Crypto Exchange Comparison Tool

Compare Your Options

See how Globitex compares with other exchanges on key metrics important for European users.

Comparison Results

| Metric | Globitex | Kraken | Bitpanda | Revolut |

|---|---|---|---|---|

| EUR Deposits via IBAN | Yes | Yes | Yes | Yes |

| Mobile App | No | Yes | Yes | Yes |

| Taker Fee | 0.20% | 0.16% | 0.20% | 0.99% |

| Number of Coins | 20-30 | 350+ | 200+ | 15+ |

| Transparency Reports | No | Yes | Yes | Yes |

| User Reviews | Very Few | Many | Many | Many |

| CoinMarketCap Tracking | No | Yes | Yes | Yes |

Why This Matters: Low user activity and liquidity mean you might get worse prices and difficulty executing trades, even if fees look good on paper.

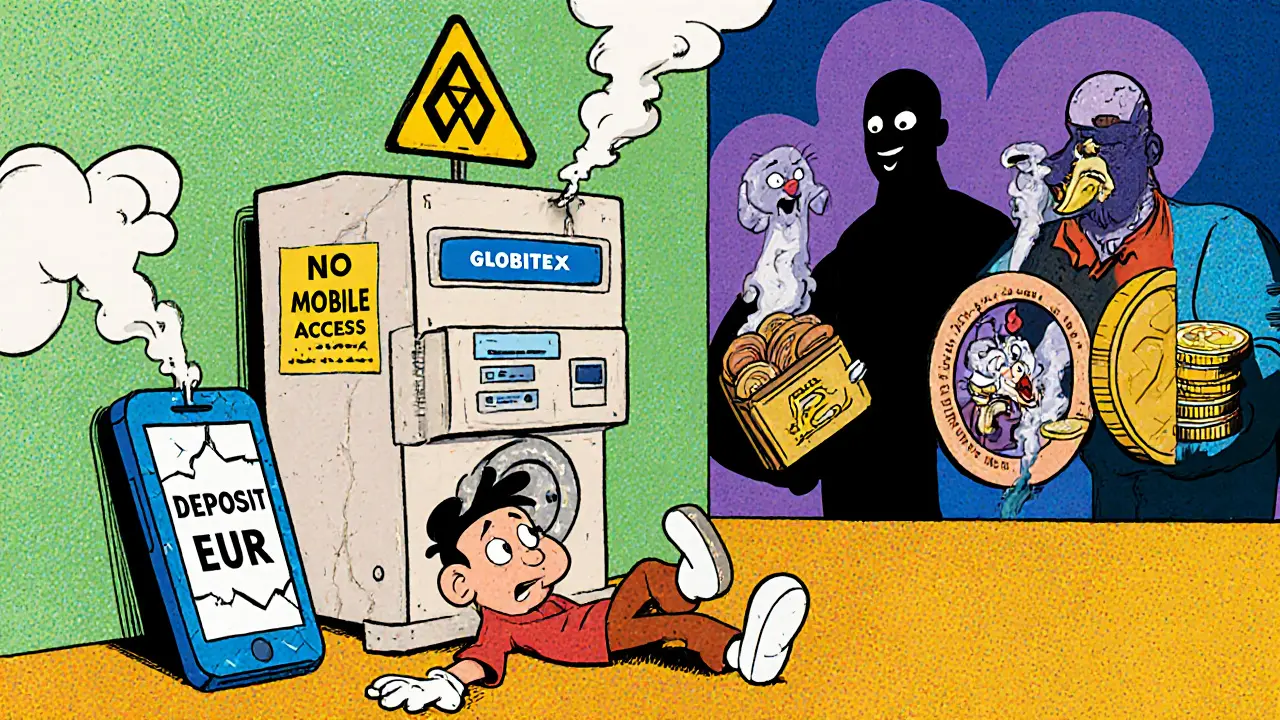

When you're looking for a crypto exchange in Europe, you want something that works with your bank, doesn’t charge you extra for deposits, and actually has people trading on it. Globitex promises exactly that - EUR deposits via IBAN, zero maker fees, and no withdrawal fees. But here’s the problem: almost no one is using it.

Globitex launched in May 2017, based in Latvia with offices in London, Riga, and Vilnius. It’s not a giant like Binance or Coinbase. It’s small. And that’s not necessarily bad - some of the best exchanges started small. But Globitex hasn’t grown. It’s stuck.

