval-even if you think you’re just running a wallet app or a loyalty points system.

The authority breaks licensing into seven distinct categories:

- Virtual Asset Exchange Services (spot and derivatives trading)

- Fiat-to-Virtual Asset Broker Services

- Virtual Asset-to-Virtual Asset Broker Services

- Virtual Asset Transfer Services (money transmission)

- Custody Services (cold storage, institutional wallets)

- Wallet Provision Services (consumer-facing wallets)

- Token Issuance (STOs, utility tokens, NFTs)

Most companies need at least two licenses. For example, a platform that lets users trade ETH for USDT and store it needs both Exchange and Custody licenses. If you’re launching your own token on top of that, you add Token Issuance. Each layer adds cost, complexity, and scrutiny.

The Real Cost of a VARA License in 2025

Many startups think VARA is affordable because some fees sound low. They’re wrong. The numbers don’t lie:

- Application fee: AED 40,000-100,000 ($11,000-27,000)

- Annual supervision fee: AED 80,000-200,000 ($22,000-54,000)

- Capital requirement: AED 100,000 to AED 5 million depending on license type

Here’s what that looks like in practice:

A company applying for Exchange + Custody + Broker licenses needs:

- AED 5 million (Exchange)

- AED 4 million (Custody)

- AED 1 million (Broker-Dealer)

- Total capital: AED 10 million ($2.7 million)

Plus AED 100,000 in application fees and AED 200,000 per year in supervision. That’s over $3 million upfront just to start. No bank loan, no investor, no grant will cover this unless you’re already a serious player. Smaller operators-like indie NFT platforms or local crypto ATMs-often can’t afford it. That’s intentional. VARA isn’t built for mom-and-pop shops.

The 2025 Restrictions That Kill Applications

VARA’s 2025 rules aren’t just about money-they’re about control. And they’ve gotten much tighter.

Banned tokens: Monero, Zcash, and any other privacy coin are completely prohibited. If your platform supports them-even as a legacy feature-you’ll be flagged for AML violations. VARA’s stance is clear: anonymity is incompatible with their regulatory model.

Marketing approval required: You can’t run a TikTok ad, Google campaign, or influencer promotion without VARA’s written consent. They review every word, image, and claim. Phrases like “guaranteed returns” or “risk-free investment” are automatic rejections.

Whitepaper updates: Every token issuance now requires a revised whitepaper approved by VARA. It must include detailed risk disclosures, tokenomics, team background checks, and legal disclaimers. No more vague “web3 revolution” buzzwords. If your whitepaper reads like a startup pitch, it won’t pass.

Token categorization: VARA now classifies tokens into three buckets:

- Category 1: Asset-backed tokens, stablecoins, security tokens → Full VARA license required

