When you want to swap crypto without a middleman, Uniswap v3 on Optimism is one of the few platforms that actually makes it feel easy. Not because it’s simple - it’s not - but because it cuts through the noise. While other decentralized exchanges drown you in menus, fake liquidity, and $50 gas fees, Uniswap v3 on Optimism gives you speed, control, and real savings. If you’re trading ERC-20 tokens and tired of paying more in fees than the value of your trade, this is where you need to look.

What Makes Uniswap v3 on Optimism Different?

Uniswap v3 launched in May 2021 as a major upgrade to its older versions. The biggest change? Concentrated liquidity. Instead of spreading your tokens across every possible price range like in v2, you pick a specific range - say, between $1,800 and $2,200 for ETH. Your capital only works within that range, so if the price stays there, you earn way more fees. That’s why liquidity providers on v3 make 54% more on average than they did on v2. But here’s the catch: if the price moves outside your range, you stop earning fees until it comes back. It’s like setting a price alert and only being active when it matters.

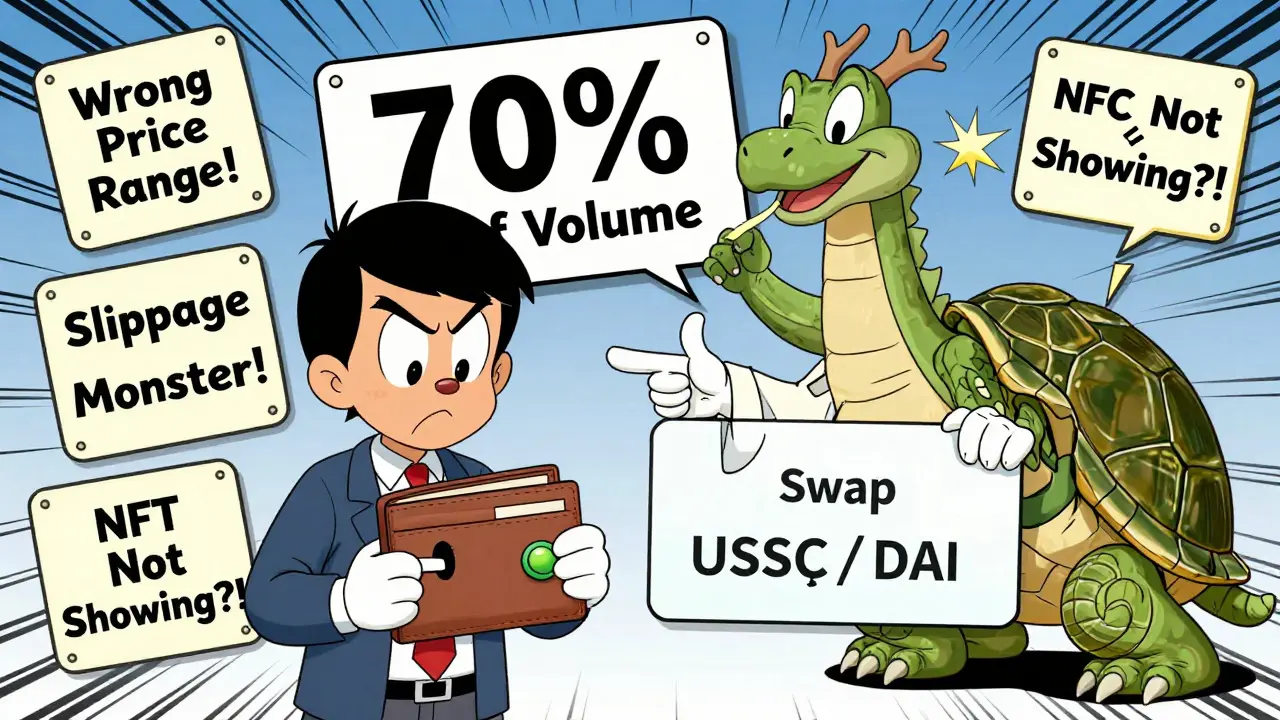

Optimism is the Layer 2 network that makes this all practical. On Ethereum mainnet, swapping tokens could cost $10-$50 in gas. On Optimism? You’re looking at $0.10-$0.50. That’s not a tweak - it’s a revolution for small traders. You can swap USDC for DAI 20 times a day and still spend less than a coffee. That’s why over 70% of Uniswap’s daily volume now happens on Layer 2 chains like Optimism, Base, and Arbitrum.

