Early Crypto Regulations: How Rules Shaped Today's Blockchain Landscape

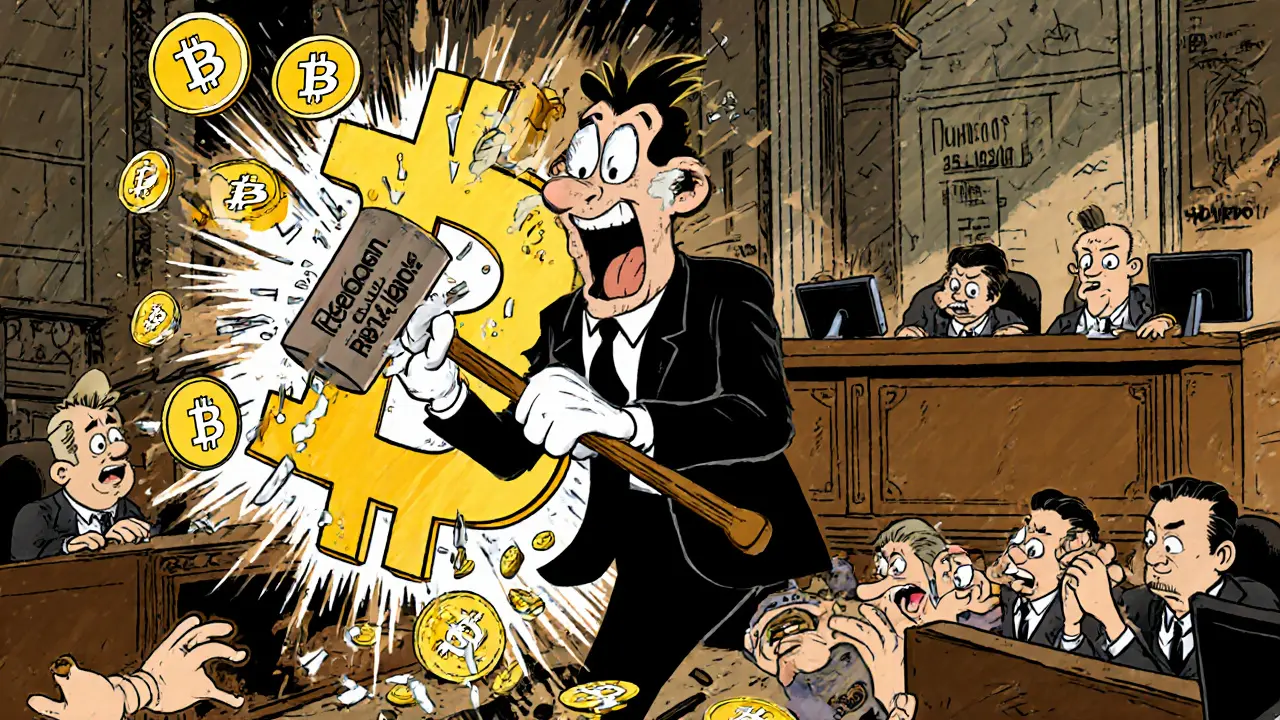

When early crypto regulations, the first government attempts to classify and control digital currencies like Bitcoin. Also known as cryptocurrency legal frameworks, these rules emerged in the early 2010s as regulators scrambled to understand something entirely new—money that wasn’t issued by banks or backed by governments. Back then, no one knew if Bitcoin was a currency, a commodity, or just code. The U.S. Treasury called it a convertible virtual currency. The IRS treated it as property. The SEC didn’t yet have a clear playbook. These weren’t just legal opinions—they became the blueprint for everything that followed.

Those early decisions didn’t just define Bitcoin—they shaped crypto compliance, the systems and standards crypto projects must follow to avoid legal trouble. When exchanges like Mt. Gox collapsed, regulators saw chaos. That pushed countries to demand KYC and AML checks. When ICOs exploded in 2017, the SEC stepped in with warnings—and later, enforcement actions. Now, every token launch, every airdrop, every DEX fee structure carries the weight of those early rulings. You can’t understand why the blockchain legal framework, the patchwork of laws governing how blockchains operate across borders feels so confusing today without seeing how it was built piece by piece from reactive, often contradictory, rules.

And it wasn’t just the U.S. Countries like Japan moved fast, licensing exchanges before others even had a definition. Russia banned domestic use but allowed cross-border Bitcoin trade. Iran restricted exchanges but didn’t ban crypto outright. These differences created a global mosaic of rules—and today’s crypto users are still navigating that maze. The crypto taxation, how governments track and tax crypto transactions as income, capital gains, or property rules you face now? They started with a single IRS notice in 2014. The airdrop scams you see today? They exist because early regulators didn’t define what a token actually is. And the exchanges you trust—or avoid—were built or shut down based on whether they met the first wave of compliance demands.

What you’ll find in the posts below isn’t just history. It’s the reason why a DEX fee in 2025 isn’t just about gas—it’s about legal risk. Why a token named CATALORIAN has no real value: because regulators never gave it a legal path. Why Costa Rica allows crypto businesses but not legal tender. Why Iran’s citizens trade on restricted platforms. Why you need to ask if an airdrop is real or just a loophole. The rules from ten years ago didn’t disappear—they became the invisible walls around every crypto action you take today.