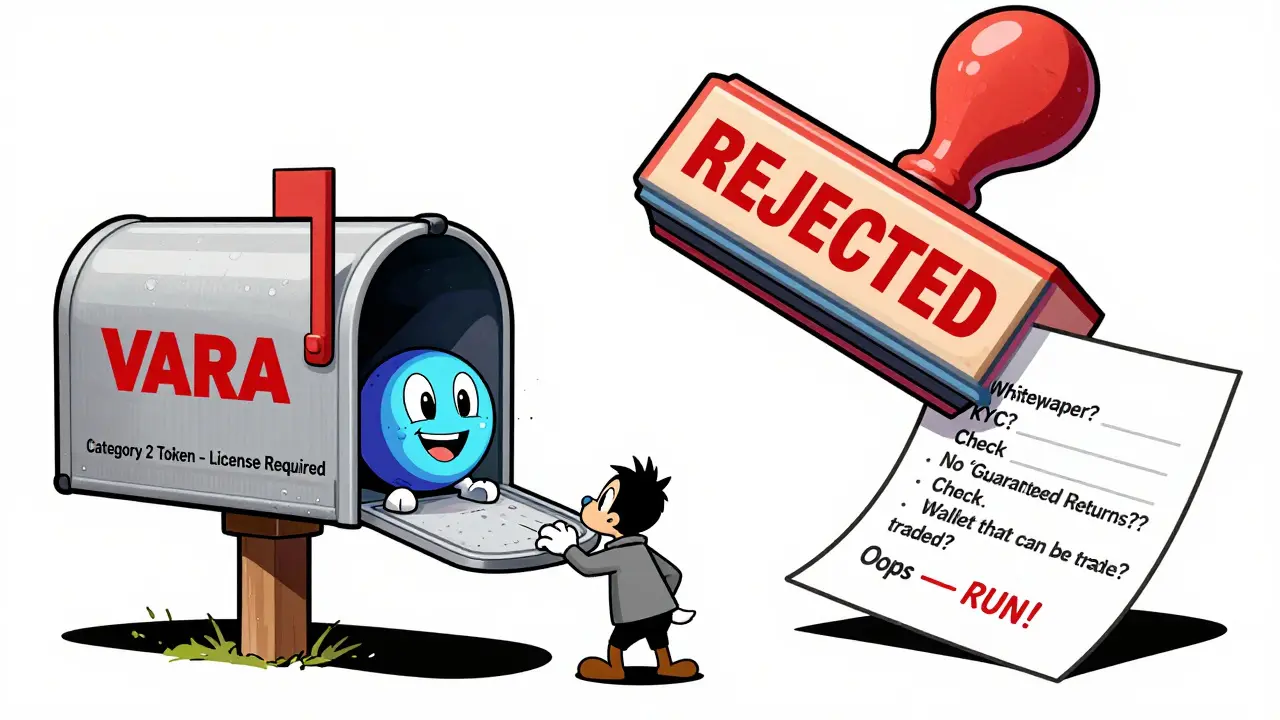

- Category 2: Utility tokens (e.g., access to a platform) → Must be distributed by a licensed entity

- Exempt: Loyalty points, in-game credits → No license needed, but still under VARA oversight

If you’re selling a token that gives users access to a game or service, you might think you’re exempt. But if that token can be traded on a secondary market, VARA will treat it as Category 2. And that means you need a licensed distributor. No loopholes.

How VARA Compares to DIFC and ADGM

Dubai has three crypto regulators. You need to know which one you’re dealing with.

- VARA: Covers Dubai mainland and most free zones. Broadest jurisdiction. Mandatory for most crypto businesses.

- DFSA (DIFC): Only applies to the Dubai International Financial Centre. Handles institutional trading, fund management, and investment services. More aligned with traditional finance.

- FSRA (ADGM): Abu Dhabi’s regulator. Similar to DFSA but smaller. Often used by hedge funds and asset managers.

If you’re a global exchange like Binance or Crypto.com, you’ll likely apply to VARA because you want to serve customers across Dubai, not just inside a financial free zone. DIFC and ADGM are for banks and institutional players. VARA is for the crypto ecosystem.

The Application Process: What They Actually Check

VARA doesn’t just want your documents. They want proof you can run this business safely.

Your application must include:

- A detailed business plan showing revenue model, user projections, and risk assessment

- A full AML/CFT compliance framework with staff training records

- KYC procedures that meet FATF standards (including biometric verification)

- Technology architecture diagrams showing data storage, encryption, and backup systems

- Insurance policy covering cyber theft and operational failure

- Proof of local incorporation in Dubai or a free zone

Foreign companies can own 100% of their entity in free zones like DMCC or DIFC. But you still need a local legal presence. You can’t apply from offshore.

VARA also requires third-party audits every year. They’ll check your transaction logs, wallet addresses, and internal controls. If your compliance team is just one person who also handles customer support, you’re not ready.

Who’s Already Licensed-and Why It Matters

As of late 2025, over 120 companies hold VARA licenses. That includes:

- Crypto.com

- Binance

- OKX

- Bybit

- Bitget

- Gate.io

These aren’t small players. They’re global giants. Their presence signals two things: VARA is trusted internationally, and it’s serious about enforcement. If you’re trying to compete with them without matching their compliance standards, you’re setting yourself up for failure.

