Technical analysis for cryptocurrency isn’t about guessing. It’s about reading what the market is already telling you through price and volume. If you’ve ever looked at a Bitcoin chart with lines, bars, and colored candles and wondered what they mean, you’re already on the right path. This isn’t magic. It’s pattern recognition - the same way a seasoned driver knows when to brake based on road conditions. In crypto, those conditions are written in price action.

How Technical Analysis Works in Crypto Markets

Technical analysis (TA) looks at one thing: what happened before. It doesn’t care why Bitcoin jumped 12% last Tuesday. It only cares that it did - and that similar jumps happened in the past under similar conditions. The core idea is simple: history repeats. Not because of luck, but because human psychology doesn’t change. Fear and greed drive markets, whether it’s stocks, gold, or Dogecoin. The five basic assumptions behind crypto TA are:- Price reflects everything - news, rumors, whale moves, even Twitter trends.

- Prices move in trends - up, down, or sideways. They don’t jump around randomly.

- History tends to repeat - patterns like head and shoulders or flags show up again and again.

- Chart patterns work because enough people believe they work - self-fulfilling prophecy.

- The market is always right. Even if you think Ethereum should be worth $5,000, if it’s trading at $2,800, that’s the real value right now.

Key Tools Every Crypto Trader Uses

You don’t need a PhD to use these. Most exchanges like Binance, Coinbase Pro, and Kraken give you these for free. Here are the most common ones:- Support and Resistance: These are price levels where buying or selling has historically stopped the trend. Support is the floor - where buyers step in. Resistance is the ceiling - where sellers take over. If Bitcoin bounces off $60,000 three times, that level becomes sacred.

- Trend Lines: Draw a line connecting two or more lows (for uptrends) or highs (for downtrends). If price keeps respecting that line, the trend is alive. Break it, and the trend may reverse.

- Moving Averages (MA): These smooth out price data. The 50-day and 200-day MAs are the most watched. When the 50-day crosses above the 200-day, it’s called a Golden Cross - a signal many traders see as bullish. In 2021, this pattern preceded 78% of major Bitcoin rallies, according to CoinGlass.

- Relative Strength Index (RSI): This measures momentum on a scale of 0 to 100. Above 70? Overbought. Below 30? Oversold. But here’s the catch: in strong trends, RSI can stay overbought for weeks. It doesn’t mean price will drop - just that it’s been rising fast.

- Bollinger Bands: Two lines around a moving average that show volatility. When price hits the upper band, it might be overextended. When it squeezes into the middle, a big move is often coming.

These tools aren’t used alone. The best traders combine them. A 2024 Kraken backtest showed that a single indicator (like MACD) had only 58% accuracy. But when three indicators lined up - say, a Golden Cross, rising volume, and RSI breaking above 50 - accuracy jumped to 82%.

Technical vs. Fundamental Analysis: What’s the Difference?

People mix these up all the time. Here’s the difference:- Technical Analysis: Asks, “What is the price doing?” It looks at charts, volume, and patterns. No need to know who’s behind the project.

- Fundamental Analysis: Asks, “Why is the price doing that?” It digs into team credibility, tokenomics, real-world use cases, and adoption numbers.

TA shines in short-term trading - hours to weeks. If you’re day trading Solana or scalping Ethereum, TA is your daily driver. Fundamental analysis works better for long-term holds - think months or years. If you’re buying Bitcoin because you believe it will replace gold, you’re doing fundamental analysis.

But here’s the truth: the best crypto traders use both. A 2025 Delphi Digital report found that the most profitable strategies combine RSI divergences with on-chain data like exchange net outflows. Why? Because TA tells you when to act. Fundamentals tell you why it might work.

What Goes Wrong? Common Mistakes

Most people fail not because TA doesn’t work - but because they use it wrong.- Too many indicators: A CryptoQuant study found traders using more than five indicators had 34% lower profits. Clutter leads to confusion. Start with three: moving averages, RSI, and volume.

- Wrong timeframe: Looking at a 5-minute chart to decide if you should hold Bitcoin for a year is like checking the weather to plan your wedding. Use higher timeframes (daily, weekly) to find the trend. Then use lower ones (4-hour, 1-hour) to time your entry.