How Globitex Makes Money (And Why It’s Not Working)

Globitex’s fee structure looks great on paper: 0.20% for takers, 0% for makers. That’s supposed to encourage people to place limit orders and add liquidity. In theory, it’s smart. But here’s the catch - there’s almost no liquidity to begin with.

Compare that to Binance, where maker fees are often 0% and taker fees are 0.04% for high-volume traders. Kraken charges as low as 0% for makers and 0.16% for takers. Even Coinbase, which charges up to 3.99% on card buys, has far more volume. Globitex’s 0.20% taker fee is higher than most major exchanges. And if you’re not getting better prices because no one’s trading, that fee doesn’t matter. You’re just paying more for less.

Withdrawals? No fees from Globitex. You only pay the blockchain miner fee. That’s good. But if you’re trying to move Bitcoin or Ethereum out and the network is congested, you’re still paying $5-$15 in gas. That’s not unique. Other exchanges do the same. So no real advantage there.

What Coins Can You Trade?

Globitex lists maybe 20-30 cryptocurrencies. That’s it. Bitcoin, Ethereum, Litecoin, some stablecoins like EURS - the basics. No Solana. No Cardano. No meme coins. No new tokens. If you’re looking to trade anything outside the top 10, you won’t find it here.

Compare that to Kraken, which lists over 350 coins, or Coinbase with 235. Even smaller exchanges like Bitpanda offer more variety. Globitex doesn’t even try to compete on selection. It’s not trying to be a one-stop shop. It’s trying to be a EUR gateway. But if you’re only trading EUR pairs, why not use a platform that actually has volume?

EUR Deposits? Yes. But Is It Worth It?

The one thing Globitex does well is EUR integration. Through its group company Nexpay UAB, it holds an E-money license. That means you can deposit and withdraw EUR directly using an IBAN. No third-party payment processors. No currency conversion headaches. If you’re in the EU and want to move money from your bank to crypto without paying fees, this is one of the few platforms that makes it easy.

But here’s the twist: you can’t do this on mobile. The EURO Wallet is only accessible via desktop. No app. No mobile web version that works properly. If you’re used to checking your balance on your phone, you’re out of luck.

Security: What’s There - And What’s Missing

Globitex says it uses two-factor authentication, multisig wallets, and brute-force protection. That’s standard. Nothing special. But there’s no public proof of cold storage audits. No transparency reports. No third-party security certifications. You’re trusting them to keep your coins safe - and that’s risky.

Major exchanges like Kraken and Coinbase publish regular proof-of-reserves reports. They’re audited by firms like Grant Thornton. Globitex doesn’t. That’s not a dealbreaker for everyone, but when your exchange has almost no users, you want extra reassurance. You don’t get it.

User Reviews? Barely Any

This is the biggest red flag.

On Cryptogeek, Globitex has a 3 out of 10 rating - based on one review. One. That’s not a sample. That’s a whisper. On another platform focused on Azerbaijan markets, it scores 6.5 out of 10 - but the site explicitly says to avoid anything below 7.5. So even that rating is a warning.

And here’s the kicker: CoinMarketCap doesn’t track Globitex at all. It’s labeled an “Untracked Listing.” That means no one can verify its trading volume. No one knows if it’s moving $100,000 a day or $10,000. That’s not normal. Even tiny exchanges get tracked if they have any real activity. If you’re not on CoinMarketCap, you’re invisible to serious traders.

There are no Reddit threads. No Twitter discussions. No YouTube reviews. No complaints on Trustpilot. Nothing. That doesn’t mean it’s a scam. It means almost nobody uses it. And if no one’s using it, why should you?

Who Is Globitex For?

There’s one person who might benefit from Globitex: someone in the EU who only wants to buy Bitcoin or Ethereum with EUR and doesn’t care about trading volume, altcoins, or app access. Someone who values direct bank transfers over everything else.

But even then - why not use Bitpanda or Revolut? Both offer EUR deposits, lower fees, better apps, and more coins. Bitpanda even lets you buy fractional shares of stocks and gold. Revolut is faster, simpler, and has 40 million users.

Globitex isn’t better. It’s just different. And different doesn’t mean better when you’re trading crypto.

Final Verdict: Avoid Unless You Have a Specific Need

Globitex isn’t a scam. It’s registered. It has an E-money license. It doesn’t charge withdrawal fees. It supports EUR IBAN. Those are real pros.