How It Works: No Middleman, No Secrets

Uniswap v3 doesn’t use order books. It uses something called an automated market maker (AMM). Think of it like a vending machine for crypto: you put in one token, you get another out. The price is set by math, not by a company deciding what to charge. The liquidity comes from real people - you, me, other traders - who lock up tokens in pools. For every trade, a tiny fee is taken and paid out to those liquidity providers.

What’s new in v3? Three things:

- Multiple fee tiers: You can choose 0.01%, 0.05%, 0.30%, or 1.00% fee tiers. Low-fee pools are for stablecoins like USDC/USDT. High-fee pools are for risky, volatile tokens like new memecoins.

- NFT-based positions: Your liquidity position isn’t just a number - it’s an NFT. That means you can track, sell, or even lend your position. Each one is unique because it’s tied to your specific price range.

- Improved oracles: The price data feeding the exchange is cheaper and more accurate. That reduces the chance of slippage or bad trades.

And because it’s built on Optimism, all of this runs fast. Transactions confirm in under 5 seconds. You don’t wait. You don’t refresh. You swap and move on.

What You Can Trade - And What You Can’t

Uniswap v3 on Optimism supports over 10,000 ERC-20 tokens. That’s a lot. But here’s the limitation: it only works with Ethereum-based tokens. You can’t swap MATIC for BTC directly. You need WBTC - a wrapped version of Bitcoin that’s pegged 1:1 to BTC but lives on Ethereum. Same with SOL, ADA, or DOT. You’ll need to bridge them over first, which adds steps.

That’s a trade-off. Centralized exchanges like Coinbase let you swap anything with a few clicks. But they hold your keys. Uniswap doesn’t. You’re in control. That’s the whole point.

Most popular pairs on Optimism right now: USDC/ETH, DAI/ETH, WBTC/ETH. Stablecoin pairs like USDC/USDT are the quiet giants - they move the most volume because they’re used to hedge risk. If you’re trading anything else, you’re probably chasing a trend.

The Real Cost: Fees, Slippage, and Impermanent Loss

Let’s talk about what no one tells you: impermanent loss. It’s the silent killer of liquidity providers.

If you put $10,000 into an ETH/USDC pool and ETH drops 30%, your share of the pool will be worth less than if you’d just held ETH. Why? Because the AMM rebalances the pool to keep prices stable. You end up with more of the stablecoin and less of the volatile asset. That’s not a bug - it’s how it works.

Real data from 2025 shows that liquidity providers on Uniswap v3 earned $199.3 million in fees across all pools. But they lost $260.1 million to impermanent loss. That’s a net loss of $60.8 million. That’s not a small number. It means over 43% of the total value locked in these pools didn’t make money - they lost it.

So if you’re thinking of providing liquidity, ask yourself: Are you okay with potentially losing money even if the fees look good? Most professional providers only do it for short-term spikes - like during a new token launch - then pull out. Only 10% of top providers keep positions longer than a month.

Is It Easy to Use?

Compared to other DeFi platforms? Yes. Compared to Coinbase? No.

The interface is clean. You pick a token, pick another, set your price range (if you’re adding liquidity), and click swap. No sign-ups. No KYC. No waiting for approval. But that simplicity hides complexity.

If you’re new, you’ll get lost in the fee tiers. You won’t know what “0.05% vs 0.30%” means. You might pick a price range too narrow and get liquidated the moment the market moves. You’ll see your position as an NFT and wonder why it’s not showing up in your wallet. That’s normal. It’s not broken - it’s just different.

