China Crypto Mining Ban Timeline & Impact Simulator

Key Agencies Involved

- People's Bank of China Financial Regulator

- State Administration of Foreign Exchange Capital Flow Monitor

- Cyberspace Administration Digital Activity Tracker

- Ministry of Industry and Information Technology Technology Compliance

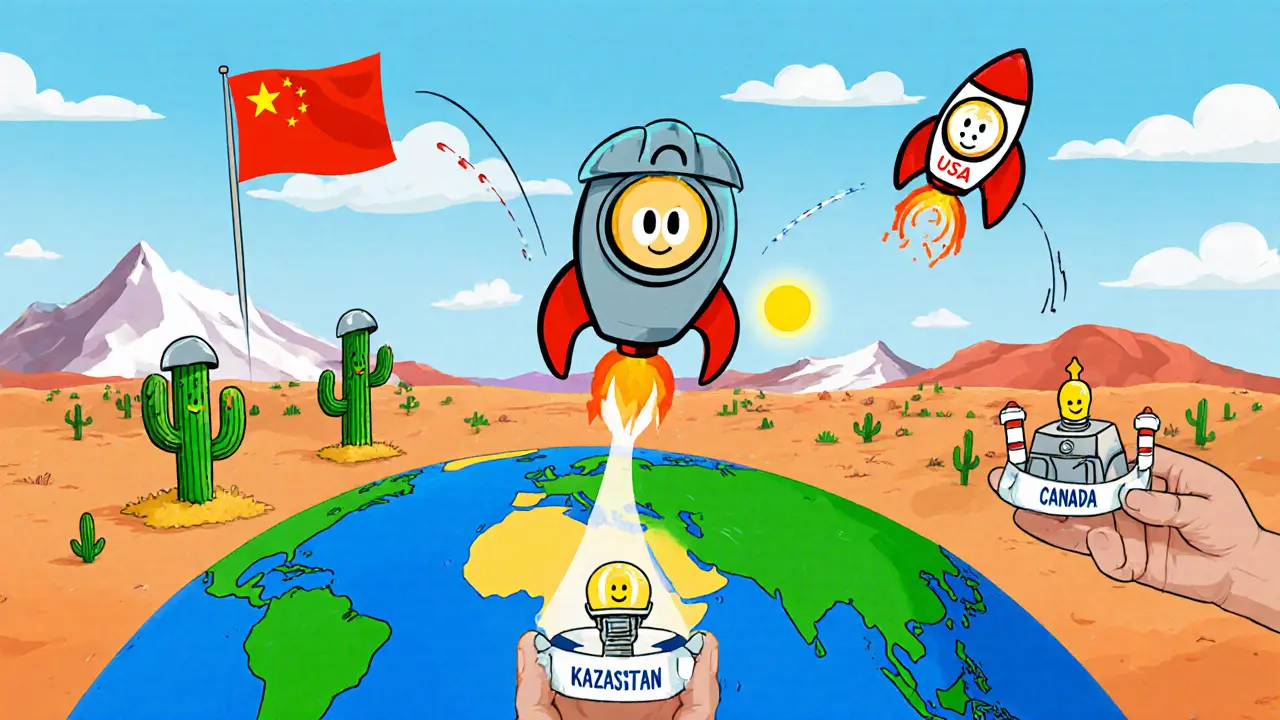

Global Hash Rate Shift

Before 2021: China (~65% of global hash rate)

After 2025: Redistribution to:

- • United States (+15%)

- • Canada (hydro-rich provinces)

- • Kazakhstan (low-cost gas)

Note: Underground operations still contribute ~3-5%

Legal Evolution Timeline

2013 – Banking Restrictions

PBOC barred banks from processing Bitcoin transactions.

2017 – ICO and Exchange Shutdown

Banned initial coin offerings and forced exchanges offline.

2021 – Nationwide Mining Ban

PBOC declared all crypto transactions illegal, closed mining farms.

2025 – Comprehensive Criminal Ban

Making mining, trading, and ownership punishable crimes with imprisonment.