But the cons outweigh them:

- Zero trading volume (untracked on CoinMarketCap)

- One user review, rating 3/10

- No mobile app

- Only 20-30 coins

- Taker fee is higher than competitors

- No transparency reports or audits

If you’re just starting out and want to buy Bitcoin with EUR, use Revolut, Bitpanda, or Kraken. They’re cheaper, faster, and have real communities behind them. If you’re trading regularly, you need volume - and Globitex doesn’t have any.

Globitex feels like a platform stuck in 2017. It was built for a time when crypto was simpler. But now, the market has moved on. And Globitex hasn’t.

What Should You Do Instead?

If you’re in the EU and want to buy crypto with EUR:

- For beginners: Use Revolut - fast, simple, no KYC for small amounts.

- For low fees and more coins: Use Kraken - 0.16% taker fee, 350+ coins, transparent audits.

- For fiat on-ramps and stability: Use Bitpanda - EUR deposits, fractional investing, EU-regulated.

None of these platforms are perfect. But they all have users. They all have volume. They all have reviews. Globitex doesn’t.

Don’t get drawn in by the 0% maker fee. If no one’s making orders, it’s just a marketing gimmick. You want an exchange that’s alive - not a ghost town with a website.

Globitex is a ghost town. Zero volume means their 0% maker fee is just a fancy sign on an empty store. You don’t need a crypto exchange that looks good on paper-you need one where people are actually trading.

OMG I literally cried when I saw this review. This is the exact reason I abandoned crypto for a year. I thought Globitex was my golden ticket-EUR deposits, no fees, oh my god I was so naive. Then I tried to buy BTC and the order book was emptier than my fridge after a breakup. I felt like I was talking to a robot in a haunted mall. I’m still traumatized.

Why is everyone acting like this is surprising? Globitex never had a marketing budget. No influencers. No TikTok ads. No YouTube reviews. Just a dry PDF with fee charts. Meanwhile, Bitpanda and Revolut are sponsoring football teams. If you’re not visible, you’re dead. Simple math.

They’re hiding something. No audits. No reviews. No mobile app. CoinMarketCap doesn’t even track them. That’s not incompetence. That’s a red flag bigger than a billboard in Times Square. I bet they’re laundering money through fake trades. Or worse-running a honeypot for newbies. I’ve seen this before. It ends badly.

So let me get this straight. You’re telling me there’s a crypto exchange that’s literally worse than my ex’s text replies? 0% maker fee? Cool. So what? No one’s making orders. It’s like having a Ferrari with no gas. And no app? Bro. I’m on my phone 24/7. If I can’t check my portfolio while waiting for coffee, I’m not using it. Thanks but no thanks.

The real tragedy isn’t that Globitex failed. It’s that it was built for a world that no longer exists. In 2017, people thought crypto was about technology. Now it’s about liquidity, community, and trust. You can’t build trust with a static website and a promise. You build it with transparency, volume, and users who show up every day. Globitex didn’t fail because of fees. It failed because it forgot crypto is a social experiment.

STOP WASTING TIME ON GHOST PLATFORMS. If you’re serious about crypto, you don’t play around with dead exchanges. You go where the action is. Kraken. Bitpanda. Revolut. They’re alive. They’re growing. They have real people behind them. Don’t let a pretty fee structure fool you. Volume is oxygen. No volume? You’re suffocating.

hey i tried globitex last year just to see what it was like. i thought maybe it was a hidden gem. turns out it was more like a hidden tomb. i sent my eur, waited 2 days, and then realized i couldnt even see my balance on my phone. i ended up moving everything to kraken. best decision ever. just use the big ones. theyre not perfect but at least they dont make you feel like youre trading in a ghost town.

One must acknowledge the structural limitations of niche financial infrastructure in a hyper-competitive market. Globitex, despite its regulatory compliance and IBAN integration, suffers from a fatal lack of network effects. In digital asset markets, liquidity is not merely an advantage-it is the very foundation upon which utility is built. Without participants, even the most elegant fee model becomes a monument to irrelevance.

if you’re just starting out and you’re reading this, just use revolut. it’s stupid simple. no stress. no drama. you can buy btc with your debit card in 30 seconds. globitex is like trying to use a typewriter when everyone else has a laptop. you’re not being smart-you’re just being stubborn.

