MagicSwap Slippage Calculator

Calculate Your Trade Impact

MagicSwap has limited liquidity, which means your trades can experience significant slippage. Enter your trade amount to see:

- Expected slippage percentage based on MagicSwap's average 0.685% spread

- Total cost including slippage

- Comparison to Uniswap's typical lower slippage

- Recommendation based on trade size

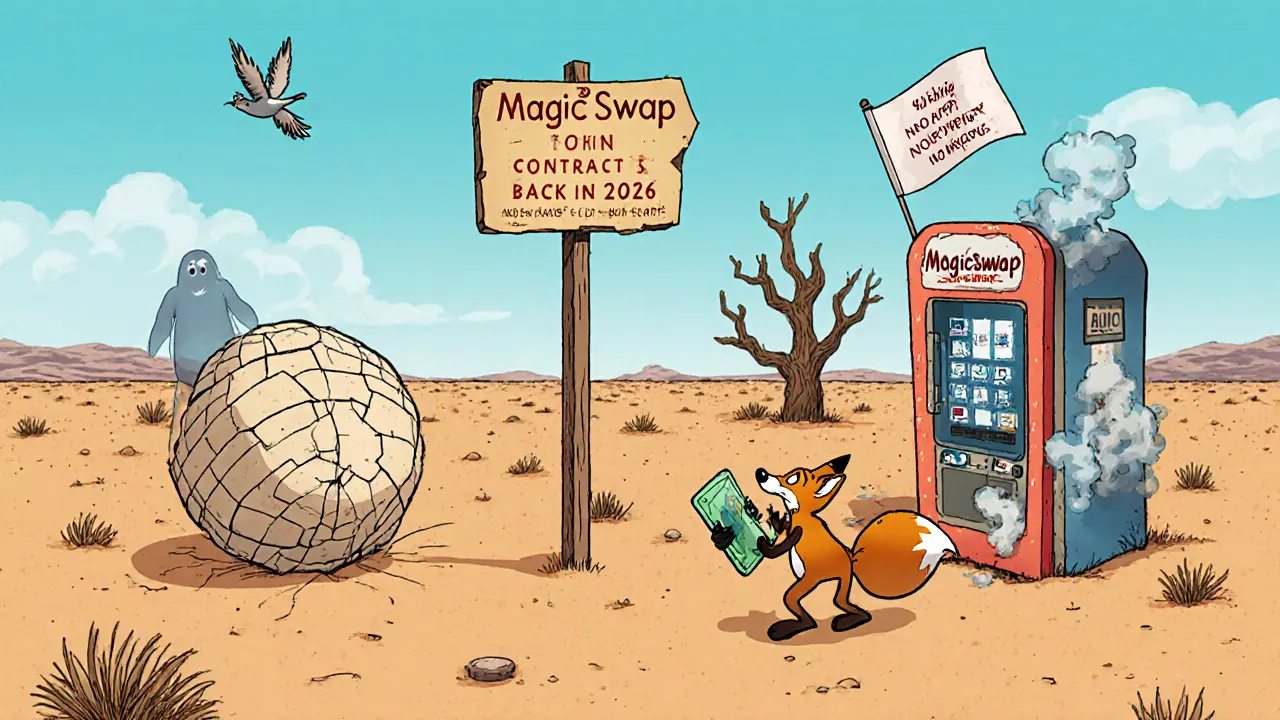

If you’re looking for a new crypto exchange that doesn’t require KYC and lets you trade directly from your wallet, you might have heard of MagicSwap. But here’s the reality: MagicSwap isn’t another Uniswap or PancakeSwap. It’s tiny. And that’s not necessarily a bad thing - if you know what you’re getting into.

What Exactly Is MagicSwap?

MagicSwap is a decentralized exchange (DEX) that launched in 2023. That means no central company controls it. No one holds your keys. No one can freeze your funds. You trade directly through smart contracts on the blockchain. That’s the whole point of DeFi - control, transparency, and no middlemen. But unlike bigger DEX platforms that support hundreds of tokens, MagicSwap only offers 3 coins and 4 trading pairs. That’s it. You won’t find Bitcoin, Ethereum, or Solana here. You won’t even find popular memecoins like Dogecoin or Shiba Inu. The selection is intentionally narrow, which tells you this isn’t built for mass adoption yet.How Does It Work?