Rationale Behind the Crackdown

Energy Consumption

Bitcoin mining uses up to 120 TWh annually, conflicting with carbon neutrality goals.

Financial Stability

Decentralized tokens operate outside PBOC's monetary policy control.

Illicit Activity

Cryptocurrencies linked to money laundering and unregulated fundraising.

Digital Yuan Promotion

Need for a clean digital currency landscape free of private tokens.

Comparison Table

| Aspect | Pre-2025 | 2025 Ban |

|---|---|---|

| Legal Status | Regulatory discouragement; administrative fines | Criminal offense with imprisonment |

| Scope | Targeted at large-scale farms and exchanges | All mining, trading, ownership prohibited |

| Enforcement Tools | Banking checks, occasional raids | AI-driven power-grid monitoring, coordinated raids |

| Penalties | Fines up to ¥500,000 | Fines, equipment confiscation, up to 3 years jail |

| Impact on Hash Rate | Gradual decline (~30% global share) | Near-total removal (~3-5% underground) |

Practical Takeaways

- Do not attempt to set up mining rigs in China. Legal risk outweighs any cost advantage.

- Monitor official communications from PBOC and Cyberspace Administration.

- If you own crypto assets, relocate them to jurisdictions with clear regulatory frameworks.

- Consider diversifying into the digital yuan ecosystem for exposure to China's digital finance plans.

Quick Takeaways

- All forms of cryptocurrency mining, trading, and ownership are criminal offences in China as of May312025.

- The ban stems from energy consumption concerns, financial risk, illegal‑activity fears, and the promotion of the state‑backed digital yuan.

- China’s crackdown shifted most of the global hash power to the US, Canada, Kazakhstan and other crypto‑friendly regions.

- Underground mining still exists but faces steep penalties and sophisticated detection methods.

- Future prospects for legal crypto mining in China are virtually nonexistent.

When it comes to cryptocurrency mining in China is the practice of using computer hardware to solve blockchain puzzles, a activity the Chinese government now classifies as a criminal offense, the landscape has flipped completely over the past decade. What started as a loosely regulated arena in 2013 has become a fully enforced prohibition, culminating in the China crypto mining ban announced on May312025. Below we break down the legal timeline, the agencies enforcing the rules, the rationale behind the crackdown, and the ripple effects on the global crypto ecosystem.

Legal Timeline: From Caution to Criminalization

The Chinese approach evolved through four major phases:

- 2013 - Banking restrictions: The People’s Bank of China (PBOC) barred banks from processing Bitcoin transactions.

- 2017 - ICO and exchange shutdown: The same PBOC, together with the State Administration of Foreign Exchange (SAFE), banned initial coin offerings and forced domestic exchanges offline.

- 2021 - Nationwide mining ban: The PBOC declared all crypto transactions illegal and ordered the closure of every mining farm, ending China’s dominance of roughly 65% of global hash rate.

- 2025 - Comprehensive criminal ban: Legislation signed by the State Council makes mining, trading, and even private ownership a punishable crime, with penalties ranging from heavy fines to imprisonment.

Each step was reinforced by tighter coordination among the Cyberspace Administration, the Ministry of Industry and Information Technology, and local law‑enforcement units.

Key Government Agencies and Their Roles

Multiple bodies work in concert to squash crypto activity:

- People's Bank of China acts as the chief financial regulator, issuing bans and conducting bank‑level compliance checks.

- State Administration of Foreign Exchange monitors cross‑border capital flows to prevent crypto‑related currency flight.

- Cyberspace Administration tracks internet traffic and digital wallets for illegal activity.

- Ministry of Industry and Information Technology oversees technology compliance, especially power‑usage anomalies that signal mining rigs.

These agencies share data through a national compliance network that flags suspicious electricity consumption, unusual financial transfers, and abnormal network traffic.

