When you deposit ETH and USDC into a DeFi liquidity pool, you’re not just adding money-you’re setting up a tiny marketplace that runs on math. That math is called the liquidity pool token ratio. It’s what keeps prices fair, trades smooth, and your money from vanishing when prices swing. Most people think liquidity pools are like bank accounts. They’re not. They’re automated trading engines, and the ratio between the tokens inside them is the engine’s blueprint.

How Token Ratios Work in Simple Terms

Imagine a pool with 100 ETH and 200,000 USDC. That’s a 50/50 ratio by value, not by count. Every time someone swaps ETH for USDC, the pool adjusts. If someone buys 10 ETH, the pool gives them those 10 ETH but takes 20,000 USDC in return. Now the pool has 90 ETH and 220,000 USDC. The ratio changed. That’s how the price of ETH goes up in the pool-because there’s less of it left. This is based on the constant product formula: x × y = k. x is the amount of one token, y is the other, and k is a fixed number that never changes. As x goes down, y has to go up to keep k the same. That’s automatic price discovery. No order books. No middlemen. Just math. Most DeFi apps like Uniswap, SushiSwap, and PancakeSwap use this model. If you want to add liquidity, you have to put in equal dollar value of both tokens. Put in $1,000 of ETH? You need $1,000 of USDC. The system won’t let you do otherwise. That’s the default 50/50 ratio.Why 50/50 Isn’t Always Best

The 50/50 rule works fine for unrelated assets like ETH and USDC. But what if you’re pairing two stablecoins-USDC and DAI? Or two tokens that move together, like WBTC and BTC? Keeping them at 50/50 wastes capital. Why? Because their prices rarely change relative to each other. That’s where weighted pools come in. Balancer was the first to let you set custom ratios-like 80/20, 70/30, even 95/5. A pool with 80% USDC and 20% DAI makes sense if you expect DAI to stay close to $1. You’re not locking up half your money in something that barely moves. You’re optimizing for efficiency. Curve Finance took this further. Their stableswap algorithm keeps ratios almost perfectly balanced for stablecoin pairs. It doesn’t use the constant product formula. Instead, it uses a hybrid model that minimizes slippage. Swap 1,000 USDC for DAI? You get almost exactly 1,000 DAI. No surprise price jumps. That’s why Curve dominates stablecoin trading.Concentrated Liquidity: The New Game Changer

