DeFi Airdrop Legitimacy Checker

Airdrop Risk Assessment

Enter key metrics from potential airdrop opportunities to evaluate their legitimacy. Based on lessons from the JF token collapse.

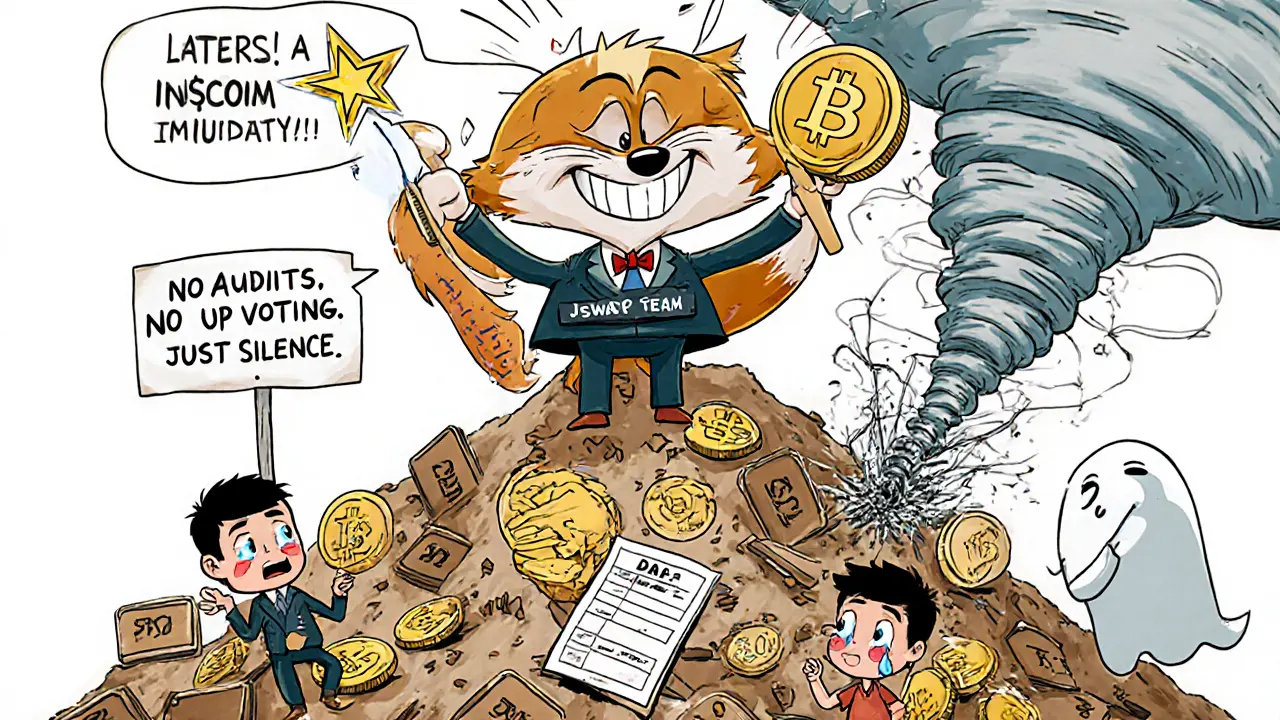

The JF airdrop from Jswap.Finance promised big returns - high APYs, multi-million-dollar TVL, and free tokens for early users. But today, the token trades at $0 on major exchanges. No volume. No liquidity. No price movement. What went wrong? And should you ever trust a DeFi airdrop like this again?

What Was Jswap.Finance?

Jswap.Finance launched in late 2021 as a decentralized exchange built on OKExchain. It wasn’t just another swap platform. It claimed to be a full DeFi ecosystem: swap mining, liquidity pools, single-token vaults (called ‘machine gun pools’), DAO dividends, and even a cross-chain bridge. The native token, JF, had a fixed supply of 100 million tokens. All platform profits were supposed to be used to buy back and burn JF, making it deflationary. At its peak, Jswap had nearly 100,000 users and over $60 million locked in its pools. Some liquidity pairs, like JF/USDT, were offering APYs over 1,400% in 24 hours. Those numbers looked insane - and they were. High yields like that are rarely sustainable. They’re usually a sign of speculative hype, not real value.How Did the JF Airdrop Work?

