Costa Rica Crypto Business Feasibility Calculator

Calculate Your Crypto Business Viability

Determine the estimated time, costs, and challenges for establishing a crypto business in Costa Rica based on your specific situation.

Costa Rica doesn’t treat Bitcoin, Ethereum, or any other cryptocurrency as money. Not legally. Not officially. Not even close. That’s not because the country hates crypto - it’s because it’s trying to avoid the chaos seen in places like El Salvador, where Bitcoin became legal tender and sparked economic confusion. Instead, Costa Rica has carved out a middle path: crypto exists, but it’s not money. And that makes all the difference.

What ‘No Official Recognition’ Really Means

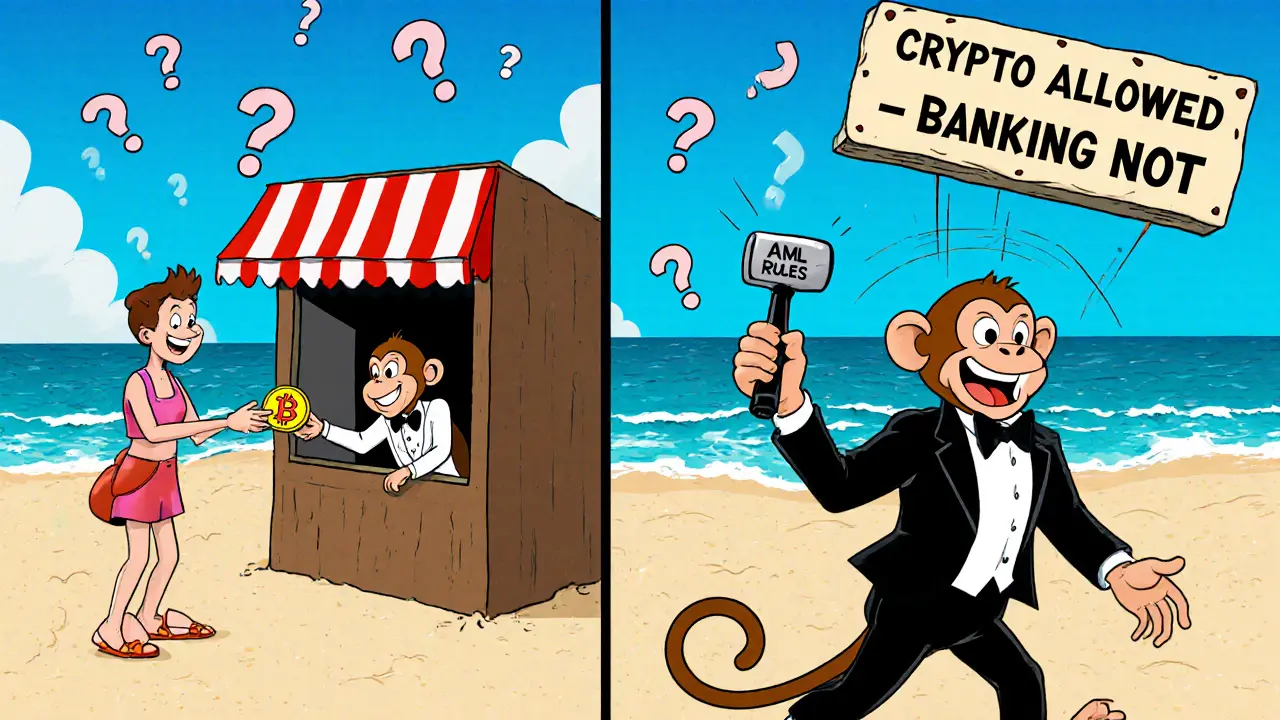

The Central Bank of Costa Rica made it crystal clear back in 2021: cryptocurrencies are not legal tender, not foreign currency, and not a form of payment that businesses must accept. That means if you walk into a coffee shop in San José and try to pay with Bitcoin, the barista can say no - and it’s completely legal. You can’t use crypto to pay taxes. You can’t use it to settle debts in court. And banks don’t have to treat it like dollars or colones. But here’s the twist: crypto isn’t banned. People trade it. Businesses accept it. Exchanges operate. The government just refuses to give it the same status as the national currency. This isn’t a crackdown - it’s a deliberate pause. The goal? To avoid financial instability while still letting innovation happen.How Crypto Is Still Allowed - And Regulated

