Wrapped Token Bridge Security Checker

This tool evaluates key security factors for wrapped token bridges. Each factor contributes to overall risk level. Review your bridge's security practices to make informed decisions.

Security Factors

Security Assessment Results

Bridge:

Overall Risk Level:

Security Score: /100

Key Findings:

Recommendation:

Key Takeaways

- Wrapped tokens rely on a trust‑anchor-usually a custodial vault-that must be secured with multi‑signature and MPC controls.

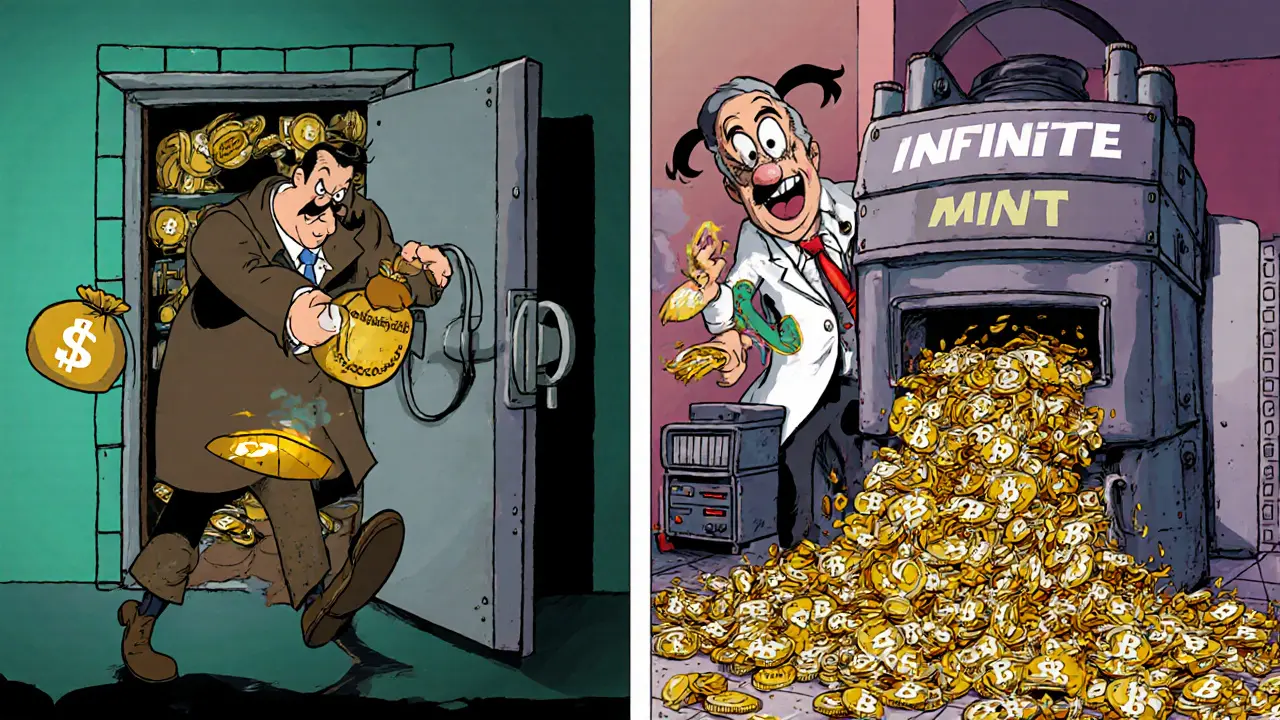

- The two biggest attack families are collateral theft and infinite‑mint exploits; both can wipe out a token’s backing.

- Robust security mixes cold storage, multi‑sig wallets, formal smart‑contract audits, and insurance where possible.

- DeFi protocols that accept wrapped tokens as collateral inherit bridge risk; diversify and monitor bridge health.

- Regular risk‑checks, audit transparency, and community‑driven monitoring are the best defense against bridge failures.

What a Wrapped Token Bridge Actually Is

When moving assets across chains, wrapped tokens are digital representations of native blockchain assets locked on their original chain and minted on a target chain. The bridge is the infrastructure that locks the original asset, creates the wrapped version, and later reverses the process.

Typical flow:

- User deposits the native asset (e.g., BTC) with a custodian an entity that holds the locked asset in a secured vault.

- The custodian confirms the lock, then a smart contract code that mints the wrapped token on the destination chain issues an equivalent amount (e.g., WBTC on Ethereum).

- User can now trade, stake, or lend the wrapped token on the destination chain.