The main JF airdrop happened through MEXC’s Kickstarter program in November 2021. Users had to lock up MX tokens to vote for JF to be listed on the exchange. The more MX you contributed, the more JF you got. Over 23 million MX tokens were pledged. Successful participants received 35,200 JF tokens each - a big reward at the time. Bitget also ran promotions where users could earn JF by completing challenges. The platform said all crypto rewards could be converted into Jswap tokens. But here’s the catch: these weren’t free tokens handed out to random wallets. You had to spend real money (MX or other crypto) to qualify. That’s not an airdrop in the traditional sense - it’s a marketing campaign disguised as one.

What Happened to the JF Token?

Today, JF trades at $0 on Binance, CoinMarketCap, and other major trackers. Trading volume is zero. Circulating supply is listed as zero. The all-time high is marked as “NaN” - not a number. That’s not a glitch. That’s a death certificate. The market cap is $0. The 24-hour DEX trading volume is $40.24. That’s less than the cost of a coffee. For a project that once had $60 million in TVL, this is a catastrophic collapse. The deflationary model - buying back and burning tokens - only works if people are trading. No trades? No buybacks. No value. The smart contract address (0x5fAc...C85b0A) exists on OKExchain, but there’s no evidence of active development, audits, or community updates since 2022. The Telegram and Twitter accounts linked to the project are silent. No announcements. No roadmap progress. Just radio silence.Why Did It Fail?

Three reasons: unsustainable yields, no real utility, and zero liquidity. First, those 1,400% APYs weren’t from fees. They were from new token emissions - essentially printing money to pay early users. That’s a classic Ponzi structure. Once new money stopped flowing in, the whole thing collapsed. Second, JF had no real use case. It wasn’t used for governance in any meaningful way. DAO voting was either non-functional or ignored. There were no dApps built on top of it. No NFTs. No staking rewards beyond the initial hype. It was just a token with no purpose. Third, the project never secured real market makers or liquidity providers. Without them, the token couldn’t trade. No one could sell. No one could buy. And when users realized there was no exit, they dumped their tokens - if they could.

Should You Participate in Similar Airdrops Today?

If you’re thinking about joining a new DeFi airdrop that promises high APYs or free tokens, ask yourself these questions:- Is there real trading volume? (Not just TVL - actual trades)

- Is the token listed on at least two major exchanges with real liquidity?

- Are the team members verifiable? Do they have public track records?

- Is the smart contract audited by a reputable firm like CertiK or PeckShield?

- Does the token have a clear use case beyond speculation?

What’s the Real Lesson?