Why China Went All‑In on the Ban

The crackdown is driven by four strategic concerns:

- Energy consumption: Bitcoin mining can use up to 120 TWh annually, a figure that clashes with China's pledge to peak carbon emissions before 2030. \n

- Financial stability: Decentralized tokens operate outside the PBOC’s monetary policy, creating potential capital‑flight risks.

- Illicit activity: Cryptocurrencies have been linked to money‑laundering, ransomware payments, and unregulated fundraising.

- Digital yuan promotion: The central bank’s e‑CNY project needs a clean digital‑currency landscape free of competing private tokens.

By eliminating the private crypto ecosystem, the state can channel resources toward the government‑issued digital currency.

Impact on Global Mining Power

Before the 2021 ban, China contributed roughly 65% of the world's Bitcoin hash rate, thanks to cheap coal power and proximity to hardware manufacturers. After the 2025 announcement, the immediate market reaction was stark: Bitcoin fell from about $111,000 to $104,500 within hours, and total crypto market cap shed over 10%.

The hash power redistributed to regions with friendlier policies:

- United States - a surge in Texas and Wyoming facilities added 15% of global hash rate.

- Canada - hydro‑rich provinces like Quebec attracted energy‑efficient farms.

- Kazakhstan - low‑cost natural gas became a magnet for displaced miners.

These shifts have altered network decentralization dynamics and forced mining hardware makers to innovate for better energy efficiency.

Underground Mining: How It Persists and What Risks It Carries

Despite the criminal ban, small‑scale, covert operations still eke out a presence, often hidden in rural factories, abandoned warehouses, or even residential basements. Studies estimate that China still contributes 3‑5% of the global hash rate via these underground sites.

Risks are severe:

- Police raids can lead to equipment seizure and prison terms of up to three years.

- Electricity providers are mandated to report abnormal consumption, triggering automated shutdowns.

- Covert setups lack the economies of scale, making them financially unviable in the long run.

Authorities are also deploying AI‑driven analytics to correlate power‑grid data with blockchain mining signatures, tightening the net around any remaining operations.

What the Future Holds for Crypto Mining in China

All signs point to a permanent closure of legal mining activities. The government continues to pour resources into the digital yuan, with pilot programs expanding across major cities. Analysts expect:

- Even harsher penalties for repeat offenders.

- More sophisticated detection tools that cross‑reference power usage, bank transfers, and internet logs.

- A continued exodus of mining hardware to overseas markets, bolstering those economies.

For anyone considering mining in China, the only safe path is to exit the jurisdiction entirely.

Comparison: Pre‑2025 Restrictions vs. 2025 Comprehensive Ban

| Aspect | Pre‑2025 (2013‑2024) | 2025 Comprehensive Ban |

|---|---|---|

| Legal Status | Regulatory discouragement; violations primarily administrative fines. | Criminal offense with possible imprisonment. |

| Scope | Targeted at large‑scale farms and exchanges. | All mining, trading, and private ownership prohibited. |

| Enforcement Tools | Banking checks, occasional raids. | AI‑driven power‑grid monitoring, coordinated raids, financial seizure. |

| Penalties | Fines up to ¥500,000. | Fines, equipment confiscation, up to 3 years jail. |

| Impact on Hash Rate | Gradual decline, still ~30% global share. | Near‑total removal; residual ~3‑5% underground. |

Practical Takeaways for Investors and Miners

- Do not attempt to set up mining rigs in China. The legal risk outweighs any cost advantage.

- Monitor official communications from the PBOC and the Cyberspace Administration for any policy tweaks.

- If you own crypto assets, relocate them to exchanges in jurisdictions with clear regulatory frameworks.

- Consider diversifying into the digital yuan ecosystem if you need exposure to China’s digital finance plans.

Frequently Asked Questions

Is cryptocurrency mining completely illegal in China now?

Yes. As of May312025, any form of crypto mining, trading, or private ownership is deemed a criminal offense under Chinese law.

What agencies enforce the ban?

The People’s Bank of China, State Administration of Foreign Exchange, Cyberspace Administration, and the Ministry of Industry and Information Technology coordinate enforcement through banking checks, power‑grid monitoring, and digital‑activity tracking.