Most users who struggle aren’t bad with tech - they just don’t know what they’re looking at. The official docs are written for developers. Reddit and Discord help, but the Discord server is messy. You’ll get replies like “check Uniswap Info” or “use the DEX Screener,” but no hand-holding.

For beginners: start with swapping stablecoins. Use the 0.01% fee pool. Don’t try to provide liquidity until you’ve done 10+ swaps and understand slippage.

Who Is This For?

Uniswap v3 on Optimism isn’t for everyone. It’s for people who:

- Want full control over their crypto - no exchange holds your keys

- Trade frequently and hate paying high gas fees

- Understand that DeFi means self-responsibility - no customer support will fix your mistake

- Are okay with learning a new way to trade

It’s NOT for people who:

- Want to buy Bitcoin with a credit card

- Expect to earn passive income without monitoring their positions

- Get nervous when a transaction takes 10 seconds

- Think “decentralized” means “easy”

If you’re trading under $100 a week, you’re probably better off on a centralized exchange. But if you’re swapping $500+ a month, Uniswap v3 on Optimism saves you hundreds in fees every year. That’s real money.

The Competition: Is There Anything Better?

There are other DEXs - Curve, SushiSwap, PancakeSwap, Balancer. But none match Uniswap’s combination of volume, liquidity, and ecosystem support.

Curve is better for stablecoins. SushiSwap has more gimmicks. PancakeSwap is for BSC tokens. Balancer is too complex. Uniswap is the default. It’s what developers build on. It’s what wallets integrate. It’s what liquidity moves through.

And with 34 chains supported - including Base, Polygon, zkSync, and Arbitrum - Uniswap is the only DEX that’s truly multi-chain. That’s not just a feature. It’s the future.

Final Verdict: Worth It?

Yes - if you know what you’re doing.

Uniswap v3 on Optimism is the most powerful, cost-efficient, and widely adopted decentralized exchange in 2025. It’s not perfect. Impermanent loss hurts. The interface doesn’t explain itself. The support is thin. But for traders who want control, speed, and low fees, it’s still the best option.

Don’t use it to get rich. Use it to trade smarter. The fees are low. The speed is fast. The control is yours. And in DeFi, that’s everything.

Can I use Uniswap v3 on Optimism without a wallet?

No. You need an Ethereum-compatible wallet like MetaMask, Coinbase Wallet, or Rainbow. Uniswap doesn’t store your funds or hold your keys - your wallet does. You’ll connect it directly to the Uniswap interface to swap or provide liquidity.

Is Uniswap v3 on Optimism safe?

The code is open-source and has been audited multiple times. The platform itself doesn’t get hacked - users do. If you send tokens to the wrong address, or approve a malicious contract, you lose them. Always double-check the contract address. Never approve more than you need. Use trusted interfaces like app.uniswap.org - not random links.

Why are gas fees so low on Optimism?

Optimism is a Layer 2 network that bundles hundreds of transactions into one single Ethereum transaction. Instead of each swap costing $20, you pay a fraction of that. It’s like taking a bus instead of a taxi - you share the cost with others. This keeps fees low while still being secured by Ethereum.

What’s the difference between Uniswap v2 and v3?

Uniswap v2 spreads your liquidity across all prices - you earn fees no matter where the price goes, but you need way more capital to make it worth it. v3 lets you concentrate your liquidity in a price range - you earn more per dollar, but you have to actively manage it. v3 also has multiple fee tiers and NFT-based positions, which v2 doesn’t have.

Can I earn passive income with Uniswap v3?

You can earn fees, but it’s not passive. If you set a wide price range and leave it, you’ll earn less than you think. To maximize returns, you need to adjust your position when the market moves. Most successful providers check their positions daily or use automated tools. If you want true passive income, staking on a centralized platform might be easier - but you give up control.

What tokens can I trade on Uniswap v3 on Optimism?