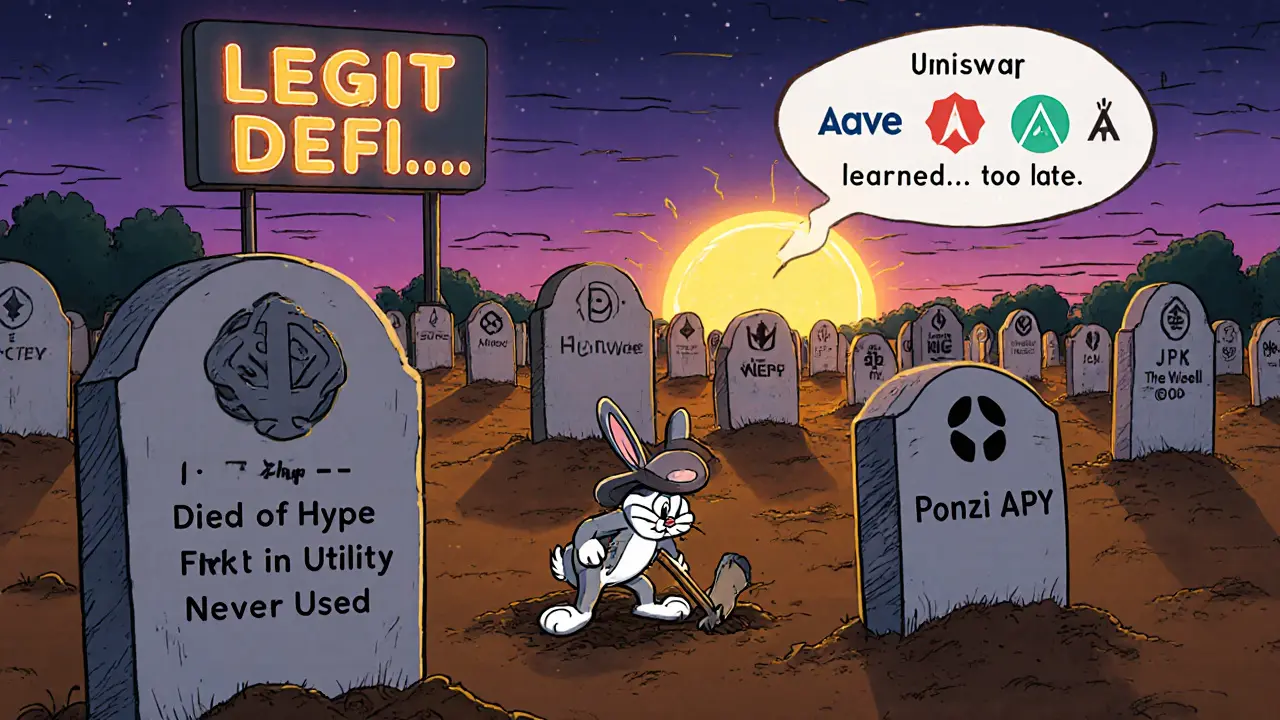

Airdrops aren’t free money. They’re a way for projects to attract users, create buzz, and get listed on exchanges. But if the underlying protocol has no substance, the token will die - no matter how big the initial reward. Jswap.Finance didn’t fail because of bad luck. It failed because it was built on speculation, not sustainability. The JF airdrop was the bait. The collapse was the trap. If you want to earn from DeFi, focus on projects with:- Proven track records (3+ years active)

- Transparent team and code

- Real users, not just bots

- Low but steady volume, not spikes

- Community-driven governance, not just token rewards

Was the JF airdrop really free?

No. The main JF airdrop required users to lock up MX tokens on MEXC to vote for the token’s listing. You didn’t just sign up - you spent real crypto to qualify. That’s not a free airdrop. It’s a paid promotion. Bitget’s challenges also required active participation, not passive claiming.

Can I still claim JF tokens today?

No. All official airdrop programs ended in late 2021. The MEXC Kickstarter is closed. Bitget no longer lists JF-related promotions. Even if you had a wallet that qualified, there’s no way to claim the tokens now because the project has no active infrastructure to support distributions.

Why is JF trading at $0?

Because no one is buying or selling it. With zero trading volume on major exchanges and no liquidity providers, the price can’t be determined. The $0 value isn’t a technical error - it’s a market reality. The token has no demand, so it has no value.

Is Jswap.Finance still operating?

No. There have been no updates, audits, or community announcements since early 2022. The website is inactive. Social media channels are silent. The smart contract still exists on OKExchain, but it’s not being maintained or used. The project is effectively dead.

What should I do if I still have JF tokens?

If you hold JF tokens, you’re holding an asset with no market value. You cannot sell them. You cannot stake them. You cannot use them in any DeFi protocol. The best course of action is to remove them from your wallet to avoid confusion. Do not invest more money trying to ‘recover’ them - that’s a common scam tactic.

Are there any legitimate DeFi airdrops left?

Yes - but they’re rare. Legitimate airdrops come from projects with real usage, audited code, and active communities. Examples include recent airdrops from established protocols like Uniswap, Curve, or Aave. Always research the team, check trading volume, and never invest more than you can afford to lose. If it sounds too good to be true, it is.

Man, I remember when everyone was jumping on JF like it was the next ETH. I even locked up some MX tokens hoping for a quick flip. Turns out, I just paid to get scammed. The APYs were insane, but looking back, if it smells like a Ponzi and looks like a Ponzi… you get the picture.

Never again. I’ve learned to check for real liquidity before even glancing at an airdrop page.

Same. I held JF for a year thinking ‘maybe it’ll bounce.’ Spoiler: it didn’t. Now I just delete any wallet with dead tokens. No sentimental attachment to digital ghosts.

Also, why do people still check CoinMarketCap for JF? It’s not even a ghost anymore. It’s a deleted file.

Zero volume zero value zero future. Done.

People who fell for this didn’t just lose money-they lost their sense of skepticism. This wasn’t a failure of technology. It was a failure of human greed. If you can’t see that 1400% APY is a red flag screaming ‘RUN,’ then you shouldn’t be in DeFi at all.

You didn’t get scammed. You volunteered.

Let us not forget the deeper metaphysical truth here: value is not assigned by markets, but by collective belief. JF was a mirror held up to the illusion of decentralized finance-where the promise of liberation became the cage of speculation.

The token did not die because of bad code. It died because it was never meant to live. It was a ritual, not a revolution.

Those who still hold JF are not investors. They are mourners at a funeral they refused to attend.

OMG I’m so mad I didn’t see this coming 😭 I thought ‘oh it’s on MEXC so it’s legit’-NOPE. That’s like trusting a guy in a suit who says ‘trust me bro’ at a gas station.

