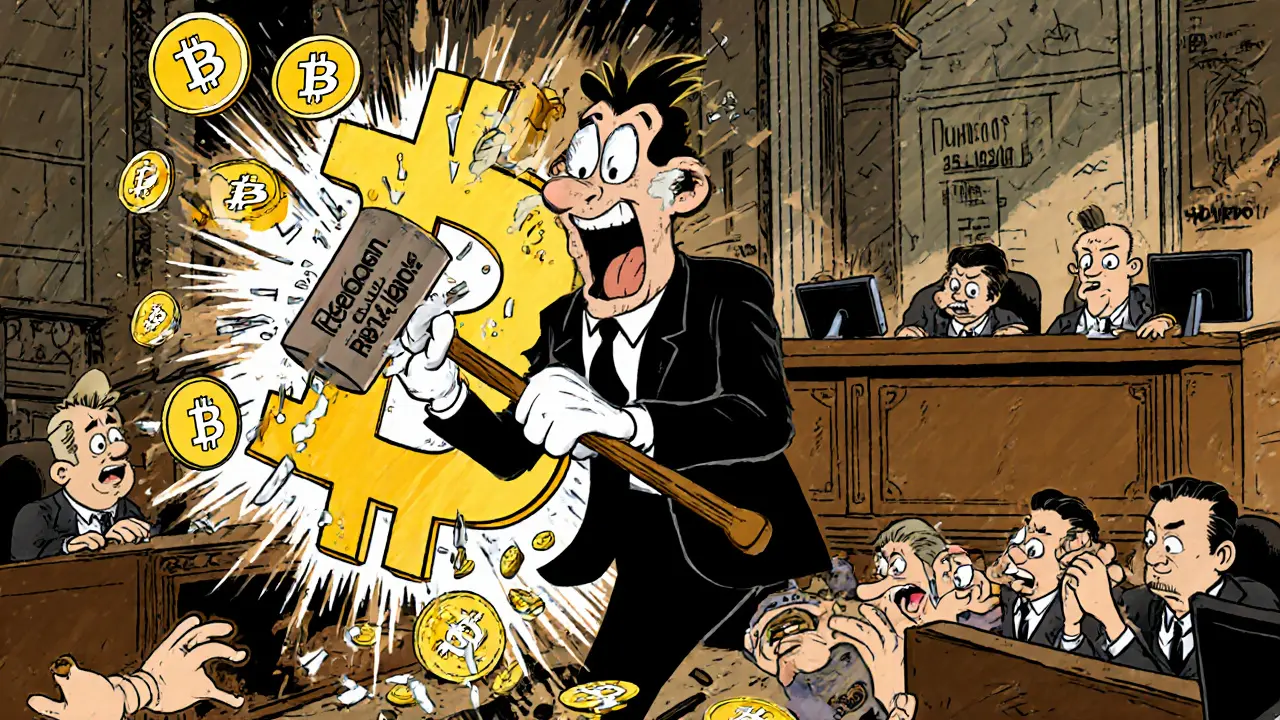

Bolivia Cryptocurrency Ban: What It Means for Users and Traders

When Bolivia cryptocurrency ban, a 2014 central bank decree that made all cryptocurrency transactions illegal within the country. Also known as crypto prohibition in Bolivia, it was one of the earliest and strictest moves by a national government to shut down digital currencies outright. Unlike countries that regulate crypto with licensing or taxes, Bolivia didn’t just discourage it — it criminalized it. The ban targets banks, payment processors, and individuals who trade, hold, or transfer Bitcoin, Ethereum, or any other digital asset. But here’s the twist: people still do it.

The ban doesn’t stop Bolivians from using crypto. Many rely on peer-to-peer platforms, local traders, or foreign exchanges to buy and sell Bitcoin. Some use it to send money home from abroad, bypassing expensive wire transfers. Others trade on Telegram groups or WhatsApp networks, where cash-for-Bitcoin deals happen in person. This underground market thrives because the economy is unstable, inflation is high, and the national currency, the boliviano, loses value. Crypto isn’t a luxury here — it’s a workaround. Meanwhile, crypto regulation Bolivia, the legal framework that enforces the ban and monitors financial institutions. Also known as Bolivian financial controls, it’s enforced through the Central Bank of Bolivia, which threatens fines and jail time for banks that facilitate crypto trades. But enforcement is inconsistent. Rural areas see little to no oversight, and even in cities, authorities rarely prosecute individuals — only institutions.

Compared to neighbors like South America crypto, the regional trend of varying crypto policies across Latin American nations. Also known as Latin American digital currency adoption, it includes countries like El Salvador, which made Bitcoin legal tender, or Argentina, where crypto is widely used to fight inflation, Bolivia stands out as an outlier. While other countries in the region are experimenting with digital pesos or crypto-friendly banks, Bolivia doubled down on prohibition. Yet, its citizens are more crypto-savvy than ever. They’ve learned how to trade without banks, how to store keys securely, and how to spot scams — skills that aren’t taught in schools but are learned out of necessity.

The crypto exchange restrictions, rules that block access to international platforms or freeze accounts tied to crypto activity. Also known as financial access limits in Bolivia, these restrictions push users into risky, unregulated channels aren’t just about control — they’re about fear. The government worries about money laundering, capital flight, and loss of monetary sovereignty. But the real cost is innovation. Young entrepreneurs can’t build DeFi apps. Small businesses can’t accept crypto payments. Even remittance services struggle to operate legally. And while the ban remains on paper, the market has already moved on.

What you’ll find below are real stories and breakdowns of how people in Bolivia and similar regions navigate crypto under pressure — from the scams they avoid to the tools they use when banks won’t help. These aren’t theoretical guides. They’re survival manuals written by people who refused to wait for permission to use money that works.