But it’s not just about big names. VARA has also approved dozens of local startups-NFT marketplaces, DeFi lending platforms, tokenized real estate firms. The difference? They built compliance into their product from day one, not as an afterthought.

What Happens If You Skip VARA?

Operating without a VARA license in Dubai is illegal. The penalties aren’t fines-they’re shutdowns, asset freezes, and criminal charges.

In 2024, a Dubai-based crypto wallet service was raided after serving 15,000 users without a license. The founders were banned from entering the UAE. Their servers were seized. Their bank accounts frozen. No warning. No grace period.

VARA works with the UAE’s financial intelligence unit and police. They monitor blockchain activity, track domain registrations, and follow advertising trails. If you’re offering crypto services to people in Dubai, you’re on their radar-even if you think you’re “just a small operation.”

Is VARA Worth It?

Yes-if you’re serious about scaling in the Middle East, Asia, or Africa. Dubai’s tax-free environment, strategic location, and VARA’s clarity make it the most attractive crypto hub outside Switzerland and Singapore.

But if you’re a solo developer with a token idea and $50,000 to spend? You’re better off launching in a jurisdiction with lighter rules-like Portugal, Malta, or even Wyoming. VARA isn’t for dreamers. It’s for operators who can handle the weight of regulation.

The companies that succeed here don’t see VARA as a barrier. They see it as a stamp of legitimacy. Once you’re licensed, you can open bank accounts with major institutions. You can partner with local businesses. You can attract institutional investors. That’s the real value.

But it’s not cheap. It’s not fast. And it’s not forgiving. If you’re not ready to invest millions and hire a full compliance team, don’t waste your time applying.

Can I get a VARA license if I’m not based in Dubai?

No. You must incorporate your business in Dubai mainland or a designated free zone like DMCC, DIFC, or RAKEZ. VARA only licenses legal entities registered in the UAE. Foreign companies can own 100% of their entity in free zones, but they still need a local legal presence to apply.

How long does the VARA licensing process take?

Typically 4 to 8 months. The timeline depends on how complete your documentation is. Companies with strong compliance teams and clear business plans often get approved in 4-5 months. Those with incomplete applications, vague whitepapers, or weak AML systems can face delays of 6-8 months or more. VARA doesn’t rush approvals-they want to get it right.

Are privacy coins like Monero completely banned under VARA?

Yes. VARA explicitly banned Monero, Zcash, and all other privacy-enhancing cryptocurrencies under Administrative Order 2023/2024. No licensed VASP can offer trading, custody, or transfer services for these assets. Even if you’re not actively promoting them, having them on your platform is a violation.

Do I need a license to issue an NFT in Dubai?

It depends. If your NFT is just a digital collectible with no financial rights (like a piece of art), you don’t need a license. But if the NFT represents ownership in a real asset, grants revenue sharing, or can be traded as an investment, it’s classified as a virtual asset. In that case, you need a Token Issuance license from VARA.

Can I apply for multiple VARA licenses at once?

Yes. Many companies apply for multiple licenses simultaneously-like Exchange + Custody + Broker. But each license has its own capital requirement, and they’re additive. Applying for three licenses means you need the full capital for each one. There’s no discount. You’ll also need separate compliance systems for each service type.

so i just spent 8 months trying to get this license and they rejected me because my whitepaper said "web3 will change everything"?? like bruh. i didn’t even use the word "decentralized" and still got flagged. VARA’s reading comprehension is worse than my ex’s texting replies.

Man this is actually super helpful 😅 I was debating whether to even try applying. The capital requirements are insane but if you’re serious about scaling, this is the only way to play in the region. Kudos to the author for laying it out so clearly 🙌

Let me be perfectly clear: VARA isn’t a regulator-it’s a corporate gatekeeper disguised as a financial authority. They’ve weaponized compliance to eliminate competition. The fact that they ban privacy coins isn’t about AML-it’s about control. And the 2025 token categorization? Pure regulatory overreach. You’re not allowed to innovate unless you’ve got a legal team bigger than your dev team. This isn’t crypto freedom. It’s crypto feudalism.

