When you build something on blockchain, you don’t start from scratch. You reuse smart contracts, plug in oracles, connect to DeFi protocols, and layer in identity systems-all of them independent pieces that talk to each other. That’s composability. It’s what lets a simple wallet interact with a lending protocol, a prediction market, and a cross-chain bridge in one transaction. But every time you connect another piece, you add a new point where something can break. And that’s where the trade-off kicks in.

What Composability Actually Means in Blockchain

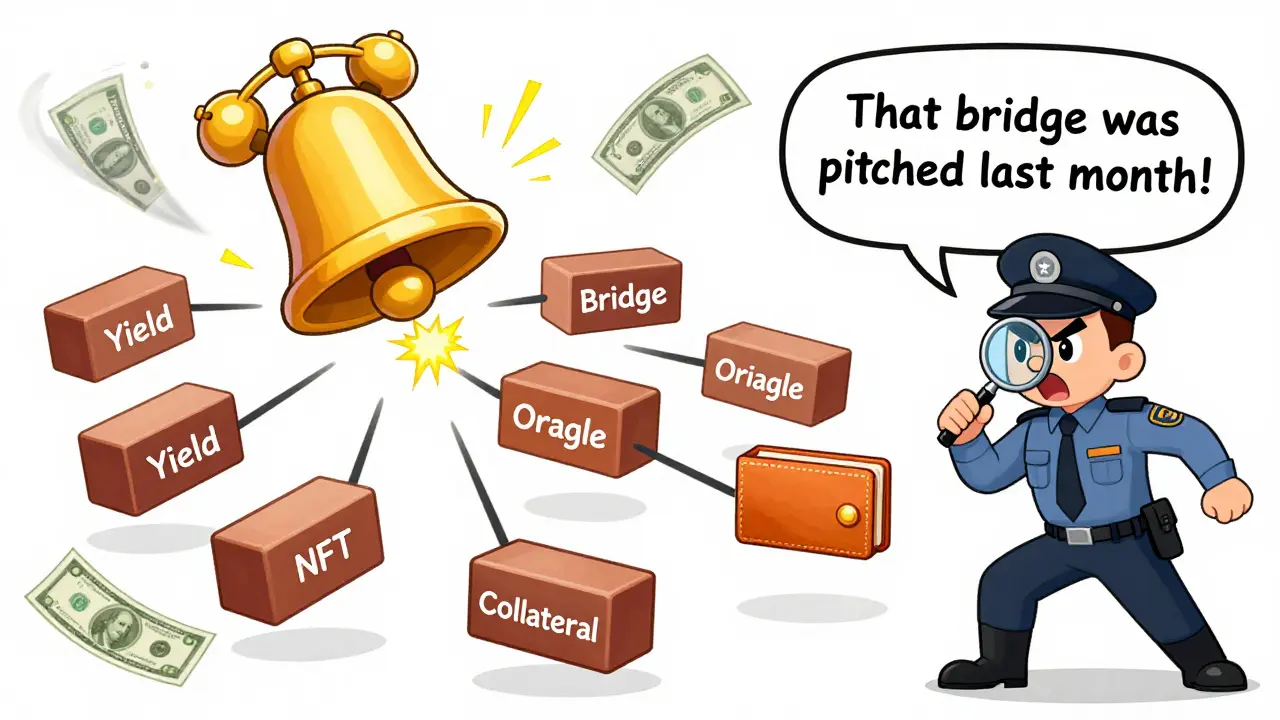

Composability isn’t just a buzzword. It’s the ability to stack blockchain components like LEGO bricks. A DeFi protocol like Aave doesn’t rebuild lending from the ground up. It uses Uniswap’s price feeds, Chainlink’s oracles, and OpenZeppelin’s secure contract templates. Each component has its own address, its own code, its own security model. When they work together, they create something far more powerful than any single part. This isn’t theoretical. In 2025, over 60% of new DeFi applications on Ethereum and Layer 2s were built using at least three pre-deployed protocols. The result? New products launch in days, not months. A startup can spin up a yield aggregator that taps into ten different protocols-all without writing a single line of core lending logic. But here’s the catch: each connection is a potential backdoor.The Security Risks Multiply With Every Connection

In a monolithic system, you have one codebase, one set of permissions, one firewall. In a composable system, you have ten, fifty, even hundreds of moving parts. Each smart contract, each external API call, each token bridge becomes a new attack surface. Take the 2024 Wormhole exploit. A vulnerability in one bridge contract allowed attackers to mint over $300 million in fake tokens. That wasn’t a flaw in Ethereum. It wasn’t a flaw in the wallet. It was a flaw in how one small piece connected to another. The system was composable-too composable. The attack didn’t need to break the whole chain. It just needed to break one link. JetSoftPro’s 2025 research found that composable blockchain systems have 3.7 times more attack vectors than monolithic ones. Why? Because:- Each external call (like fetching price data from Chainlink) requires trust in an unknown contract.

- Permissionless access means anyone can interact with your contract-unless you lock it down.

- State changes ripple across systems. A bug in a token’s transfer function can crash every protocol that holds it.

- There’s no central log. Monitoring becomes a nightmare when transactions flow through six different contracts before settling.