Of course no one uses it. Look at the coin list. 20-30 coins? In 2024? That’s not a crypto exchange-that’s a museum exhibit. You want to trade Solana? Nope. Dogecoin? Nope. Shiba Inu? LOL, nope. If you’re not listing the top 100, you’re not even in the game. This isn’t 2017 anymore. Grow up or get buried.

I had a dream last night that I deposited EUR into Globitex and woke up to find my entire portfolio had vanished. I screamed. My cat ran away. I haven’t slept since. I think this platform is haunted. Or worse-it’s a government experiment to see how long people will trust a website with zero reviews. I’m filing a complaint with the FTC just in case.

it’s weird how people overlook the basics. if you can’t use it on your phone, you’re not going to use it. simple as that. i don’t care how good the fees are. if i have to sit at my laptop to check my crypto, i’m already out. mobile is non-negotiable now. globitex missed that.

you know what’s really interesting here? it’s not just about liquidity or fees or even the app-it’s about the psychological contract between user and platform. when you deposit money, you’re not just handing over cash-you’re handing over trust. and trust is built through consistency, visibility, and community. globitex offers none of that. it’s like dating someone who never texts back. you keep waiting for them to change. but they never do. and eventually you realize you were never the priority.

bro i just want to say... i love globitex. it’s my little secret. i’ve been holding my btc there since 2018. no one knows about it. it’s like my own private crypto club. the fact that no one else uses it? that’s the point. i’m not here to compete. i’m here to preserve. the world doesn’t need another binance. it needs quiet sanctuaries. globitex is my temple. 🙏💸

The economic principle of liquidity preference is fundamental here. Individuals demand assets that are readily convertible into cash with minimal transaction cost and price impact. Globitex fails on all three metrics: conversion speed is hindered by lack of counterparties, price impact is irrelevant due to zero volume, and transaction cost, while nominally low, is functionally meaningless without market depth. Thus, rational actors avoid it. This is not a failure of marketing-it is a failure of economic viability.

0% maker fee? yeah right. and the moon is made of cheese. no one’s making orders because no one trusts it. and no one trusts it because there’s no volume. circular logic. and why is there no mobile app? because they’re too lazy to code it. or worse-they’re hiding something. i’m not buying it. not one bit.

you know what’s sad? globitex could’ve been something. they had the license. they had the eu access. they just didn’t care. they thought if they built it, people would come. but no. people don’t come to quiet places. they come where the noise is. where the memes are. where the influencers are. globitex was too proud to chase attention. now it’s just a footnote.

i’ve been watching globitex for years. i used to check it every week like a weird habit. nothing changed. same 20 coins. same desktop-only interface. same silence. no new listings. no updates. no blog posts. just a website that looks like it was designed in 2016. i don’t even know why i still visit. maybe i’m hoping it’ll wake up. it won’t.

the fact that you’re even considering this exchange means you haven’t used kraken yet. just go there. it’s easier. cheaper. faster. and you’ll actually be able to sell your btc without waiting 3 days for a buyer. globitex is a trap for the hopeful. don’t fall for it.

if you’re in europe and want to deposit euros safely, globitex is technically okay-but only if you’re not trading. if you want to trade, go to kraken or bitpanda. they’re regulated, have apps, and real order books. globitex is like a bicycle with no pedals. it looks nice but won’t move you anywhere.

the most important metric in crypto isn’t fees-it’s user retention. if no one stays, the platform is a ghost. globitex has no retention because it offers no reason to return. no updates, no community, no engagement. even if the fees were perfect, the experience is barren. crypto isn’t just about technology-it’s about people. and people need connection.

let me be the first to say it: globitex is a regulatory shell game. e-money license? yes. proof of reserves? no. volume? zero. community? nonexistent. they’re not trying to be a crypto exchange-they’re trying to be a compliant fiat gateway for laundering. and the fact that no one’s talking about it? that’s the whole point. silence is the cover. don’t touch it.

you know what’s worse than globitex? people defending it. like it’s some kind of underground hero. bro. it’s not brave. it’s dead. i tried to withdraw once. took 72 hours. no updates. no email. nothing. i gave up and moved to kraken. now i sleep at night. don’t be like me.

you’re missing the point. globitex isn’t for the masses. it’s for the quiet ones. the ones who don’t want to be part of the circus. i don’t need memes. i don’t need solana. i just need to move euros to btc without paying $20 in fees. and i can. and that’s enough. you want noise? go to binance. i want peace. 🙏