Using MagicSwap is similar to other DEXs. You connect your Web3 wallet - probably MetaMask or WalletConnect - and you’re good to go. No sign-up. No email verification. No identity checks. You just trade. The platform only does spot trading. No margin. No leverage. No futures. If you’re looking to go long on a coin with 5x leverage, you’ll need to look elsewhere. MagicSwap is strictly for buying and selling tokens at current market prices. One thing that stands out: there are no market-making fees. That’s rare. Most DEXs charge small fees to liquidity providers or use automated market makers that indirectly cost traders more. MagicSwap skips that. That could mean lower costs for frequent traders - if the liquidity is there.Liquidity and Trading Spreads

This is where MagicSwap gets tricky. The average bid-ask spread is around 0.685%. That’s not terrible. For comparison, Uniswap’s average spread on major pairs like ETH/USDC is often under 0.3%. On smaller, less liquid tokens, it can hit 2% or more. So MagicSwap’s spread sits in the middle - decent for a small DEX, but not competitive with the giants. The real issue? Liquidity depth. MagicSwap ranks in the 19th percentile for order book depth. That means if you try to trade more than a few hundred dollars’ worth of a token, you’ll likely get slippage. Slippage is when the price moves against you during your trade because there aren’t enough buyers or sellers. Imagine you want to buy $500 worth of $MAGIC (the platform’s native token). You set a 1% slippage tolerance. But because there’s so little liquidity, the system has to pull from shallow pools. Your $500 trade ends up costing you $518. That’s not a glitch - that’s how small DEXs work.

Why It’s Hard to Compete

MagicSwap doesn’t have yield farming. No staking. No liquidity mining rewards. No governance tokens you can vote with. It doesn’t even have a mobile app. Compare that to SushiSwap, which lets you earn interest just by locking up your tokens. Or PancakeSwap, which has lotteries, NFTs, and a whole ecosystem. Even newer DEXs like Curve or Balancer offer advanced tools like concentrated liquidity. MagicSwap is barebones. And in 2025, that’s a problem. Traders don’t just want to swap tokens - they want to earn, farm, and grow their holdings. MagicSwap doesn’t offer any of that.Who Is This For?

Honestly? Only two kinds of people should use MagicSwap right now:- Those who already hold one of the three tokens listed and need to swap them without using a centralized exchange.

- Early adopters testing new DeFi projects, willing to accept high slippage and low volume for the chance to get in early.

No User Reviews? That’s a Red Flag

You won’t find many reviews on Reddit, Twitter, or even crypto forums. That’s not because MagicSwap is secret. It’s because almost no one is using it. A DEX with zero community feedback is like a restaurant with no customers and no online ratings. Maybe the food is amazing. Or maybe no one’s brave enough to try it. There are no documented cases of hacks, rug pulls, or smart contract exploits - but that’s because there’s barely any money on the platform. The risk is low because the stakes are low.

Gas Fees and Wallet Setup

MagicSwap runs on Ethereum-compatible chains, so you’ll pay Ethereum gas fees when you trade. That means you need ETH in your wallet to cover transaction costs. If you’re trading small amounts, the gas fee might be higher than the trade itself. You’ll also need to understand slippage settings, approval limits, and how to check token contracts before connecting your wallet. If you’re new to DeFi, MagicSwap isn’t the place to learn. Start with Uniswap or QuickSwap first.Is MagicSwap Safe?