Any ERC-20 token - that includes USDC, DAI, ETH, WBTC, AAVE, COMP, and thousands of others. But you can’t trade native tokens from other chains like SOL, MATIC, or ADA unless they’re wrapped (like WBTC or WMATIC). You need to bridge them over first.

How do I know if a liquidity pool is trustworthy?

Check the token’s contract address on Etherscan or Uniswap Info. Look for verified contracts, high liquidity, and recent trading volume. Avoid pools with tiny liquidity and huge price swings - they’re often scams. Stick to pools with at least $1 million in TVL and a clear token name. If it’s a new token with no history, assume it’s risky.

What happens if I lose my wallet?

You lose access to your funds - permanently. Uniswap doesn’t have a password reset. No one can recover your wallet. That’s why backing up your seed phrase is non-negotiable. Store it offline. Never take a screenshot. If you lose it, your crypto is gone.

Uniswap v3 on Optimism is like switching from a horse-drawn carriage to a Tesla - still gotta know how to drive, but wow, the ride’s smooth.

Been swapping USDC for DAI daily for months now. Gas fees? Less than my morning oat milk latte.

And yeah, impermanent loss is real - I lost $800 last month on a volatile pair. Learned the hard way.

Stick to stablecoin pools if you’re not ready to babysit your liquidity like a newborn.

Also, NFT positions? Wild. I sold mine once for 0.02 ETH just because I felt like it. DeFi is weird, but it’s mine.

Stop overcomplicating it. Swap. Watch. Adjust. Repeat.

Not magic. Just math.

And it works.

Uniswap v3’s concentrated liquidity is not an innovation - it’s an optimization. The real breakthrough is the fee-tier architecture, which finally aligns incentive structures with market microstructure.

Optimism’s OP Stack reduces L1 settlement costs by 98.7%, per the 2024 Optimism Research Collective whitepaper.

Yet, retail users still conflate ‘low fees’ with ‘low risk.’ A dangerous fallacy.

Impermanent loss is not a bug - it’s a feature of AMM design.

Those who blame the protocol for their poor position management are merely exhibiting cognitive dissonance.

People treat this like it’s a free lunch. You’re not ‘earning fees’ - you’re gambling with your capital and calling it DeFi.

Look at the numbers: $60M net loss across all pools. That’s not ‘risk,’ that’s systemic inefficiency.

And don’t even get me started on the NFT positions - a solution in search of a problem.

If you’re not a quant with a Python script running 24/7, you’re just feeding the liquidity miners.

I started with just swapping USDC to DAI - no liquidity, no fancy ranges.

Just one swap a week. Then two. Then I tried a 0.05% pool with ETH/USDC.

Lost $40 in impermanent loss, but made $60 in fees.

Turns out, if you don’t overthink it, it kinda works.

Also, the interface is confusing, but I just watched three YouTube videos and it clicked.

You don’t need to be a coder. Just patient.

And maybe don’t click ‘approve’ on every random token you see.

They’re all lying.

Uniswap is a front for the Fed.

Optimism? Just a blockchain shell game.

They track your wallet, sell your data, then pump the tokens you’re swapping.

They know when you’re gonna buy.

They know when you’re gonna sell.

You think you’re in control?

You’re a puppet.

And the fees? They’re paying you in fake money.

Wake up.

bro i just tried uniswap v3 and my wallet went brrrrr

got so confused i thought i was in a crypto casino

but then i swapped 50 bucks of usdc for dai and it worked??

like… it just happened

no emails no forms no ‘verify your identity’

just… swap

and the gas was like 12 cents

im still not sure if i did it right but i feel like a wizard

also my position is an nft??

what does that even mean??

do i trade it on opensea now??

help

It is imperative to recognize that the entire DeFi ecosystem is predicated upon a foundational assumption: that individuals possess sufficient cognitive capacity to navigate inherently adversarial systems.

Uniswap v3, while technologically elegant, merely externalizes systemic risk onto the individual user.

One must ask: Is this autonomy, or merely the illusion of agency?