Even without legal tender status, crypto businesses aren’t operating in a wild west. Since 2021, the government has been quietly building rules around them. The big shift came in July 2025, when a new bill, Proyecto de Ley Expediente 22.837, passed its first legislative debate. This law doesn’t make crypto money. Instead, it defines what crypto businesses can and can’t do. Under the new rules, any company offering crypto services - exchanges, wallet providers, custody services - must register with SUGEF, the country’s financial oversight body. But here’s the catch: registration doesn’t mean approval. It’s more like a heads-up. The government says, “We know you’re here. Now follow these rules.” Those rules are strict. Every crypto business must:- Verify the identity of every customer (KYC)

- Keep detailed records of every transaction for at least five years

- Flag suspicious activity, especially involving high-risk users like politicians or foreign entities

- Have internal controls and trained staff to handle anti-money laundering (AML) risks

Why Costa Rica Chose This Path

El Salvador made headlines in 2021 when it made Bitcoin legal tender. But the results were messy. Businesses struggled to accept it. Tourists got confused. The IMF warned of economic risks. Costa Rica watched. And decided not to follow. Instead, it looked at Panama, which created a “regulatory sandbox” for crypto startups. Costa Rica chose something different: a tight, crime-focused approach. The logic? If you can’t prevent money laundering, you shouldn’t encourage adoption. Ricardo Quesada, a former government official, put it plainly: “This law isn’t about promoting crypto. It’s about protecting the financial system.” That’s why the bill focuses on VASPs - Virtual Asset Service Providers - not on making crypto a currency. It’s also why Costa Rica is aligning with global standards like the OECD’s Crypto-Asset Reporting Framework (CARF) and the FATF guidelines. The country wants to be seen as compliant, not chaotic. That matters for foreign investors, international banks, and future trade deals.

The Real Problem: Banking Access

Here’s where things get messy for crypto businesses in Costa Rica. Yes, you can register a company. Yes, you can hire staff. Yes, you can build a platform. But opening a bank account? That’s a nightmare. Traditional banks - the kind that hold most of the country’s money - are terrified of crypto. Even though the law doesn’t ban it, banks still see it as high-risk. Many refuse to work with crypto firms outright. Others demand impossible paperwork, charge exorbitant fees, or shut accounts after a few months. According to user reports on Reddit and industry surveys, entrepreneurs spend 6 to 8 months trying to find a bank willing to take their money. One founder, known online as “CRCryptoFounder,” said he was rejected by three major banks before finding a small regional credit union willing to work with him - under strict monthly audits. The result? Many crypto startups operate on cash or offshore accounts. Some use crypto-to-fiat gateways based in other countries. It’s a workaround, not a solution. And it adds cost, complexity, and risk.Who’s Winning and Who’s Losing

Despite the banking headaches, Costa Rica still attracts crypto businesses - and for good reason.- Tax benefits: No capital gains tax on crypto trades for individuals. Corporate tax rates are among the lowest in Latin America.

- Political stability: No coups, no hyperinflation, no sudden policy reversals.

- Infrastructure: Reliable internet, skilled tech workers, and a growing startup ecosystem.

What’s Coming Next

The law passed its first vote in July 2025. Final approval is expected by October 2025. But that’s just the beginning. A second bill, Proyecto de Ley 23.415 (the “Cryptoassets Market Law”), is still being reviewed. This one could add more structure - maybe even licensing tiers for different types of crypto businesses. SUGEF has also been allocated $2.3 million to upgrade its digital monitoring systems, so it can track transactions in real time. By mid-2026, experts predict Costa Rica will fully meet FATF standards. That means international banks will be more willing to work with Costa Rican crypto firms - if they’re compliant. The country’s crypto market is already worth $1.2 billion. About 14.3% of adults have owned crypto at some point. That’s below the Latin American average, but growing fast. Deloitte projects a 23.5% annual growth rate through 2028 - if the new rules are implemented smoothly.Bottom Line: It’s Not a Ban. It’s a Tightrope.

Costa Rica isn’t trying to kill crypto. It’s trying to keep it from killing the financial system. You can use crypto. You can build a crypto business. You can even make money from it. But you won’t get government backing. You won’t get easy banking. And you won’t get consumer protection. It’s a calculated gamble. The country bets that a cautious, rules-first approach will attract serious players - not speculators or scammers. And so far, it’s working. Businesses are coming. Banks are slowly adapting. The tech is improving. But if you’re thinking of starting a crypto company in Costa Rica, don’t expect a red carpet. Expect paperwork. Expect delays. Expect banks saying no. And expect to work twice as hard to prove you’re clean. That’s the price of doing crypto in a country that refuses to call it money - but won’t stop you from using it, either.Is it illegal to use Bitcoin in Costa Rica?