Technically, yes - as long as the smart contracts haven’t been compromised. But safety isn’t just about code. It’s about liquidity, volume, and community trust. No audits are publicly listed. No security firm has published a report. That’s not normal for a platform that handles real money. Even small DEXs like SushiSwap or 1inch had audits within months of launch. If you’re trading $100 worth of tokens? Fine. If you’re trading $10,000? You’re taking a gamble.The Verdict: Too Early to Bet On

MagicSwap isn’t a scam. It’s not a Ponzi. It’s just… unfinished. It’s a prototype. A testnet with a website. A DEX that could grow - if it gets funding, liquidity, and users. But right now, it’s not ready for anyone who isn’t actively hunting for low-volume alpha. If you’re looking for a reliable place to swap crypto, stick with Uniswap, PancakeSwap, or Raydium. They’re bigger, safer, and have way more options. If you’re curious and want to see what happens when a new DEX tries to enter a saturated market? Go ahead. Connect your wallet. Trade $20. See how it feels. But don’t expect miracles. Don’t expect support. Don’t expect volume. MagicSwap might become something. Or it might vanish in six months. No one knows. And that’s the biggest risk of all.Is MagicSwap a legitimate crypto exchange?

Yes, MagicSwap is legitimate in the sense that it’s a real smart contract-based DEX with no evidence of fraud or theft. But legitimacy doesn’t mean safety or reliability. It’s a low-volume, low-liquidity platform with no public audits or community reviews. Use it only with small amounts you’re willing to lose.

What coins can I trade on MagicSwap?

MagicSwap currently supports only 3 cryptocurrencies and 4 trading pairs. The exact tokens aren’t publicly listed in detail, but they’re likely small-cap or platform-native tokens. You won’t find Bitcoin, Ethereum, or any major coins. Always check the token contract address before trading - there’s no official list.

Does MagicSwap have a mobile app?

No, MagicSwap does not have a mobile app. You can only access it through a web browser using a Web3 wallet like MetaMask. There’s no iOS or Android version, and no plans for one have been announced.

Can I earn interest or stake tokens on MagicSwap?

No, MagicSwap offers no staking, yield farming, or liquidity mining rewards. It’s purely a spot trading platform. If you want to earn passive income from your crypto, you’ll need to use a different platform like Aave, Compound, or PancakeSwap.

Is MagicSwap better than Uniswap?

No, MagicSwap is not better than Uniswap. Uniswap supports over 10,000 tokens, has billions in liquidity, and offers advanced features like concentrated liquidity pools. MagicSwap supports 3 tokens and has less than 0.1% of Uniswap’s volume. For almost every use case, Uniswap is faster, cheaper, and safer.

What’s the minimum amount I can trade on MagicSwap?

There’s no official minimum trade size. You can trade as little as $1. But because of gas fees on Ethereum-compatible chains, trading under $20 often isn’t worth it. The transaction fee might cost more than your trade profit.

Does MagicSwap require KYC?

No, MagicSwap does not require KYC. Like all decentralized exchanges, you trade directly from your wallet without providing any personal information. This is one of its few advantages over centralized exchanges like Binance or Coinbase.

What wallet works with MagicSwap?

MagicSwap works with any Web3 wallet that supports Ethereum Virtual Machine (EVM) chains - including MetaMask, Trust Wallet, and WalletConnect. You need to have ETH or a compatible native token (like BNB or MATIC) to pay for gas fees. Always verify the MagicSwap website URL to avoid phishing scams.

Been using MagicSwap for a week now with $20. Honestly? It works. No drama, no rug pulls, just clean swaps. If you're not trying to move big money, it's fine. I like that there's no fluff - no staking, no lottery, no hype. Just trade and go.

It is, of course, entirely predictable that a platform with such minimal liquidity and zero governance structure would emerge in this phase of the crypto cycle - a classic symptom of speculative fatigue and the commodification of decentralization. One must ask: if a DEX cannot offer yield, cannot scale, and cannot even maintain a public audit trail, is it truly decentralized, or merely a hollow shell masquerading as innovation? The absence of community feedback is not neutrality - it is abandonment.

I get why people are skeptical, but I tried it out of curiosity - traded $15 of $MAGIC for $WARP and back. Gas was a pain, yeah, but the trade went through fine. No slippage over 2% if you keep it under $50. It’s not for everyone, but if you’re just moving small amounts and don’t trust CEXes? It’s a quiet little tool.