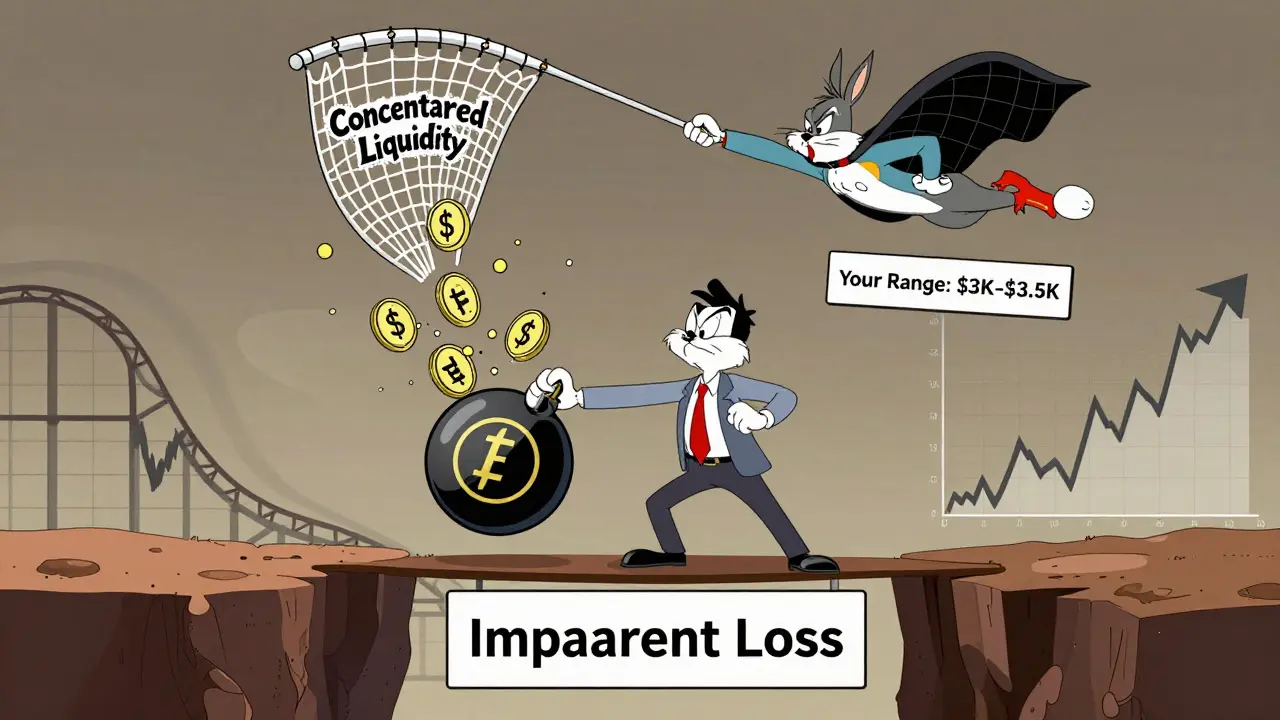

Uniswap v3 changed everything in 2021. It introduced concentrated liquidity market makers (CLMM). Instead of spreading your money across every possible price, you pick a range-say, between $3,000 and $3,500 for ETH/USDC. All your liquidity only works within that band. This means you can put $10,000 into a CLMM pool and get the same trading depth as $100,000 in a traditional pool. Capital efficiency skyrockets. But there’s a catch: if ETH drops below $3,000 or rises above $3,500, your liquidity stops working. You’re not earning fees anymore. You have to manually adjust your range. This isn’t for beginners. It’s for people who watch the market, track price trends, and can predict where trading will cluster. In 2025, over 60% of new liquidity on Uniswap is concentrated. That’s how much the industry has shifted.

What Are LP Tokens, and Why Do They Matter?

When you deposit tokens into a pool, you don’t just get a receipt. You get an LP token-a digital proof of your share in that pool. If you put in 1% of the total value, you get 1% of the LP tokens. These tokens represent three things:- Your share of the underlying tokens (ETH, USDC, etc.)

- Your share of trading fees collected by the pool

- Your right to withdraw your original deposit plus fees

Impermanent Loss: The Hidden Cost

This is where most people lose money without realizing it. Impermanent loss happens when the price of one token in the pair moves significantly compared to the other. Say you deposit 1 ETH and 2,000 USDC into a 50/50 pool. ETH is $2,000 at that moment. A week later, ETH rises to $4,000. The pool rebalances. Arbitrage traders buy ETH from the pool (because it’s cheaper than on exchanges), driving the pool’s ETH down and USDC up. When you withdraw, you might get 0.7 ETH and 2,800 USDC. That’s $4,800 total. But if you’d just held the ETH and USDC outside the pool, you’d have 1 ETH ($4,000) and 2,000 USDC ($2,000)-$6,000 total. You lost $1,200. That’s impermanent loss. It’s called “impermanent” because if ETH drops back to $2,000, the loss disappears. But if you withdraw before it rebounds, it becomes permanent. The bigger the price swing, the bigger the loss. That’s why experts recommend:- Using 50/50 pools only for volatile, unrelated assets

- Using weighted or stable pools for correlated assets

- Avoiding pools with tokens that have wildly different volatility

How to Choose the Right Ratio for Your Strategy

Not all liquidity pools are created equal. Your goal determines your ratio:- Maximize fees → Use concentrated liquidity on high-volume pairs like ETH/USDC within a tight price range

- Minimize risk → Stick to stablecoin pools (Curve) or 80/20 weighted pools with one stable asset

- Speculate on price → Use CLMM and bet on where the price will go. High reward, high risk

- Long-term holding → Avoid pools entirely. Just hold the tokens. Liquidity provision is not passive income-it’s active trading with your capital

What Happens When Ratios Get Out of Whack?

If a token’s price on an exchange spikes but the pool doesn’t adjust fast enough, arbitrage traders step in. They buy the cheap token from the pool and sell it on the open market. That brings the pool’s price back in line. This is healthy. It keeps the system fair. But it also means you’re indirectly funding those traders. Every time they rebalance your pool, you lose a little value to impermanent loss. The more volatile the asset, the more often this happens. That’s why ETH/USDC pools have higher fees than USDC/DAI pools. The risk is higher, so the reward is higher.What You Need to Get Started

You don’t need to be a coder to use liquidity pools. But you do need:- A wallet that supports the blockchain (MetaMask for Ethereum, Trust Wallet for BSC)

- Sufficient gas fees (ETH, BNB, etc.) to pay for transactions

- Understanding of the token pair’s volatility

- Clear reason for why you’re providing liquidity

What’s Next for Liquidity Pool Ratios?