No, it’s not illegal. Individuals and businesses can buy, sell, hold, and use Bitcoin and other cryptocurrencies. The government doesn’t ban them. But they’re not legal tender, so no one has to accept them as payment. You can’t use crypto to pay taxes or settle official debts.

Do I have to pay taxes on crypto in Costa Rica?

Individuals don’t pay capital gains tax on crypto trades. There’s no specific crypto tax law for personal investors. For businesses, profits from crypto activities are subject to standard corporate income tax, which is around 30%. The government hasn’t introduced a special crypto tax like India or the U.S., making it one of the more tax-friendly countries in Latin America for crypto holders.

Can I open a bank account for my crypto business in Costa Rica?

It’s possible, but extremely difficult. Most major banks refuse to work with crypto firms due to perceived AML risks. Many entrepreneurs spend 6-8 months trying to find a bank willing to open an account. Some succeed with smaller credit unions or foreign banks, but they often face strict monitoring, higher fees, and sudden account closures. Banking access remains the biggest operational hurdle for crypto startups.

What happens if my crypto exchange gets hacked in Costa Rica?

There is no government insurance or compensation program for lost crypto. Unlike banks, crypto businesses aren’t required to hold reserves or insure user funds. If a platform fails or is hacked, users typically lose their assets with no legal recourse. The new regulations require businesses to follow AML rules, but they don’t mandate financial safeguards for customers.

Is Costa Rica becoming a crypto hub like El Salvador?

No. El Salvador made Bitcoin legal tender - Costa Rica is doing the opposite. Instead of pushing adoption, Costa Rica is focused on regulation, compliance, and preventing financial crime. It’s attracting serious, compliant businesses - not speculators or retail users. The goal isn’t to be the next Bitcoin country. It’s to be the most trustworthy crypto jurisdiction in Central America.

When will Costa Rica officially recognize crypto as money?

There are no plans to do so. The government has made it clear that legal tender status is off the table. The focus remains on regulating crypto as a digital asset, not a currency. Even the latest bills passed in 2025 reinforce this stance. Don’t expect a change unless there’s a major political or economic shift.

This whole thing is just a fancy way of saying 'we're scared'.

Costa Rica doesn't want crypto because it's too real, too raw, too free. They'd rather keep people tied to banks that charge them for breathing.

It's not regulation-it's fear in a suit.

Let me be clear: this so-called 'middle path' is just bureaucratic cowardice wrapped in OECD jargon. The Central Bank isn't protecting the system-they're protecting their own irrelevance. If you're not willing to embrace decentralized finance, you're just a gatekeeper holding the door shut while the world walks around it. The fact that businesses still flock here despite banking nightmares proves one thing: the market doesn't need permission to innovate. It just needs space. And Costa Rica? They're giving it just enough rope to hang themselves with compliance paperwork.

I get why they're cautious. But the banking access issue is brutal. I know someone who started a wallet service here and spent 8 months getting rejected by every major bank. One told him, 'We don't do business with digital money.' Like it's magic or something.

It’s actually kind of refreshing to see a country take a measured approach. El Salvador’s experiment was chaotic, and honestly? It scared a lot of people. Costa Rica isn’t rejecting crypto-it’s just refusing to turn it into a political symbol. They’re treating it like a tool, not a religion. That’s smart. And the AML rules? Necessary. If you’re running a crypto business, you should be held to the same standards as any financial institution. The problem isn’t the rules-it’s the banks still acting like it’s 2013.

Let’s not romanticize this. Costa Rica’s stance isn’t 'clever'-it’s a half-measure that creates more problems than it solves. Yes, they’re avoiding El Salvador’s mess, but they’re also strangling innovation with red tape. AML compliance? Fine. But when your own regulators can’t even get banks to open accounts for compliant businesses, you’re not regulating-you’re sabotaging. And the fact that individuals get zero protection when exchanges collapse? That’s not prudence. That’s negligence dressed up as policy.

The real winners? Offshore banks and shell companies. The losers? Every honest entrepreneur trying to build something real in San José.

Of course they don't recognize crypto. The IMF and the World Bank are pulling the strings behind this. They don't want people to escape the fiat system. This is all part of the Great Financial Control Plan. The 'regulations' are just traps to identify and track every crypto user. Soon they'll require biometric verification just to hold a wallet. Mark my words: this is the first step toward a digital serfdom where every transaction is monitored and taxed.