THIS IS THE FUTURE. NO KYC. NO BORING STAKING. JUST PURE TRADING. WHY DO YOU WANT MORE? YOU WANT A FANCY APP? YOU WANT TO EARN INTEREST? GO BACK TO YOUR BANK. THIS IS DEFI. NOT A BANK WITH A DIFFERENT LOGO.

Let me ask you this: who funded MagicSwap? No audits. No team disclosure. No whitepaper. Zero social presence. That’s not a startup - that’s a honeypot. They’re waiting for someone to deposit $5k, then drain the pool with a flash loan and vanish. This isn’t DeFi. It’s a digital trap.

I appreciate how honest this review is. MagicSwap feels like a prototype someone built over a weekend - and honestly, that’s kind of beautiful. It’s not meant to compete with Uniswap; it’s meant to exist as a quiet experiment. Sometimes, the most interesting projects are the ones that don’t shout.

they're watching you. every trade. every wallet connection. they're building a profile. this isn't a dex - it's a surveillance tool disguised as freedom. 💀

Canada’s got a whole bunch of people thinking this is ‘innovation.’ Bro, it’s a side project with a domain name and a MetaMask button. If you’re not trading on Uniswap or Pancake, you’re not in the game. You’re just playing pretend.

For beginners exploring DeFi, I strongly recommend starting with platforms that offer educational resources, clear documentation, and community support. MagicSwap, while technically functional, lacks these foundational elements. Consider using Uniswap or SushiSwap to build confidence before venturing into niche DEXs.

Oh wow, a DEX with three tokens. How avant-garde. Did they also forget to add a logo? Or maybe the team just took a nap after writing the smart contract? Truly, the pinnacle of Web3 innovation - minimalism as a business model.

Wait-so you’re saying… there’s NO staking? NO yield? NO governance? NO APP? And you’re calling this a ‘DEX’? That’s not a platform-that’s a glitch. And you’re seriously recommending this? What even is your definition of ‘useful’?

bro magic swap is lit!! i trade 100$ daily on it!! gas fee is high but i dont care!! i love the vibe!! no kyc no problem!! the team is real!! they are from india!!

Y’all are overthinking this. MagicSwap is the crypto equivalent of that tiny taco truck no one talks about but the locals swear by. You don’t go there for the menu - you go because you trust the guy flipping the tacos. I’ve traded $300 total. No issues. No drama. No screaming marketing. Just clean swaps. I’m not rich, I’m not a whale - I’m just someone who likes things simple. This is it. 🌮🔥

Zero audits. Zero reviews. Zero transparency. This is exactly how rug pulls begin. People think they’re being ‘decentralized’ when they’re just being reckless. If you can’t prove you’re safe, you’re not safe. End of story.

It’s not that MagicSwap is bad. It’s that the entire crypto ecosystem has become a theme park. Everyone wants roller coasters, merch, and NFTs. MagicSwap is the bench in the corner where you sit and just watch the sky. Maybe that’s the real rebellion.

why do you care about liquidity if you are not a whale you are just a small trader you just need to swap your tokens stop acting like you are running a hedge fund

I’ve seen so many people trash this project, but I think it’s worth remembering that not every project needs to be a giant. Sometimes the quiet ones are the ones that last. I’m not putting money in - but I’m keeping an eye on it. Maybe it’ll surprise us.

My friend used this to swap some leftover tokens from a dead project. Took 2 minutes. Paid $0.80 in gas. No issues. It’s not glamorous, but it did exactly what it promised. Sometimes that’s enough.

They’re gonna drain the liquidity next week. I’ve seen this script before. No audits, no team, no community. Just a website and a promise. They’ll make one big trade, pull the plug, and disappear. You think you’re being ‘decentralized’? You’re just the bait.

I’m not here to hype it or trash it. I just traded $12 and it worked. No drama. No panic. No 2000-word threads. Sometimes that’s the most valuable thing you can say about a crypto tool.

Actually, I think the lack of staking and yield farming is kind of refreshing. Most DEXs feel like casinos now. MagicSwap just lets you swap. No pressure. No FOMO. Just trade. It’s like a digital coffee shop - not a nightclub.