Why Composability Wins-Even With the Risks

You might think: “Then why bother?” Because the cost of not being composable is higher. In 2025, DeFi protocols that didn’t use composability lost market share fast. Why? Users don’t want to wait weeks for a new feature. They want to earn yield from multiple sources in one click. They want to use their NFT as collateral. They want to swap tokens without leaving their wallet. The data is clear: projects using composable architecture launch features 80% faster than those building everything in-house. Compound, Aave, and Curve didn’t become giants by writing every line of code. They became giants by letting others build on top of them. And the ROI? Enterprises using composable DeFi stacks report 295% higher returns over three years-not because they’re riskier, but because they adapt faster. A liquidity pool that can automatically shift between protocols based on yield rates doesn’t need a team of engineers to rebuild it every quarter. It just swaps out the contract address.

Where the Trade-Off Gets Real

The biggest security failures don’t come from clever hackers. They come from lazy integration. A team copies a popular staking contract from GitHub. They change the name. They deploy it. They assume it’s secure because “it’s been used before.” But the original contract had a flaw that was patched six months ago. The team didn’t check. They just reused it. Or worse-they use a contract that’s been audited, but the audit didn’t cover how it interacts with their other contracts. That’s called “emergent risk.” It’s not in any single piece. It’s in how they fit together. This is why security in composable systems isn’t about checking boxes. It’s about understanding relationships:- Does your contract accept tokens from unverified sources?

- Are you calling external functions with unchecked return values?

- Do you know who controls the admin key on that oracle you’re using?

- What happens if one of your dependencies goes offline-or gets hacked?

How to Build Securely Without Sacrificing Composability

You don’t have to choose between speed and safety. You just need to build smarter. Here’s what works in 2026:- Use only audited, battle-tested components. OpenZeppelin, Aave, and Compound contracts have been tested across millions of transactions. Don’t roll your own ERC-20. Don’t write your own price feed. Use what’s proven.

- Limit external calls. Every time your contract talks to another, it’s a risk. Can you cache data? Can you use a pull model instead of a push model? Reduce dependencies.

- Implement zero-trust checks. Assume every external contract is hostile. Validate all inputs. Revert on unexpected returns. Don’t trust a token’s balance without checking its transfer function.

- Use a security layer. Tools like Slither, MythX, and CertiK’s runtime monitor can scan for dangerous patterns across multiple contracts. Some platforms now auto-block risky interactions before deployment.

- Monitor everything. Set up alerts for unusual transaction patterns. If your contract suddenly receives 10,000 ETH from a new address, you need to know immediately.

The Future: Composability Without the Fear

The good news? The industry is fixing this. In 2025, Ethereum Foundation launched the Composable Security Standard, a set of mandatory checks for any contract that wants to be listed on major DEXs or DeFi aggregators. It requires:- Explicit permissioning for external calls

- Standardized error codes for cross-contract failures

- Automated dependency graphs that show which contracts interact with which

Final Thought: It’s Not If, It’s How

Composability is the engine of innovation in blockchain. You can’t build the next big thing without it. But you can’t ignore the security cost. The question isn’t whether to use composability. It’s how deeply you’re willing to dig into the risks before you click deploy. The best builders don’t just write code. They map out every connection. They ask: “What happens if this breaks?” Then they build for that worst-case scenario. Because in blockchain, a single weak link doesn’t just break your app. It can break trust in the whole system.Is composability only for DeFi, or does it apply to NFTs and gaming too?

Composability applies to everything on-chain. NFTs can be used as collateral in lending protocols. Game assets can be traded across different worlds using standardized token standards like ERC-1155. A character skin from one game can be rented out in another via smart contracts. The more systems interconnect, the more valuable the assets become-but also the more critical it is to secure every interaction.

Can I use composability safely on a public blockchain like Ethereum?

Yes, but only if you follow strict security practices. Public blockchains are permissionless, which means anyone can interact with your contract. You must assume every call is malicious. Use reentrancy guards, validate all inputs, avoid external calls unless absolutely necessary, and always test interactions in a local fork before deploying. Many top DeFi protocols do this successfully every day.

What’s the biggest mistake people make when combining smart contracts?

Assuming that if each contract is secure on its own, the whole system is secure. That’s called the “composability illusion.” Real-world attacks like the Poly Network hack and the bZx flash loan exploits happened because of unexpected interactions between contracts that were individually fine. Security isn’t additive-it’s emergent. You have to test the whole chain, not just the pieces.

Do I need a security audit for every contract I reuse?

Not if it’s from a trusted, widely-used source like OpenZeppelin, Aave, or Uniswap. These have been audited repeatedly and battle-tested with billions in value. But if you’re copying code from a random GitHub repo-even if it’s labeled “secure”-you’re taking a huge risk. Always check the audit history, the number of transactions, and whether the contract has been flagged by tools like DeFiSentry or CertiK.

How do I know if a protocol is too risky to integrate with?

Check three things: 1) Has it been audited by a reputable firm? 2) What’s its TVL (total value locked)? Low TVL often means low scrutiny. 3) Is it on DeFiLlama or similar platforms with a risk score? Protocols with red flags like admin keys, unverified code, or sudden liquidity changes should be avoided unless you’re intentionally taking on high risk for high reward.