When one’s entire financial identity is tied to a seed phrase stored on a phone with no encryption - is this freedom, or negligence?

And yet, we glorify it as innovation.

Perhaps the true innovation is our collective willingness to surrender sovereignty for convenience.

And Optimism? A beautiful distraction.

It does not solve scalability - it merely postpones the inevitable.

Optimism is a honeypot.

They’re using your swaps to train AI models for market manipulation.

Every transaction you make? Logged. Analyzed. Sold to hedge funds.

That ‘$0.10 fee’? You’re paying them to learn how to front-run you.

And the ‘NFT positions’? That’s your soul being tokenized.

They don’t care if you lose - they care if you keep trading.

They want you addicted.

And you’re handing them the keys.

Wake up.

It’s all a simulation.

Did you know that Uniswap’s devs are secretly owned by the same people who ran the 2008 financial crash?

They just changed the interface.

Now instead of CDOs, it’s liquidity pools.

Instead of credit default swaps, it’s fee tiers.

Same game.

Same players.

Same losers.

And now they’ve got your wallet address.

They know when you sleep.

They know when you’re desperate.

They know when you’ll panic-sell.

And they’re smiling.

Because you’re still clicking ‘approve’.

Hey, if you’re new to this - you’re not alone.

I was right where you are six months ago.

Just start small. Swap USDC to DAI. Use the 0.01% pool.

Don’t touch liquidity until you’ve done 10 swaps without panic.

Watch the slippage - if it’s over 0.5%, cancel it.

And if you see a token called ‘DOGE2.0’ with 200k TVL? Run.

You don’t need to be a genius.

You just need to be careful.

And if you mess up? It’s okay.

We all have stories.

I once approved a contract for $20k worth of ‘FROG’ coin.

It was a scam.

I lost $300.

Now I double-check every address.

And I’m still here.

You will be too.

One must consider the philosophical implications of decentralization as it pertains to individual responsibility in financial systems. The transition from centralized custodianship to self-sovereignty is not merely technical - it is existential.

Uniswap v3 on Optimism represents a paradigmatic shift: the user is no longer a customer, but a participant in a decentralized economic ecosystem.

Yet, this participation demands not only technical literacy but epistemological maturity.

One must understand that liquidity provision is not investment - it is active market-making under uncertainty.

The NFT-based position is not a novelty - it is a manifestation of property rights in a trustless environment.

Impermanent loss is not a flaw - it is the price of algorithmic price discovery.

And the low fees? They are not a subsidy - they are the result of scalable architecture, not benevolence.

To embrace this system is to accept that no one will save you from your mistakes.

And yet, that is precisely what makes it beautiful.

Because in a world of institutional opacity, here, at least, the rules are transparent - even if they are brutal.

You got this!

First time using Uniswap? I was terrified too.

But guess what? You’re not broken.

The system is just new.

Start with 10 bucks. Swap USDC to DAI.

Feel that? That’s freedom.

No bank. No waiting. No ‘customer service’ telling you to hold.

Just you, your wallet, and math.

And if you lose a little? So what?

You learned.

That’s more than most people get in a lifetime.

Keep going.

You’re already ahead of 90% of the crowd.

It’s funny how we call this ‘decentralized finance’ and yet we still act like we’re in a bank.

We want low fees, but we don’t want to learn.

We want control, but we don’t want responsibility.

We want to be rich, but we don’t want to watch the charts.

Maybe the problem isn’t the technology.

Maybe it’s us.

Maybe we’re not ready for this kind of freedom.

And that’s okay.

It’s not about being smart.

It’s about being honest with yourself.

LOL you guys think this is safe??