- When the user wants to unwrap, the wrapped token is burned, the custodian unlocks the original asset, and it’s sent back.

This process takes two to five minutes and can be triggered via a UI or directly through contract calls.

Where the Real Risk Lives

Bridge security boils down to two threat categories that have repeatedly caused costly exploits.

- Collateral theft: An attacker tricks the custodian or compromises the vault keys, withdrawing the native assets while the wrapped tokens remain in circulation. Because the wrapped token’s value is anchored to the locked collateral, a loss of backing makes the token essentially worthless.

- Infinite‑mint (fractional‑reserve) attacks: A flaw in the minting logic allows an attacker to create more wrapped tokens than the locked collateral supports. Those extra tokens can be sold on DEXs or used as collateral in lending markets, inflating supply without backing.

Both attacks ripple beyond bridge users. Any DeFi protocol that accepts the compromised wrapped token inherits the loss, potentially leading to insolvency.

How Modern Bridges Try to Stay Safe

Leading designs-like the architecture used by ChainPort-layer security across custodial, contract, and insurance domains.

- Cold storage vaults offline repositories that hold the majority of native assets, disconnected from the internet keep the bulk of collateral away from attackers.

- Multi‑signature vaults wallets that require multiple independent keys to authorize any movement of funds add a human‑layer of decision‑making.

- MPC (Multi‑Party Computation) a cryptographic protocol that splits private key material among several parties, so no single holder can act alone further decentralizes signing authority.

- Only a tiny slice of assets lives on “hot” bridge contracts, reducing the attack surface for on‑chain exploits.

- Comprehensive smart‑contract audits independent reviews that scan contract code for logic flaws, re‑entrancy bugs, and other vulnerabilities are published for transparency.

- Some operators purchase insurance coverage that reimburses users in case of a verified bridge loss, adding a financial safety net.

Even with these layers, the core model still depends on a trusted custodian. Users must evaluate the custodian’s security practices, governance, and track record.

Risk‑Mitigation Checklist for Users and Protocols

| Risk | Mitigation | Typical Implementation |

|---|---|---|

| Collateral theft | Cold storage + multi‑sig + MPC | Vaults secured by Fireblocks, Gnosis Safe, and offline key shards |

| Infinite‑mint exploit | On‑chain balance checks & audits | Contracts enforce 1:1 mint‑burn ratio, audited by Certik, OpenZeppelin |

| Smart‑contract bugs | Formal verification & multiple audits | Static analysis tools, bug bounties, open source review |

| Operational error | Multi‑sig governance + time‑locks | Require ≥3 signatures, 24‑hour delay for large withdrawals |

| Insurance gap | Purchase bridge‑specific coverage | Policies from Nexus Mutual, Bridge Insurance Pool |

How DeFi Protocols Should Treat Wrapped Tokens

If a lending market accepts a wrapped token as collateral, the protocol is indirectly exposed to bridge health. Here are three practical steps to limit that exposure:

- Monitor the bridge’s on‑chain health metrics (e.g., locked collateral ratio, recent audit status).

- Cap the maximum amount of any single wrapped token that can be used as collateral.

- Maintain a reserve pool or insurance line that can cover short‑term losses if a bridge fails.

Projects that built in these safeguards during the Ethereum‑to‑Polygon boom survived the 2023 WBTC bridge hack with minimal damage.

Choosing a Secure Bridge: A Quick Decision Framework

When you need to move assets, ask yourself these questions. Answering them reliably points you to a bridge with stronger wrapped token security posture.

- Is the bridge’s custodial model publicly audited? Look for third‑party audit reports that are easy to download.

- What percentage of assets lives in hot contracts? Less than 5% is a good baseline.

- Does the bridge use multi‑signature and MPC for key management? Verify the providers (e.g., Fireblocks, Gnosis Safe).

- Is there an insurance policy that covers both collateral loss and over‑minting? Check the policy limits and claim process.

- How often does the bridge undergo security drills or bug bounty programs? Frequent testing signals an active security culture.

If a bridge ticks most of these boxes, it’s likely a safer bet than a newer, untested service.

Future Outlook: What Will Make Wrapped Token Bridges Even Safer?

Industry trends point toward three developments that could raise the security floor.

- Decentralized custodianship: Projects like RenVM are experimenting with threshold signatures run by a network of independent nodes, removing a single custodian.

- Zero‑knowledge proof verification: zk‑rollups could prove that the correct amount of collateral is locked without exposing private keys.