Uniswap v4, launching in early 2026, will let developers build custom pool logic using “hooks.” Imagine a pool that automatically shifts its ratio when volatility spikes. Or one that adds liquidity when price moves past a certain point. This isn’t science fiction-it’s coming. On-chain analytics tools are also getting smarter. You’ll soon be able to see real-time ratio drift, impermanent loss projections, and optimal rebalancing triggers-all inside your wallet. The future of DeFi liquidity isn’t about just depositing and forgetting. It’s about actively managing your ratios, understanding the math behind them, and aligning them with your market view.What happens if I deposit unequal amounts of two tokens in a liquidity pool?

Most DeFi platforms won’t let you. Pools like Uniswap and PancakeSwap require equal dollar value of both tokens to maintain the 50/50 ratio. If you try to deposit more of one token, the system will automatically swap the excess to match the required ratio before adding liquidity. This prevents imbalance and ensures fair pricing.

Can I lose money even if the token price goes up?

Yes. If the price of one token in the pair rises sharply compared to the other, the pool rebalances, and you end up with more of the stable token and less of the rising one. Even if the total value of your position increases, you could have made more by just holding the tokens outside the pool. This is called impermanent loss, and it’s a key risk in liquidity provision.

Are 80/20 liquidity pools safer than 50/50?

It depends. An 80/20 pool reduces your exposure to the more volatile asset, so if one token crashes, you lose less. But it also means you earn fewer fees if the minority token trades heavily. These pools are best for stablecoin pairs or when one token is a governance token with low trading volume. They’re not inherently safer-they’re just differently risky.

Why do stablecoin pools like USDC/DAI have lower APY than ETH/USDC?

Because stablecoins rarely move in price relative to each other. Less price movement means less trading activity and fewer fees generated. ETH/USDC has high volatility, so traders swap back and forth constantly, creating more fee revenue. Higher fees = higher APY. Stable pools trade volume for stability.

Do I need to manually rebalance my concentrated liquidity position?

Yes. In concentrated liquidity pools like Uniswap v3, your liquidity only earns fees within your chosen price range. If the market moves outside that range, you stop earning fees until you adjust your range. Many users use tools like DeFi Saver or Zapper to automate this, but it’s still an active task-not passive.

Love how this breaks down the math without jargon. I used to think LPs were just passive income, but now I get it-they’re like being a market maker in a tiny, chaotic bazaar.

Thanks for the clarity.

Oh wow, another ‘DeFi for dummies’ guide. Did you forget to mention that your ‘equal dollar value’ requirement is just a capitalist illusion designed to funnel wealth to arbitrage bots? I mean, come on.

At least acknowledge the systemic exploitation before pretending this is ‘fair math.’

The constant product formula is not ‘magic.’ It’s a deliberate design choice with known inefficiencies. Your conflation of ‘math’ with ‘fairness’ is a category error.

Also, ‘impermanent loss’ is a misnomer-it’s opportunity cost, and you’re just bad at portfolio management.

CLMM is the future. The k=x*y model is archaic. Concentrated liquidity enables capital efficiency at scale, especially for institutional-grade DeFi.

Stop using Uniswap v2 like it’s 2020.

Let’s be real: liquidity provision isn’t about ‘earning fees.’ It’s about participating in a decentralized market structure that replaces centralized exchanges with algorithmic governance.

But most people treat it like a savings account, and that’s why they get wrecked.

Impermanent loss isn’t a bug-it’s a feature. It forces you to think about price discovery, not just APY.

And yes, holding tokens outside the pool is safer-but you’re also forfeiting your role as a market participant.

DeFi isn’t for the passive. It’s for the engaged.

If you don’t understand the ratio, you shouldn’t be in the pool.

That’s not elitism. It’s responsibility.

Most ‘experts’ don’t even know what k represents. They just chase yield.

That’s why the space is full of people who lost everything after a 30% ETH dip.

Math doesn’t care about your FOMO.

It just calculates.

And if you’re not watching the numbers, you’re not investing-you’re gambling.

lol this is just a fancy way to say ‘you’re giving free money to bots’ 😂

They’re not telling you the real reason 50/50 exists-it’s a backdoor for the Fed to manipulate crypto prices through controlled liquidity.

Ever wonder why every stablecoin pair has the same ratio? Coincidence? I think not.

Big Finance is using AMMs to smooth volatility before the next crash.

They’re building a crypto version of the gold standard-just with USDC.

Wake up.

bro this is so dope i just deposited my last 2 eth into a 70/30 wbtc/usdc pool and i feel like a crypto wizard 🤓💸

who knew math could make you feel like you’re hacking the system??

