Crypto Whale Tracking: Follow the Big Players and Avoid Their Traps

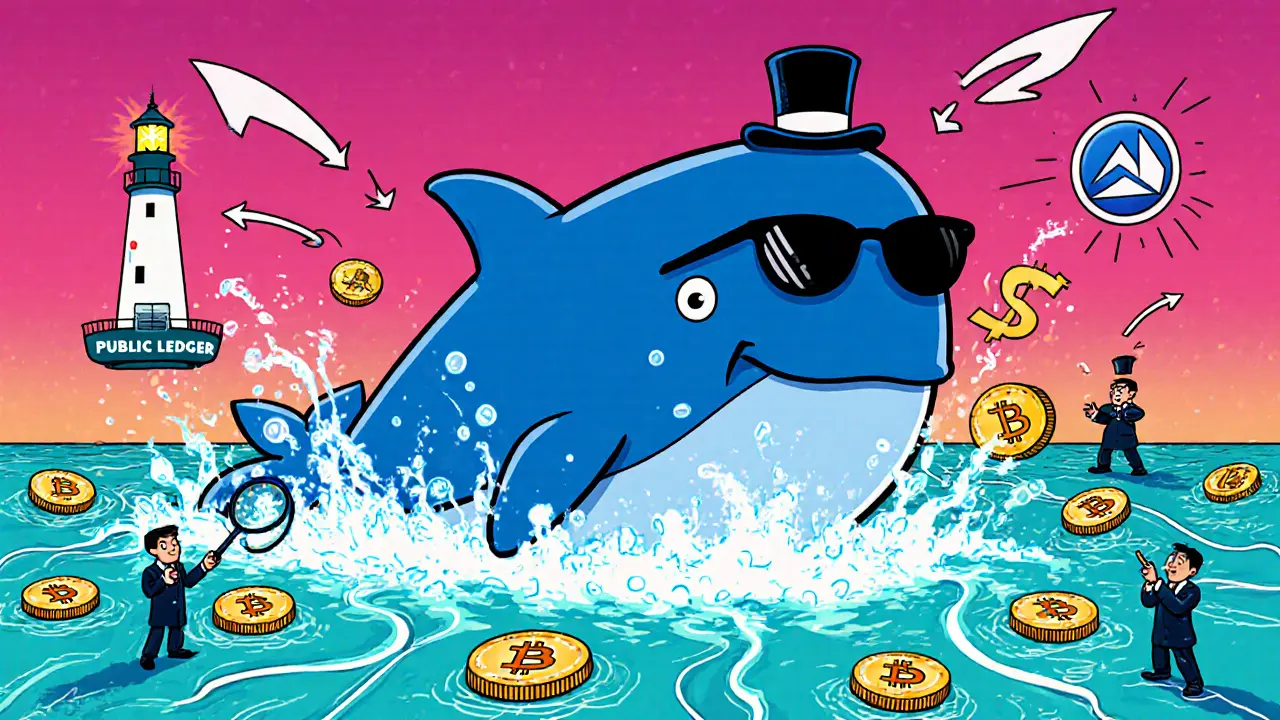

When you hear crypto whale tracking, the practice of monitoring large cryptocurrency wallets to spot major market moves. Also known as large wallet monitoring, it’s not magic—it’s data. These whales hold millions in crypto, and when they move, prices shake. You don’t need to be a trader to understand this: if one wallet buys 500 BTC all at once, the market notices. If another sells 20,000 ETH in small chunks over days, that’s a stealth move. Crypto whale tracking is about reading those signals before they turn into price spikes or crashes.

But here’s the catch: most people think whale tracking means copying their moves. That’s dangerous. Whales don’t trade to help you profit—they trade to exit, accumulate, or manipulate. Some use fake wallets to create false volume. Others dump small amounts to lure retail buyers in before slashing prices. Tools like blockchain analytics, software that traces on-chain transactions across public ledgers show you where money flows, but they don’t tell you why. That’s where context matters. You need to know if a whale is moving coins to an exchange (likely selling), locking them in a staking contract (likely holding), or sending to a new wallet (possibly preparing for a big move). large wallet addresses, unique identifiers for crypto accounts holding significant sums are public, but their intent isn’t. That’s why tracking alone isn’t enough—you need to pair it with volume trends, exchange inflows, and news.

And that’s exactly what this collection covers. You’ll find real breakdowns of tokens that got crushed after whale exits, airdrops that turned out to be empty shells designed to lure attention, and exchanges that vanished right after big holders pulled out. You’ll learn how to spot when a "hot" token is just a whale’s exit ramp. No fluff. No hype. Just what the chain actually shows—and what it doesn’t. Below, you’ll see how crypto whale tracking isn’t about following the big guys. It’s about seeing through them.