Now I only look at projects with at least 3 years of updates and real people on Twitter. Not bots. Not influencers. Real humans.

For those still holding JF: please, delete the tokens from your wallet. They’re not ‘assets’-they’re digital clutter. And if someone DMs you saying ‘I can help you recover your JF for a small fee’-block them. That’s the second scam layer.

Protect your peace. Not your tokens.

They called it an airdrop. It was a bait-and-switch with a whitepaper.

Next time, just buy pizza with your crypto. At least you’ll taste something.

It’s wild how fast these things go from ‘next big thing’ to ‘what even was this?’

I think the real lesson isn’t about DeFi-it’s about how easily we trade curiosity for greed. We don’t need more tools. We need more patience.

I used to think airdrops were a way to democratize access to crypto. Now I see them as marketing grenades-designed to blow up early adopters while the team quietly cashes out.

The JF collapse wasn’t an anomaly. It’s the blueprint. Every project promising ‘free money’ is just a lottery ticket printed by people who already know they’re going to win.

If you’re reading this and still thinking ‘maybe it’ll rebound’-you’re not waiting for a recovery. You’re waiting for a miracle. And miracles don’t happen in DeFi.

Don’t mourn the token. Mourn the time you spent hoping.

Next time, ask: who’s getting rich here? Not who’s getting rich for me.

And if the team’s Twitter hasn’t posted since 2021? That’s not a pause. That’s a funeral notice.

my bad for not checking the team. thought jswap had real devs. turns out their github was just a readme with ‘coming soon’

lesson learned. no more anonymous teams. no more ‘we’re a DAO’ without names.

I’m not mad. I’m just disappointed. I thought we were building something better. Turns out, we were just building better marketing.

Still believe in DeFi. Just not in the hype cycles. Maybe next time we’ll get it right.

Y’all act like this was some new thing. This is the same script since 2017: pump → hype → rug → silence. The only difference now is the NFTs and the TikTok influencers.

They didn’t trick you. You tricked yourself because you wanted to believe.

And now you’re mad because you didn’t get rich? That’s not a crypto problem. That’s a psychology problem.

Bro I lost $8k on this. Still check the price every day. I know it’s zero. But I still check. Like a bad habit. Like checking your ex’s Instagram.

It’s not about the money. It’s about the ‘what if’.

Just want to say-this is why I don’t chase airdrops anymore. I stake in well-audited protocols with real users. Slow, steady, boring.

But I sleep at night.

And my portfolio doesn’t have digital ghosts in it.

Anyone who participated in JF deserves to lose everything. No excuses. No sympathy. You were warned. You chose ignorance over research.

DeFi isn’t for the lazy. It’s for the disciplined.

And you weren’t either.

US devs got scammed by a project on OKExChain? Pathetic. We got real DeFi here. This is why we need less crypto bros and more American innovation.

Next time, stick to Bitcoin. At least it doesn’t vanish into thin air.

Very simple. If APY is too high, it is fake. If team is hidden, it is dangerous. If no volume, it is dead. I learned from this. Now I wait and watch. Not jump.

still holding JF 😭 but i’m keeping it as a reminder… like a scar. next time i’ll do my homework. promise. 🙏

bro i got 35k JF and now it’s worth $0.00000001… but i still have the meme i made of it as my wallpaper. it’s my crypto tattoo now 😂

It’s not about the money. It’s about the betrayal. You trusted a system that was never meant to be trusted. You believed in decentralization, but the people behind it were just trying to get rich before the party ended.

We were all just extras in a movie that never got made. The script was written by greed. The director was anonymity. The ending? A silent blockchain.

And now we’re left wondering if we were the audience… or the punchline.

Wait… so if I just hold JF long enough… does it become a collectible? Like a rare coin from a failed empire?

Maybe in 20 years, it’ll be in a museum. ‘Look kids, this is what people thought was money in the 2020s.’

Bro that’s actually kind of poetic. JF tokens: the new Beanie Babies of crypto.

Everyone had one. Everyone thought they were valuable. Then… silence.

Just delete it. Seriously. I kept mine for 8 months. It was a mental burden. Now my wallet is clean. My peace is restored.

Not all losses are financial. Some are emotional. And you don’t need to carry both.

There is a sacred silence in the blockchain where value once lived. JF is not gone-it is simply no longer remembered. The ledger holds its record, but the community has moved on.

And perhaps that is the most profound death of all: not the loss of price, but the loss of meaning.

Let us honor it not with rage, but with quiet wisdom.

Next time, we will listen-not to the promises, but to the silence between them.