Biggest mistake people make? Thinking VARA is like the SEC. It’s not. The SEC has loopholes. VARA doesn’t. If you’re a startup with $50k and a dream, you’re not getting licensed. Period. But if you’re building something real and you can afford the $3M upfront? This is the golden ticket. Once you’re in, you can bank with HSBC, partner with Emirates NBD, and get real institutional traction. It’s brutal-but it works.

Interesting breakdown. One thing I’m curious about: how do they handle cross-border DeFi protocols that don’t have a physical presence but serve users in Dubai? Do they just assume everyone’s IP is traceable and treat it as jurisdictional overreach?

It is profoundly disconcerting that a jurisdiction with such stringent regulatory architecture is being lauded as a "crypto hub." One must question the philosophical underpinnings of a system that equates financial inclusion with capital concentration. The ban on privacy coins, while ostensibly rooted in AML concerns, constitutes a de facto violation of fungibility-a foundational tenet of monetary integrity. Furthermore, the requirement for whitepaper revisions under bureaucratic auspices is tantamount to prior restraint upon speech. One must ask: is this innovation, or is this authoritarianism with a corporate veneer?

VARA isn’t here to help you. It’s here to filter you out. If you can pass, you’re ready to play with the big boys. If not? Go somewhere cheaper.

It’s no surprise the U.S. startups are crying about the cost. In America, you can’t even get a business license without a lawyer and a notary. At least Dubai has standards. If you can’t afford $3 million to run a crypto business, you shouldn’t be running a crypto business. This isn’t a startup playground-it’s a financial fortress. And the fact that you think it’s unfair proves you’re not cut out for real finance.

Oh please. You think VARA is bad? Try getting a license in Switzerland. At least here you don’t need to hire a Swiss lawyer who charges 800 CHF/hour just to sign your name. And don’t act like you’re some oppressed crypto anarchist-your "NFT loyalty points" are just a scam with better UI. VARA’s keeping the wolves out. You’re just mad because you’re not one of the wolves.

So let me get this straight-you spent $3 million to get a license so you can... sell tokens to people who already bought them on Binance? Congrats. You just paid a tax to become a middleman. VARA didn’t create a crypto hub. They created a $3 million toll booth for people who don’t understand decentralization. And you’re all patting yourselves on the back like it’s a win. Pathetic.

I’ve been watching this space for years and honestly I think VARA’s approach is kind of genius even if it’s brutal. The fact that they’re forcing everyone to be serious about compliance means the whole ecosystem is cleaner. I’ve seen so many crypto projects in the US just vanish overnight because they were running on smoke and vibes. Here you either build solid infrastructure or you don’t get in. And yeah it’s expensive but think about it-if you’re trying to attract real institutional money you need that stamp of approval. It’s not about being fair it’s about being credible. And credibility doesn’t come cheap. I’m not saying it’s perfect but I’m saying it’s working better than most places

I really appreciate how thorough this breakdown is. It’s easy to get caught up in the hype of "crypto in Dubai" without understanding the real barriers. I’ve worked with several teams trying to launch here and the emotional toll is real-especially when you’ve poured your savings into it only to be told your whitepaper "lacks sufficient risk disclosure." But you know what? The ones who made it through? They’re not just surviving-they’re thriving. They’ve got real partnerships, real banking, real traction. VARA doesn’t care about your passion. It cares about your process. And honestly? That’s the kind of discipline the whole industry needs.

As someone from Canada who’s watched this unfold, I find it fascinating how VARA is creating a new model for crypto regulation-not based on bans or chaos, but on structured inclusion. The token categorization system? Brilliant. It’s like a spectrum: from pure utility to financial instruments. And the marketing approval? It’s annoying but necessary. We’ve seen too many scams target retail investors with TikTok ads promising 1000% returns. VARA is protecting the ecosystem from itself. Not perfect, but far better than the Wild West elsewhere.

Typo in the title: "2025 Restrictions" should be "2025 Restriction". Also, "VARA" is capitalized inconsistently in paragraph 3. Minor, but it’s jarring.