- Standardized insurance pools: Emerging meta‑insurance platforms aim to pool risk across multiple bridges, offering cheaper coverage and faster payouts.

Until those solutions mature, the best defense remains layered security, transparent audits, and active monitoring.

Frequently Asked Questions

Can I trust a wrapped token if the bridge hasn’t been audited?

No. An unaudited bridge lacks a publicly verified guarantee that its smart contracts enforce a 1:1 mint‑burn ratio. Without an audit, you’re betting on the custodian’s internal processes, which may hide bugs or insecure key handling.

What’s the difference between hot and cold bridge assets?

Hot assets sit on on‑chain contracts that can be accessed instantly; they’re the smallest fraction of total collateral and are the most exposed to on‑chain attacks. Cold assets are stored offline in vaults, often behind multi‑signature and MPC controls, making them far harder for hackers to reach.

How does insurance work for wrapped token bridges?

Insurance providers sell policies that trigger when a bridge loss is verified by an independent auditor or court decision. Coverage typically caps at a percentage of the locked collateral and may require the user to submit proof of loss and the bridge’s audit report.

Should I diversify across multiple bridges?

Diversifying reduces concentration risk. If one bridge fails, you still have assets secured on other chains. However, each additional bridge adds its own operational risk, so balance diversification with the security reputation of each service.

What on‑chain signals indicate a bridge is unhealthy?

Watch for a declining collateral‑to‑wrapped‑token ratio, unusually high gas fees for minting/burning, or the sudden removal of audit reports. Many bridges publish health dashboards that aggregate these metrics.

This is so dope 😍 I just used WBTC on Polygon last week and had no clue how much risk was involved. Cold storage + MPC? That's next-level stuff. Thanks for breaking it down!

The structural risks outlined here are critical for institutional adoption. Without standardized audit disclosures and transparent collateral ratios, wrapped tokens cannot be reliably integrated into regulated financial systems. Transparency is not optional-it is foundational.

US-based bridges are the only ones worth using. Foreign custodians? No thanks. If it ain't audited by a US firm it ain't safe period

Y'all need to stop treating bridges like they're magic portals! They're just smart contracts with humans behind them. If you're staking your life savings in WBTC without checking the custodian's multi-sig setup, you're basically handing your keys to a stranger at a gas station. 🔐 Don't be that person. Check the audits. Look at the wallet addresses. Ask questions. You got this!

Bro this is fire 🔥 I just moved 5 BTC to Polygon via ChainPort and now I get why they use MPC. No more hot wallets for me. Also 5% hot assets? That's genius. I'm telling my whole crypto group about this

The reliance on centralized custodians remains the fatal flaw. No amount of multi-sig or MPC can fully eliminate human error or coercion. The only truly secure solution is trustless atomic swaps.

I... I didn't realize that... the collateral ratio... could drop like that. I'm so nervous now. I have like, 30k in WBTC. Should I... should I move it? I don't know what to do. Please help.

While the technical mitigations described are commendable, the underlying architectural dependency on custodial intermediaries fundamentally contradicts the decentralized ethos of blockchain technology. Until the custodial model is replaced with verifiable, trustless mechanisms, the entire paradigm remains vulnerable to systemic collapse.

Great breakdown! One thing I'd add: if you're a DeFi protocol using wrapped tokens, don't just rely on the bridge's audit report-set up your own on-chain alerts for collateral ratio changes. A 1% drop might not mean disaster, but if it drops 3x in a day? That's your cue to pause deposits. Small proactive steps save big losses.

In India, we're seeing a surge in WBTC usage for DeFi yields-but most users don't even know what MPC means. I've started hosting weekly Telegram sessions to explain cold storage vs hot wallets, and honestly? It's wild how many people think 'crypto' = 'safe'. We need more grassroots education, not just audits. Also, did you know Nexus Mutual now covers bridge exploits? That's huge! 🙌

Huh. I always thought bridges were just like PayPal for crypto. Guess I was wrong. Interesting.

This is exactly why we need more community-run health dashboards. I've been tracking 4 major bridges for months. One had a 15% drop in collateral last month-no one talked about it. If we crowdsource monitoring, we can catch problems before they blow up. Let's build a simple bot that pings us when audit reports disappear. I'll share the code.

The casual tone of this article is frankly inappropriate for a subject of such systemic financial risk. One cannot discuss cryptographic custodial architecture with emoticons and colloquialisms-it undermines the gravity of potential macroeconomic exposure. A peer-reviewed whitepaper, not a Reddit post, is the appropriate medium.