So… they let you use crypto, but won't let you bank it? That's like letting someone drive a car but banning gas stations. Clever.

Wait-so you can buy Bitcoin, but if you try to turn it into colones? Banks say NO? That’s not regulation, that’s psychological warfare. I’ve seen this before-in the 90s, when banks refused to serve sex workers. Same energy. Same fear. Same ignorance. They don’t understand the tech, so they punish the users. And the worst part? The people who actually need this-remittance workers, freelancers, small shops-are the ones getting locked out. This isn’t protecting the system. It’s protecting the status quo from itself.

Costa Rica’s model is actually a textbook example of regulatory pragmatism. They’re not rejecting DeFi-they’re de-risking it. VASP registration + KYC + AML = compliance layer without systemic exposure. This is what every jurisdiction should be doing before legal tender debates. The banking access issue? That’s a market failure, not a policy one. Banks are still operating under legacy risk models. But once FATF alignment kicks in and SUGEF’s real-time monitoring goes live, the liquidity will follow. We’re talking about a $1.2B market growing at 23% annually-this is just the pre-launch phase. The real crypto hubs aren’t the ones shouting about sovereignty-they’re the ones building compliant infrastructure. Costa Rica’s playing 4D chess while El Salvador’s still stuck on checkers.

It is imperative to recognize that the regulatory framework enacted under Proyecto de Ley Expediente 22.837 represents a paradigmatic shift in Latin American digital asset governance. The emphasis on VASP registration, rather than legal tender status, aligns Costa Rica with the FATF’s Travel Rule and OECD’s CARF, thereby mitigating systemic financial risk while preserving technological autonomy. The banking sector’s resistance, though problematic, is a transient friction point rooted in institutional inertia. The absence of capital gains taxation for individuals is a strategic advantage that will attract high-net-worth participants seeking jurisdictional stability. Furthermore, the $2.3 million investment in SUGEF’s digital surveillance infrastructure signals a commitment to enforcement, not suppression. This is not a half-measure-it is a meticulously calibrated policy architecture designed for long-term resilience.

Why do people keep acting like this is some genius move? They let you use crypto but won't let you bank it? That's not regulation that's just being a dick. You're telling entrepreneurs 'you can build this thing but we won't let you cash out' what kind of messed up economy is this

I think Costa Rica’s approach is underrated. It’s not sexy like El Salvador, but it’s sustainable. You don’t need to make crypto legal tender to benefit from it. You just need to let it exist without burning the whole system down. The banking issues are frustrating, sure-but they’ll get solved over time. The fact that they’re aligning with global standards means foreign capital will eventually come in. And honestly? I’d rather have a country that’s cautious than one that’s reckless.

It’s easy to call this ‘cowardice,’ but I’ve talked to small business owners here who are just glad they don’t have to deal with Bitcoin price swings affecting their payroll. They don’t want to be financial pioneers-they want to sell coffee and pay their rent. The government’s stance protects them from volatility and scams. The real issue is the banking gap, and that’s something the private sector and regulators need to fix together-not something to demonize the whole policy over.

USA does it better. We don't play games with crypto. We regulate it or ban it. Not this half-assed 'you can use it but we hate you' nonsense.

Costa Rica is just another socialist country pretending to be cool. They want to control everything. Crypto is freedom and they’re scared of it. They’re just trying to look smart while crushing innovation. This is why the world is leaving places like this behind.

They’re not protecting the system-they’re protecting the banks. Again. Always the banks. And now they’re using ‘anti-money laundering’ as a cover to crush anyone who dares to be different. This isn’t regulation, it’s a witch hunt. And the fact that users get zero protection if their exchange gets hacked? That’s not just negligent-it’s criminal. Who’s going to pay for the losses? The people. Always the people. Meanwhile, the regulators get their $2.3 million budget and a pat on the back. This is how empires die-in paperwork.

While the regulatory posture of Costa Rica is indeed cautious, it is neither irrational nor inherently hostile to innovation. The absence of legal tender status is a legally coherent position that preserves monetary sovereignty. The regulatory framework for VASPs, though burdensome, is proportionate to the risks inherent in decentralized financial services. The banking sector’s reluctance is a market-driven phenomenon, not a policy failure. It is, therefore, premature to characterize this approach as a failure. Rather, it represents a deliberate, incrementalist strategy that prioritizes systemic integrity over speculative momentum. Time will determine its efficacy, but the foundational principles are sound.