- Ignoring context: In September 2021, Bitcoin dropped 30% in 24 hours after China banned crypto. All the technical signals were green. But a regulatory shock overrides charts. Always know what’s happening in the world.

- Chasing perfection: No pattern works 100% of the time. Even the “cup and handle” pattern - which predicted Bitcoin’s 2024 rally - failed half the time in backtests. You need a system, not a holy grail.

Real Examples: Success and Failure

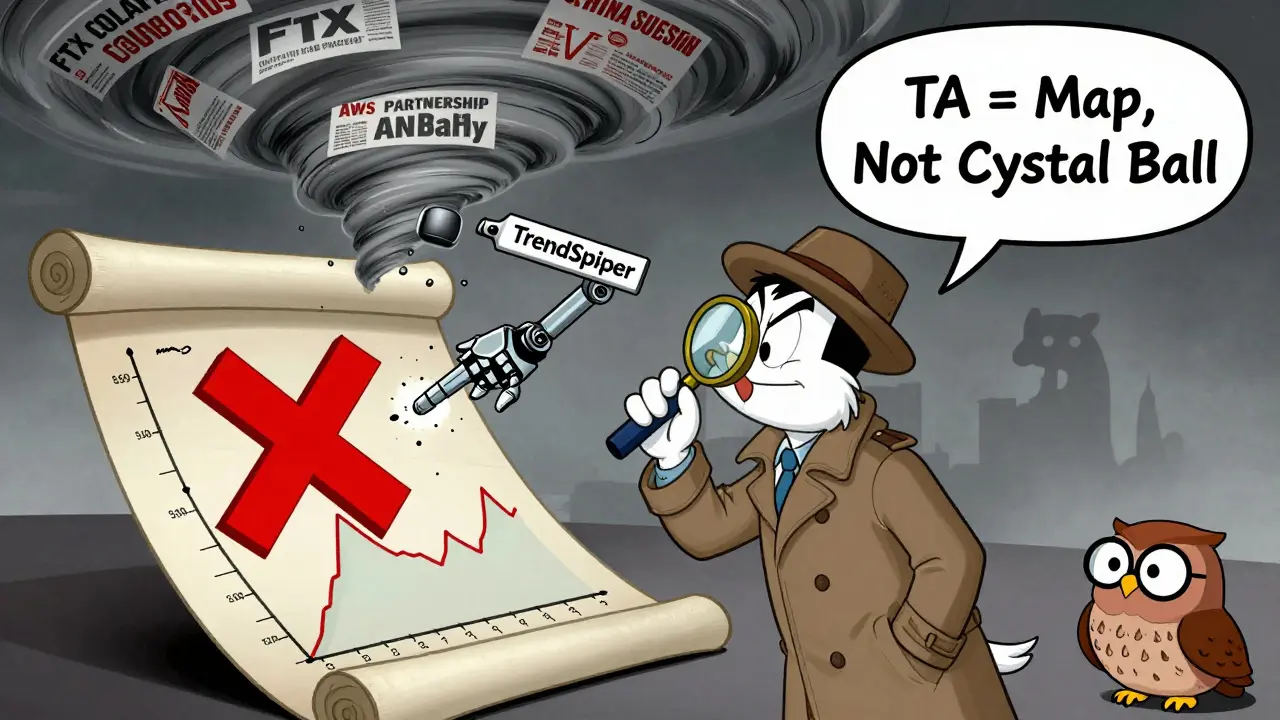

On Reddit’s r/CryptoMarkets, a trader named u/CryptoGains2025 turned $1,000 into $15,000 in six months. How? He used Fibonacci retracement levels (specifically the 61.8% level) on 4-hour charts, only entering when volume spiked. He didn’t overtrade. He waited for confluence. But another trader on Bitcointalk.org lost $20,000. He relied on the “head and shoulders” pattern on Ethereum. Then, Ethereum announced a surprise partnership with AWS. The price jumped 40% overnight. His pattern was broken. He didn’t account for news.That’s the lesson: TA is a tool, not a crystal ball. It’s most powerful when used with awareness - not blind faith.

What’s New in 2025?

TA isn’t stuck in the past. Platforms are evolving:- TradingView added Crypto-Specific Indicators in January 2025 - things like funding rate heatmaps and perpetual futures open interest. These show how much leverage traders are using, which can signal a coming squeeze.