Can underground mining still operate?

A small fraction of hash power (about 3‑5%) persists in concealed setups, but operators face high arrest risk and aggressive detection methods.

How did the ban affect global Bitcoin prices?

The announcement triggered a drop from roughly $111,000 to $104,500 within 24hours and wiped over 10% of total crypto market capitalization.

What is the Chinese government’s alternative to private crypto?

The digital yuan (e‑CNY), a state‑issued central bank digital currency, is being rolled out in major cities as the official digital payment method.

China's decisive stance against cryptocurrency mining reflects a broader philosophical commitment to societal stability and ecological stewardship.

By elevating environmental concerns to the level of legislative imperatives, the state underscores the moral responsibility of technological advancement.

The transition from regulatory discouragement to criminalization embodies a logical progression rooted in the precautionary principle.

One may argue that such a trajectory safeguards the collective good, preventing unchecked energy consumption that jeopardizes climate goals.

Moreover, the alignment of monetary policy with state-sponsored digital currency initiatives illustrates a coherent vision of financial sovereignty.

In this light, the ban can be perceived as an ethical safeguard against the volatility and illicit potential of decentralized assets.

It also serves as a cautionary exemplar for nations grappling with the balance between innovation and regulation.

The enforcement mechanisms, ranging from AI‑driven power‑grid monitoring to coordinated raids, demonstrate a sophisticated approach to policy implementation.

While critics may decry the loss of individual autonomy, the overarching objective remains the preservation of public order and environmental integrity.

From a philosophical standpoint, the collective sacrifice demanded by the ban echoes the utilitarian principle of maximizing societal welfare.

The state’s investment in the digital yuan further reinforces the argument that a centralized digital currency can coexist with, and even enhance, economic resilience.

Those who view this development through a libertarian lens might feel constrained, yet the pragmatic benefits are evident in reduced illicit activity and improved monetary oversight.

It is also noteworthy that the redistribution of hash power has catalyzed advancements in energy‑efficient mining technologies abroad.

This secondary effect aligns with the global pursuit of greener blockchain solutions.

Ultimately, the Chinese government's resolute posture invites a measured reflection on the responsibilities that accompany technological empowerment.

It is my hope that this discourse fosters constructive dialogue rather than polarizing debate.

The ban effectively eliminates legal mining operations in China, so relocating hardware to jurisdictions with clear regulations is the safest strategy.

From a cultural perspective, China's move underscores its emphasis on collective responsibility over individual financial experimentation, aligning with broader societal values.

Stay focused on the bigger picture; the global hash rate is shifting, and there are plenty of opportunities in more crypto‑friendly regions.

I understand the anxiety many miners feel, but given the severe penalties, it’s prudent to reconsider any plans involving Chinese territory.

This crackdown is a moral imperative; allowing unchecked mining would betray our duty to the planet and nurture criminal enterprises.

Imagine the vibrant ecosystems that could flourish when resources are diverted from power‑hungry rigs to sustainable ventures-truly a colorful rebirth.

i think its definetly a good move to stop the illegal minning, but some ppl will still try to do it in secret.

It’s hard to see the bright side, but moving away from risky environments protects both assets and peace of mind.

What they don’t tell you is that the real agenda is to funnel all financial power into a secret shadow network controlling the digital yuan.

Not worth the risk.

From a technical standpoint, the AI‑driven power‑grid analytics represent a quantum leap in real‑time detection, effectively nullifying any clandestine hashrate.

Ah, the perpetual dance of regulation-truly, one must ask: is the ban a safeguard, or merely a paradoxical proclamation, a symbol, a signal, an echo of control?

The crackdown is overblown; the data shows only a minimal underground presence, making the punitive measures disproportionate.

Oh great, another government stepping in to tell us we can’t mine-because obviously, that’s what the world needed.

i see u all worried bout the ban but pls keep calm its better 2 move your assets to safer places