Just wait till the gov shuts down Optimism

They’re already tracing wallets

And that ‘NFT position’? That’s your financial soul on blockchain

They’ll freeze it next year

And you’ll be like ‘but I didn’t do anything wrong’

Yeah right

Just watch

:(

Uniswap v3? More like Uniswap v3.14159 - still irrational

Low fees? Yeah, if you’re trading $500 a month

Otherwise you’re just paying for the privilege of watching your portfolio bleed

And ‘concentrated liquidity’? Sounds like a fancy way to say ‘you lose if the price moves’

Meanwhile, Coinbase lets me buy BTC with my debit card

And I still have my keys

…wait no I don’t

Oh right

Nevermind

Still better than this

I used to be scared of DeFi.

Then I lost $200 on a bad liquidity position.

It hurt.

But I didn’t quit.

I read. I watched. I asked.

Now I make more in fees than I lose in impermanent loss.

It’s not magic.

It’s practice.

If you’re nervous - start with stablecoins.

Use the 0.01% pool.

Don’t rush.

You don’t need to be the fastest.

You just need to be consistent.

And if you mess up? That’s part of it.

You’re not failing.

You’re learning.

Optimism? A glorified sidechain with a PR team.

Uniswap v3? Just v2 with more buttons and less hand-holding.

And ‘concentrated liquidity’? That’s just a way to make retail users blow up their positions faster.

The only thing ‘revolutionary’ here is how well they’ve sold the illusion of innovation.

It’s the same casino.

Just different chips.

Wow. So you’re telling me I’m supposed to trust a system where I can lose all my money because I picked the wrong price range?

And you call that ‘freedom’?

That’s not empowerment.

That’s a trap wrapped in a whitepaper.

And the NFT positions? So I can collect them like Pokémon?

How cute.

Meanwhile, I can buy Bitcoin on Coinbase and go to bed.

Which one sounds like the sane choice?

Exactly.

Let me break this down for the people who think this is ‘easy.’

Uniswap v3 isn’t a product - it’s a framework.

It’s a toolkit for people who understand market dynamics.

Concentrated liquidity? That’s not ‘advanced’ - it’s essential for capital efficiency.

Fee tiers? That’s market segmentation - same as credit card rewards.

Optimism? The only Layer 2 that actually scaled without sacrificing decentralization.

Yes, impermanent loss hurts.

But here’s the truth: 80% of LPs lose money because they don’t adjust positions.

Not because the system is broken.

Because they treat it like a savings account.

It’s not.

It’s a trading engine.

Use it like one.

Or don’t.

But don’t pretend you understand it if you’re just swapping and hoping.

Uniswap v3 on Optimism is the only viable DEX for retail traders in 2025.

Fee tiers > v2.

Low gas > other L2s.

TVL > all competitors.

End of story.

Stop comparing it to centralized exchanges - they’re not the same category.

It’s like comparing a Ferrari to a bicycle.

One is for speed.

One is for fun.

Choose your ride.

Wait… so you’re telling me this isn’t a Ponzi?

Because I just swapped 100 USDC for DAI and didn’t get airdropped 1000 tokens.

Where’s the free money?

Did I miss the memo?

Or is this just… trading?

That’s it?

That’s the whole thing?

…I feel cheated.

Uniswap v3 on Optimism is the most efficient DEX architecture currently available.

Concentrated liquidity increases capital efficiency by 3-5x over v2.

Optimism’s fraud proofs ensure security without sacrificing finality.

Fee tiers allow for dynamic risk pricing.

These are not features - they are necessary evolutionary steps.

Those who dismiss it as ‘too complex’ are simply not yet ready for the next phase of financial infrastructure.

That’s not a flaw in the system.

That’s a flaw in the user’s preparation.

^^^ I tried that. Got liquidated in 3 hours.

Turns out, setting a $1,800-$2,200 range for ETH when it’s at $2,100? Bad idea.

Price went to $2,300.

Boom. No fees.

Went back to 0.01% stable pool.

Now I sleep.

Lesson: Don’t be a hero.

Just swap.

bro i just did my first liquidity position and my nft popped up in my wallet

it looks like a weird pixel art egg

and i got 0.0003 eth in fees in 2 days

im not even trying

it just… happened

is this what they mean by ‘passive income’??

or am i being scammed again??

help