- Kraken now overlays on-chain metrics like NUPL (Net Unrealized Profit/Loss) directly onto charts. This lets you see if most holders are in profit - a sign the market might be overheated.

- AI-powered tools like TrendSpider use machine learning to auto-detect chart patterns with 89% accuracy. They’re not replacing traders - they’re helping them spot what humans miss.

But the biggest trend? Integration. The future isn’t TA or on-chain analysis. It’s TA with on-chain data. Glassnode reported a 300% increase in users combining both in 2024. Why? Because crypto is too unpredictable for one method alone.

How to Get Started

You don’t need money. You don’t need fancy software. Here’s how to begin:- Go to TradingView (free tier is fine).

- Pick Bitcoin or Ethereum. Look at the weekly chart first. What’s the trend?

- Add the 50-day and 200-day moving averages. Watch for crossovers.

- Add RSI. Note when it goes above 70 or below 30.

- Look at volume bars. Are they rising with price? That confirms strength.

- Practice for 30 days. Don’t trade real money. Just mark entries and exits on paper.

Most beginners take 3-6 months to feel confident. That’s normal. You’re learning a new language - one spoken by millions of traders every day.

Final Thought: Is Technical Analysis Worth It?

Some say it’s astrology. Others say it’s the only thing keeping retail traders alive in a market dominated by algorithms. The truth? It’s neither. It’s a lens. A way to see what’s happening when everything else is chaos.If you’re trading crypto, you’re already playing a game of psychology. Technical analysis gives you the rules. It won’t make you rich overnight. But if you learn to read the charts - patiently, honestly, and without overcomplicating - it will give you an edge. Not a guarantee. But an edge.

Is technical analysis reliable for cryptocurrency?

Yes - but only if used correctly. TA works because crypto markets are driven by human emotion, which creates repeatable patterns. However, it fails during major news events like regulatory bans or exchange collapses. The most reliable TA setups combine multiple indicators and are confirmed by volume and trend context. Backtests show that three-confluence signals have over 80% accuracy, while single-indicator trades only win about 55-60% of the time.

Do I need to pay for charting tools to do technical analysis?

No. Most major exchanges - Binance, Coinbase Pro, Kraken - offer free charting with essential tools like moving averages, RSI, and volume. TradingView’s free plan includes all core indicators. You only need to pay ($14.95/month) if you want advanced features like alerts, custom scripts, or multi-chart layouts. You can learn and trade successfully for free.

Which technical indicators are most effective for crypto?

According to TradingView’s January 2025 data, the top three indicators used by crypto traders are: 200-day moving average (used by 68%), RSI (62%), and Bollinger Bands (57%). The Golden Cross (50-day MA crossing above 200-day) is one of the most watched signals. But effectiveness comes from combination - not single indicators. The best traders use trend direction (from daily/weekly charts), momentum (RSI), and volume confirmation together.

Can technical analysis predict Bitcoin’s next price move?

No - not with certainty. TA doesn’t predict the future. It identifies probable outcomes based on historical behavior. For example, if Bitcoin has consistently bounced off $60,000 three times before, there’s a higher chance it will bounce again. But if a major ETF approval drops tomorrow, all charts become irrelevant. TA gives you probabilities, not guarantees. Always combine it with risk management.

Why do some experts say technical analysis doesn’t work in crypto?

Critics like Dr. Nouriel Roubini argue that crypto is too volatile and unregulated for patterns to be reliable. They point to events like China’s 2021 ban or the FTX collapse, where price crashed despite strong technical signals. These are valid concerns. But most successful traders don’t rely on TA alone. They use it to time entries within a broader strategy that includes risk control and awareness of macro events. TA isn’t a crystal ball - it’s a map. And maps are useless if you ignore the weather.

How long does it take to learn technical analysis for crypto?

Most beginners reach basic proficiency in 3-6 months. The first 4-6 weeks should focus on reading candlesticks, identifying support/resistance, and understanding moving averages. After that, practice on historical charts. Look at past Bitcoin rallies and crashes. Try to predict what would’ve happened if you’d traded then. This builds intuition. Real trading comes later - after you’ve tested your strategy on paper.