Great breakdown. I’ve been using Curve for stable swaps and never understood why the fees were so low until now. Makes perfect sense.

Y’all are so obsessed with ‘math’ and ‘ratios’ but you’re ignoring the fact that these pools are owned by venture capital firms who front-run every trade.

You think you’re contributing to decentralization? You’re just feeding the machine.

And you’re paying gas fees to do it.

Good job, patriot.

Concentrated liquidity isn’t ‘advanced’-it’s necessary. If you’re still using Uniswap v2 in 2025, you’re not a degens-you’re a relic.

APY means nothing if your liquidity is spread across 100 price points and earning 0.02% daily.

Focus on range, volume, and volatility. Not ‘yield farming.’

so i put in eth and usdc and now i have less eth than i started with but more usdc and the total is higher but i lost money???

what the fuck is happening

You’re missing the point entirely. The ratio isn’t about fairness. It’s about incentivizing liquidity providers to behave like market makers, not depositors.

And most people don’t understand that liquidity is a service-not an investment.

Stop treating it like a CD.

It is worth reflecting upon the philosophical implications of algorithmic price discovery in the absence of human intermediaries.

The constant product formula, while mathematically elegant, enshrines a form of impersonal equilibrium that mirrors classical economic theory-yet operates without the ethical considerations of human judgment.

One must ask: Is the market truly ‘fair’ when its logic is immutable, and its participants are unaware of the structural asymmetries they perpetuate?

Impermanent loss, then, is not merely a financial phenomenon-it is an existential condition of participation in decentralized systems.

Are we, as liquidity providers, merely nodes in a machine, or are we architects of a new financial consciousness?

Perhaps the real question is not how to optimize ratios-but whether we should be participating at all.

Everyone’s talking about ratios like they’re some kind of sacred geometry but no one’s talking about how the devs get paid in tokens before you even deposit

And you think you’re the one making money?

Wake up.

The system is rigged and you’re the sucker paying gas to make it work

i just lost 4000 dollars and now i feel like crying

why did i trust math

Thank you for this comprehensive and well-structured overview. I appreciate the distinction between passive holding and active liquidity provision. Many overlook the operational responsibilities involved.

It is critical to align one’s strategy with risk tolerance and market expectations-not simply chase yields.

This post deserves wider dissemination among new entrants to DeFi.

you got this! 🙌

really glad you took the time to explain this stuff so clearly

most people just copy-paste guides and blow up their wallets

you’re doing the right thing by learning the math first

keep it up, you’re gonna crush it 💪

Okay so I’ve been reading all this and I’m still confused because I thought the whole point of DeFi was to be decentralized but now I’m hearing that the biggest liquidity pools are all controlled by a handful of whales who front-run trades and then the smart contracts just auto-adjust and you’re left holding the bag with more stablecoin and less ETH and you’re like ‘wait but I thought I was earning fees’ and then you check your wallet and you realize you’ve been paying gas for six months to give arbitrage bots free money and you start questioning everything you thought you knew about finance and you wonder if the entire system is just a giant Ponzi scheme disguised as open-source code and then you go to sleep and wake up and you still don’t know if you’re a participant or a pawn but you keep depositing because the APY is 12% and you tell yourself ‘maybe next time’ and you keep clicking ‘approve’ and ‘confirm’ and you think ‘maybe I’m just bad at this’ but honestly I think the system is designed to make you feel like you’re winning while it quietly takes everything you have and I don’t even know why I’m writing this I just needed to say it out loud

Did you know that the 50/50 ratio was mandated by the CFTC in 2023 as part of a covert crypto stabilization plan? The ‘constant product formula’ was never meant for retail. It was engineered to create artificial volatility so hedge funds could short ETH and buy USDC at the bottom. They’re using your deposits as bait. You’re not providing liquidity-you’re funding a market manipulation scheme. Check the smart contract’s owner wallet. It’s the same one that funded the Terra collapse. This isn’t DeFi. It’s financial warfare.

OMG this is SO helpful!! 🥹💖

i just learned what impermanent loss is and now i get why my eth balance went down even though eth went up!!

thank you thank you thank you!!

gonna try a 80/20 pool next!! 🚀

One must consider the ontological implications of liquidity provision: Are we, as individuals, truly sovereign when our capital is algorithmically redistributed by immutable code? The ratio, while mathematically elegant, is a mechanism of control disguised as neutrality.

One does not ‘choose’ a 50/50 ratio. One is instructed to do so.

And so we comply.

Is this freedom? Or is this the quietest form of enclosure?